Summary

I am following up on my previous coverage on Samsara (NYSE:IOT), where I recommended a hold rating as I believed there were a lot of expectations embedded in the stock and valuation, especially after the 60%+% rally previously. This post is to provide an update on my thoughts on the business and stock. I am reiterating my hold rating as the stock continues to trade at a very high premium to its historical average and the index. While I am positive about the business’s performance, I think the stock is fairly valued at the moment.

Investment thesis

Regardless of my view on the valuation, the business has once again printed a very strong quarter. IOT’s 2Q24 revenue was $219.3M, an increase of +43% year over year. Non-transportation industries performed exceptionally well this quarter, helping drive a 6% revenue beat compared to expectations, and management noted strong momentum in the public sector. As a result of this stronger-than-expected performance, management raised their revenue forecast for FY24 by $28 million at the midpoint. Note that the increase in guidance is more than the beat vs consensus, which means the remaining of FY24 is expected to be much stronger than originally expected. In particular, the 33% year-over-year increase in net new ARR to $73.8 million marked the second consecutive quarter of accelerating growth. This encouraging growth in net new ARR can be traced back to the company’s underlying strengths, which include strong momentum from large customers, an increase in the number of new customers, and an increase in the size of existing accounts.

I think it’s important to point out that seven of the top ten net new ACV deals in Q2 came from brand-new customers. This is great evidence that the IOT offering is resonating with its intended markets. Management also noted an uptick in operations budgets as businesses learned that putting money into technology can actually save them money. As mentioned above, even in the public sector, interest in IOT offerings keeps growing (note that two of the top five expansion deals and two of the top five new deals were from the public sector). The largest new customer deal in Q2 came from a state government, which implemented telematics, video safety, and equipment monitoring to manage thousands of pieces of equipment, from baggage carts to passenger boarding stairs and more (from the 2Q24 earnings call). I expect the current growth momentum to continue, as having invested heavily in a dedicated salesforce team over the past few years, IOT is finally starting to see the fruits of its labor as they are ramping up (getting more mature). I believe that as the public sector increasingly embraces IoT, it will experience network effects because of the extensive cross-referencing and connections among various public entities.

Another encouraging development is IOT’s turnaround in FCF, with management forecasting continued growth in FCF throughout the remainder of FY24. But I think it’s important to point out that the huge amount of cash sitting on the balance sheet generates a sizable amount of interest income, which helps FCF significantly. Since interest rates could decline at any time (in my opinion, they have already reached their peak), I think it’s prudent to remain wary of their impact on FCF.

Valuation

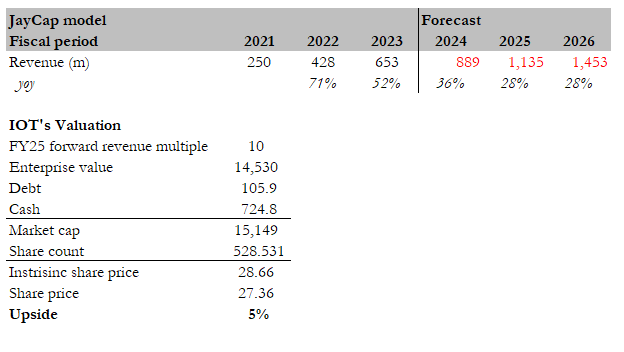

Own calculation

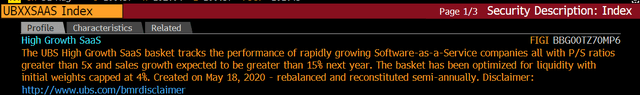

I believe the fair value for IOT based on my model is $28.66. I still think there are a lot of expectations embedded in the stock. To illustrate this, I used consensus estimates as my basis for FY24-FY26 revenue. IOT is currently trading at 13x forward revenue, which is 3x higher than its historical average. While I think the stock can continue to trade at this level given the momentum so far, I think it is more conservative to assume that it will trade back to the industry level. Looking at the UBS High Growth SaaS basket, it is currently trading at an LTM revenue multiple of 10x. I assumed that IOT would eventually trade at this level as growth starts to slow down relative to the past. At a 10x multiple, the stock is worth $28.66.

Bloomberg Bloomberg

Conclusion

IOT’s valuation leads me to maintain a hold rating. The stock continues to command a substantial premium above its historical average and industry peers, trading at 13x forward revenue compared to a 10x industry benchmark. While Samsara’s business performance remains robust, with notable growth in revenue and net new ARR, the elevated expectations already baked into the stock price warrant caution. That said, I am encouraged by Samsara’s strong quarter and its expanding customer base, especially in the public sector. The company’s investments in a dedicated salesforce and IoT offerings are bearing fruit, fostering growth momentum. However, the considerable cash reserves on the balance sheet, generating substantial interest income, pose a risk if interest rates decline.

Read the full article here