CytoMed Therapeutics (NASDAQ:GDTC)

CytoMed Therapeutics (GDCT, or the Company), a Singapore-based biotechnology company trading on the NASDAQ, is developing multiple gamma delta chimeric antigen receptor T-cell (“γδ CAR-T”) therapeutics for the treatment of cancer. The Company is one of many who are trying to exploit the body’s immune system to help fight cancer and has licensed technology from A*STAR, a highly regarded research and development governmental organization in Singapore.

Definitions and Abbreviations

Autologous – Cell therapy where the patient’s own cells are used.

Allogeneic – Cell therapy where donor cells are used for multiple patients.

Chimeric Antigen Receptor (“CAR”) – A special receptor created in the laboratory that is designed to bind to certain proteins on cancer cells. The CAR can then be added to T cells to make CAR-T cells.

Human Leukocyte Antigen (“HLA”) – A type of molecule found on a cell surface that allows other cells to know if a given cell is part of the body, or a foreign substance. – Definition Source – Wikipedia

Induced Pluripotent Stem Cells (“iPSC”) – “Induced pluripotent stem cells (also known as iPS cells or iPSCs) are a type of pluripotent stem cell that can be generated directly from a somatic cell.” – Definition Source – Wikipedia

Natual Killer Cells (“NK cells”) – “A type of cytotoxic lymphocyte that is critical to the body’s immune system. Its role is to provide rapid response to virus-infected or stressed cell, in the absence of HLA identification.” – Definition Source – Wikipedia

“Non-Hodgkins Lymphoma (“NHL”) – A type of cancer that begins in your lymphatic system, which is part of the body’s germ-fighting immune system. In NHL, white blood cells called lymphocytes grow abnormally and can form growths (tumors) throughout the body” – Definition Source – Bing Search

CAR-T Cell Therapy Overview

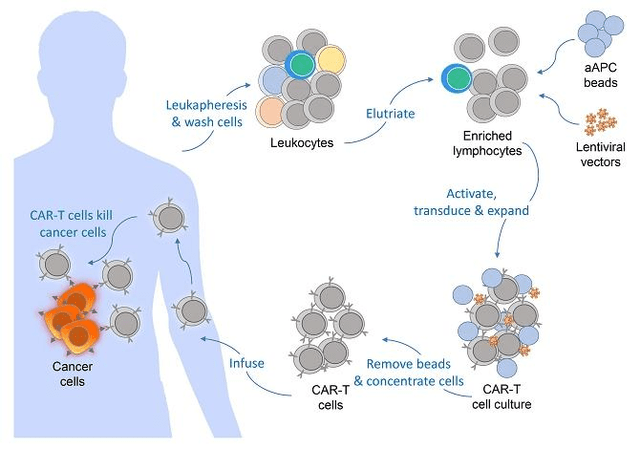

From a high level, autologous CAR-T cell therapy is relatively straight forward. T-cells are extracted from a patient’s blood. The extracted T-cells are isolated and allowed to multiply. Once in sufficient quantities, an antigen receptor is added to the cells through gene editing, usually through an engineered virus. That chimeric antigen receptor (“CAR”) is designed to bind to a surface receptor on a cancer cell. The T-cell’s normal job is to bind to target cell, start the process of destroying that cell, and recruit other immune system cells to assist in the destruction process. By adding a CAR to the surface of a T-cell, that CAR T-cell has a higher probability of attacking whatever cell becomes bound to that CAR. Thus, the CAR-T cell therapies are engineered to target and destroy cancer cells, and have become a very promising technology in the fight against cancer.

sec.gov/Archives/edgar/data/1873093/000149315223012534/form424b4.htm

Figure 1: General Autologous CAR-T cell Production Process

(Source: GDTC Form 20-F)

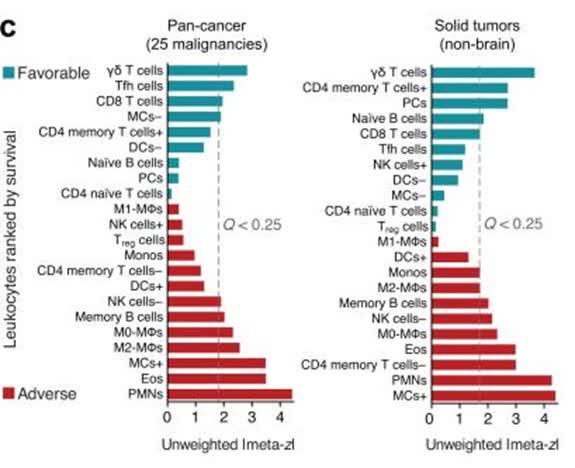

Most all CAR-T programs have focused on the αβ T cell. For autologous therapies, only the αβ T cells exist in enough quantities to isolate, engineer and re-inject into the patient. Interestingly, in a post-hoc analysis of the cell types found in tumors of those patients who have gone into remission, γδ T cells are found in the highest relative proportion inside the tumors.

Nat Med. 2015 Aug; 21(8): 938–945.

Figure 2: Prognostic Association of Various Relative Leukocytes Fractions Found in 9,000 Cancer Tumors

(Source: Nat Med. 2015 Aug; 21(8): 938–945.)

From a high level, γδ T cells seem to check a number of boxes that make them “drugable”. A) The cells do not have HLA receptors which allows them to better avoid graft versus host issues. To make αβ T cells into an allogeneic product, HLA-binding receptors need to be blocked or removed, requiring multiple processing steps, prior to adding a CAR. B) Many subtypes of the γδ T cells naturally migrate into tissues, which help them target solid tumors. C) The cells naturally have surface receptors that only target cells that are either in stress or functioning improperly.

Time will tell if human biology has some other way to recognize that an allogeneic γδ T cell is foreign and needs to be expelled. As a scientist and engineer in the life science space, I know that trying to manipulate biology can be a humbling experience. Just look at all the attempts to turn stem cells into therapies. We have survived as a species because it is hard for external microbes to manipulate our biology. Our bodies fight microscopic pathogens a million times a day. If it were easy to manipulate a cell into killing another cell, then we might not have evolved much past algae. The theory behind CAR-T cells is logical. Putting the theory into practice is very hard. The companies attempting these programs deserve a lot of respect.

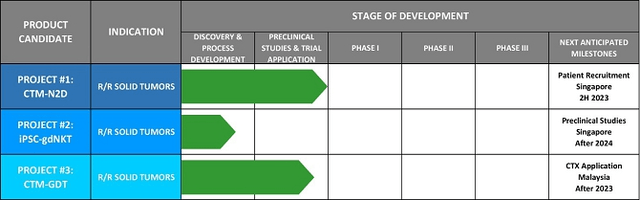

CytoMed Therapeutics – Pipeline

The Company has three programs in pipeline, each of which could itself be a platform for multiple cancer indications.

sec.gov/Archives/edgar/data/1873093/000149315223012534/form424b4.htm

Figure 3: CytoMed Therapeutics Pipeline

(Source: GDTC Form 20-F)

- CTM-N2D: Allogeneic γδ T cells that have been edited to have an NK2GD receptor, which commonly found on NK cells. The NKG2D receptor recognizes induced-self proteins from MIC and RAET1/ULBP families, which appear on the surface of stressed, malignant transformed, and infected cells. The therapy should be initiating its first in human studies in the back half of 2023.

There are over 20 clinical trials, mostly in China, that include the NKG2D receptor in an engineered cell therapy, and there are hundreds of journal articles on the receptor pathway. There is strong theoretical support for this CAR-T combination. Many other programs involving this receptor pathway should have data read out before CytoMed’s trial and should be able to provide proof of concept guidance for multiple indications to CytoMed. Those data will enable the Company to focus future efforts on indications with higher than normal probability of success.

sec.gov/Archives/edgar/data/1873093/000149315223012534/form424b4.htm

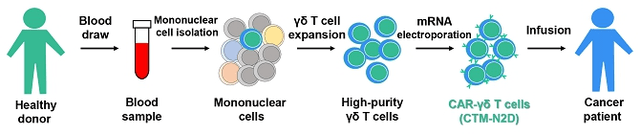

Figure 4: CTM-N2D Manufacturing Process

(Source: GDTC Form 20-F)

When talking to the Company, one can get a better sense of their process. First, because the γδ T cells are only a small fraction of the cells isolated from blood, the Company runs the collected lymphocytes through a process to stimulate the expansion of the γδ T cells before they separate the γδ T cells from the other lymphocytes. Then the company stimulates the isolated γδ T cells to expand again to attain a large number of cells. Second, and unique to CytoMed, is their use of electroporation to incorporate the mRNA required to implant the CAR, instead of using a virus. The process of electroporation can cost less than using a virus when one considers the additional cost of maintaining the virus bank and of the additional in-process testing of the viral material.

CytoMed has expressed the goal of bringing down the cost of cancer therapy. I believe that they may be able to achieve a cost advantage with their processes. 400 ml of donor blood can generate at least 20 doses, assuming a high dose of 1 billion cells.

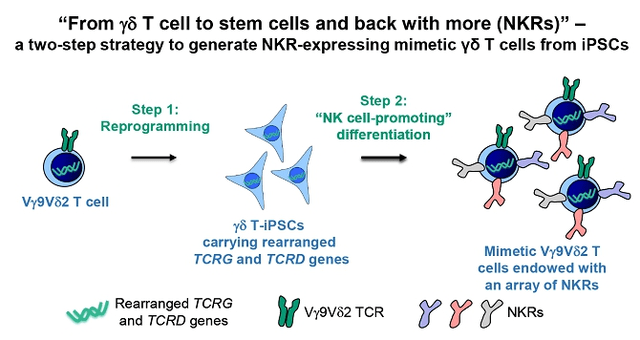

- iPSC-gdNKT: Allogeneic γδ T cells with NK cell properties. iPSC cells derived from γδ T-cells are pushed through an NK cell differentiation process. The net result is a hybrid γδ T-NK cell with surface receptors that bind to multiple surface receptors common on cancerous cells.

sec.gov/Archives/edgar/data/1873093/000149315223012534/form424b4.htm

Figure 5: iPSC-gdNKT Manufacturing Process

(Source: GDTC Form 20-F)

In my opinion, of all of CytoMed’s programs, this product platform has the most potential to become a pipeline in a product. By combining the properties of γδ T cells and NK cells, there is a strong potential to bind to multiple cellular abnormalities that could elude normal T cells or NK cells. This program is very early, and is not expected to be in patients for a few years.

One could imagine that, once they have validated all of the steps to consistently generate these cells, that the Company could then add a CAR to these cells at the iPSC stage, potentially creating a very potent, highly targeted CAR-T/NK cell. That would be a very interesting platform.

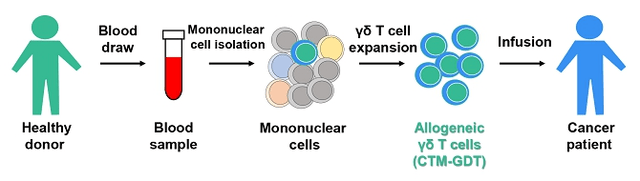

- CTM-GDT: Allogeneic γδ T cells with no modifications. These cells will be extracted from healthy donors and expanded to provide a consistent source of off-the-shelf γδ T cells to patients.

sec.gov/Archives/edgar/data/1873093/000149315223012534/form424b4.htm

Figure 6: CTM-GDT Manufacturing Process

(Source: GDTC Form 20-F)

CytoMed’s CTM-GDT program is a simple cell replacement therapy. Because the γδ T cells do not use HLA in their interaction with other cells, they have a lower probability of creating an immune response when transplanted into a patient than do αβ T cells, the predominant form of T cells. αβ T cells rely on HLA interactions, which is why the initial CAR-T cell therapies are autologous. The CTM-GDT product does not have any CAR engineering, and therefore relies on the natural anti-cancer properties of the γδ T cell. γδ T cells, which represent a very small fraction of total T cells, recognize markers of cellular stress independent of cell source, be it a bacteria or a patient’s cancer cell. γδ T cells also can accumulate inside tissues at the location of solid tumors. As a product, CTM-GDT could act as an immune booster, equivalent to putting more police on the street to look for bad actors.

Through a compassionate use program, some patients have already received CTM-GDT. At least 9 patients who had very late-stage cancer received serial infusions of γδ T cells harvested and expanded from healthy donors. Multiple patients had a partial response, and the company believes a few patients may still be alive 2 years after receiving their last dose. The Company has not had the bandwidth to track down these patients and review their medical history from the end of dosing (last dose of first group was in late 2021). The dose was likely 10-50x lower than what would be the high dose in their next clinical trial, so the data may or may be useful. While management has not published the results from the program, the fact that they are pursuing this program of unmodified γδ T cells suggests that they have seen enough efficacy to make it worth the expense, and enough safety for the regulatory authorities to allow the program to continue.

If proven safe, I believe this kind of therapy could eventually be seen as an immune booster that could be given to any cancer patient early in the diagnosis process, akin to the Multikine® therapy developed by CEL-SCI (CVM). The Phase 3 for Multikine® was arduously long because of the type of cancer pursued. CtyoMed could target more aggressive cancers and have a shorter, cheaper trial. Note: CytoMed has made no mention of pursuing this pathway – this is purely conjecture on my part.

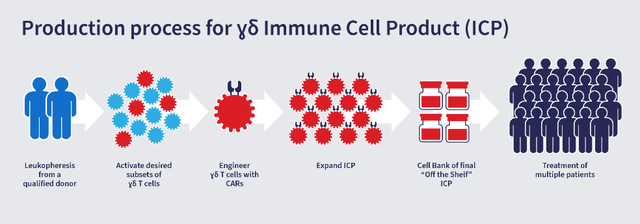

Platform Companies with Competitive Programs

There are many companies developing CAR-T cell therapeutics. A majority of them, including the thought-leader in the allogeneic space, Allogene Therapeutics (ALLO), focus on the modification of αβ T cells to both reduce graft versus host risk and better target certain cancers. Others in the space are working on NK cell products. CytoMed has put its scientific eggs into the γδ T cell basket, with their most interesting program being a combination of γδ T cells and NK cell properties. The companies below also have clinical stage programs using γδ T cells. There are likely many more that have earlier stage programs.

Adicet Bio (ACET – $77M mkt cap w/ ($100M) EV) – ADI-001 is an investigational allogeneic gamma delta CAR T cell therapy being developed as a potential treatment for relapsed or refractory B-cell NHL. ADI-001 targets malignant B-cells via an anti-CD20 CAR and via the gamma delta innate and T cell endogenous cytotoxicity receptors.

Adicet Bio – Corp Presentation

Figure 7: Adicet Bio’s γδ CAR T Cell production process

(Source: Adicet Bio)

Century Therapeutics (IPSC – $152M mkt cap w/ $37M EV) – Most of Century’s pipeline consist of allogeneic iPSC-derived NK and T cell products. IPSC creates a cell bank of induced pluripotent stem cells from a healthy donor, and then uses gene editing to remove receptors that might cause an immune reaction when administered to patients. They have one γδ T cell product, CNTY-107, which is a γδ iT product candidate for the treatment of solid tumors expressing Nectin-4.

Century Therapeutics – Corp Pres

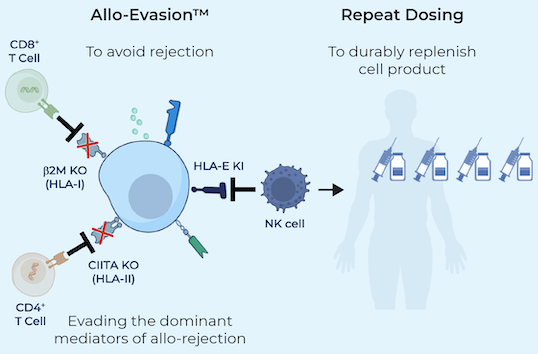

Figure 8: Century Therapeutics’ process to remove receptors that might cause host rejection

(Source: Century Therapeutics)

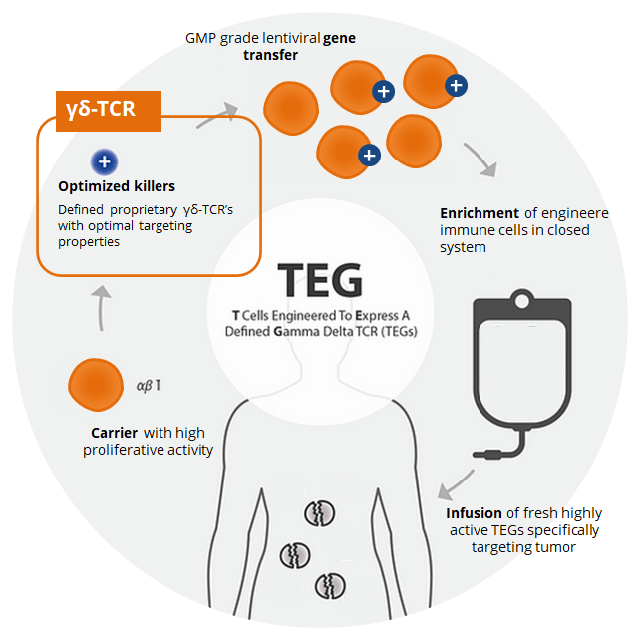

Gadeta NV (private)– GDT002 is an allogeneic-like therapy that harvests a patients αβ T cell, then adds specific γδ T cell receptors to the αβ T cell. When returned to the patient, the new cells have the proliferation tendency of the an αβ T cell and the broad tumor fighting capability of an specific γδ T cell.

Gadeta Thera – Corp Pres

Figure 9: Gedeta’s GDT002 manufacturing process

(Source: Gadeta NV)

Valuation

It is too early in development to provide a rigorous valuation of CtyoMed. None of the Company’s programs have been dosed in patients in a clinical trial. Initial approval to dose patients has been given, which suggests that the program has passed regulatory scrutiny of their toxicology work and of their manufacturing processes. However, until the program safely doses patients, the Company’s technology is unproven. That will change soon, as the Company’s CTM-2MD program is scheduled to begin its first clinical trial by the end of 2023. Once the company completes the dosing of a clinical trial, many of the biggest risks will have been mitigated.

- Is the product safe to administer to patients? We will know at the end of the trial. Despite the regulatory scrutiny of the preclinical testing, proof of safety in humans can only really be proven by dosing the cells in humans.

- Is there a biomarker signal that the therapy is hitting its target? We will probably know at the end of the first trial.

- Will the drug be effective in killing cancer cells? We may or may not know this at the end of the trial, depending on the ability to see tumor shrinkage. As I understand in study, they will be enrolling a few different kinds of cancer patients with solid tumors, called a basket trial. The odds of success of the program increase greatly if one or more tumor types are seen to shrink upon exposure to the therapy.

Once the basics risks are mitigated through the successful dosing of a few patients, then one can start to consider the usual safety and efficacy risks in a therapeutic valuation. Assuming they can dose a Phase 1 successfully and see the biomarkers and/or tumor shrinkage that they want to see, then it becomes easier to create a DCF model for each indication that they decide to pursue, and prescribe a value for the platform in general. As it stands, an enterprise value of approximately $30M does not seem off base.

With clinical data in hand, depending on the market conditions, CytoMed should be able to articulate what indications are possible for their therapy, and to request multiple years of funding from new and current investors. It is at that point, I believe, where the Company’s stock price will meaningfully appreciate. Being based in Singapore and Malaysia where employee and infrastructure costs are lower than in the US or EU, GDCT has a much lower fixed cost burn rate than its peers, and it has the opportunity to become a leading player in the Chinese, Korean and Japanese markets, which seem to have embraced cell therapy more than the US market.

In early July, the Company’s stock price rocketed up to over $9 on no news. With a public float is less than 20% of the outstanding shares, it is easy to see how a large volume day may cause the stock to move quickly. With supportive human data in an early clinical study and a long cash runway, the Company has room to run.

Cash Burn and Future Dilution

The Company lost US$1.5M and $2.5M in 2021 and 2022, respectively. The Company raised US$9.6M in their IPO in April 2023. The Company has stated that they have over 2 years of cash to run operations. For 2023 and 2024, the Company will have increased administrative costs from being public and increased R&D expenses from initiating their first clinical studies. Based on their current clinical trial plan, it is likely that the Company will be able to get to 2025 with their current cash.

I would, however, expect that the Company raises money following their first human data set reported next year. If proven safe and has some signs of efficacy, then it would be understandable for the Company to map out their next few development steps and raise the money to execute that plan.

Ownership

After the IPO, the Company had approximately 11.5M shares outstanding. The CEO, Mr. Choo, owns 2.9M, or approximately 27% of the Company. Glorious Finance Ltd. owns 4.6M shares, or approximately 43% of the Company. mDR Ltd., a public company listed on the Singapore exchange, owns 1.3M shares, or approximately 12% of the Company.

Investors in the IPO own approximately 2.4M shares, or 20% of the Company. Management (including the board) own just over 33% of the Company. 70% of the shares are owned by 5% holders or management.

GDTC is a tightly held company. Its average volume is about 25K shares. On 7/11/23, with no news, 21M shares traded and the stock hit a high of $9.25. It has since drifted back down to below the IPO price.

Potential Risks and Potential Surprises

1) Allogeneic Theory: CAR γδ T cell products are new and have yet to be approved for commercial sale. There could be some fundamental flaw in the theory behind the science. In theory, the therapy is allogeneic, meaning the cells from a healthy donor could be extracted, modified, and expanded to create treatments for 20-40 patients. If that does not turn out to be true, then the thesis of the Company is void. Safe dosing in the Phase 1 helps to reduce that fundamental scientific risk.

2) Future Financings: GDTC is a long way from revenue. As such, the Company will need multiple rounds of funding before it has the opportunity to being self-sustaining. When buying stock in this company, or any development stage life science company, one should be prepared for multiple rounds. With a public company such as this, a decent strategy may be to own a core position, to add or fade during large price fluctuations that are disconnected from news events, and to top-up after every dilutive event until your thesis changes.

3) Micro-Markets: Cancer treatments are increasingly a series of micro-markets. With these therapies that depend on cell receptor binding, the companies must be right on the receptor design, and must be right on the patient’s cancer’s propensity to have those receptors. They must also be able to be effective on top of the standard of care, which is usually a cocktail of medicines. The size of a given micro-market, and the competitive pressures in that micro-market are hard to know. Many companies have developed therapies for a particular subset of cancer patients, only to discover 4-5 years into their development, that a new drug or therapy changes the standard of care. That forces a reevaluation of the micro-market, and the potential value of the therapy. As cancer diagnostics get more specific, therapies can be more targeted at smaller and smaller micro-markets. As the size of the micro-markets shrink, the probability of competitive overlap shrinks as well. GDTC will likely target each of their CAR γδ T cell products at multiple micro-markets. Hitting one proves the thesis and reduces the scientific risk. Hitting multiple validates the platform, and likely gets them bought for a huge premium.

Conclusion

CytoMed is doing very interesting work in an emerging branch of the CAR T universe. The core thesis of using γδ T cells as a platform for an allogenic therapy is logical. The Company percolated from the work of A-STAR, Singapore’s bioscience engine. Their manufacturing process does not use viruses and does not need multiple mRNA transfer steps, which reduces complexity. A single donor can provide the material to create approximately 20 doses. Their geographic cost structure combined with their scalable manufacturing process potentially creates one of the lowest cost of goods in the space. Once the Company completes a Phase 1 in patients, the scientific risk will decrease substantially. If they see tumor shrinkage, then the odds of success increase substantially.

I believe GDTC’s science makes it worthy of owning a small, core position now; the recent volatility means it could be entertaining to trade around the position on random days. Once the Company proves safety in the Phase 1, depending on cash levels, adding to the position could make sense. If there are signals of efficacy in the phase 1, then it would make sense to perform a deeper dive to generate a more thoughtful valuation and attempt to articulate the potential upside. If the platform eventually proves successful in multiple early-stage Phase 2 studies, then it would be worthy of an overweight position as I do not believe that this Company would be independent for long – being bought out for a Kite Pharma-like valuation ($12B) would not be crazy if the science plays out. That kind of proof of platform is many years away, but the CAR γδ T cell thesis is interesting, and the Company has a plan to methodically prove the science.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here