Since our recent update on Exor, we are back commenting about CNH Industrial N.V. (NYSE:CNHI). As a reminder, Exor is a long-term shareholder in the truck manufacturer, with an equity stake of 26.89%. Here at the Lab this year, we already reported CNH’s Q1 results, providing a neutral rating on the company. So far, this was a good call, and looking back at our release called M&A optionality, CNH’s stock price declined by 13.03%. Despite a positive long-term outlook, our equal-weight valuation was due to a reasonably priced valuation and an increasing net debt development.

Mare Past Analysis

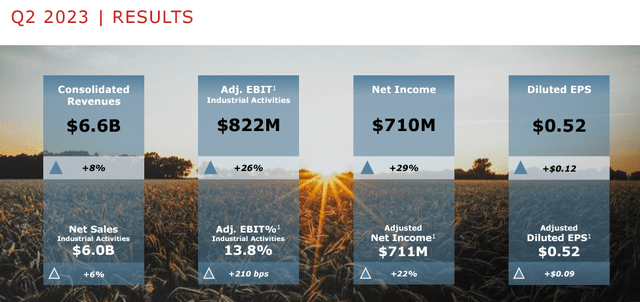

In the Q2 analysis, CNH recorded a net profit up 29% to $711 million; however, more was needed, and CNH stock price declined by 6% since the quarterly release publication (28th of July). In Q2, the company reached consolidated revenues of $6.57 billion, +8% compared to the second quarter of 2022. Net sales revenues from Industrials were $5.95 billion for the period, up $341 million from last year’s second quarter. CNH delivered a free cash flow of $386 million, and the group recorded significant improvements in EBITDA for the Agriculture and Construction segments, which report the highest quarterly adjusted EBIT margin ever. This was very much in line with our investment thesis called CNH Industrial Is Set For A Long-Term Growth, with a supportive thesis based on how to feed an ever-growing population. In our analysis, we reported how crucial it is to increase food production, and we emphasized how it is possible: “increase cultivated areas or increase the productivity of existing ones,” Higher productivity in cultivated areas could be achieved thanks to:

“Companies such as Corteva, Yara International, and LSB Industries. Their internal R&D department constantly develops new products (such as modified crops & seeds) that aim to be more resistant to climate change and natural adversity;

Corporations such as CNH Industrial innovate and develop new machines to increase food production capacity, benefiting farmers in their daily work.”

Concerning CNH innovation, the company recently hired a new head of Research and Development with the appointment of Friedrich Eichler. The manager will lead the entire R&D community and will be in charge of product development, optimizing the autonomous solutions within CNH’s product portfolio. Friedrich Eichler has over thirty years of experience in the auto engineering sector with some of the largest global manufacturers, including the Mercedes-Benz and Volkswagen Group.

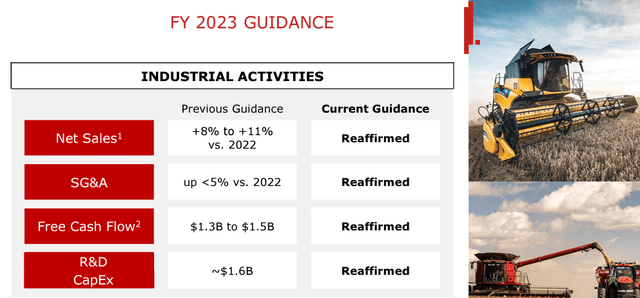

Returning to the H1 analysis, CNH delivered top-line sales of $11.9 billion and a net income of $1.186 billion, reaching a diluted EPS of $0.87. CNH confirmed the yearly outlook about industrial activities, with net sales revenues up between 8% and 11% compared to the previous year, including FX; SG&A up no more than 5% compared to 2022 and FCF in the $1.3 billion and $1.5 billion range. R&D expenses, including investment CAPEX of approximately $1.6 billion.

CNH Industrial 2023 guidance

Changes in our estimates: Why now is a buy

Following the Q2 results and CNH shares declining, here at the Lab, this might be the right momentum to move our rating from neutral to buy.

- Following John Deere, the company is the world’s second-largest farm equipment company, with a primary listing in the United States and a delisting process in Italy. Aside from a simplification and expected cost savings, being listed in the US will likely support the company’s liquidity. In addition, CNH aims to pay a quarterly dividend (in line with its competitors). Here at the Lab, we now expect more news about the de-listing process, and the company is awaiting regulatory confirmation. To support shareholder remuneration, CNH has an ongoing buyback plan; however, with only $50 million left on the existing share repurchase program. Therefore, given the solid results, we might expect a positive evolution in higher payout and/or M&A optionality;

- Following the spin-off in 2022, the company is now a purer agriculture and construction machinery player with a positive MACRO upside, given 10 billion people forecast by 2057 and higher food per capita consumption;

- Following the Q2 results, the company reached an EPS of $0.52, beating consensus estimates of $0.48. These positive results were recorded with a miss on sales by approximately 9%. This is explained by a margin expansion that is even more evident given the flat volume achieved;

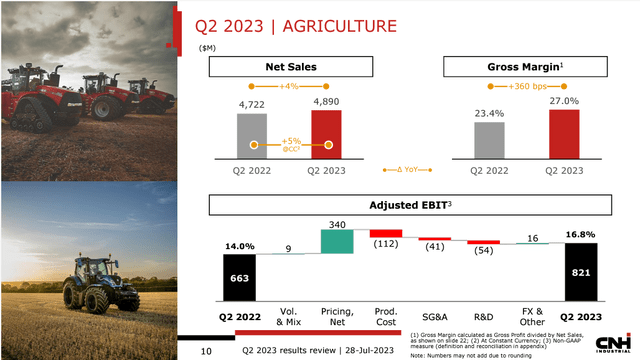

- On a negative note, the company did not raise the FY 2023 guidance, but here at the Lab, we take a more half-glass full view, leaving us more optimistic. Key to note is the Agriculture EBIT margin development, which expanded by 280 basis points to 16.8%. This is an impressive given and gives us confidence in the 2024 margin, even if we assume a slowdown in volume. On the downside scenario, even if pricing will likely moderate, CNH announced $500 million in cost savings, which should support the company’s profitability. In addition, after having listened to the Q&A call, CNH is working on decreasing inventory, and this might provide a revenue acceleration in 2024;

- In addition, we anticipate a target update change in 2024. CNH is already ahead of schedule, with agriculture and construction core operating profit margins in the 15% and 6% range.

CNH Industrial Q2 Financials in a Snap Agriculture EBIT development

Conclusion and valuation

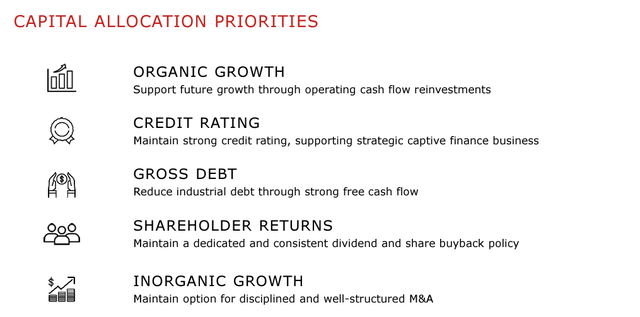

Proactive inventory management, flat volumes with the highest Agriculture margin, and a positive MACRO trajectory make CNH a solid buy. Rolling forward our valuation, we should apply a higher multiple, given the margin progression. Here at the Lab, following the Q2 results, we derived a yearly core EPS at $1.70 and valuing the company with a P/E of 11x (in line with the company’s historical valuation), we arrived at a valuation of $18.7 versus the current $13.53, with an upside of 38%. This value is also supported by an FCF yield of 10% vs. a dividend yield of less than 1%. Looking at CNH’s capital allocation priority, credit rating changes and lower debt are top priorities. Leverage was one of Mare Evidence Lab’s key risks, and we positively report that the company is addressing this topic. Additional risks include competition with incoming new Chinese players), 2) lower order backlog, 3) higher interest rate, 4) execution risks in new products, and 5) wage inflation “war” as happening in the auto segment in Detroit.

CNH capital priorities

Read the full article here