I first recommended purchasing National Fuel Gas (NYSE:NFG) in the spring of 2020. Since my article, the stock rallied up to 80% within two years. The stock has incurred a 25% correction in the last 12 months due to the plunge in the price of natural gas this year but still it has offered a total return of 44% since my article. After such a rally, it is only natural that many investors will be wondering whether it is time to take their profits. However, the stock remains cheaply valued while it has promising growth prospects ahead and an exceptional dividend growth record in place. Therefore, those who purchase National Fuel Gas around its current price are likely to be highly rewarded in the upcoming years.

Business overview

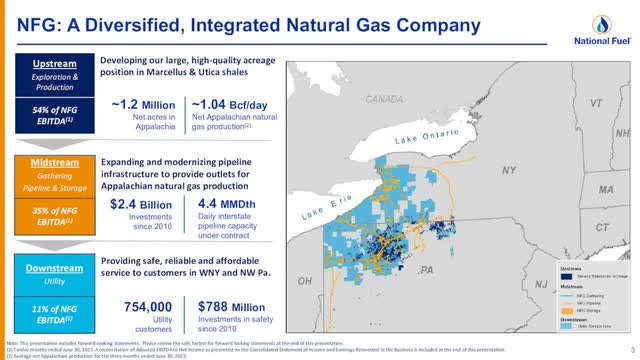

National Fuel Gas is an integrated energy company that is focused on natural gas. It has a history of 121 years and has an upstream (exploration & production), midstream (gathering and pipeline & storage) and downstream (utility) segment.

National Fuel Gas Business Overview (Investor Presentation)

Source: Investor Presentation

The company is diversified, but its upstream segment generates 54% of its EBITDA. As a result, National Fuel Gas is fairly sensitive to the cycles of the price of natural gas. This sensitivity has been obvious in each of the last three years.

National Fuel Gas posted record earnings per share of $4.29 in 2021 thanks to the recovery of the global energy market from the coronavirus crisis. Even better, the company greatly benefited from the Ukrainian crisis last year. Due to the sanctions imposed by the U.S. and European Union on Russia, which was producing about one-third of natural gas consumed in Europe, the global natural gas market became extremely tight last year. Europe imported a record number of LNG cargos from the U.S. in order to replace the lost quantities from Russia and thus the U.S. gas market became extremely tight as well. Consequently, the price of U.S. natural gas skyrocketed to a 13-year high last year. As a result, National Fuel Gas grew its earnings per share 37% last year, from $4.29 to a new all-time high of $5.88.

Unfortunately for the company, the price of natural gas is infamous for its high cyclicality. Due to an exceptionally warm winter in the U.S. and Europe, which has greatly increased gas inventories, the price of natural gas has plunged this year. While it has bounced off its bottom in April, it is still 70% lower than its peak last year. This has taken its toll on the results of National Fuel Gas.

In the most recent quarter, the company increased its output 7% year-over-year thanks to the continued development of its assets in Appalachia. However, it was hurt by the correction of gas prices, and thus it incurred a 34% decrease in its earnings per share. It is also remarkable that management marginally lowered the mid-point of its guidance for the annual earnings per share for a third consecutive quarter, from $5.10-$5.40 to $5.15-$5.25.

Moreover, there are no signs of a sustained recovery of the price of natural gas, according to the latest Short-Term Energy Outlook of the Energy Information Administration [EIA]. The U.S. natural gas inventories have climbed 12% above their 5-year average and 22% above their level a year ago. During the ongoing refill season, the net increase in stored natural gas has exceeded the 5-year average by 3% so far, primarily due to increased gas output from producers. Furthermore, U.S. natural gas inventories are expected to end the refill season at approximately 3.9 billion cubic feet, which is 7% higher than the 5-year average. Given all these facts from the latest report, it is easy to understand why the price of natural gas has slumped from last year’s levels.

As mentioned above, National Fuel Gas generates slightly more than half of its earnings from its upstream segment and hence it is sensitive to the gyrations of gas prices. On the other hand, thanks to its midstream and downstream segments, the company is much more diversified than pure upstream producers, such as San Juan Basin Royalty Trust (SJT).

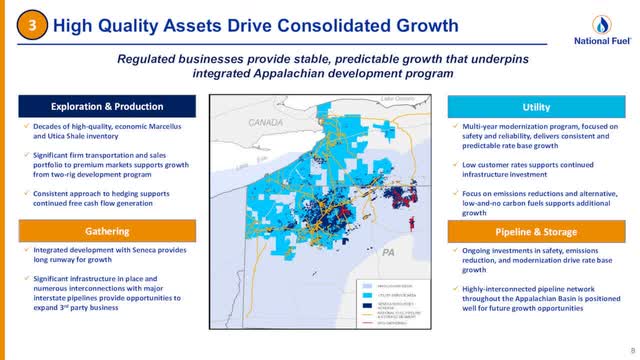

In addition, National Fuel Gas is growing its production at a fast pace thanks to the development of its high-quality properties in Appalachia.

National Fuel Gas Growth Prospects (Investor Presentation)

Source: Investor Presentation

The development of these properties are likely to drive growth, not only in the upstream segment, but also in the midstream segment, as this segment is likely to gather, transport and store greater amounts of natural gas in the upcoming years. Moreover, investors should note that natural gas is much more protected from the environmental policies of most countries than oil products, as the former is considered a much cleaner fuel.

Analysts seem to agree on the promising growth prospects, which results from the high-quality asset portfolio of National Fuel Gas. They expect the company to incur an 11% decrease in its earnings per share this year, but they expect the earnings per share to recover to $5.84 in fiscal 2024, just 1% lower than the all-time high achieved last year. It is also important to note that National Fuel Gas has exceeded the analysts’ earnings-per-share estimates in 15 of the last 17 quarters. Therefore, the company has good chances of exceeding the above forecast of the analyst community.

Valuation

Due to the significant correction of gas prices from blowout levels last year, the market sentiment has become negative on National Fuel Gas this year. As a result, the stock has declined 25% in the last 12 months and hence it is currently trading at a nearly 10-year low price-to-earnings ratio of 10.2. It is also remarkable that the stock is trading at only 9.1 times its expected earnings in fiscal 2024, which will begin on October 1st, 2023.

This price-to-earnings ratio is much lower than the 5-year average of 13.1 of the stock. During the last decade, the stock has traded at price-to-earnings ratios between 10 and 21. Therefore, it seems reasonable and prudent to assume a fair price-to-earnings ratio of 13.1, in line with the 5-year average of the stock.

Whenever the price of natural gas improves, the stock is likely to revert towards its historical valuation level. In such a case, National Fuel Gas may enjoy a 44% rally (=13.1/9.1 – 1) merely thanks to the normalization of its valuation. When the stock approaches the technical resistance of $70, which will correspond to a forward price-to-earnings ratio of 12.0, the stock will switch from a “buy” rating to a “hold” rating. Overall, National Fuel Gas has significant upside potential from its current price thanks to its exceptionally cheap valuation.

Dividend

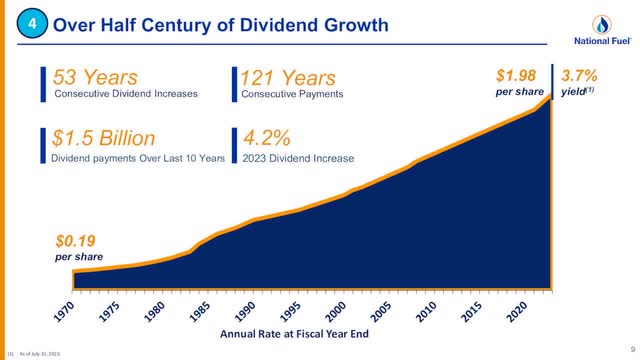

National Fuel Gas has paid a dividend every single quarter since its foundation, 121 years ago. It has also grown its dividend for 53 consecutive years, and thus it has become the first energy company to become a member of Dividend Kings.

National Fuel Gas Dividend Growth (Investor Presentation)

Source: Investor Presentation

This is an extraordinary achievement for a company that belongs to the highly cyclical energy sector and confirms the solid business execution and long-term perspective of management.

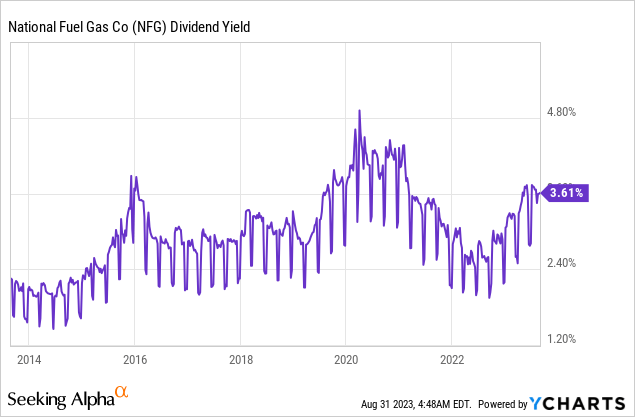

Moreover, National Fuel Gas is currently offering a nearly 10-year high dividend yield of 3.7%.

Furthermore, the stock has a solid payout ratio of 34% and hence its dividend has a wide margin of safety. The only caveat is the low dividend growth rate (3%) over the last decade. However, the nearly 10-year high dividend yield of National Fuel Gas and its healthy payout ratio render the stock an attractive candidate for income-oriented investors.

Risk

The primary risk factor for National Fuel Gas is the secular shift of the entire world from fossil fuels to renewable energy sources. This shift has accelerated since early last year, as most countries are doing their best to avoid a future energy crisis, like the one experienced after the onset of the Ukrainian crisis. To this end, most countries are investing in clean energy projects at a record pace.

However, the record investment in clean energy projects is likely to weigh on the future consumption of oil products much more than the consumption of natural gas, which is considered a much cleaner fuel than oil products. Moreover, as global energy consumption grows year after year, it may take several years for the global consumption of oil to peak, let alone the consumption of natural gas. Overall, the boom in renewable energy projects may pose a threat to the business model of National Fuel Gas but only in the very distant future.

Final thoughts

The stock of National Fuel Gas has incurred a material correction this year, as the price of natural gas has corrected off its blowout levels reached last year due to the war in Ukraine. Due to a negative market sentiment, the stock has become exceptionally cheap. It is trading at a nearly 10-year low valuation level and is offering a nearly 10-year high dividend yield. Given also its promising growth prospects, National Fuel Gas is likely to highly reward investors in the upcoming years.

Read the full article here