The Global X Uranium ETF (NYSEARCA:URA) is one of two main ETF options for investors looking to gain uranium equity exposure.

URA is an index of companies that are involved in the mining, exploration, development, and production of uranium, as well as companies that hold physical uranium or other non-mining assets.

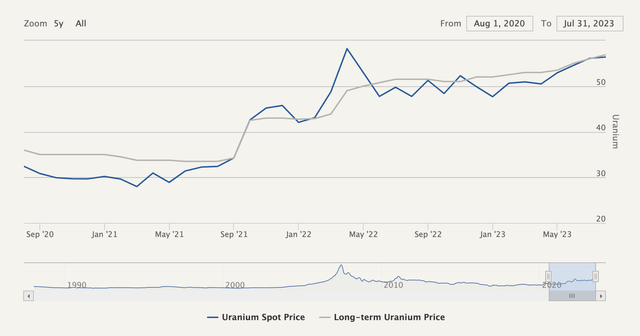

In autumn 2021, I highlighted the bull case for the physical price of uranium as the Sprott Physical Uranium Trust Fund (OTCPK:SRUUF) and other financial entities started to buy up uranium in the spot market. Since that time the price of uranium has steadily risen from $35 to $58. The URA ETF has seen steady investor interest although uranium equities have lagged the broader commodity. I believe both uranium and the URA ETF are now poised for a breakout. I expect the second phase of the bull market to commence in the coming months due to a new contracting cycle and a lack of secondary supplies going forward.

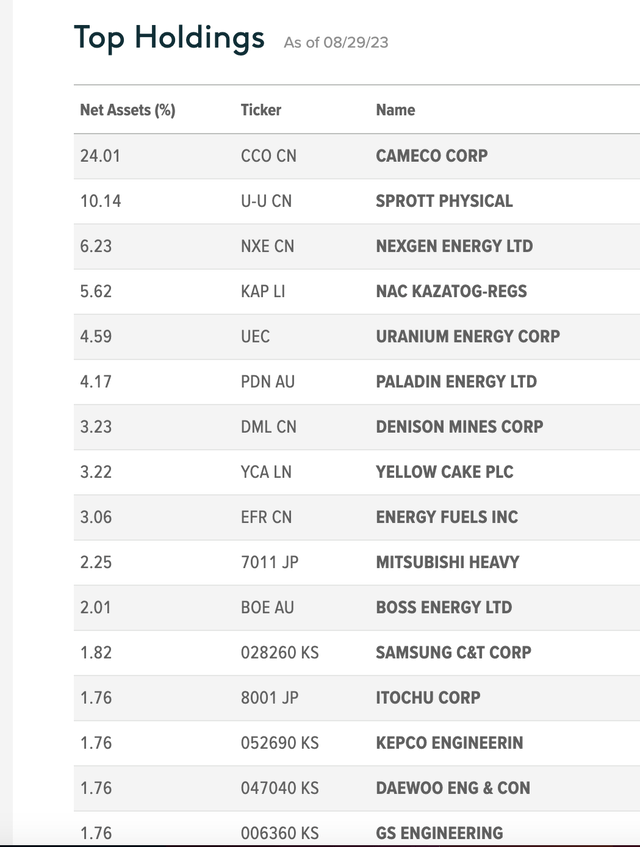

Top Holdings

Firstly, I will detail some of the holdings and fees associated with URA. URA holds blue chip uranium companies, physical uranium trusts and junior miners.

Here are the top holdings:

Global X ETFs

The largest holding is Cameco based out of Canada with a $16 billion market cap.

It should be noted that ~13% of the fund is invested in physical uranium via the Sprott (OTCPK:SRUUF) and Yellow Cake (YCA) instruments. Approximately 47% of the index is composed of companies in Canada. The ETF has taken lengths to reduce geopolitical exposure. Only 5.8% of the ETF is in Kazakhstan despite the fact that Kazatomprom (KAP) is one of the world’s largest uranium companies. Many investors did not want an ETF with a high exposure to a Russia friendly jurisdiction.

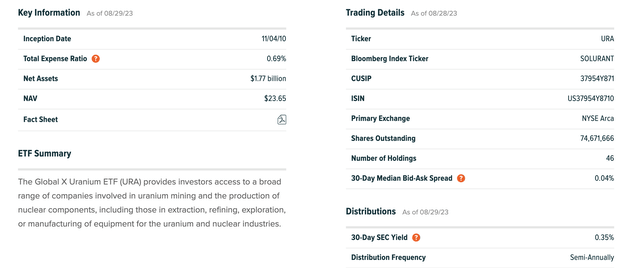

Key Data

For convenience, I’ve highlighted some of the important facts about URA.

Here is some key data including the expense ratio of 0.69%:

Global X ETFs

Two Reasons To Be Bullish

The uranium market is unique in that ~85% of the demand comes from long term contracts with utility companies. For most other commodities, investors can clearly see what is happening with the spot market or the forward curve. However, since uranium is contracted via private contracts we must piece together the demand story.

Over time, the contract price and the spot price will converge. Usually, it is the spot market that is trying to catch up with the long term contract prices.

Cameco

During Cameco’s Q2 earnings call, Grant Isaac, Cameco’s Chief Financial Officer, emphasized that the company now has a preference for market-related agreements. More importantly, Isaac explained that current contracts had escalated floors and ceilings. “For Cameco, in today’s market, mid 50 spot, we can drive $50 escalated floors, and we can drive $80 escalated ceilings.”

This piece of information is significant as it is a leading indicator of the long term health of the uranium market. The current spot price is $58 and Cameco is setting up long term contracts with a floor of $50. Utilities seem to have reconciled that the days of $20/lb uranium are over. The downside risk to the commodity has been established (barring disaster) and we have a window into where the spot market price will eventually go over the next couple of years (higher towards $80/lb).

The second main reason to be bullish about uranium and URA is that secondary supplies appear to have been greatly diminished.

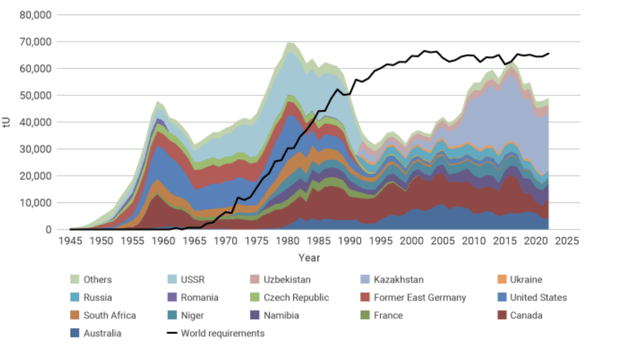

In 1993, Russia and the US entered into a program called “Megatons for Megawatts.” Russia decommissioned approximately 20,000 nuclear warheads and converted the highly enriched uranium into low-enriched uranium that is used in nuclear reactors. It is estimated that 630 million lbs of U308-equivalent entered the market until 2010. To make matters worse, commercial de-stocking added another 500 million lbs of uranium to the market. In other words, mining for uranium was a fruitless endeavour in that time period. The world was swimming in uranium. To make matters worse, nuclear reactors were being decommissioned and little new reactor growth was on the horizon. The supply demand imbalance was easily met as over a billion lbs of secondary supply was floating around the market.

World Nuclear Association

However, much of the secondary supplies have been consumed in the vicious bear market up until 2018. In 2023, it is estimated that reactor demand is 190 million lbs. Mine supply is expected to produce 130 million lbs. The 60 million lb deficit will be filled by secondary supply. However, I believe that a large portion of the 1 billion lb over supply has already been consumed. The price of uranium has skyrocketed from $18 in 2018 to $58 today. If there was still a billion lbs of over supply, I do not think the price of uranium could triple. Instead we are now dealing with a dynamic – new supply will have to come from uranium mines and greenfield development going forward. This is bullish for the price of uranium and uranium equities.

Risks

There are three main risks with the bullish uranium thesis. Firstly, there is always the risk of a nuclear meltdown. This past summer there were rumours that the Russians might blow up a major nuclear plant in the Ukraine. Any type of nuclear meltdown would severely destroy sentiment for the nuclear industry and uranium as a whole. After the Fukushima nuclear disaster in 2011, Japan temporarily closed all of their nuclear reactors. This caused an enormous secondary supply of uranium to flood the market and severely depressed the price of uranium.

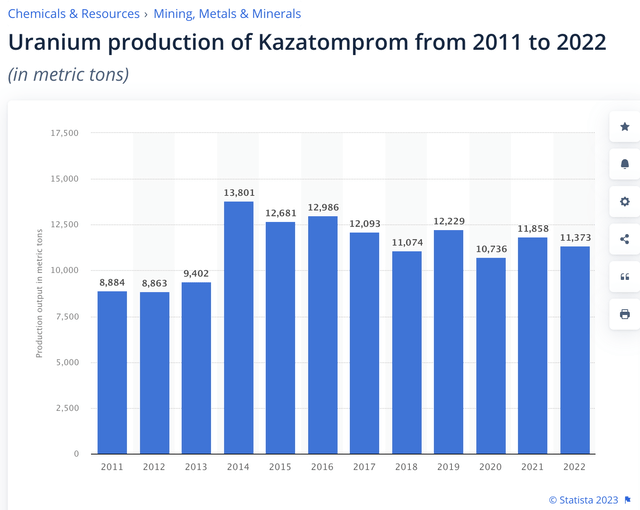

Secondly, there is a risk that major producers such as Cameco and Kazatomprom will increase production and limit the upside in the price of uranium. For example, Kazatomprom massively increased uranium production in 2014 and most likely has the ability to somewhat increase production going forward.

Statista

The final risk with the uranium thesis is that the secondary market supplies could flood the market to take advantage of higher prices. The uranium market is opaque. It is relatively easy to determine uranium demand and uranium mine supply. However, over the years there has been a huge overhang of secondary supply. We can only estimate that most of this secondary supply has been consumed. However, nobody knows for sure how much secondary supply is sitting in a warehouse in China or Russia.

Final Thoughts

I believe that uranium and uranium related equities in the URA ETF have entered the next stage of the bull market. After 18 months of consolidation, a lot of the speculative money has been flushed out of the uranium market. A new contracting cycle has started and floor prices have been established at $50/lb. Furthermore, there is evidence that the massive secondary supply of uranium has dwindled over the years. New supply will have to come from new production and this should be bullish for uranium related equities in URA.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here