Introduction

It seems that since COVID happened, shopping malls are not the same. The dynamic just feels different nowadays. I’m not a huge shopper, but I do like to go browse from time to time. Maybe buy a T-shirt or a pair of shorts here and there. I’m assuming a lot of people prefer to shop online at places like Amazon (AMZN) or some of their other favorite retailers. Rising costs could have something to do with this too. Why get dressed and drive to a mall miles away when I can order my favorite pair of shoes with the click of a button. And ordering from Amazon, you can have your order arrive the same day.

I was shopping this weekend at Fashion Valley Mall located here in San Diego. It’s one of the premier malls in the city and has several high-end stores like Louis Vuitton, Burberry, Dolce & Gabbana, and Gucci to name a few. The mall is owned by Simon Property Group (NYSE:SPG). One thing I noticed recently is there is construction everywhere. It seems like the whole mall is being revamped. Is this to draw in more customers due to the recent rise in e-commerce over the last several years? Thinking about all of this, I felt compelled to give an analysis of the company to let readers know what I think of it since it belongs to my absolute favorite sector, REITs.

Who Is Simon Property Group?

SPG is a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment, and mixed-use destinations. So the company doesn’t just own typical malls. Their portfolio consists of places with high-end shops and provides community gathering places in North America, Europe, and Asia.

Simon also invests in entertainment and experiential brands as well. If you’ve ever been to Las Vegas, then you have probably visited their properties. SPG owns the famous Forum Shops located inside Caesars Palace, a hotel owned by another REIT, and favorite of mine, VICI Properties (VICI).

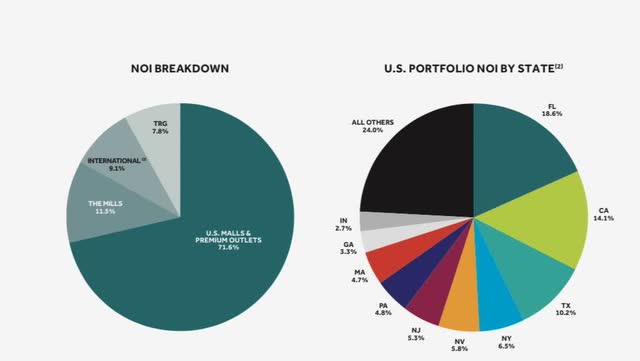

Besides Nevada, SPG has a high concentration of its properties in Florida, California, and Texas. All 3 states make up almost 43% of its net operating income.

The REIT also has international exposure with 35 total properties located in countries such as Malaysia, Thailand, and Canada. International malls account for almost 10% of NOI. As a Navy Sailor, I’ve visited all three of these countries and one of the first things we would do after getting off the ship was go find food and a mall. Thailand was always my favorite port to visit because it was so cheap. I haven’t been in over 13 years, so I’m sure things have changed.

SPG Q2 supplemental

Are Malls Making A Comeback?

You have to be living under a rock to not know the impact COVID has had on shopping malls. The pandemic happened and changed the way we shop forever, in my opinion. Many places were forced to close for months. This had a huge impact on businesses, and even on premier shopping destinations like SPG. The REIT was forced to cut its dividend by 38% in 2020 from $2.10 to $1.30.

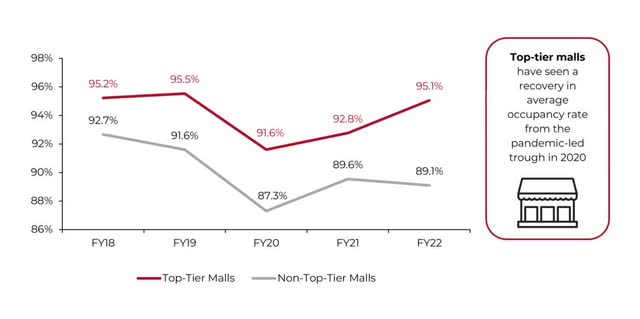

That was 3 years ago. Since then, physical retail has bounced back. Although the pandemic was officially declared over in May of this year, I think I can say most of us declared it over in 2022. More stores opened than closed last year, and malls saw their sales surge more than 11% to more than $819 billion. In 2023, mall occupancy currently sits at 95.1%, just 0.1% lower than pre-pandemic levels.

Because SPG owns what is considered higher-end properties, they have fared far better as shoppers are undeterred and continuing to search for their designer brands. The company reported an upward trend in consumers returning to stores as well as online shopping.

Coresightresearch.com

Back To Business As Usual

Although SPG was greatly affected by the pandemic, the REIT has gotten right to business as usual. Here, we take a look at their FFO and occupancy growth since quarter one of 2022. The company has seen a steady incline in its FFO and revenue growth over the last year. So, while many people say malls are dying, I think the premier ones like Simon Property are evolving.

As you can see below, SPG had a huge spike in Q4 in FFO growth. This was due to the net gain of $0.25 per share, principally from the sale of their interest in the Eddie Bauer licensing joint venture in exchange for additional equity ownership in Authentic Brands Group. They also experienced a decrease in FFO from Q3 until now. I believe this is due to the rise in interest rates last year. This will continue to put stress on tenants’ ability to pay rent, but I think SPG will be fine. The REIT has also continued to raise its dividend since its cut in 2020. They have raised the dividend a total of 8 times with 5 of them over the last year. Their latest was a 2.7% increase to $1.90.

| QTR | Q1 ’22 | Q2 ’22 | Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 |

| FFO | $2.78 | $2.96 | $2.97 | $3.40 | $2.74 | $2.88 |

| Occupancy | 93.3% | 93.9% | 94.5% | 94.9% | 94.4% | 94.7% |

Dividend Coverage

Simon’s dividend is safe and sound. With the recent 2.7% dividend raise, its payout ratio remains low at just 65%, well below the sector average.

Management also recently increased full-year guidance from $11.80 to $11.95, and now expects FFO to come in at $11.85 to $11.95, an increase of $0.05 at the bottom end & $0.02 at midpoint. Even if FFO comes in at the bottom end, this still gives them a very safe payout ratio of 64%.

Even with mall foot traffic and sales still below pre-pandemic levels, SPG has continued to beat analysts’ estimates on FFO for the last two years. To put this in perspective, this was during muted international tourism, the impact of a strong U.S. dollar versus the euro & yen, no significant acquisitions, and a $0.15 to $0.20 drag on FFO from additional investments in RGG & SPO, JCPenney & the Reebok integration at SPARC.

Valuation

Since the beginning of August, SPG has seen its price fall significantly. This is due to the earnings miss and downgrade of the stock received on August 3rd. They currently trade at a P/AFFO ratio of 10.3, below its 5-year average indicating the stock is undervalued. Those who believe in the stock’s long-term outlook will get a nice double-digit upside to its price target of $132. I think the REIT is a buy here, in my opinion, and believe investors should layer into the stock on any signs of weakness. Using the discounted cash flow model, I have a buy price of $101 but due to its quality and recent decline in price, buying now is acceptable. With the state of the economy and uncertainty in the real estate sector, investors could potentially see SPG’s price fall further. Especially if the Fed decides to conduct another rate hike later in the year.

Another thing I like about SPG is the amount of insider buying over the last year, further indicating the stock may be undervalued. Current CEO David Simon owns 0.31% or 129.7 million shares of the company. This tells me that he’s closely aligned with the financial interests of the company’s shareholders and that he believes in their long-term success.

SimplyWallSt

Risks

With the pressure of rising costs globally and high interest rates, SPG could see a decline in FFO and revenue growth over the next several months. As many companies continue to redevelop to bring in more customers, supply chain issues and rising labor costs will continue to apply pressure as many businesses brace for more increases in shipping and logistics prices. Although they have one of the strongest balance sheets with $8.8 billion in liquidity, they do have some debt maturing early next year and a total of $2.5 billion maturing at a weighted average interest rate of 3.49%.

Catalysts

Although we are in times of uncertainty, quality companies that are long-term present some great opportunities as well. Looking past the next two years, I believe Simon Property Group will continue to find innovative ways to remodel their properties to bring back in-person shopping as many malls adapt to changing consumer needs. As an owner of premier malls and high-end shopping experiences, SPG continues to modernize many of its properties with more open & inviting spaces, broader dining & gathering places, and tranquil outdoor lounges. I believe these will keep consumers coming in, especially those within the Gen Y & Z age groups. Additionally, with international exposure contributing only 9.1% of NOI, SPG has a lot of room for growth and expansion in the international space as well.

Conclusion

SPG is a member of the S&P 100 and has one of the highest credit ratings within the REIT space. The company faced major headwinds during the pandemic due to the nature of its business (mainly shopping malls) but has since recovered and raised its dividend while growing its NOI, revenue, and FFO. The company faced minor setbacks in recent quarter earnings as the current macro environment cost the REIT $0.08 due to higher interest expense. The company will most likely continue to see more headwinds in the near term due to higher for longer interest rates but has continued to remodel its properties to bring in more customers, which will have a great effect on consumer spending at its premier properties over the longer term. Furthermore, SPG trades below its 5-year P/AAFO average making it a buy, in my opinion.

Read the full article here