After the recent pullback in its unit price, I now consider Dorchester Minerals, L.P. (NASDAQ:DMLP) undervalued after previously having a hold rating on it. Dorchester’s unit price has fallen 7% since I last looked at it, despite oil prices increasing by several dollars over that time frame.

There seems to be some confusion around one of Dorchester’s proposed amendments to its partnership agreement, and that confusion may be contributing to its recent underperformance.

While it may appear that Dorchester is asking for permission to make significantly larger acquisitions without unitholder approval, the proposed amendment would actually only increase the size of its potential acquisitions by around 2%.

Dorchester is currently allowed to issue approximately 26 million common units (with a current market value of around $730 million) for an all-equity acquisition. It is also currently allowed to spend approximately $16 million for an all-cash acquisition.

However, if the acquisition is made via a combination of cash and equity, then it is currently allowed to issue around 4.3 million common units and spend $8 million in cash. This would limit the size of a combined cash and equity acquisition to around 18% of what it could do with an all-equity acquisition. Dorchester’s proposed amendment would put the combined cash and equity acquisition limits more in-line with the individual limits for all-cash and all-equity acquisitions.

Acquisitions

Here’s a look at Dorchester’s acquisitions since the start of 2021. Over that period, Dorchester has announced six acquisitions involving total consideration of 4.409 million common units that were worth $100.1 million at the time of the deal. Dorchester has typically paid for acquisitions only with equity.

| Acquisition Closing Date | Units | $ Million |

| June 2021 | 725,000 | $12.2 |

| December 2021 | 1,580,000 | $31.3 |

| March 2022 | 570,000 | $14.8 |

| September 2022 | 816,719 | $20.4 |

| July 2023 | 343,750 | $11.0 |

| August 2023 | 374,000 | $10.4 |

| Total | 4,409,469 | $100.1 |

Dorchester has a bit over 39 million outstanding common units now, so the 4.409 million common units paid for these acquisitions adds up to around 11% of its current unit count.

It is challenging to determine whether Dorchester paid a good price for these acquisitions, though, since it typically does not provide many details about each acquisition. Dorchester typically provides info about the location and size (in net royalty acres) of the acquired assets along with the purchase price. However, it does not provide details such as expected production and cash flow from the acquired assets.

Proposed Partnership Agreement Amendment

Some people have asked about Dorchester’s proposed amendment number 3 to its partnership agreement, expressing questions about Dorchester’s potential to do much larger acquisitions now.

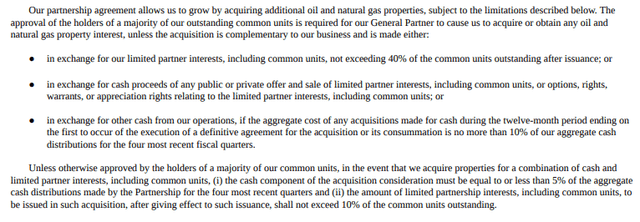

However, in an all-equity acquisition, Dorchester is already allowed to issue common units up to 40% of the total outstanding common units after issuance. Dorchester currently has approximately 39 million outstanding common units, so it could issue 26 million common units (current market value of $730 million) for an acquisition. That would be 40% of the post-acquisition total of 65 million outstanding common units.

Dorchester’s 2022 10-K (dmlp.net)

Dorchester is also currently allowed to spend up to $16 million in cash (based on 10% of trailing year distributions up to the end of Q2 2023) for an all-cash acquisition.

If Dorchester adds any cash (currently allowed up to $8 million in a mixed cash and equity deal) to the acquisition consideration, then it is currently limited to issuing common units up to 10% of the total outstanding common units after issuance. It could issue only approximately 4.3 million units (current market value of $120 million), which would be 10% of the post-acquisition total of approximately 43.3 million outstanding common units.

Thus adding a small cash component would currently limit its transaction size (at $128 million) to around 18% of what it could achieve (around $730 million) via an all-equity transaction.

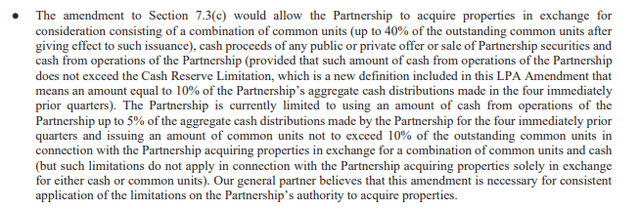

Dorchester’s Proposed Amendment (dmlp.net)

Dorchester is now aiming to be allowed to do mixed cash and equity transactions involving around 26 million units and $16 million in cash (total value of close to $0.75 billion).

This proposed amendment appears to give Dorchester more flexibility with structuring its acquisitions, but doesn’t meaningfully change (only a 2% increase) the total size of its potential acquisitions. Net cash is likely to be only a minor component of any acquisition consideration.

Another part of the proposed amendment would allow Dorchester to do asset swaps (or similar transactions) without needing to distribute the cash proceeds to unitholders. For example, it could sell some assets for $30 million and then use those proceeds for an acquisition at around generally the same time.

Here’s a scenario of a transaction Dorchester may be able to do if its proposed amendment is approved (and is currently not allowed to do). Dorchester first sells assets for $30 million and then pays $40 million and 5 million common units (approximately $140 million in market value) to acquire assets. This transaction would use $10 million in net cash.

Distribution And Valuation

Oil strip prices have moved up several dollars since I last looked at Dorchester, adding a few cents to its potential quarterly distributions. At Q2 2023 sales volumes, a $5 increase in oil prices would increase Dorchester’s quarterly distribution by approximately $0.06 per unit.

Despite the increase in oil prices, I am still maintaining my long-term commodity price estimates at $75 oil and $3.75 gas. At those commodity prices I expect Dorchester to end up with around $0.80 per unit in quarterly distributions, which would support a valuation of $32 per unit.

The rise in near-term commodity prices means that Dorchester is more likely to deliver quarterly distributions slightly above $0.80 per unit in the near-term though.

At a bit over $28 per unit, I believe that Dorchester now offers some (approximately 13%) potential capital appreciation in addition to a 13% yield (at a quarterly distribution of $0.80 per unit)

Conclusion

Dorchester Minerals, L.P.’s proposed amendment seems to have raised questions about whether it is planning on making some very large acquisitions. However, Dorchester is currently allowed to issue up to 26 million common units for an acquisition anyway. The amendment would give it more flexibility in using asset sales to pay for the cash consideration of an acquisition and potentially use a small amount of net cash in conjunction with issuing units.

With the recent pullback in Dorchester’s unit price (at a time when oil strip has been going up), I now consider Dorchester to be undervalued at its current unit price.

Read the full article here