Main Thesis & Background

The purpose of this article is to evaluate the state of the broader market and why commodities – whether specific ones or a broad basket fund – may offer a decent value proposition at present. The reason for bringing this up is that I continue to see under-investment (especially in oil and natural gas) that could cause a jump in these prices globally. In addition, other commodity-type metals like copper and silver continue to play an important role in the transition to “clean” energy and electric panels. Finally, natural resources and crops are impacted by more extreme weather, global conflicts, and a growing population. All of these factors lead me to believe the next move will be higher for many inputs (commodities) we all rely on.

With equity and bond prices getting a rebound in 2023, I see this as an opportune time to get more creative with my broader portfolio allocation. This includes a shift to some natural resource / commodity plays and I will explain why I feel this way in this review.

*There are a host of ways to play “commodities”. One could invest in Energy funds, such as the Vanguard Energy ETF (VDE). Or you can invest in specific futures ETFs – such as one for oil or natural gas: ProShares Bloomberg Ultra Crude Oil ETF (UCO) or United States Natural Gas ETF (UNG). Better still would be a diversified basket of different commodities, which would include oil and gas but other assets like chemicals, crops, or metals. A newly launched fund from VanEck is the Commodity Strategy ETF (CMCI) that I have my eye on. There are a plethora of options in this space, however. A few to consider are the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PBDC) and iShares S&P GSCI Commodity‑Indexed Trust (GSG) among many others.

Upfront Word Of Caution: Performance During Times Of Stress Is Mixed

To start I want to be realistic about the risks and potential rewards from diving in to this sector theme. While I see merit to it – and I stand by that outlook – this is not for everyone. Commodities in general are a more volatile asset class, with some more volatile than others. Gold is a bit more stable, but items like oil, silver, copper, wheat, etc. are prone to seeing big swings in the short-term. This is something for readers to be firmly aware of and to ensure this aligns with their overall investment strategy.

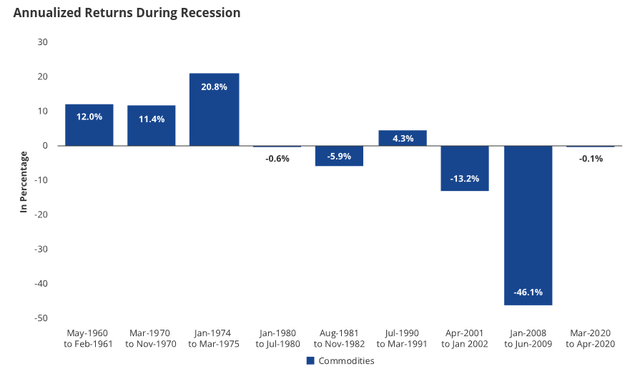

With that said, let’s examine how commodities as a whole perform during periods of economic stress. I see this as relevant because recession risks remain high in the U.S. and other parts of the developed world. The Fed remains determined to bring inflation down and in doing so they are likely to dampen economic growth. So – if a recession is on the way – does investing in commodities even make sense at the moment?

The answer is “it depends”. If we look back in history at broad commodity index performance during prior recessions we see a mixed picture. There are times when this sector posted both strong gains and times when it posted big losses:

Performance During Recessions (Commodity Index) (FactSet)

The obvious question is how will this theme play out this time around – and the answer is the wild card. Nobody knows for sure and history suggests there is a good chance of both out-performance or under-performance. This is not inherently good or bad but highlights the risks. If an investor is truly looking for “protection”, this probably isn’t the right move. If the sector performs poorly that will only compound losses.

But the opposite is also true. Commodities have served as profitable hedges before in other recessionary periods. If that ends up being the case if – and when – a recession occurs this time around then those who have the foresight to buy this idea will be well prepared to mitigate overall losses. The latter argument here is the one I am banking on, but I wanted to ensure my followers knew that this is not a foregone conclusion and has risks of its own.

But It May Be The Time For Hedges

With the understand that commodity performance (as a whole) is a bit mixed during difficult economic scenarios – why consider this play at all right now?

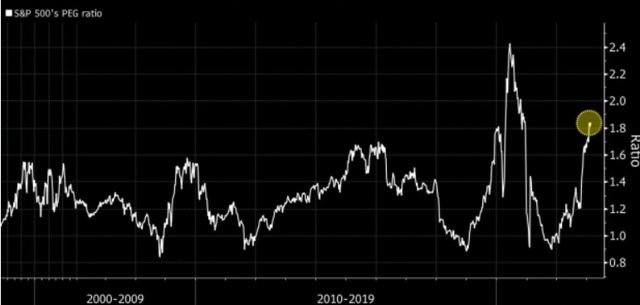

Well the answer – for me anyway – rests with the relative value of other options. What I mean is that equities look a bit pricey here. I am sitting with handsome gains for 2023 and don’t want to trigger tax obligations. So that prevents me from selling off exposure. But valuations tell me to be cautious, so I’m not a big buyer here either. So, that begs the questions, what I am to do with excess cash? The answer for me is to diversify and commodities is one way to do that.

To understand the baseline behind this argument, let us consider stock valuations. A commonly used metric, the PEG ratio, shows us that the S&P 500 is not exactly cheap right now. In fact, it looks darn expensive on a historical basis. The PEG ratio measures the market’s P/E multiple divided by its forecast growth rate. The higher it is, the more expensive shares are, and this metric is flashing a valuation warning sign:

S&P 500 PEG Ratio (Bloomberg)

The conclusion I draw here is that stocks are pricey and the time is ripe for finding some alternative investments. This in no way means stocks cannot keep going up. That has happened in the past and inevitably will in the future in similar scenarios. Stocks simply have an upward bias over time. So I am not sitting here predicting a sudden or mass reversal out of nowhere.

But I am suggesting that new positions here seem to lack a strong risk-reward proposition. A PEG ratio (along with the current PE of 18 for the S&P 500) are vulnerable to a correction if growth expectations do not match reality in the coming months. While I will remain long my current equity positions, I do not have a lot of comfort that this is the place to put new cash at the moment. That has led me to explore commodities as an alternative.

The Sector Theme Starting To Draw Interest

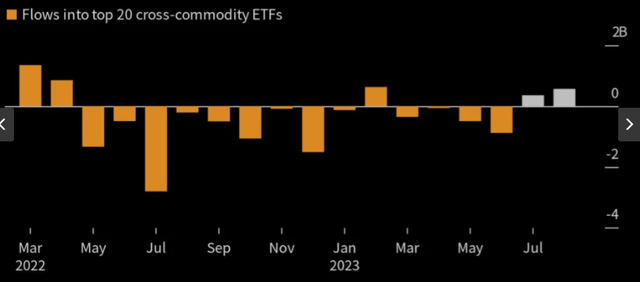

Another bullish attribute I see currently is that this sector’s momentum is starting to turn. After months of retail outflows from commodity-focused ETFs, investors are returning in a big way:

Investor Inflows (Commodity-Based ETFs) (Yahoo Finance)

Certainly it would have been great to front-run this action a few months ago, but we are just getting started in a new cycle in my opinion. After months of disinterest, investors are interested again and we often see this sector see sustained momentum in both directions over time. This suggests that there is plenty of room for this rally to continue since it is just getting started.

While I normally like to be a contrarian when it comes to sector trends, I don’t see commodities as overbought. If anything the interest is still quite weak given the level of consistent outflows we have seen over the past year. For me, I view the renewed inflows as a chance to ride this momentum going forward.

Oil and Gas Investment Is Probably Too Low

As I have mentioned, commodities investment means a variety of things. This is a diverse sector and there are many funds and strategies investors can use to play this space. Even still, the most popular way to do so is through oil and gas (and these inputs often make up a substantial allocation within “commodity” funds as a result).

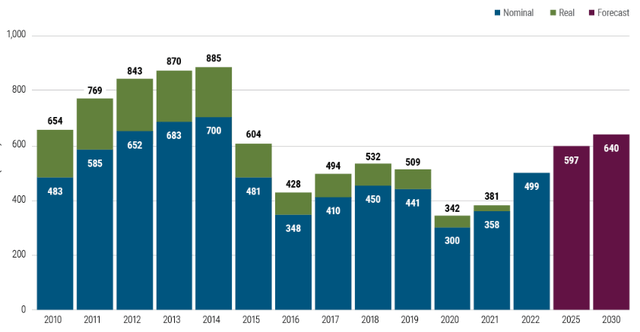

For this reason I believe focusing on the supply dynamics in the energy/oil and gas sectors is critical for expected future returns for this broader idea. As consumers are probably aware, oil and gas prices have both been rising over the past year. This is the result of supply not keeping up with rising demand around the globe. The good news for investors (and bad news for consumers) here is this demand-supply imbalance is probably going to persist. The reason is that oil and gas capital expenditures, while rising recently, are still much lower in the past few years than they were in the previous decade:

Oil and Gas Capital Expenditures (Global) (S&P Global)

With OPEC+ continuing to announce cuts to production and no meaningful change in energy policy here in the U.S., I see a global shortage continuing for the year ahead which will keep prices elevated. While there are negative political ramifications for this reality – as well as pain for consumers ahead – this is a positive dynamic for investors.

Global Trends Are Tailwinds For Resources

Through this review I have discussed some short-term developments for why this is a good investment idea. But there is more to this story. Over the long-term I see continued demand for “stuff”. What I mean is, countries around the world continue to see their populations grow, continue to invest in new sources of energy, and continue to meet the rising demands and needs of their citizens. This means natural resources and commodity inputs are going to be in more demand year after year.

This is why I want exposure to it now and in the future. For a short list of trends that I see as positive for the many commodity ETFs available to retail investments, see below:

- Population growth

- Urbanisation

- Infrastructure investment

- Decarbonization

- “Clean energy”

- Rising living standards around the world

What I am driving at here is that demand for many commodities is likely to stay high for years and decades to come. While I don’t see any real urgency to rush in to this sector aggressively now, I do see both short-term and long–term tailwinds that will make this a profitable place to be.

Bottom-line

The commodities sector has a number of positive attributes both right now and due to longer term global trends. Investors have a number of different ways to gain exposure to this space, many of which I believe have a lot of merit. I am hopeful this review gives service members some solid food for thought and a few ways to potentially profit off this idea.

Read the full article here