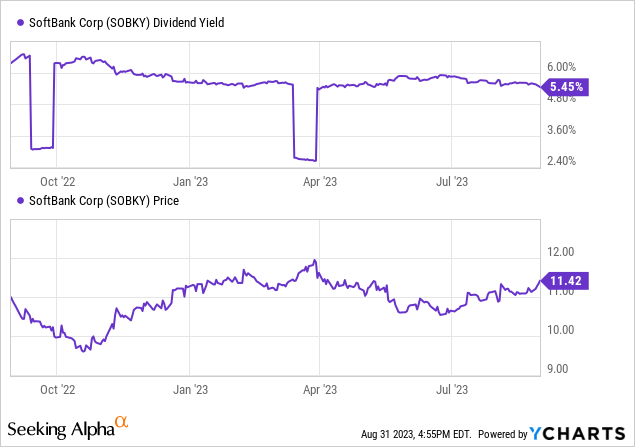

Since I last covered the name, Softbank’s telco arm, SoftBank Corp. (OTCPK:SOBKY), has rallied strongly. And if the recent quarterly report was any indication, further upside may still be on the cards as well. Overall revenue and profitability numbers were up across the board, helped by narrowing revenue declines and solid subscriber net adds. Alongside continued growth in enterprise and improved visibility into a breakeven path for the financials business, the company appears to be well on track to hit its mid-term business plan targets.

SoftBank Corp.’s efforts in investing ahead of the curve also mean a more benign capex outlook, underpinning positive free cash generation and, by extension, the company’s JPY86/share dividend target (implying a mid-single-digit % yield). Adding optionality to the mid to long-term case are efforts to tap into new generative artificial intelligence (‘AI’) revenue streams – not only via a next-generation search engine (through subsidiary Z Holdings) but also via enterprise sales of its AI capabilities. Progress on its AI efforts, along with operating profitability at PayPay, present key catalysts for the next leg of upside for SoftBank Corp. stock.

Resilient Quarter for the Core Telco Business

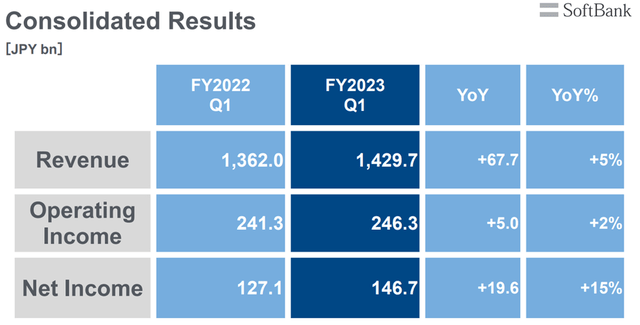

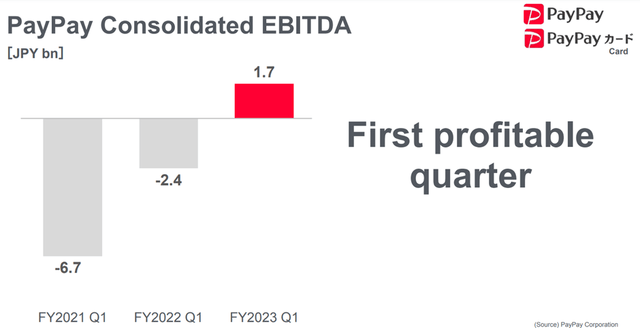

Softbank Corp. kicked off its fiscal year strongly, with a +5% YoY revenue increase, driving operating profit growth (including one-off gains) of +2% YoY (32% of the company’s full-year target). Digging deeper, the resilience of its consumer segment operating metrics was a key highlight, with strong main mobile subscriber (+180k) and smartphone (+320k) net adds implying narrower mobile per-user revenue declines YoY. Enterprise sales were in line at +4% revenue and +8% operating profit growth, though at 26% of the segment’s full-year target is slightly trailing the progress on the consumer side. Also, positive were lower-than-expected financial segment operating losses, helped by PayPay turning EBITDA positive in Q1 without sacrificing its revenue growth (+41% YoY) or user acquisition (point investment user base now at >11m).

SoftBank Corp.

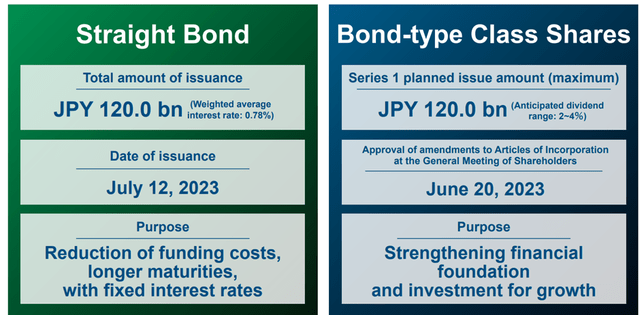

Building on the earnings strength, management now expects more progress on expanding mobile subs and narrowing the mobile business revenue declines in the coming quarters. Along with better enterprise operating profit growth and the financial segment accelerating toward breakeven, a guidance raise vs. the current full-year target seems likely. The only blemish on the quarter was the delayed JPY100bn buyback amid a JPY120bn issuance (comprising <1% debt/bond-type class shares with a 2-4% dividend), earmarked for long-term growth investments. This means that on the buyback front, Softbank Corp. trails key peer KDDI Corporation (OTCPK:KDDIY) (JPY300bn) and possibly Nippon Telegraph and Telephone Corporation (OTCPK:NTTYY) (no specific target), though its well-covered ~5% dividend yield remains the best of the Japanese telcos.

SoftBank Corp.

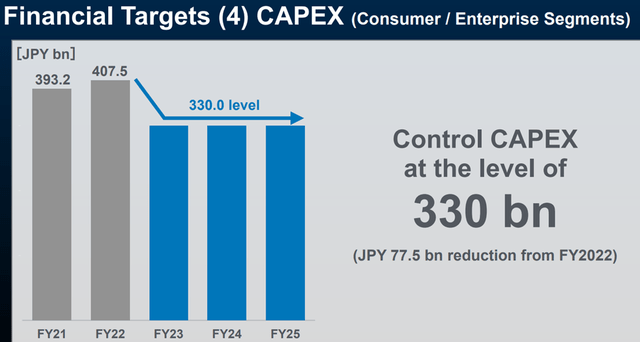

Making Good Progress on the Mid-Term Management Plan

SoftBank Corp.’s resilient fiscal Q1 profitability bodes well for the achievability of its new mid-term business plan. Recall that management is targeting JPY535bn of overall profits for FY25 and JPY970bn at the operating level. On cash generation, keeping telco capex (consumer and enterprise segments) below JPY330bn/year over the period is key. This seems feasible, given the company has moved well past the peak of its infrastructure capex cycle, clearing the way for more shareholder returns. In turn, adj free cash flow from the domestic telco operations is targeted should more than adequately fund JPY86/share of dividend payouts (in line with current levels).

SoftBank Corp.

In combination with its buyback run rate, this implies Softbank Corp.’s total yield (dividend and buybacks) will likely run in the high-single-digits %, well ahead of comparable global telco yields and key fixed income benchmarks (the risk-free JGB 10-year currently yields 0.6%). Given its insulation from capital markets volatility as well (isolated to standalone investment arm Softbank Group post-spinoff), my view on Softbank Corp. as a mid to long-term bond proxy remains intact.

Emerging Optionality from PayPay and Generative AI

While cash from the telco business is being deployed into capital returns, there is room for growth as well, particularly on the financials side. The key here is credit card and QR code payments business PayPay, now a consolidated Softbank Corp. subsidiary post-integration of PayPay Card (effective stake of >40%), which continues to deliver strong user acquisition and top-line growth. Sustained profitability likely isn’t far off either, with a first EBITDA positive result in fiscal Q1. So, as marketing spending winds down and consolidated gross merchandise value expansion unlocks scale economies, achieving its operating profitability target by FY25 seems well within reach.

SoftBank Corp.

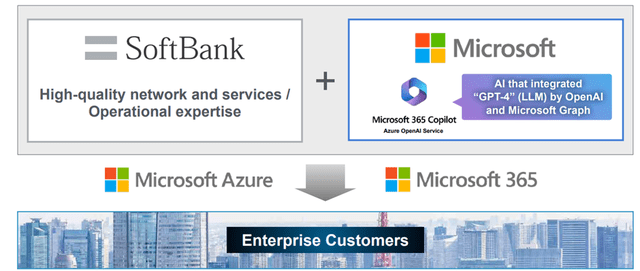

A relatively new growth driver for the company is generative AI. Following news flow in recent months citing the development of in-house generative AI capabilities via SB Intuitions (vs. licensing from OpenAI), management confirmed as much in fiscal Q1, citing ChatGPT revenue contribution (part of a strategic tie-up with Microsoft (MSFT)) and a JPY20bn investment in its own data center. In addition to licensing out its generative AI product, Softbank Corp. (via subsidiary Z Holdings) is also leveraging AI in a next-generation search engine (a la the Microsoft Bing/Open AI integration). While this all sounds positive on paper, the relatively low initial capex outlay likely means generative AI won’t be a meaningful contributor anytime soon. But it does also point to a gradual approach, which makes sense given the telco’s capex needs. In the meantime, I would keep an eye out for the pace of ChatGPT growth in the enterprise business as an early gauge for the potential AI market opportunity.

SoftBank Corp.

A Reliable Dividend Yielder with Compelling New Growth Engines

Softbank Corp. has started its fiscal year off strongly; with overall operating profits already amounting to >30% of full-year targets, the telco looks poised for a guidance raise sooner rather than later. The core mobile business is all about resilience over growth – despite the top-line YoY decline in fiscal Q1 2024, strong net adds and narrowing per-user revenue declines bode well for the achievability of full-year targets. With the enterprise momentum set to extend into the coming quarters as well, the telco remains in great shape to hit its mid-term plan ahead of schedule.

Higher core profitability and lower telco capex also mean the company’s capital returns (JPY86/share dividend payout and JPY100bn buyback) are well-covered without sacrificing its growth objectives in generative AI and payments (PayPay). While the stock isn’t as cheap either at a high-teens earnings multiple following the rally in recent months, I think there’s enough growth potential here to justify current valuations. In the meantime, investors get a well-covered mid-single-digit % yield to wait.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here