Thesis

While the Newcrest Mining (OTCPK:NCMGY) acquisition will dilute Newmont’s (NYSE:NEM) existing shareholders, I believe the upsides of this acquisition outweigh the dilution. The Newcrest addition would increase Newmont’s gold production by roughly 30%, which means that it will probably offset the weak Q1 and Q2 productions and increase its production by 30% as it starts production again in the Éléonore and Peñasquito mines. Furthermore, gold prices have recovered from their lows through the fourth quarter of 2022 and the first quarter of 2023 and are currently trading 7% higher over the highs of Q3 of last year. All of that points to Newmont having a strong year despite the hurdles it faced, which is why I’m giving it a buy rating.

Newcrest Acquisition

If Newmont completes the Newcrest acquisition, it will become the biggest gold producer in the world, producing around 8,000 koz annually. But to complete the acquisition, Newmont will have to issue around 356 million shares, which would represent around 31% dilution to existing shareholders.

While dilution is most often hated by shareholders, in this case the company would be adding $17.5 billion of assets, including around $650 million in liquidity and $615 million in material inventory. Newmont will also be increasing its gold production by more than 35%, since Newcrest has produced 2,105 koz of gold in its FY23. Adding that to the 6,000 koz it has produced in 2022 would mean that its production can reach 8,100 koz of gold annually. But I think the gold giant would have to wait until next year to reach these numbers since it had a rough start to the year due to the workers strike in the Peñasquito mine in Mexico and the wildfires that made it cease operations in the Éléonore mine in Canada.

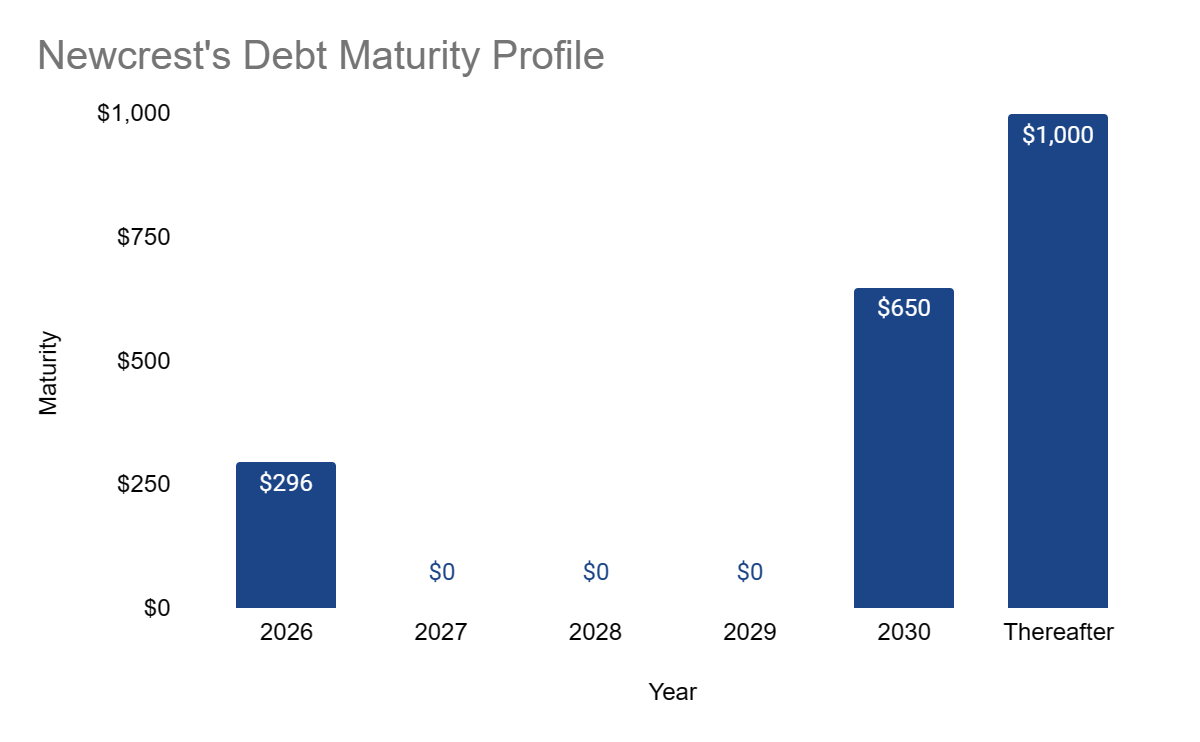

Also, Newmont will be adding around $2 billion in debt to its debt profile, which is around $5.6 billion, which would make its total debt around $7.6 billion. That said, I don’t believe this will pose a big problem for it since the earliest debt maturity for Newcrest is in 2026 and Newmont doesn’t have any maturities before 2027, which makes its current cash of $2.8 billion more than enough to pay the upcoming debt off as it generates more cash to pay future maturities.

Newcrest Q4 2023 earnings presentation

Increased Production All Around

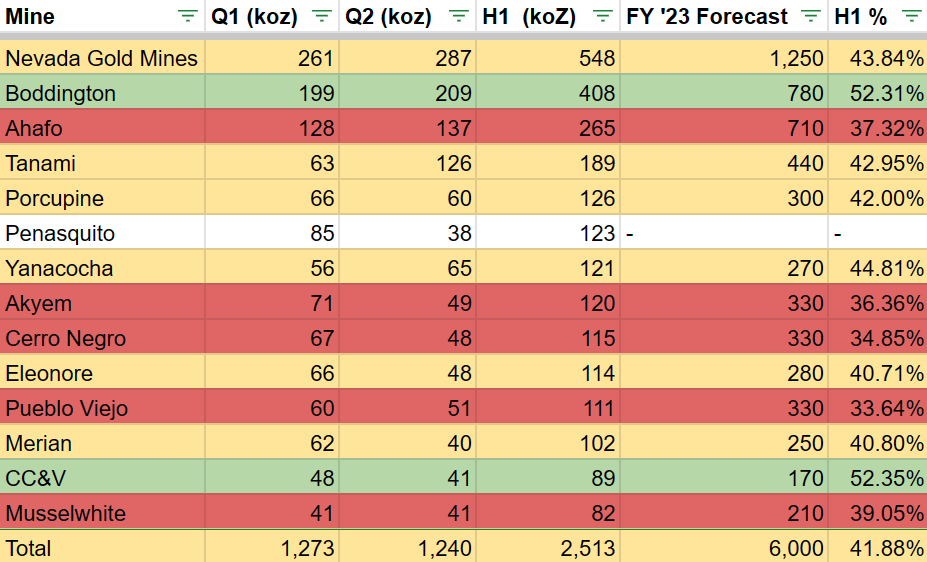

Out of the 14 mines, only two have produced more than 30% of the FY ‘23 forecast, and five have produced less than 40% of the target, with the majority of mines producing middle-of-the pack results between 40% and 50%. The biggest loss for Newmont is the Ahafo mine’s underperformance, since it was supposed to make up more than 10% of its overall production. That said, Boddington overperforming can help offset the decline in production in Ahafo.

Newmont Q4 2022, Q1,Q2 2023 earnings presentations

Excluding the Peñasquito mine in Mexico that is still not in operation due to the workers strike, Newmont expects increased production in almost all of its mines. Both Boddington and Tanami mines, which made around 27% of its production in Q2, are expected to maintain their performance, with Tanami projected to reach its highest production in Q4.

Furthermore, all of the Canadian mines are expected to increase production, including Éléonore, which is ramping up production after the wildfires in Canada affected its numbers. While there are still no updates regarding Peñasquito, other South American mines are expected to increase production in H2, with Merian projected to increase its production by 40% and Cerro Negro reaching full productivity in H2.

The increase in production isn’t exclusive to mines under Newmont’s management; both Nevada Gold Mines and Pueblo Viejo, which it owns 38.5% and 40% of, respectively, and are under Barrick’s (GOLD) management, are expected to see increased production. It is also worth mentioning that despite Newmont owning only 38.5% of Nevada Gold Mines, it is its highest gold producer and contributes around 23% of its total production.

The overall expected increase in production, combined with the Newcrest acquisition, should allow Newmont to see a relatively strong second half of 2023.

Competition

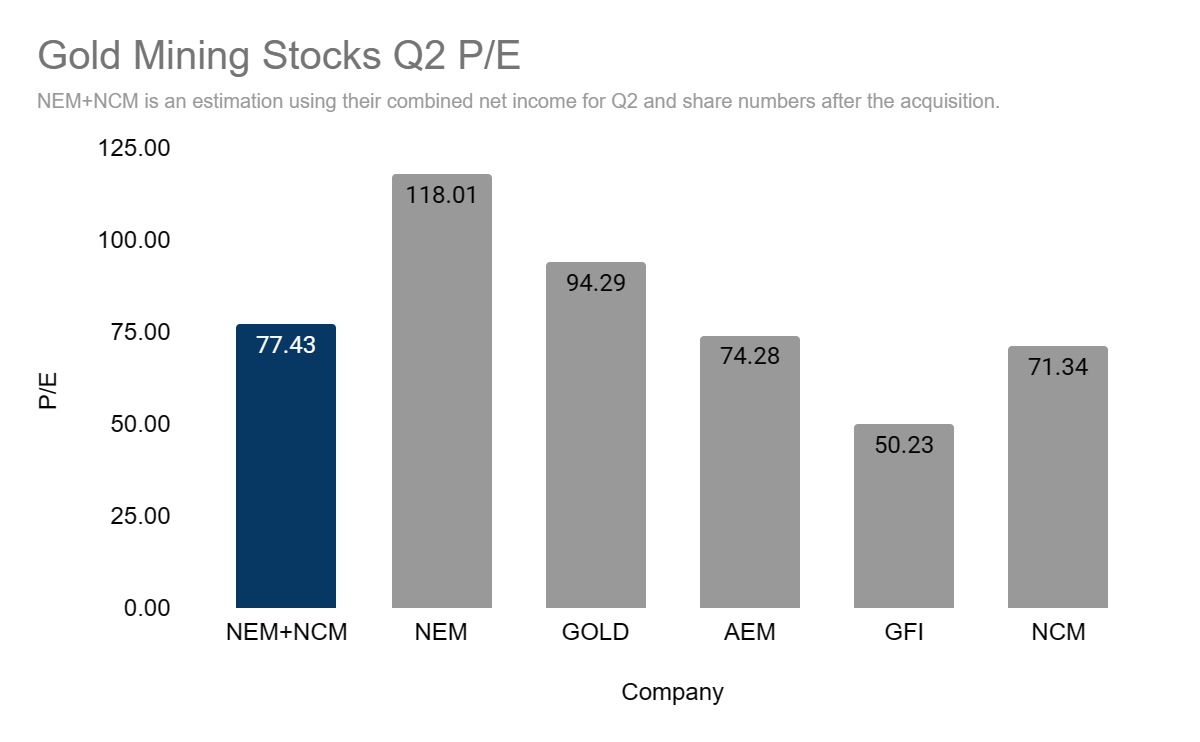

I believe that if the Newcrest acquisition goes through, Newmont will be undervalued compared to other gold mining companies at its current PPS. While Newmont’s P/E for the quarter was relatively higher than other gold mining stocks, after the acquisition, its P/E would be considered middle of the pack. But we need to take into consideration that the company’s income was affected by the strike in Peñasquito and shutting down operations in Éléonore, which, other than the production decline, added $45 million in operating costs and depreciation.

Gold mining stocks P/E ratio, each company’s earnings report

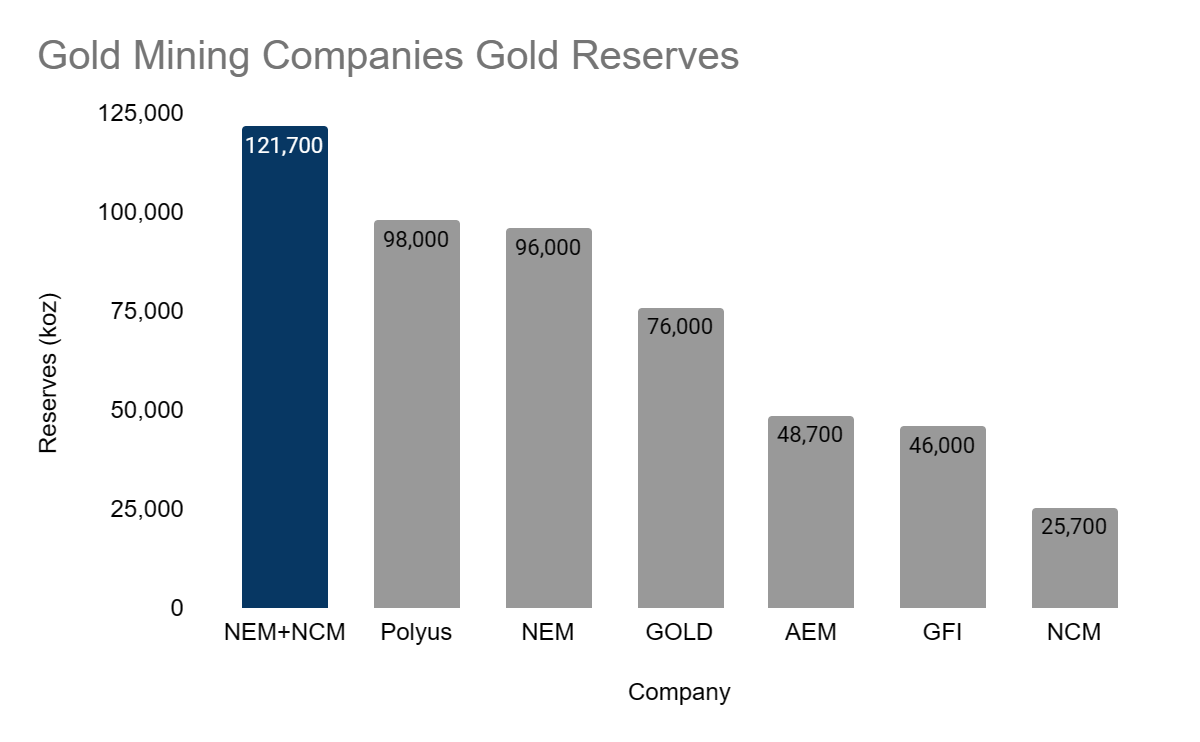

While it might seem that this would be a correction that was overdue due to an overvalued stock, I don’t believe that as Newmont’s real value comes from its large gold reserves. The company already has the second largest gold reserve among all gold mining companies. After the acquisition though, Newmont will surpass Russian gold mining company Polyus and have the largest gold reserve in the world.

Polyus, NEM, GOLD,AEM, GFI, NCM Earning Presentations

Gold Prices Could Drive Growth and Margins

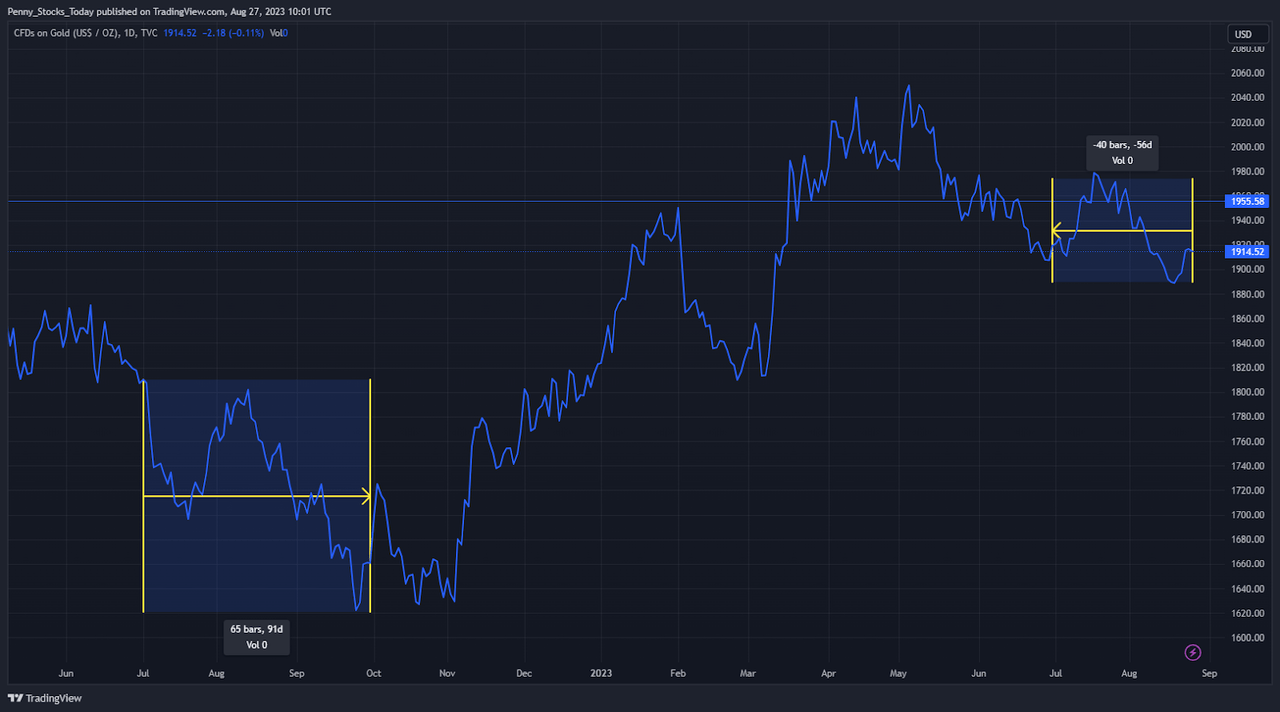

Another thing that will improve Newmont’s H2 is the recovery in gold prices. In Q3 2022, gold reached its 52-week low, which means that it could sell its gold at much more favorable prices compared to the same period last year.

Trading view

Despite gold prices decreasing slightly from Q2, they are still in a much better position than the lows of Q3 and Q4 of 2022. That, combined with the increased production and the Newcrest acquisition, should see the gold giant achieve high growth numbers in Q3 and Q4 2023.

Risks

While the Newcrest acquisition has been approved by multiple regulators, it has yet to get clearance from authorities like the Australian Foreign Investment Review Board, the Japan Fair Trade Commission, the Philippine Competition Commission, and the Papua New Guinea government. If any of these sides doesn’t approve the acquisition, the deal will probably fall through. While the deal falling through won’t affect Newmont’s business, it would be a missed opportunity for the gold giant to expand its business and become the undisputed largest gold producer in the world.

Conclusion

Although the Newcrest acquisition is not finalized yet and still requires the clearance of multiple authorities in different countries, if approved, it would increase Newmont’s gold production by more than 30%, making it the largest gold producer in the world. Meanwhile, the gold giant expects an increase in production in the second half of the year as it starts mining higher grade ores. Gold prices recovery compared to the same period last year will help increase both its revenue and margins. While Newmont might have had a rough Q2, I believe H2 will be a different story, especially if the Newcrest acquisition goes through, which is why I assign it a buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here