Intro

Zeta Global Holdings Corp. (NYSE:ZETA) is a young software outfit based out of New York that provides companies (marketers) the tools necessary to both retain and grow their customer bases significantly. This is achieved through Zeta’s robust AI platform where marketers can significantly improve their customer & prospect streamlining processes which results in far better targeting and sales numbers overall.

Suffice it to say, that with AI being the buzzword across a whole host of industries in recent months, Zeta is obviously operating in a high-growth space. As the information age continues to gain traction, Zeta’s customers (marketers) know that their respective marketing campaigns must consistently undergo a process of continuous improvement. Competition is rife across all forms of digital media (and will only grow) which means companies will continue to shell out large amounts of money on their respective marketing budgets over time.

Therefore (and herein lies the challenge concerning Zeta’s success & longevity), Zeta’s AI technology must continually improve to ensure it is seen by its clients as ‘superior’ compared to the other marketing software competitors out there. The issue is not whether Zeta’s AI offering becomes more intelligent, as it undoubtedly will be due to new information & signals being able to be screened at breakneck speeds. The issue is how fast ZETA’s value-adding offerings can improve compared to its competitors.

Technical Chart

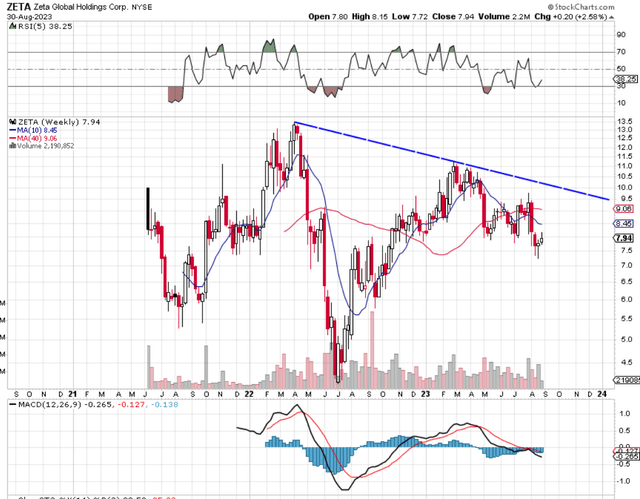

From a technical standpoint, Zeta remains unproven as we see below. In the company’s short life span to date, we see that shares continue to make intermediate lower lows with the company’s 10-week moving average ($8.45 per share) continuing to trail the corresponding 40-week average ($9.06) by some distance. Technically, we would need to see a bullish moving average crossover, as well as shares breaking out above that, downcycle intermediate trend line (>$10 a share) in order to become interested on the long side in this play.

ZETA Intermediate Chart (Stockcharts.com)

Profitability V Growth

With respect to Zeta’s recent second-quarter earnings call, the CFO pointed to the company’s quarterly earnings track record, growing margins, and the raising of full-year guidance. On the surface based on these Q2 trends, one may believe that profitability in Zeta has been improving significantly at the firm but this may not necessarily be the case as we see below.

Sales grew for example by 24% organically to hit $172 million but this growth rate was practically the same rolling quarter growth rate the company reported in Q1. The CFO was also quick to point to the company’s adjusted EBITDA margin expansion and positive free cash flow of $13 million in the quarter.

When one gets past the growth metrics, however, the glaring profitability metric that continues to stick out like a sore thumb (and which is the most important metric from Wallstreet’s standpoint) is Zeta’s GAAP net earnings. Net profit in the quarter came in negative at -$52.2 million and despite showing improvement, clearly shows that Zeta remains some distance from reporting positive bottom-line profitability.

Furthermore, what investors need to take into account here is that positive cash flow can essentially be generated in a myriad of different ways. Therefore, if indeed Zeta continues to generate sustained positive free cash flow numbers (in a negative earnings environment), we would caution investors to see whether shares are being diluted or if shareholder equity is being adversely affected over time. Remember, a business can grow much easier when internally generated profits are readily available to invest.

Valuation

Therefore, ZETA’s present value is predicated on the growth that is expected of it going forward. The number of scaled customers at Zeta continued to grow in Q2 but this trend also is not set in stone for the following reason. Marketing always comes after product development within companies and is invariably one of the first areas to be cut when profits fall. The CFO alluded to this on the recent Q2 earnings call when he stated that the ‘insurance’ vertical continued to come under pressure due to above-average loss ratios taking place in that space at present. Therefore, although Zeta may be well diversified across a whole host of verticals that need its services, the moment any one of those sectors (Travel, Education, etc.) comes under pressure, ZETA’s growth may suffer as a result.

Shares at present trade with a forward sales multiple of 2.38 and a forward book multiple of 7.25. ZETA’s assets in particular (sector book multiple of 4.11) look expensive especially when one considers that goodwill and intangible assets make up 46%+ of the company’s assets. Therefore, strong growth needs to continue in Zeta in earnest.

Conclusion

To sum up, although ZETA continues to grow its sales and adjusted EBITDA numbers, the lack of strong growth with respect to the company’s GAAP earnings is clearly demonstrated by the bearish trend on the stock’s intermediate technical chart. Investors essentially need to see more than the present 20%+ top-line growth rate to essentially move the needle here. We look forward to continued coverage.

Read the full article here