Macro uncertainty aside, these are pretty good times for Dutch bank ING (NYSE:ING). Higher interest rates in the Eurozone after years of zero-to-negative base rates mean the bank can finally reap the benefits of its sticky low-cost deposit franchise, while credit quality also remains very supportive of earnings right now.

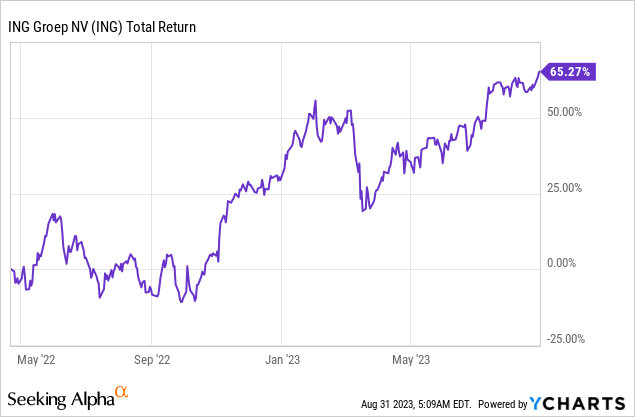

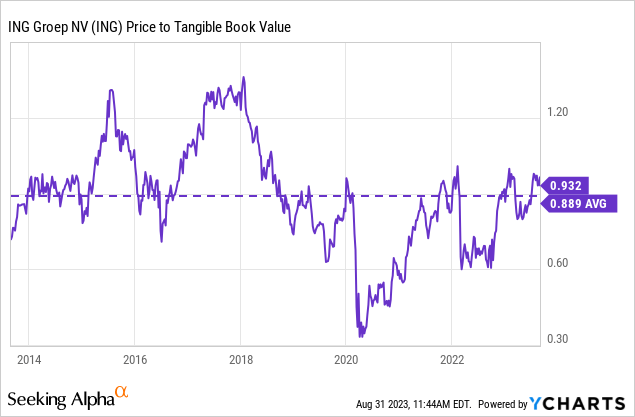

As a result, profits have surged since I first covered the name with a Buy rating in April 2022. The shares have even managed to see a limited re-rate in that time, with ING now trading at around 0.95x tangible book value (“TBV”) versus 0.7x back then. All told, that has led to a total return of ~65% over that 16-month period.

Shareholders would be forgiven for wanting a little more. That P/TBV re-rate, though welcome, only takes us back to the pre-COVID average multiple – but with the kicker that the interest rate environment is now much better for ING’s profitability. For the bank to trade as if rates were still at zero – or even lower – suggests that the market remains skeptical of its current earnings power, perhaps on some combination of possible future lower interest rates (leading to lower net interest income) and/or a recession (leading to materially higher loan loss provisioning).

The above is obviously something to consider going forward, but with a lot of negatives already baked into the current share price ING remains a compelling value case to me and I rate it as a Buy.

Making Hay While The Sun Is Shining

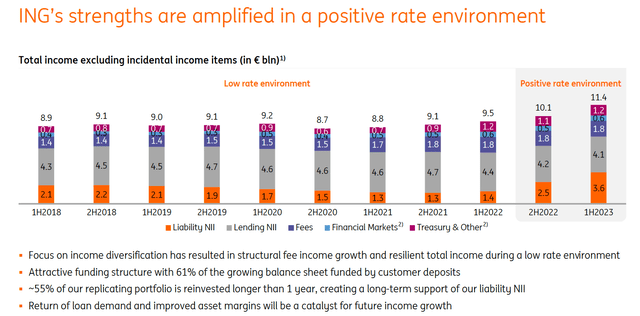

For years, ING was battling away against chronically low interest rates and a fiercely competitive market in its bread-and-butter lending products. That has all changed these past few quarters, with the recent surge in Eurozone interest rates resulting in a significant amount of extra spread income being generated off its deposit base. Income from lending has actually fallen, but with that more than offset by income generated by the replicating portfolio:

Source: ING Group 1H23 Results Presentation

Quarterly net interest income has thus risen sharply, increasing around 20% to €4.05B since last time out, while operating leverage has helped turn that into a ~60% rise in quarterly pre-provision earnings.

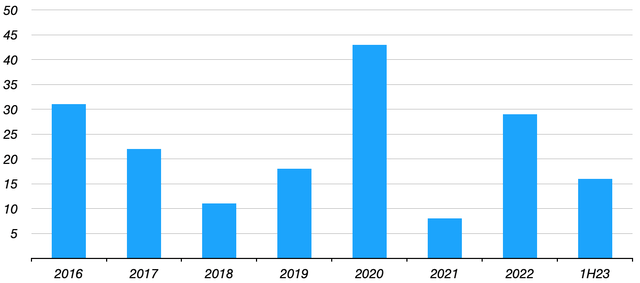

Asset quality also remains much stronger than I thought it would back in Q2 of last year. Impaired loans have basically held steady relative to total loans, while the provisioning expense remains at cycle lows. Last quarter, ING’s cost of risk was just 6bps annualized.

ING Group: Annual Cost Of Risk

Data Source: ING Group Annual Results

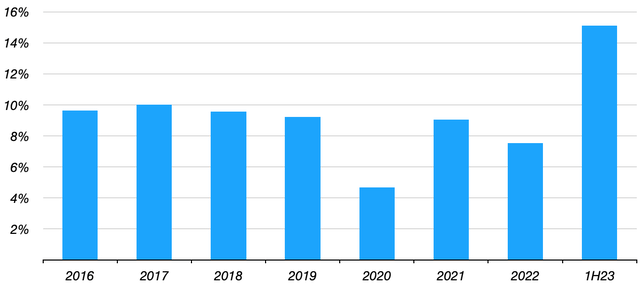

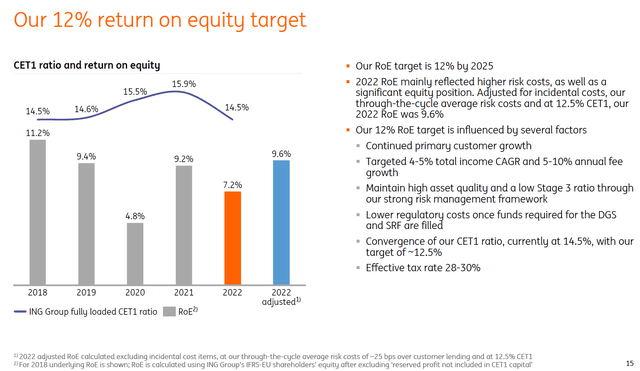

The upshot of the above is that the bank is posting the kind of profitability metrics that management could only dream of in the zero-to-negative rate environment that characterized the pre-COVID years. In H1, the bank generated an annualized return on tangible equity of nearly 16%, which is around 8-9ppt higher than its 2016-2022 average.

A Skeptical Market

ING is now posting a comfortable double-digit ROTE, yet the current €13.10 share price only maps to a valuation of 0.95x TBV. It looks like the market is skeptical that the bank’s current earnings power is sustainable.

The above may make sense in the context of, one, a future increase in bad debt provisioning, which would hurt pre-tax profits, and two, if the current rate of NII generation proves to be unsustainable, with headwinds including higher funding costs, squeezed lending margins and eventually lower interest rates in the Eurozone. That would consequently hurt pre-provision earnings.

On point one, provisioning will rise for the simple reason that it is currently unsustainably low. On management’s through-the-cycle expense guide of 25bps, ROTE would drop to around a point-and-a-half or so all else equal. A nastier than anticipated recession could lead to an extra layer of risk there, but with 40% of the loan book in residential mortgages, annualized pre-provision earnings running at over €11B to absorb losses, and the bank very well capitalized with a 14.9% CET1 ratio, I’m not overly worried.

On point two, ING is now passing on more of the rate hikes in order to retain deposits. The average pass-through rate during Q2 was around 20%, but that had risen to around 29% as of the date of the earnings call:

So until now, we had 20%. But with the rate increase on the Netherlands as for August 15, the tracking would be 29%.

Steven van Rijswijk, CEO ING Group, Q2 2023 Earnings Call

Lending margins also remain tight due to the fiercely competitive nature of the bank’s primary lending products, while the market might also be anticipating a future move back to lower interest rates in the Eurozone. This would eventually hit income from the replicating portfolio, but with a lag that would act to support overall NII generation in the medium-term. Management revealed that around 55% of the portfolio had a duration longer than one year, which will be reinvested at higher rates.

And going forward, we expect continued tailwind from these higher rates, given the structure of our replicating portfolio. Around 55% of the €480 billion replicating portfolio is reinvested longer than one year and we will continue to reprice at higher rates in the coming years.

Steven van Rijswijk, CEO ING Group, Q2 2023 Earnings Call

Value Case Remains Compelling

The key point to take away is that ING is already trading as if its earnings will revert back to pre-COVID levels. We know what profitability looks like in that kind of negative-rate environment: ING earned around €4.3B per annum in average net income between 2017-2021, mapping to a circa high single-digit average ROTE.

ING Group: Annual Return On Tangible Equity

Data Source: ING Group Annual Results

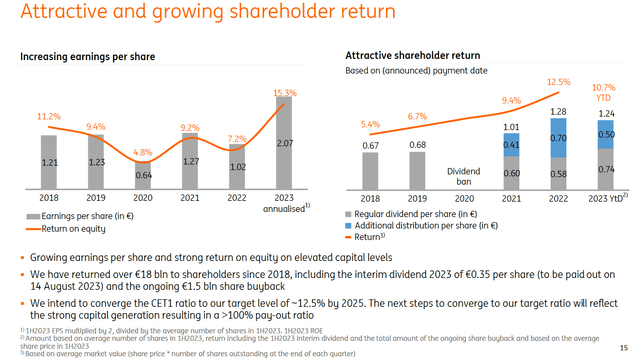

That makes the current share price a fair deal. Management’s stated dividend distribution policy is 50% of net income, meaning that even if earnings collapsed back to their 2017-2021 levels you would still be looking at a yield of approximately 5%. Further, because the bank is overcapitalized the total payout ratio is planned to be above 100% out to 2025. That means investors can still expect a double-digit shareholder yield even assuming materially lower earnings.

Source: ING 1H23 Results Presentation

The current market-cap is €47B, while TBV stands at around €48B. So, a fairly conservative downside scenario sees the bank trade on a P/E of 11x with a ROTE that is commensurate with its current P/TBV, which is around the average during the negative rate decade:

That leaves a lot of upside should the bank actually turn out to be structurally more profitable going forward than it was in the last decade. Indeed, management is targeting a ROTE in excess of 12% by 2025. On that basis, shareholders would not only be enjoying a double-digit yield from dividends and buybacks, but also additional re-rating potential worth an extra 20% over the next couple of years.

Source: ING Group FY22 Results Presentation

ING may have returned 65% since initial coverage in Q2 2022, but with even a downside case looking reasonably attractive, I’m happy to stick with a Buy rating on these shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here