It’s been a few months since I last covered Suburban Propane Partners L.P. (NYSE:SPH). In my last article, I recommended SPH as a buy given the stability of its business model and the challenging macro environment.

However, since February, the economic environment has improved, as overall inflation has subsided and GDP growth remained robust. At the same time, business fundamentals appear to be deteriorating at SPH, with the company reporting YTD diluted EPS of $2.25 vs. $3.04 YoY on poor expenses management. Given the worsening risk/reward picture, I am downgrading my view on Suburban Propane to neutral.

Brief Company Overview

Suburban Propane Partners, L.P. is a publicly traded Master Limited Partnership (“MLP”) that operates in the marketing and distribution of propane, renewable propane, renewable natural gas (“RNG”), fuel oil, and other refined fuels to retail and wholesale customers. Suburban Propane has operations in 41 states, serving more than 1 million residential, commercial, industrial and agricultural customers through approximately 700 locations.

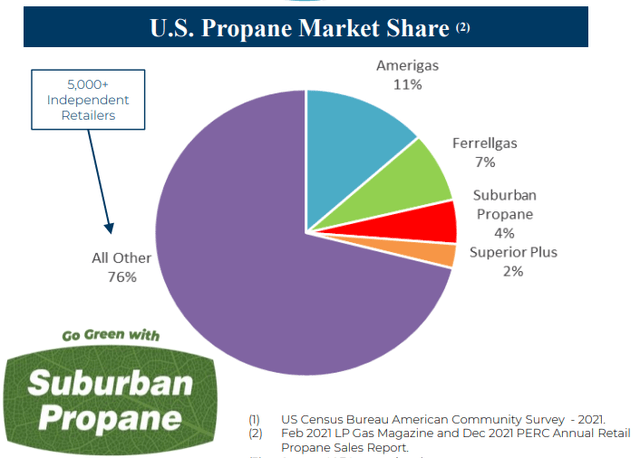

Although Figure 1 is dated, Suburban remains the number 3 player within the fragmented U.S. propane distribution market.

Figure 1 – US propane market (SPH investor presentation)

Readers who want to learn more about the propane distribution business should consult the company’s 10K report or my initiation article.

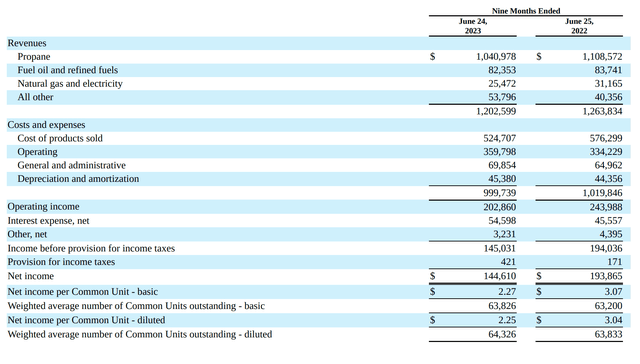

Earnings Soft In 2023

Recently, Suburban announced its fiscal third quarter results, with revenues of $279 million, missing consensus by $2 million and -$0.08 in EPS, beating consensus by a penny.

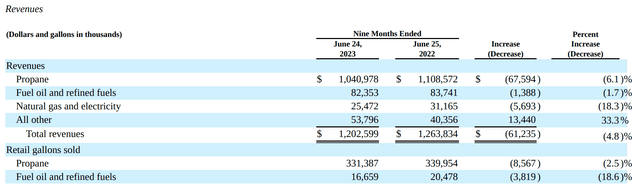

In my opinion, YTD operations have been disappointing, as reported revenues were $1.2 billion, a decline of 4.8% YoY versus the same point last year. While Suburban’s revenues can be volatile as it is dependent on fuel prices, I am more concerned about the 2.5% decline in propane volumes and the 18.6% decline in fuel oil volumes (Figure 2).

Figure 2 – YTD revenues have declined 4.8% YoY (SPH 10Q report)

As many investors and readers who live on the North American East Coast can attest to, the recent winter and spring was unusually warm. Average temperatures (measured in heating degree days) across Suburban’s service territories for the first 9 months of fiscal 2023 were 8% warmer than normal, leading to reduced heating demand for Suburban’s fuels.

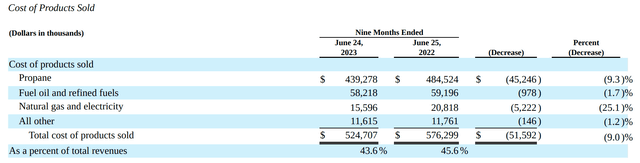

However, Suburban was able to manage gross margins well, with COGS coming in at 43.6% of revenues, a 2% improvement YoY (Figure 3).

Figure 3 – SPH showed good COGS management (SPH 10Q report)

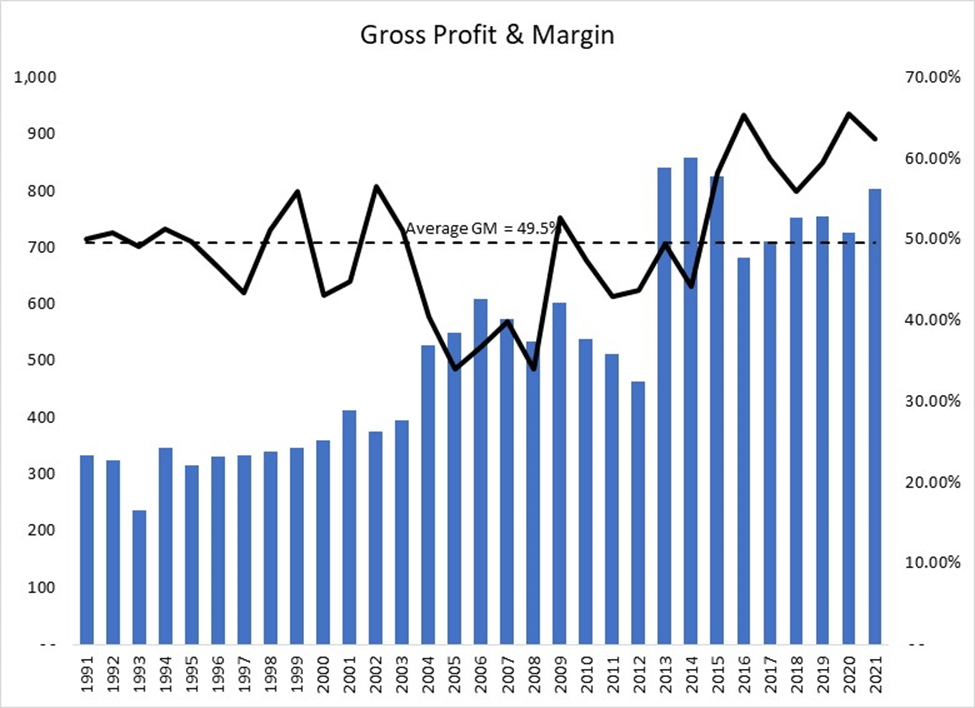

A 46.4% gross margin is more consistent with the company’s 49.5% average gross margin from 1991 to 2021 (Figure 4, reproduced from my initiation report).

Figure 4 – Average gross margin for SPH (Author created with data from company reports)

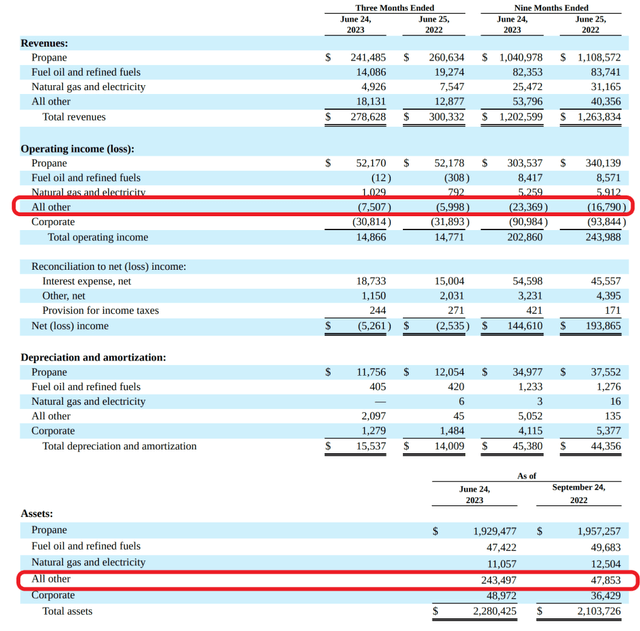

However, despite solid gross margin control, operating income was materially weaker in YTD 2023 as operating expenses and general & admin expenses surged 7.7% and 7.4% respectively to $360 million and $70 million (Figure 5).

Figure 5 – SPH operating income materially lower YTD (SPH 10Q report)

Combined with higher interest expenses (Suburban assumed green bonds and drew down part of its credit facility to make a large acquisition in the RNG space), net income declined 25.4% YoY to $144.6 million and diluted EPS declined 26.0% YoY to $2.25.

RNG Business Still Unprofitable

On the topic of RNG acquisitions, in my prior article, I noted the acquisition of two operating RNG facilities from Equilibrium in December 2022. The assets include a large-scale RNG facility in Stanfield, Arizona, with 7 anaerobic digesters designed to process waste from approximately 55,000 dairy cattle, and an operating facility in Columbus, Ohio, processing food waste into fertilizer and biogas for several large food and beverage manufacturers in the area.

My main concerns with the Equilibrium acquisition is the large price tag ($190 million for 2 operating plants plus a ‘platform’ to coinvest in future opportunities) and the unknown economics of the RNG business.

So far, we have seen large increases in YTD operating expenses and G&A expenses at a corporate level without a commensurate increase in revenues.

Since RNG results are lumped into the ‘All other’ segment, we can only surmise that the nascent RNG business remains unprofitable, as the segmented ‘All other’ operating income was a loss of $23.4 million YTD 2023, compared to an operating loss of $16.8 million in 2022 (Figure 6). Revenues in the segment also increased by a paltry $14 million dollars, a drop in the bucket versus the $190 million acquisition price tag.

Figure 6 – Segmented results (SPH 10Q report)

At this point, it is unclear how much additional investment may be required to bring the RNG business to breakeven profitability.

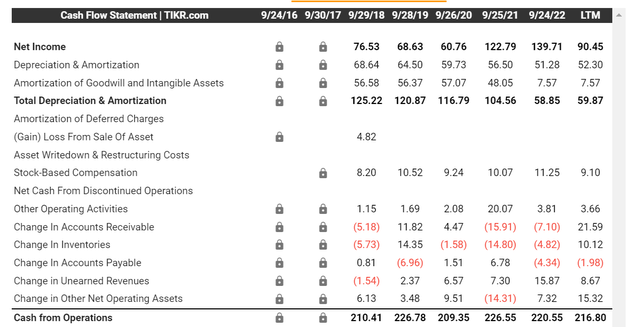

Dividend Maintained But Operating Cash Flows Declining

Although Suburban’s earnings declined YoY to only $2.25 / share for the first 9 months of the year, it is still sufficient to fund the company’s $0.325 / quarter distribution, or a forward yield of 8.9%.

However, investors should note that operating cash flow for Suburban has been creeping lower, from $227 million in 2021 to $221 million in 2022 and $217 million in the last twelve months (Figure 7). On a per share basis, operating cash flow has declined from $3.58 in 2021 to $3.45 in 2022 and $3.37 in the last twelve months.

Figure 7 – Operating cash flows have been creeping lower (tikr.com)

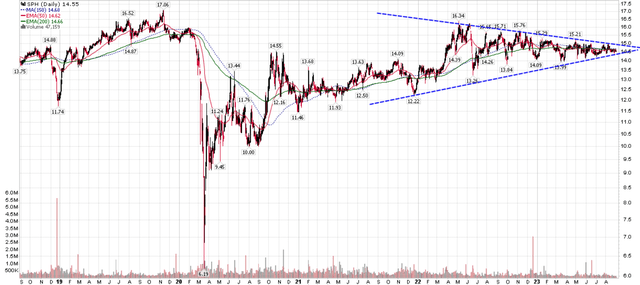

Technical Picture Getting Murky

Technically, the picture for Suburban Propane has degraded from a bullish uptrend into an indecisive sideways consolidation (Figure 8). SPH’s distribution-adjusted stock price is now approaching the apex of a triangle pattern that can either break bullish or bearish.

Figure 8 – SPH stock price is in consolidation (Author created with price chart from stockcharts.com)

Risks To Monitor

Although Suburban continues to pay its $0.325 / quarter distribution, the fundamentals of SPH’s core business has deteriorated in the past year. Demand for propane and other fuels have been weak due to weather and perhaps a switching to ‘greener’ technologies.

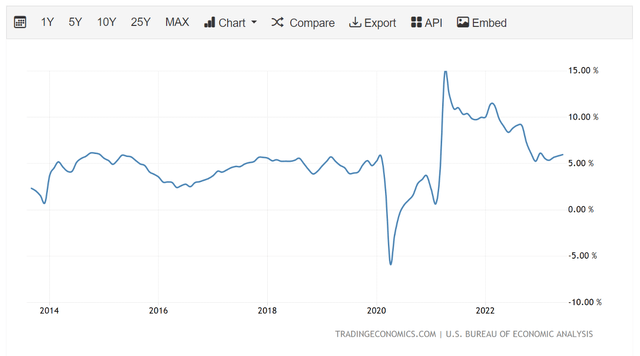

More importantly, operating expenses and G&A expenses have continued to grow at an alarming rate, reducing profitability. Since propane distribution is a very labor intensive business (think truck drivers delivering residential propane tanks and fueling wholesale storage tanks), SPH’s problems is a direct microcosm of the wage inflation that is still impacting American businesses (Figure 9).

Figure 9 – U.S. wage inflation still high (tradingeconomics.com)

Unless SPH can raise unit margins to compensate for higher wages, profitability will continue to suffer.

Furthermore, Suburban appears to be carrying significant costs from a nascent RNG business that does not appear to be profitable. If management makes further unprofitable acquisitions in the RNG space, corporate profitability and the balance sheet will suffer.

Conclusion

Overall, Suburban Propane’s fundamentals have deteriorated considerably in the past twelve months, partly on adverse weather conditions affecting fuel demand, but more so from poor expenses control. I am also worried that the nascent RNG business is still years from contributing to the top and bottom line.

Given the decline in fundamentals, I am downgrading my view on Suburban Propane to Neutral (or Hold). While the partnership’s $0.325 / quarter distribution is still attractive, downside risks have grown and alternative investments appear more attractive.

Read the full article here