In my last article about U.S. Bancorp (NYSE:USB) – published about a year ago – the headline was straight-forward and a warning to all investors: Don’t invest in banks before a recession. And although that warning was connected to USB in this article, it was a warning for (almost) all banks. And it was sometimes a bit tricky to explain why we should not invest in banks despite single digit (or low double-digit) valuation multiples. The simplest argument would be: Do not invest in cyclical businesses (and banks and many other financial institutions are rather cyclical) even when the low valuation multiples are tempting as cyclical businesses perform best (and have the lowest valuation multiples) right before the cycle peak. Since the article was published the stock declined about 40% and clearly underperformed the broader market (the S&P 500 was more or less stable). Reason enough to take another look.

Good Results?

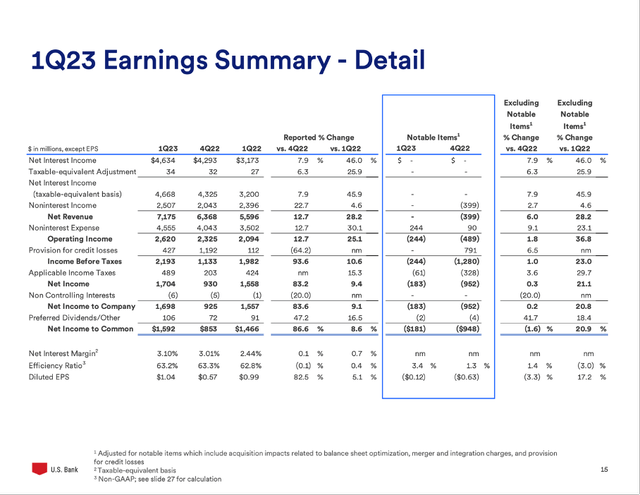

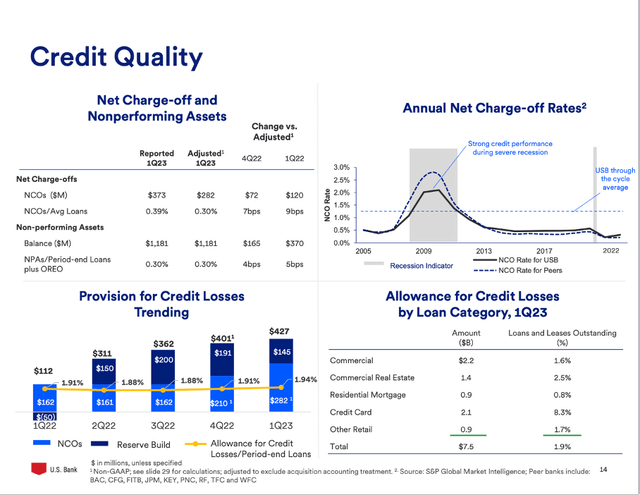

As usually, we start by looking at the last annual or quarterly results, and when keeping the stock price movement in the last few months in mind one might be surprised about the results. Despite fears among investors, U.S. Bancorp performed well and increased its noninterest income from $2,396 million in Q1/22 to $2,507 million in Q1/23 – resulting in an 4.6% YoY increase. And net interest income increased even 45.9% YoY from $3,200 million in the same quarter last year to $4,668 million in Q1/23. Diluted earnings per share also increased from $0.99 in Q1/22 to $1.04 in Q1/23 – an increase of 5.1% YoY. One reason for the rather low bottom line growth rates was the much higher provision for credit losses which increased from $112 million in Q1/22 to $427 million in Q1/23.

U.S. Bancorp Q1/23 Presentation

Great Valuation?

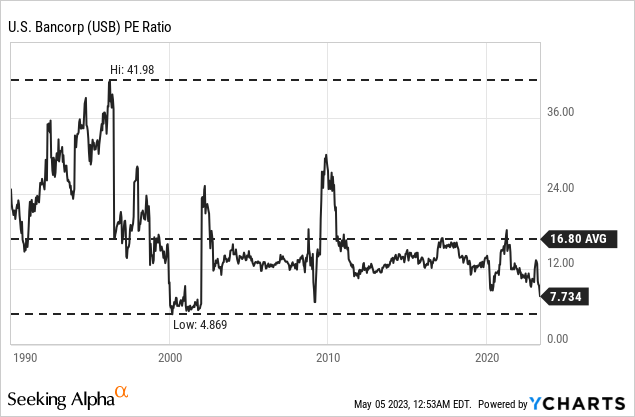

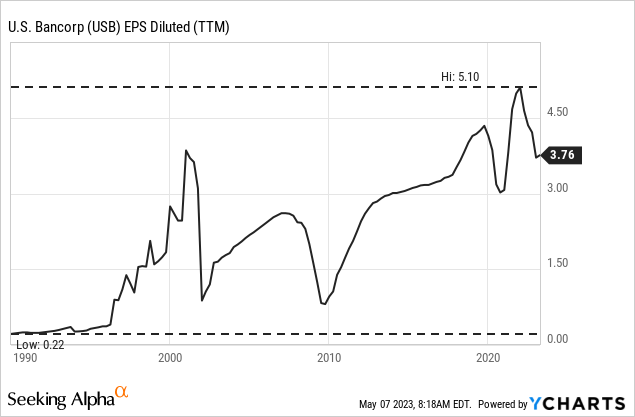

On the surface, the quarterly results were quite good and certainly no reason to panic. Combined with the low valuation multiples, U.S. Bancorp looks like an incredible bargain at this point. At the time of writing, U.S. Bancorp is trading for 7.7 times earnings and that is not only cheap on an absolute basis, it is also one of the cheapest valuation multiples U.S. Bancorp has been trading for since 1990.

There have only been three times since the 1990s when USB was trading for a lower P/E ratio – but these three times were the last three recessions, and this is one reason to be cautious as the risk for a lower P/E ratio is rather high (it could also go much higher if earnings per share are declining steeply). At this point, we can use almost every metric we know and try to determine an intrinsic value by using many different calculations, U.S. Bancorp is cheap and looks like a real bargain, but we should be really cautious as this might just be the look on the surface.

Sustainable, High Dividend?

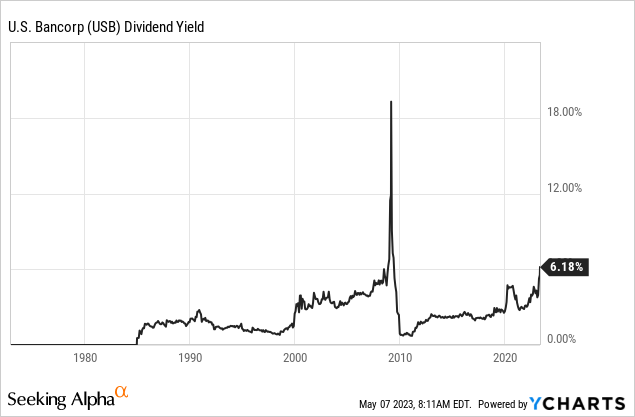

Not only the last quarterly results and the P/E ratio looks compelling. The dividend yield of 6.7% looks very tempting for every investor. When asking the question if the dividend of a company is sustainable, we usually look at the payout ratio. In case of USB, the company is paying out 51% of the trailing twelve-month EPS, which is in line with most other banks and a typical payout ratio and now reason to worry.

But we should not be blinded by the high dividend yield. When looking at previous recessions, a dividend freeze (like in 2020) or a dividend cut (like in 2009) is likely.

The Recession Is Still Upon Us

So far, I rather presented arguments for U.S. Bancorp being a great investment. But I also mentioned several times that we are just looking at the surface and already implying that just looking at the surface might be misleading and that we must dig deeper.

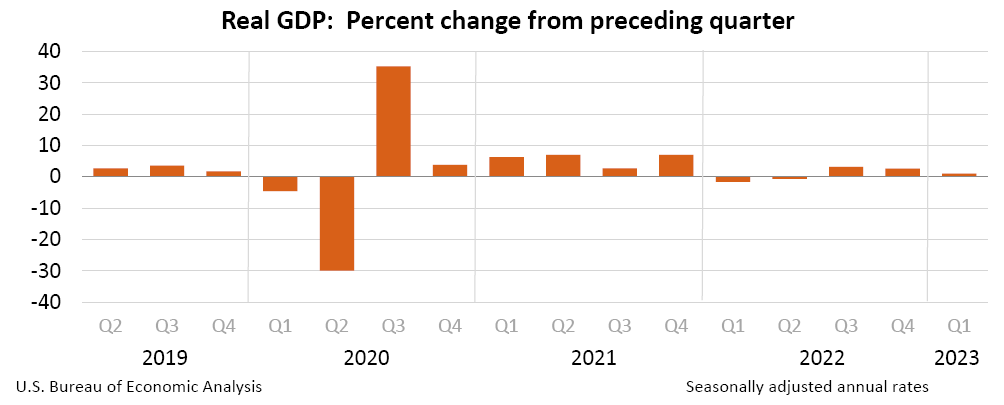

In my last article I argued not to invest in banks before a recession – and according to official data, we are not in a recession so far. Of course, we only know in hindsight when the recession started, but there is a good chance the recession started in the United States in April 2023. In the first quarter of 2023, GDP in the United States could still grow by 1.1% but we clearly see a declining trend and in the second quarter, growth could be negative.

United States GDP (U.S. Bureau of Economics)

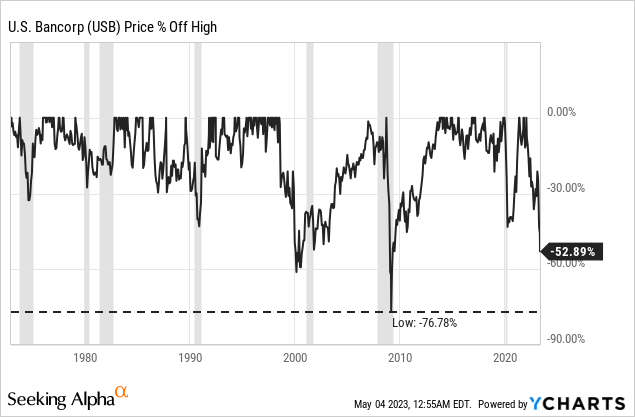

It might be tempting to invest in U.S. Bancorp after the stock declined more than 50% already (and such a steep decline is certainly a reason to take a closer look at the stock), but we saw steeper declines during past recession. In the late 1990s (Asian Financial Crisis and following Dotcom crash) the stock declined 60% and during the Great Financial Crisis the stock declined even 77%.

Financial Stability of USB

When looking at the three FDIC-insured banks that collapsed so far in 2023 – Silicon Valley Bank, Signature Bank and First Republic – and unusual picture is presented to us. These three banks collapsed in part due to bank runs and investors pulling out funds and lowering deposits and therefore forcing the bank to liquidate other assets to make the payments. And as I have explained in my article “Banking Crisis: The next domino is falling” it is rather untypical for banks to collapse due to declining trust and investors panicking as deposits are insured to a certain degree (increasing the trust in the banking system).

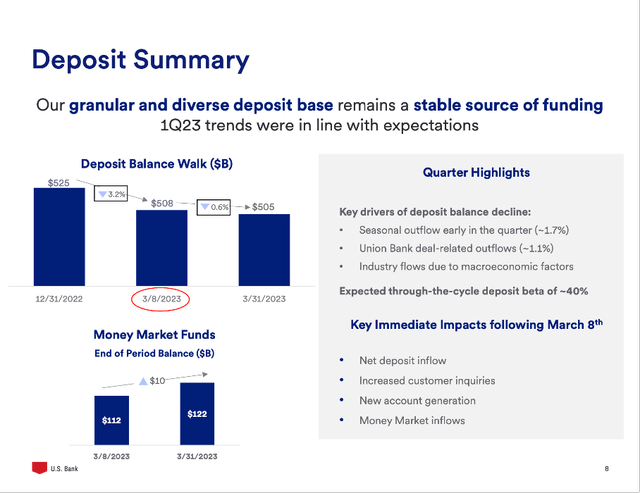

But keeping in mind the three bank failures, we should take a closer look at the deposits. And while total deposits increased year-over-year, we saw a decline from $525 billion in deposits at the end of December 2022 to $505 billion in deposits at the end of March 2023. Although this is no reason to panic right away, it is also not a good sign.

U.S. Bancorp Q1/23 Presentation

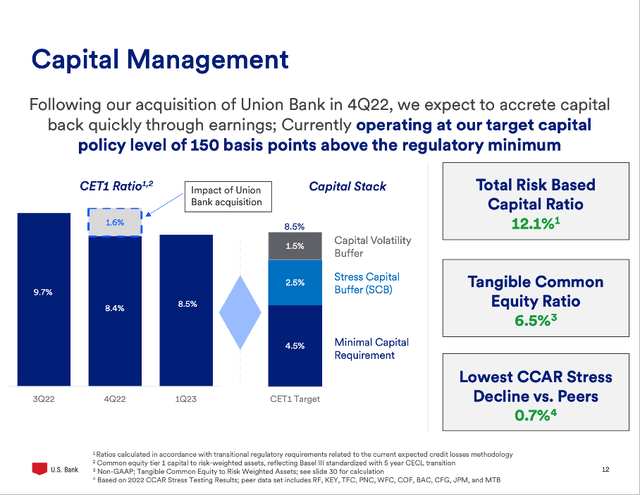

And while the Basel III standardized CET 1 ratio improved from 8.4 in the previous quarter to 8.5 (it was 9.8 one year earlier), other metrics got worse (by the way, a CET1 ratio of 8.4 is not great, but we will get to this). The loan-to-deposit ratio of USB is 0.76 right now (compared to 0.69 one year earlier) and usually ratios below 0.8 are seen as acceptable. The loan-to-asset ratio was 0.57 at the end of Q1/23 and declined from 0.53 one year earlier. Here metrics below 0.6 are usually seen as acceptable.

These metrics are all still acceptable and above the minimum requirements, but they are certainly not great.

Over the last few quarters, we see provision for credit losses constantly increasing and in Q1/23, it was $427 million (with $145 million for reserve building). Consequently, the allowance for credit losses also increased over the last few quarters to $7,523 million right now (about 1.9% of loans and leases outstanding).

U.S. Bancorp Q1/23 Presentation

And while this might all look solid at first, $7.4 billion in allowance for credit losses can be a too small amount when disaster strikes as we might talk about several billions quickly. It also doesn’t protect the bank from customers losing trust and pulling funds.

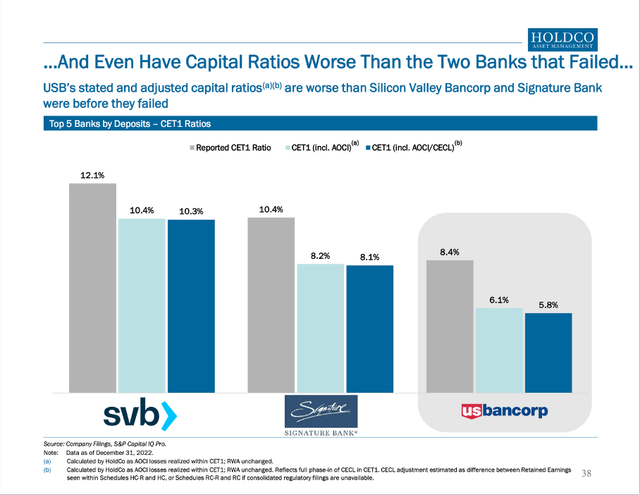

Of course, management is trying hard to present the bank as a sound and stable financial institution. HoldCo Asset Management released a presentation recently that is painting a completely different picture (thanks to IP Banking Research for bringing this to my attention in this article). Basically, the main argument is: If U.S. Bancorp would be treated as Category II bank (and when reaching $700 billion this is the case), its CET 1 ratio would actually be 2.2% as the bank does not have to include unrealized AFS losses in its capital ratios – in contrast to the big four banks JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C) and Wells Fargo (WFC). HoldCo Asset Management argues that U.S. Bancorp would have the lowest CET 1 ratio of 393 banks if it would have to report like a category II bank. By the way: U.S. Bancorp is the largest U.S. bank that is not included in the list of global systemically important banks also leading to lower requirements for U.S. Bancorp.

HoldCo Asset Management Presentation

To end this section with a positive note, I like to point out that U.S. Bancorp was constantly profitable for 33 years since 1990 (when using TTM numbers). This is impressive for almost every company and especially for a cyclical business like a bank. And it also must be seen as a sign of stability.

But past results are no indication for the future and a few wrong decisions might be enough to tank a bank: Credit Suisse is a good example for a bank that performed quite well during the Great Financial Crisis but made several mistakes in the subsequent years which led to the failure we witnessed a few weeks ago.

Stability of the Banking System

It is not enough to just look at U.S. Bancorp – we also must look at the banking system (and the financial system) as nothing happens in isolation and especially the banking system is vulnerable to terrible ripple effects and chain reactions being able to lead to disaster. In the first two weeks of March, the world was shocked by what appeared to be another banking crisis. Credit Suisse collapsed and especially regional banks in the United States were hit hard. But after the first shock, confidence seemed to re-emerge, and we could read statements about the crisis probably being contained and how unlikely a second Great Financial Crisis is. In two articles I explained my rather different view on the market. In the above-mentioned article, I explained how the banking crisis was just the next domino falling in the typical process leading towards a recession and in another article I also saw the U.S. stock market on the brink.

And when looking at the most recent developments I do not want to spread panic, but I don’t see any reason for confidence – and in my opinion only a fool would bet on a soft landing or mild recession. I don’t know if we are at the beginning of another major banking crisis (nobody does), but I see no evidence to rule out such a scenario.

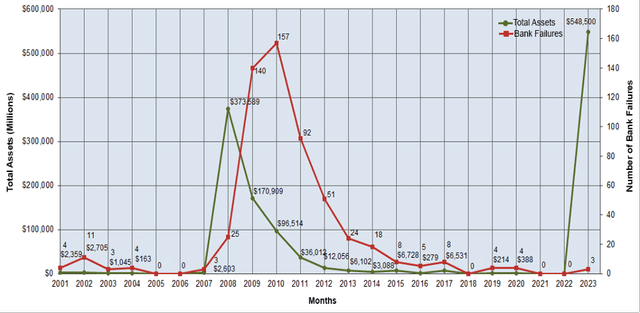

Especially as a few days ago, the third FDIC-insured bank in the United States collapsed – after Signature Bank and Silicon Valley Bank in March 2023, the First Republic Bank followed in May 2023. So far, only 3 banks failed in 2023 and compared to 2008 when 25 banks collapsed the numbers seem rather low (in 2009 the number of failed banks increased to 140 and in 2010 it was even 157 banks). However, when looking at the total assets of the failed banks, the amount in 2008 was “only” $374 billion and in 2023 it is already $549 billion (and the year is not over). One can argue that amounts from 2023 can’t be compared with 2008, which is true. But even when adjusting for inflation, the $549 billion would result in $388 billion in 2008 and the amount is still higher.

Bank failures since 2001 (FDIC)

And we are not done: At the time of writing, PacWest Bancorp (PACW) with $44 billion in assets seems close to a collapse and the rumor mill surrounding Western Alliance Bancorporation (WAL) also started to simmer.

Recently, the FED raised the federal funds rate by 25bps once again. We might be close to the FED pivot everybody is talking about for months, but so far interest rates are increasing, and the level of speculation is still rather high. And as the high interest rates already brought several banks to its knees, even higher interest rates might lead to further banks tumbling. This is especially true as ripple effects will most likely occur in the coming months. As mentioned above, nothing happens in isolation and especially the banking system is densely interconnected, and one bank failing will have effects on other banks.

I would also like to mention Howard Mark’s latest memo “Lessons from Silicon Valley Bank” in which he argued that the SVB collapse might rather be an outlier and he is seeing the risk for a second Great Financial Crisis rather low. And who am I to disagree with Howard Marks – nevertheless, I would not be so optimistic. While I might be a little more pessimistic about the outlook for the banking sectors, Howard Marks seems to have a similar opinion about the direction of the economy and the markets and is also expecting rough times ahead.

And as I have argued in my article “The next banking crisis?” the problem seems to be technology (once again) and especially cryptocurrencies and with the crypto market being only a fraction of the housing market, the crypto market hopefully does not have the same devastating impact on the economy as housing did in 2008. I also would not argue that 2023 is another 2008 (at this point), but on the other hand, in May 2008 we also looked differently on that year than in September or October of 2008.

Catching a Falling Knife or Buying Opportunity?

It is really difficult for me to make up my mind about U.S. Bancorp. The business still seems to be sound, has a high dividend yield and is trading for a low stock price and hence a lot of negativity is already priced in. However, a collapse or bankruptcy is certainly not priced in, and I would be very cautious not to catch a falling knife.

U.S. Bancorp undoubtedly has not the best metrics regarding financial stability and is only slightly above the required Stress Capital Buffer (as the acquisition has a huge negative impact on the CET 1 ratio).

U.S. Bancorp Q1/23 Presentation

And as investors are already deeply worried about U.S. Bancorp (with the stock clearly underperforming other major banks), it might take only a few small steps towards fear and panic and a bank run.

Right now, is not the time to invest in risky assets – and U.S. Bancorp must be classified as rather risky at that point. Although I don’t think U.S. Bancorp will collapse, I am not able to rule out that U.S. Bancorp might get into serious trouble. And with regional banks continuing to collapse and a recession (with all its negative implications) being still ahead of us, I like to pass on U.S. Bancorp (and probably all the other regional banks) and look for investments somewhere else. Of course, when the stock price will continue to decline, the stock certainly is getting interesting at some point (despite the potential risk of a recession).

Read the full article here