Federal Reserve Chairman Jay Powell, in his speech at Jackson Hole, assured the world that the Fed would do what was necessary to bring inflation under control.

And, so the Federal Reserve continues to do what it has done for the past year and one-half.

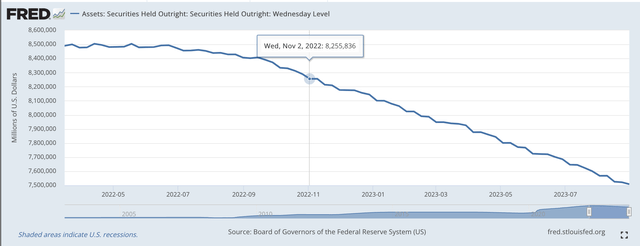

Believe it or not, the Fed has been reducing the size of its securities portfolio steadily since the middle of March 2022 – and here we are in September 2023.

I am not sure everyone would have believed that the Fed would carry on its “quantitative tightening” exercise for such a long period of time.

But, here we are.

In the past five weeks, from July 26, 2023, through August 30, 2023, the Federal Reserve saw its securities portfolio decline by $92.8 billion.

And, from March 16, 2022, through August 30, 2023, the securities portfolio has fallen by $982.4 billion. Note that another $62.8 billion has been removed from the Fed’s balance sheet do to the elimination of premiums and discounts associated with the securities portfolio.

So, in a year-and-one-half, the Fed has overseen a decline in its balance sheet of over $1.0 trillion associated with the reduction in the securities portfolio.

Here is what the chart looks like.

Securities Held Outright (Federal Reserve)

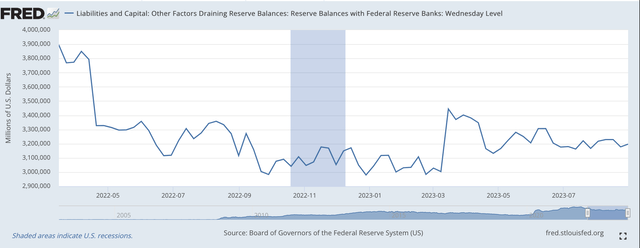

The reduction in the securities portfolio, however, is not the only balance sheet managing that Federal Reserve officials have done.

The Federal Reserve in increasing its policy rate of interest has had to manage the liquidity in the banking system so that quantitative easing transition continues smoothly.

Since May 2022, the Federal Reserve has kept Reserve Balances With Commercial Banks relatively constant. The line item on the Fed’s balance sheet titled Reserve Balances With Federal Reserve Banks can be considered to be an account of the “excess reserves” in the commercial banking system.

After the initial decline in this balance sheet item, the Fed has kept the excess reserves in the commercial banking system relatively constant. The only exception occurred in March 2023 with the failure of a couple of commercial banks, the Fed did allow these Reserve Balances to rise.

Here is the picture of this series.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

As of Wednesday, August 30, 2023, the total for Reserve Balances with Federal Reserve Banks stands at $3,196.5 billion or $3.2 trillion.

There is a lot of liquidity in the commercial banking system these days.

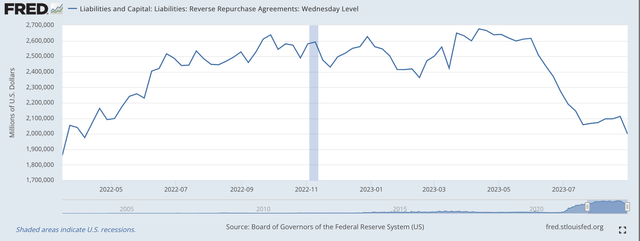

The Federal Reserve has been able to manage these reserves by use of Reverse Repurchase Agreements and by movements of money in and out of the General Account of the U.S. Treasury Department.

Reverse Repurchase Agreements (Federal Reserve)

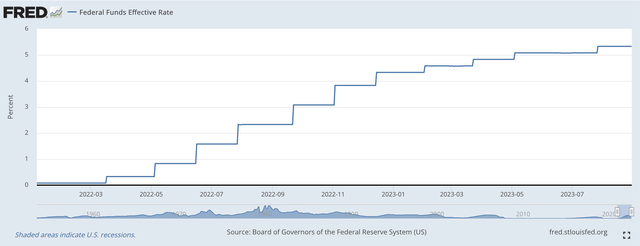

Mr. Powell has continually stated that the Federal Reserve will do what it needs to do to bring down inflation.

The question here is just how much more “quantitative tightening” the Federal Reserve is going to do.

Some analysts see the Fed going out for another year or so in terms of reducing the size of the securities portfolio.

The Fed still has over $7.5 trillion in securities held outright…and there still is a lot of liquidity on the books of the commercial banking system…and the financial system as a whole.

The stock market could not have performed as it did over the summer months if the financial markets had been strapped for cash.

So, the question still remains…just how much more does the Fed need to do?

The Fed’s policy rate of interest is now up to an effective level of 5.33 percent.

Effective Federal Funds Rate (Federal Reserve)

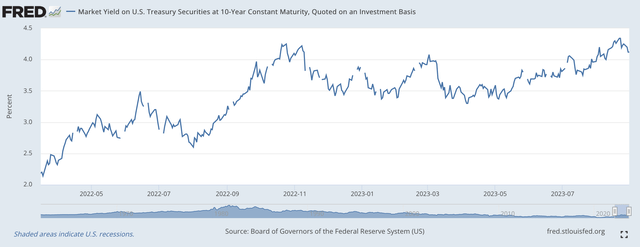

Also, note that the term structure of interest rates has a negative twist to it. Historically, when longer-term interest rates have fallen below the level of short-term rates, this is an indication that a recession is coming.

The slope of the term structure cure has been negative for a long time.

Yield on 10-Year Treasury Security (Federal Reserve)

Still, the recession has not occurred.

So the Federal Reserve continues along.

Is it possible that this “Quantitative Tightening” will extend out another year?

Read the full article here