Thesis

Banco BBVA Argentina (NYSE:BBAR) is one of the largest banks in Argentina. It is positioned to benefit from the ongoing digital transformation and the large portion of the unbanked population. The bank excels on all risk metrics and has a robust balance sheet structure. Its loan portfolio is well diversified between retail, enterprises, and industries. The bank`s liabilities are distributed primarily in time deposits and savings accounts. Hence mitigating BBAR`s liquidity risk.

Based on Excess Return valuation, the company is overvalued, but compared to other major banks in LATAM is cheap. The country-specific risk has been priced, and the share price has risen since the beginning of the year. The current price levels are excellent entry points to build a position for the next 12 to 18 months.

Argentina is a soft spot for me as an investor and traveler. It is a risky place to invest, but as Robert Koenigsberger, Chief Investment Officer of Gramercy, says:

Argentina is the gift that keeps on giving.

Argentina as an investment opportunity

Argentina is not only a football world champion but the only country that has defaulted nine times on its sovereign debt. It has spectacular natural resource endowments, good demography, and a high literacy rate among its population.

On 21 October 2023 are the next presidential elections. The expectations are for another political pendulum swing from left to right. The surprising winner of PASO was Javier Milei. The next occupant in Casa Rosada will likely be Milei, who is libertarian and pro-market-oriented. Argentina’s equity markets follow an apparent boom-and-bust cycle in tight correlation with the internal political changes.

I am a strong proponent of Argentinean investments, and it’s reflected in my portfolio. I have been successfully investing in Argentina for the last two years. Said that the boom cycle had just started. My focus is the Argentinean banking segment. Banks in Argentina share similarities with its neighboring countries. The major trends are serving the unbanked population and transitioning to digital banking. The chart below from Visual Capitalist illustrates the former:

Visual Capitalist

The growth potential in digital banking is immense. Brazil is among the leaders in that field. Argentina is in the middle, which is a positive sign because the Argentineans are still climbing the adoption curve. Fintech companies initiated the penetration of digital banking in Argentina. The established banks, too, are pushing hard for digital transformation. Among the most successful is Grupo Galicia (GGAL), with its subsidiary Naranja X. BBAR, another great contender in the competition.

Company Overview

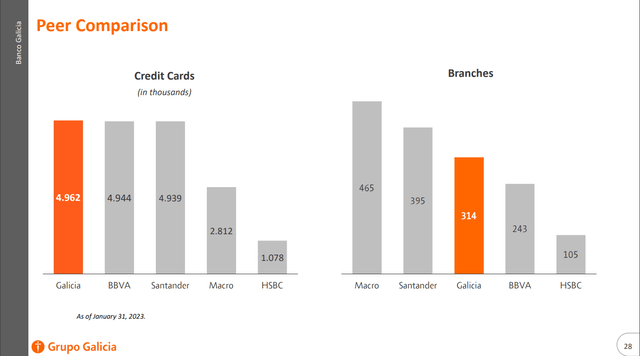

Banco BBVA Argentina is one of the largest banks in Argentina. The bank is a Banco Bilbao Vizcaya Argentaria SA subsidiary. The latter owns 66.1 % of BBAR shares. The two charts below from Grupo Galicia compare the banks in Argentina by size:

Grupo Galicia Q2 presentation

BBAR is second to GGAL in credit card customer services and fourth in branch network size. Both metrics are positive because Argentina has 26 % of its unbanked population while the banks transform their services into digital ones. The former means BBAR has good penetration and still has a new customer base to attract. The latter means efficiency due to declining costs to maintain an expanded branch network.

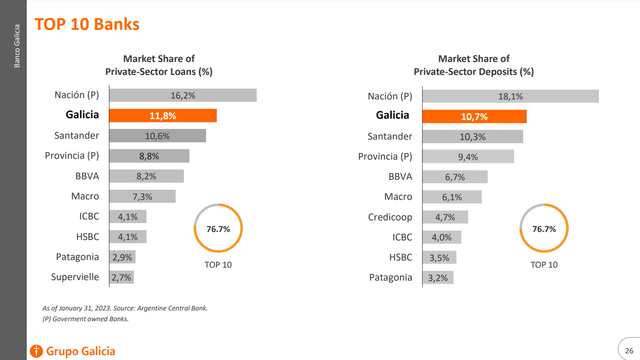

Grupo Galicia Q2 presentation

The chart above compares the market share in private-sector deposits and private-sector loans. BBAR is well positioned in the middle. That means there is still a place for growth.

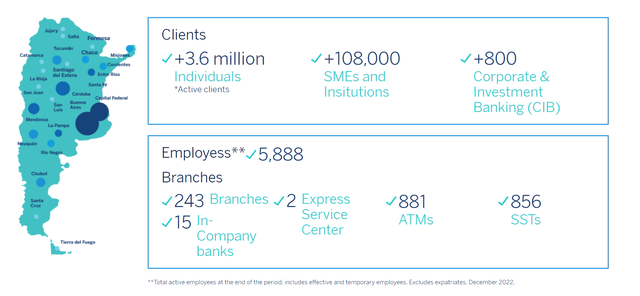

The bank offers a wide range of products for retail and business customers. The company operations are spread across Argentina. The image below shows the company’s network.

BBAR Q2 presentation

The customer base is diversified between individuals, small and medium enterprises (SMEs), and corporations.

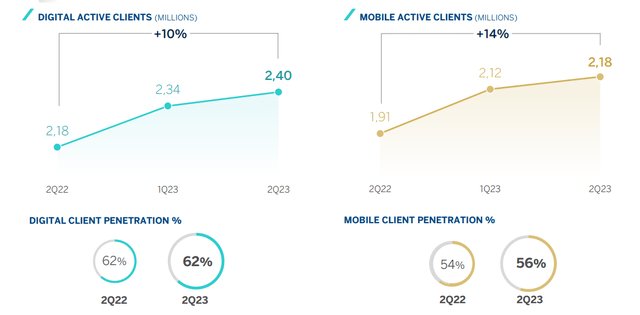

As noted above, digital transformation is essential for all banks. BBAR is doing a great job attracting more customers to its digital services. The charts below from the last company’s presentation illustrate BBAR’s progress in customer acquisition.

BBAR Q2 presentation

For the last quarter, the company registered steady growth in its customer base. Considering the declining number of branches and the focused expansion of its digital services, BBAR has more potential for growth.

Company Financials

Every bank balance sheet has specific we, as analysts, have to decode. The main points are evaluating assets and liabilities structure, estimating the bank`s solvency and liquidity, and measuring the bank`s profitability.

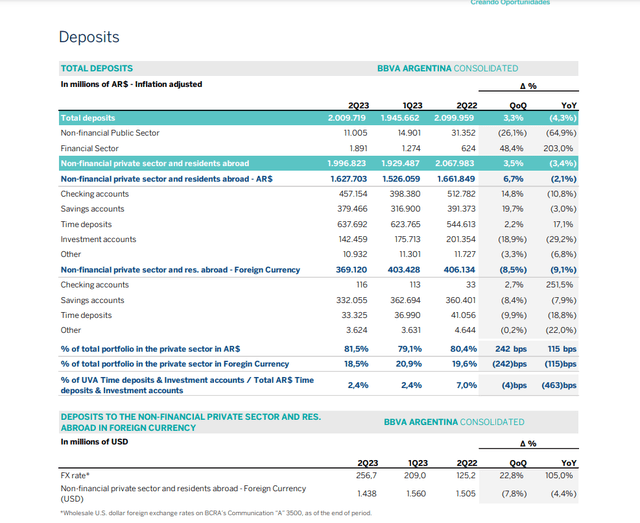

BBAR is a classic bank using maturity transformation, i.e., borrowing at lower rates for shorter periods and lending at higher rates for longer periods. Both sides of the balance sheet represent that principle. On the right are the deposits. The image below from the last company presentation shows BBAR deposits by type.

BBAR Q2 presentation

Time deposits represent 30 % of the total deposited funds, and savings accounts for 18.5 % of the total. Those are the most illiquid client deposits due to fixed maturity and penalties for early withdrawal. A balance sheet with a higher percentage of those deposits is safer for the banks despite being more expensive because longer-term rates are higher than shorter-term ones.

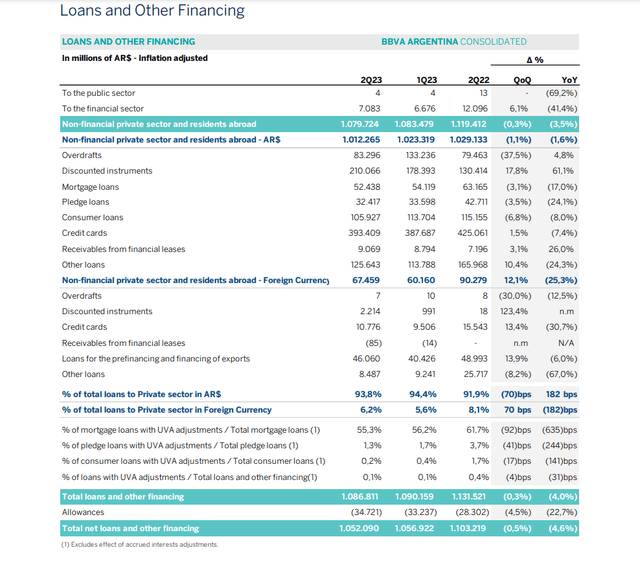

The asset side of the BBAR’s balance sheet consists of variable types of loans. The table below from the last company presentation illustrates that:

BBAR Q2 presentation

The bank loans portfolio is divided between commercial and retail loans. The former are used primarily in agriculture and livestock, manufacturing, and wholesale products. They constitute 45 % of all commercial loans. The rest are distributed between the other economic sectors. Argentina is among the world’s major exporters of agriculture and livestock products. BBAR exposure in the industry is an excellent advantage in structural inflation periods such as the current decade.

A small fraction of the loans is attributed to mining companies. As a resource-rich country in the political transition from left to right, I expect more investments in the mining industry. BBAR can take advantage if it increases its exposition to miners and commodity producers.

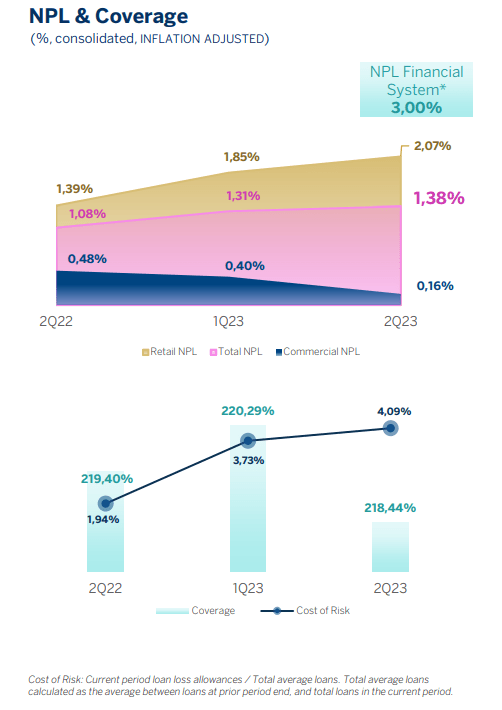

Every bank has nonperforming assets. The point is to mitigate them below loan loss allowance. BBAR maintains NPL below the country’s average. The chart below from the Q2 company presentation shows BBAR NPL and coverage.

BBAR Q2 presentation

Retail NPL has increased in the last quarter, but commercial NPL has declined in the same period. Considering the tumultuous situation in Argentina, BBAR NPL is impressive.

The table below dissects the BBAR balance sheet. The data is taken from the Q2 2023 report:

|

Asset ratios: assets structure |

|

|

Cash/Total Assets |

13 % |

|

Credit Cards/Total Assets |

12.5 % |

|

Loans (ex., Credit cards)/Total Assets |

19 % |

|

Bonds/Total Assets |

41 % |

|

Liability ratios: capital structure |

|

|

Deposits/ Total Liabilities |

78 % |

|

Borrowings/ Total Liabilities |

14 % |

|

Company bonds/ Total Liabilities |

– |

|

Equity/ Total Liabilities + Equity |

18 % |

|

Solvency ratios: |

|

|

Credit Cards Receivables /Deposits |

19 % |

|

Loans (ex., Credit Cards) /Deposits |

30.5 % |

|

Cash/Deposits |

21 % |

|

Borrowings/ Total Assets |

– |

The composition of the assets is vital for banks’ survival abilities. I like to see a higher percentage of liquid assets such as cash and government bonds. BBAR is doing well on those metrics – for every peso in assets, the bank holds 0.13 pesos in cash, and against every peso in assets is 0.41 invested in government bonds.

On the liabilities side, I am looking at how the bank finances its assets acquisitions. Every bank’s primary source of funds is deposits, and secondary are bond issuance and borrowings. BBAR uses deposits to fund its operations. The deposits form 78 % of the BBAR`s liabilities.

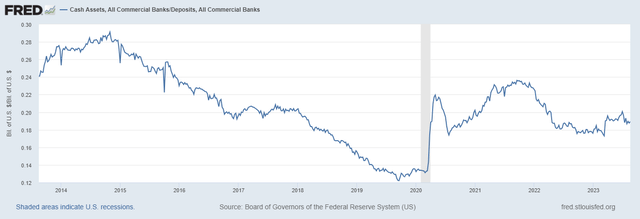

Putting together both sides of the balance sheet, I estimate the bank`s solvency. The most critical metric is cash to deposits, i.e., how many pesos of liquid funds we have against every deposited peso. BBAR has sufficient liquidity; the bank holds 0.21 pesos for every deposited peso. In other words, for every 5 pesos in deposits, BBAR has 1 peso in cash reserves. The chart below is from the FRED database and illustrates the Cash/Deposit ratio for all US commercial banks.

FRED database

BBAR stands above the current value of 19.5 %. Other critical metrics are the Basel III requirements. The table below presents BBAR’s solvency ratios. All data is sourced from the BBAR Q2 report.

|

Capital (in millions AR pesos): |

|

|

Regulatory Capital |

519,000 |

|

Tier 1 capital |

511,250 |

|

Common equity tier 1 (CET1) |

485,000 |

|

Risk-Weighted Assets |

1,828,243 |

|

Basel III Ratios: |

|

|

Regulatory capital ratio (Capital adequacy ratio) |

28.4 % |

|

Tier 1 ratio |

28.0 |

|

CET1 ratio |

26.3 % |

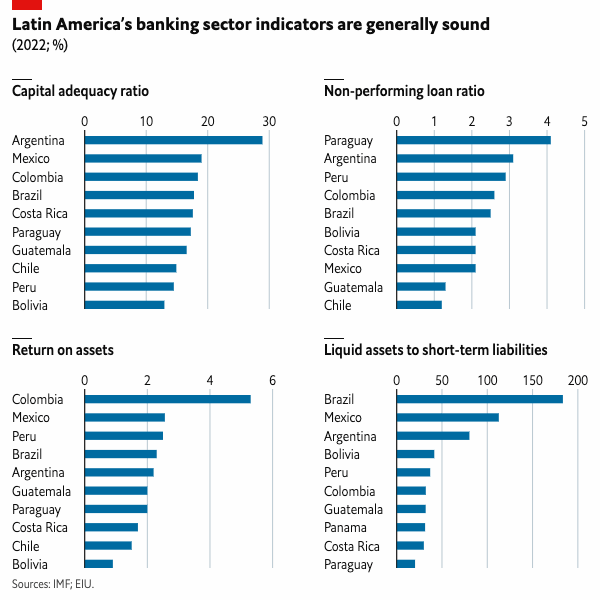

BBAR is a safe bank considering all ratios. The table below from S&P Intelligence shows where Argentina stands compared to its LATAM peers. BBAR`s capital adequacy ratio is the same as the country average. Argentina has higher than its peer CAR, despite the constant economic turmoil in Argentina.

S&P Intelligence

The image above illustrates another critical metric for any bank – Return on Assets (ROA). BBAR ROA is 3.6 %, higher than the country’s average of 2.3 %. The table below illustrates the rest of the efficiency parameters I like to use. All data is sourced from the BBAR Q2 report.

|

ROE |

21.3 % |

|

RoTE |

26.7 % |

|

RoCET 1 |

24 % |

|

ROA |

3.6 % |

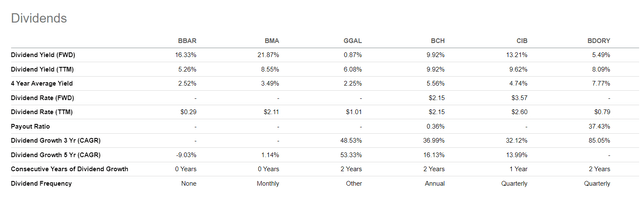

BBAR profitability fluctuates around Argentina’s average. The table below compares BBAR`s dividends.

Seeking Alpha BBAR profile

The company pays dividends but not on a regular base. The current yield is lower compared to other large LATAM banks. If BBAR keeps raising its customer base and maintains its net interest margins, the dividend might reach an impressive yield of 15.3 %.

Valuation

For the valuation of BBAR, I use the Excess Return Model. I do follow Professor Damodaran’s framework and its database.

Assumptions and inputs:

- Risk-free rate equals the 5Y average of USA long-term Government bond Rate, 2.2%.

- Growth rate, g, equals the 5Y average of the USA long-term Government bond Rate, 2.2%.

- Argentina’s equity risk premium is 23.21 %.

- BBAR’s book value per share is 3.35 $ (01/09/2023).

- Banks’ unlevered Beta 0.41.

- BBAR Debt/Equity ratio 73.1 %.

- Argentina’s effective tax rate is 35 %.

- BBAR ROE 21.3 %

1. Calculate Levered Beta with the formula below:

Levered Beta = Unlevered Beta * (1+D*(1-T)/E).

2. Calculate the discount rate (discount rate as the cost of equity) using the resulting value for leveraged beta. The formula I use is:

Cost of Equity = Risk-Free Rate + (Levered Beta * Equity Risk Premium).

3. Calculate Excess Returns using NU’s ROE, Book Value, and Cost of Equity:

Excess equity return = = (Stable Return on equity – Cost of equity) x (Book Value of Equity per share).

4. Calculate Excess Returns Terminal Value assuming perpetual constant growth and stable cost of equity:

Excess Returns Terminal Value = = Excess Returns / (Cost of Equity – Expected Growth Rate).

6. Calculate the Value of Equity.

Value of Equity = Book Value per share + Terminal Value of Excess Returns.

For BBAR, I get the following results:

Terminal Value of Excess Returns Per Share = $ 0.15

Intrinsic value per share = $ 3.5

Current market price = $ 5.78 (09/01/2023)

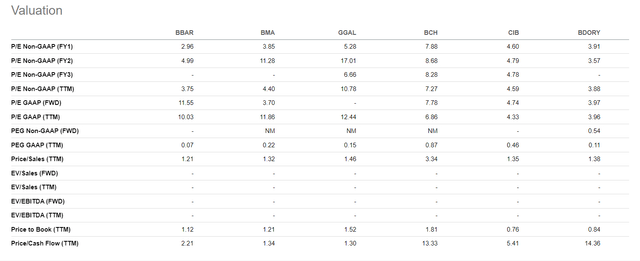

The table below compares BBAR against some of the largest banks in Argentina, Chile, Colombia, and Brazil.

Seeking Alpha BBAR profile

When I weigh up banks, I use price to book and price to sales. Both metrics are not perfect but are less prone to manipulation. Against its peers, BBAR is cheaper. Otherwise, the stock is overvalued based on excess return estimates.

Risks

Rule number one in investing: do not invest in Argentina. It is too risky and obscure, but my view differs. Argentina offers exceptional opportunities, but not for free. The volatility is the admission fee we pay to get multi-baggers.

Investing in Argentina carries many risks, but one of the most pronounced is the default risk. Last month, the Argentinean Central Bank ran out of reserves. The country was close to another default. On 23 August, the IMF approved a $ 7.5 billion disbursement, extending the financial lifeline to the impoverished government. The second risk specific to every commodity-based economy is the economic risk, i.e., the inflation rate, commodity prices, etc. Argentina is a major commodity exporter, and its economy is the first derivative of livestock, oil and gas, and cash crop prices.

Banks have four significant risks: liquidity, credit, market, and operational. The liquidity risk is the bank`s ability to face its debt obligations. Credit risk is the potential for the borrower or other bank`s counterparty to be unable to meet its obligations by the agreed terms. In BBAR`s case, that means a high percentage of non-performing loans and credit card delinquencies. As we saw, the bank`s NPL is below the Argentinean average. Regarding liquidity, BBAR is well positioned because the primary origin of its funds is deposits. Most of them are time deposits and savings accounts with longer maturities.

The Argentinean equity market follows its own boom and bust cycle. It has a relatively low correlation to developed markets. A new potential bull run has started, and the market risk is relatively low. Operational risk measures the potential of losses due to inadequacy or failures of conduct, internal processes, or external events. That is an idiosyncratic risk that is not measurable. It depends more on qualitative factors like corporate culture and leadership qualities.

Money always moves from the impatient and unprepared to the patient and prepared, and Argentina requires both in abundance. Investing in unknown and high-risk regions and markets is dangerous. The circle of competence works not only at the industry level but also at the geographic level.

The Argentinian equity market is brutally cyclical. Unlike the US or Europe, in Argentina, you cannot hold stocks for decades, realize capital gains, and receive regular dividends. Strategies like buy and hold, dollar cost averaging, and long-term positions for over a few years are dangerous. Investing in Argentine companies requires a strict risk management plan that requires active position management.

Conclusion

The Argentinean stocks already bottomed last year, and the expectation of eventual political change has fueled the current upside move. The results from PASO were surprising for the political analyst. However, they added credibility to my investment thesis on another Argentinean boom cycle. BBAR is a bet on the Argentinean economic recovery, digital transformation of the banking industry, and serving the unbanked populations. The bank has a great risk profile and a diverse portfolio of loans. The stock price is expensive compared to Excessive Return calculations but is cheaper than its peers.

Read the full article here