Intro

Winnebago Industries, Inc. (NYSE:WGO), based in Minnesota, has been making recreational vehicles since 1958. They generated around $5 billion in revenue as of 2022. In recent years, they expanded into towables, accounting for 83% of their RV unit volume. They also ventured into boating and acquired companies like Chris-Craft, Newmar, and Barletta pontoon boats. They’re even exploring electric and autonomous technology. WGO has evolved beyond motorhomes into a diversified player in the recreational vehicle industry.

In this analysis, we’ll take a close look at Winnebago’s financial performance and its outlook for potential growth. Our examination will delve into how the company is earning money, its profitability, and how effectively it manages its cash flow. By gaining a deeper understanding of these aspects, you’ll be better equipped to make an informed decision about whether to invest in WGO, and you’ll also understand why we suggest buying the stock.

Track Record

When you’re thinking about investing your money, it’s like trying to predict the future. But one good way to guess what might happen is by looking at what’s happened in the past. By checking out a company’s history – things like how revenue and free cash flow for example – you can get an idea of how good they are at handling different situations. This kind of research also shows you if the people in charge of the company, the leaders, are making smart decisions. Are they coming up with good plans? Are they dealing well with problems that pop up?

So, when you’re thinking about putting your money into a company like Winnebago Industries, Inc., it’s like looking at their report card from the past. And you know what? WGO has a pretty good report card when it comes to making money. They’ve been doing well financially over the years, which can be a pretty good sign when you’re thinking about where to put your money.

We have here the financial numbers for WGO, the company, over the past decade. The company’s revenue has been on a steady upward trend. In 2013, it was at $803 million, and by 2022, it had grown to a substantial $4,958 million. That’s a whopping 517.30% increase in total revenue during this period. When we calculate the average yearly growth rate, it comes out to about 19.96%.

Data by Stock Analysis

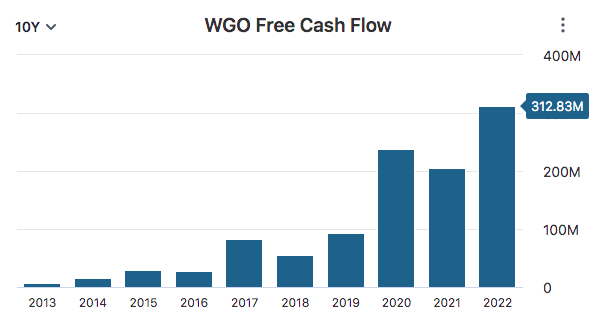

Now, let’s talk about free cash flow, which is essentially the money a company has left over after covering its operating expenses and investments in its business. In 2013, WGO had a free cash flow of $6.55 million, but by 2022, it had significantly increased to $312.83 million. That’s a tremendous growth of 4,676.03% in free cash flow over these years. When we calculate the average yearly growth rate for free cash flow, it’s about 47.20%.

Data by Stock Analysis

So, what do these numbers tell us? Well, WGO has been doing very well in terms of revenue growth, and its free cash flow has also seen substantial improvement. This suggests that the company has been effectively managing its finances and potentially has the resources for future investments or returning value to its shareholders.

WGO’s impressive growth can be attributed to a couple of key factors that have helped solidify their standing in the market. Firstly, their longevity in the business, spanning over 60 years, has been a significant contributor to their success. When a company has been around for that long, it builds trust with customers. People know that they have a history of making reliable and high-quality recreational vehicles (RVs). This trust in their brand is like a strong foundation for growth.

Secondly, WGO has wisely diversified their product range to cater to a wide range of customer needs. They offer everything from small travel trailers to large motorhomes. This versatility is a financial advantage because it allows them to tap into different segments of the market. When times are tough for one type of RV, they can rely on sales from another. It’s a bit like having a diversified investment portfolio; it helps spread the risk.

WGO’s growth is closely tied to their reputation for quality and their ability to adapt to the changing needs of their customers. These factors have played a significant role in their continued success over the years and have allowed the company to establish an impressive track record in profitability in addition to its growth.

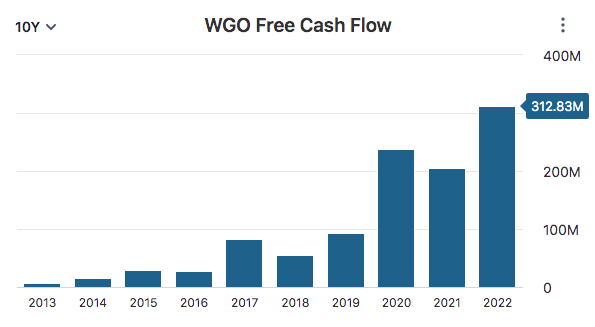

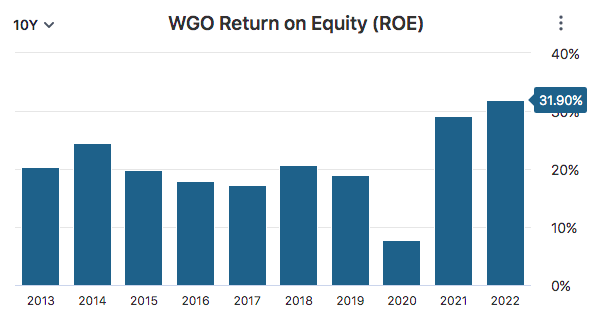

When we look at WGO’s 10-year average return on equity, or ROE, it stands at a pretty impressive 20.82%. This is a measure of how effectively the company is using its shareholders’ equity to generate profits. In simple terms, it means that for every dollar invested by shareholders, WGO is making, on average, about 20.82 cents in profit.

Data by Stock Analysis

But let’s not stop there. To put this in perspective, we should also consider the sector median ROE, which is like the average score for all the companies in WGO’s industry. In this case, that sector median ROE is 10.93%. So, WGO is doing significantly better than the average company in its sector when it comes to generating profits with shareholders’ money.

This tells us that WGO has been quite efficient in using its resources to make money for its investors. A high ROE like this often indicates a financially healthy and well-managed company which can ultimately lead to fantastic returns for investors.

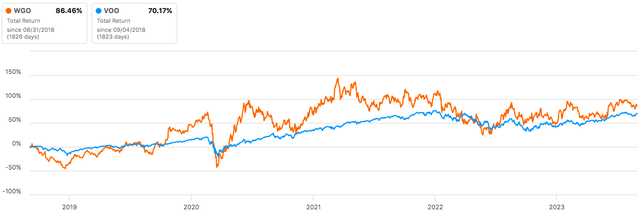

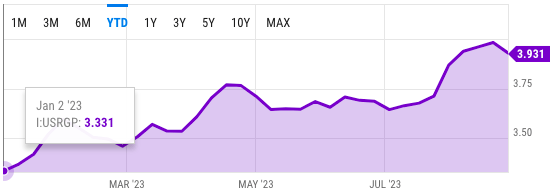

Over the past 5 years, WGO total return was an impressive 86%, while the S&P 500 (SP500) had a total return of 70%. This means that WGO outperformed the overall stock market during this period, making it a strong investment choice. However, remember that past performance doesn’t guarantee future results, so let’s take a look at the company’s outlook for the future.

Data by Seeking Alpha

Outlook

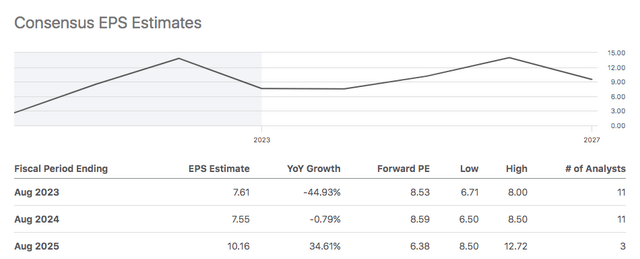

Let’s talk about WGO’s future outlook based on the average analyst estimates, this data can be found on the Earnings Estimates page on Seeking Alpha’s website. For the fiscal period ending in August 2023, analysts estimate that WGO’s earnings per share (EPS) will be around $7.61. The estimated YoY (Year-over-Year) growth for this period is -44.93%, which indicates a potential decrease in earnings compared to the previous year.

Data by Seeking Alpha

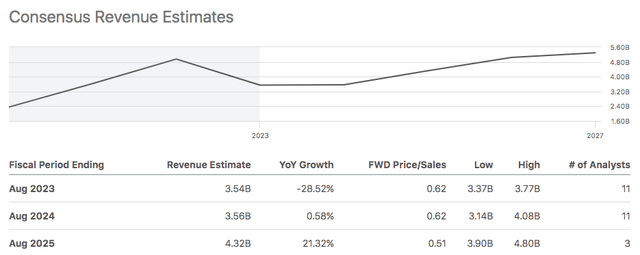

When it comes to Revenue, analysts are estimating it to be approximately $3.54 billion for the same period ending in August 2023. However, the estimated YoY growth for revenue is -28.52%, suggesting a potential decline in sales compared to the previous year.

Data by Seeking Alpha

So, from these analyst estimates, it appears that there might be some challenges on the horizon for WGO in terms of both earnings and revenue. The negative growth percentages indicate a potential decrease in profitability and sales compared to the prior year. There are some potential threats to WGO that are contributing to the company’s poor outlook.

First, we have the threat of an economic downturn. During a downturn, people tighten their wallets, it can lead to a substantial decrease in demand for RVs. Over the past year we’ve seen a significant rise in both inflation and interest rates and the threat of a recession has clouded WGO’s outlook. These macroeconomic factors have led to fewer RV buyers, and sales and profits for WGO have taken a hit.

In addition, there’s the issue of rising fuel prices. Just like you might hesitate to take a long road trip if gas prices are soaring, higher fuel prices can make RVs more expensive to operate. When people see the cost of fuel going up, they might be less willing to buy an RV because they’re concerned about the ongoing fuel expenses. This, in turn, can lead to a decrease in demand for WGO’s products. Over the last year, fuel prices in the US have steadily increased, creating a real headache for RV owners and WGO investors. Below is a chart that shows how the price of a gallon of gas has steadily increased throughout 2023.

Data by YCharts

So, these are some of the major threats that WGO faces. They have the potential to contribute to the company’s poor outlook because they can reduce demand for their RVs and increase operating costs.

Despite these concerns, WGO is working to grow through innovation. The company has recently acquired Lithionics Battery, a leader in lithium-ion battery solutions. This is a big deal because it means WGO is staying at the forefront of technology in the RV and outdoor recreation world. Lithium-ion batteries are more efficient and longer-lasting, making them perfect for RVs and outdoor enthusiasts who want extended off-the-grid experiences. By adding this technology, WGO is offering better power solutions to its customers.

This move not only keeps WGO competitive but also positions them as leaders in innovation in the industry. It’s a smart strategy to meet the changing preferences of modern adventurers and potentially drive more growth for the company in the future.

Valuation

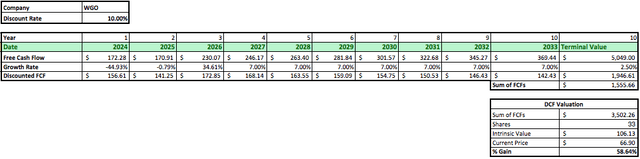

To determine WGO’s intrinsic value we will run a discounted cash flow, or DCF, analysis on the company. By running this DCF analysis on WGO, we can get a true value of a company’s stock based on its future cash flows.

First, we’ll start with the company’s initial free cash flow in 2022, which is $312 million. We’ll estimate a growth rate for the next few years based on analyst insights. We have a growth rate of -44.93% for 2023, -0.79% for 2024, and a positive rebound of 34.61% for 2025.

Now, for the next phase of our DCF analysis, we’ll use the average compounded annual growth rate of revenue and free cash flow over the past decade, which is over 33%. Typically we’ll apply this growth rate from year 4 through year 10 but since this growth rate is so high, we’ll use a more conservative growth rate of 7% for these years.

We’ll use a discount rate of 10%, which represents the market’s average return with reinvested dividends. We also need a perpetual growth rate, which is how much we think the company will grow indefinitely after year 10. Here, we’re using a conservative estimate of 2.5%.

Now, after crunching the numbers, WGO’s projected intrinsic value comes out to be $106.13. This is our estimate of what the stock should be worth based on our analysis which represents a substantial upside of 58% to the company’s current share price.

Author’s Work

Takeaway

Winnebago Industries, Inc. is a well-established RV manufacturer with a strong history of growth. They’ve diversified their product range, which has contributed to their success. Financially, WGO has seen impressive growth in both revenue and free cash flow over the past decade. Their 10-year average ROE of 20.82% indicates efficient financial management. Over the last 5 years, WGO outperformed the broader market, with a 86% total return compared to the S&P 500’s 70%.

However, there are some near-term concerns, including the potential impact of economic downturns and rising fuel prices. Analyst estimates suggest a decrease in earnings and revenue for 2023. Despite these challenges, WGO is investing in innovation through acquisitions like Lithionics Battery, positioning them at the forefront of technology in the RV industry.

A DCF analysis indicates Winnebago Industries, Inc. stock may be undervalued, with a projected intrinsic value of $106.13, offering a significant upside. Therefore, we think it’s a good decision to buy WGO based on the company’s strong track record, innovative acquisitions, and current valuation.

Read the full article here