As much as I wish that every call that I made went perfectly, some take a while to play out. Others, from time to time, never do. This is part of the game, and it stems from the fact that markets are not perfectly rational, nor are humans. Information asymmetry is also a major problem when it comes to making investment calls. I have learned in the past to do everything I can to try and identify the difference, though, between a play that needs more time to work out and a play that never will.

When it comes to a company like G-III Apparel Group (NASDAQ:GIII), it is clear that my assessment recently has been wrong. However, I do not think that the prospect itself deserves to be abandoned. Yes, the company is facing some pain right now. But if management can come through on guidance for 2023, shares look cheap enough, both on an absolute basis and relative to similar firms, to offer some pretty attractive upside.

Tough times

It has been almost a year since I last wrote about G-III Apparel Group. My last article on the company was published in late November 2022. Shares of the company had been falling leading up to that point, with mixed financial results likely causing the pain. At that time, however, I maintained that overall fundamentals remained robust and that shares were cheap enough to appreciate nicely once the dust had settled. Since then, the picture has not played out exactly as I would have hoped. The stock is down 8.9% at a time when the S&P 500 (SP500) has gone up 13.7%.

Author – SEC EDGAR Data

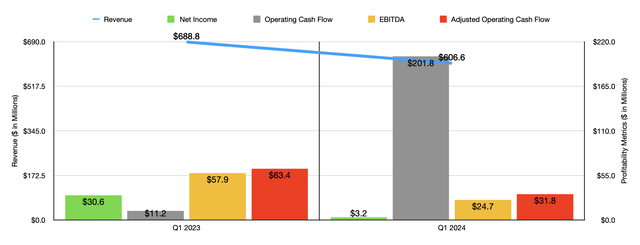

Sometimes, the market can move in a way that doesn’t make sense when you consider the fundamental performance of a business. But this is not one of those instances. To see what I mean, we should first look at the financial performance for the company covering the first quarter of its 2024 fiscal year. This is the quarter that was just reported on. Overall revenue for the enterprise was $606.6 million. This represents a drop of 11.9% over the $688.8 million management reported one year earlier. A lot of the pain for the firm came from its wholesale operations. Revenue declined from $680.9 million in the first quarter of the company’s 2023 fiscal year to $586.9 million the same time this year.

Net sales of Calvin Klein and Tommy Hilfiger licensed products, as well as sales associated with DKNY and Donna Karan offerings, caused the bulk of this pain. Management chalked this up to a reduction in consumer demand. And interestingly, the picture would have been even worse had it not been $60.9 million in extra revenue the company generated from the inclusion of results of the Karl Lagerfeld business.

Federal Reserve

Even though I have no doubt in the numbers that management provided, it is worth noting that retail data is very closely tracked. Clothing and clothing accessories revenue for the first seven months of this year, relative to the same seven months of 2022, actually ended up coming in 0.9% higher than it was the same time last year. That translates to overall clothing and clothing accessories store revenue to $166.4 billion for that seven-month window.

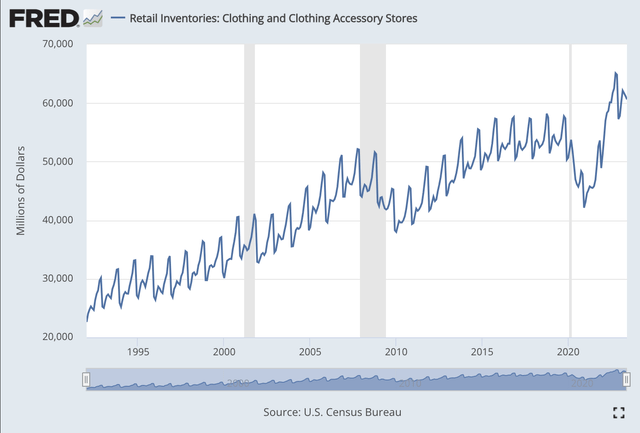

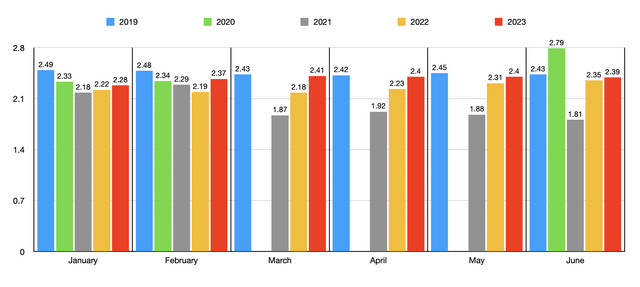

We should also be looking at some other data points. For instance, inventory levels would definitely be important. Retail inventories associated with clothing and clothing accessories ended up at $60.63 billion as of June of this year. That’s up only slightly from the $60.13 billion reported one year earlier, and it is an increase over the $52.83 billion reported for June 2019. I picked that year because it was the final year before the pandemic began. But of course, this does not deal with the question of inflation. A better metric would probably be the retail inventories/sales ratio for this space. As of the end of the most recent month for which data is available, which covers June of this year, this ratio was 2.39. That compares to the 2.43 reported for June 2019.

Author – Federal Reserve Data

*Inventory/Sales Data Per Month.

**I intentionally excluded data for March, April, and May for 2020 because those results were extreme outliers caused by the pandemic.

What all of this suggests to me is that inventory levels are more or less where they should be and sales, in relation to inventories, are in what you would expect to be for the normal range. This is somewhat disconcerting when stacked up against the data reported by G-III Apparel Group for its most recent quarter. However, this does not necessarily destroy the bullish stance regarding the firm. But before we get into that side of the argument, we should touch on briefly the bottom line performance of the enterprise.

With the drop in revenue came a decline in profits. That should not be surprising. Net income in the most recent quarter totaled $3.2 million. That’s down from the $30.6 million reported for the first quarter of 2023. It is true that operating cash flow skyrocketed from $11.2 million to $201.8 million. But if we adjust for changes in working capital, we would get a decline from $63.4 million to $31.8 million. And over that same window of time, EBITDA for the company was slashed from $57.9 million to only $24.7 million.

Author – SEC EDGAR Data

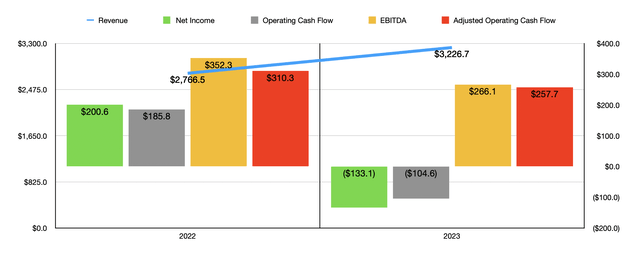

Despite the rough start to the 2024 fiscal year, management does remain optimistic about the year in its entirety. They are currently forecasting revenue of $3.29 billion. As you can see in the chart above, this would represent a modest increase over the $3.23 billion the company reported for the 2023 fiscal year. Net income should be somewhere between $125 million and $130 million, while EBITDA should total between $267 million and $272 million. Both of these figures indicate a year-over-year improvement compared to what the company saw in 2023. No guidance was given when it came to other profitability metrics. But if we assume that the year-over-year increase for EBITDA, at the midpoint, will be an indicator, then adjusted operating cash flow should be around $261 million this year.

Author – SEC EDGAR Data

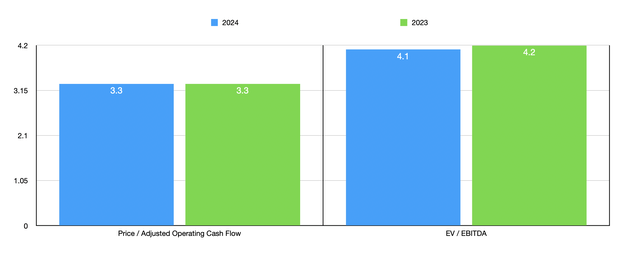

In the chart above, you can see how shares are priced on a forward basis using these estimates. In fact, the company is priced very similarly to what we would get using data from 2023.

As part of my analysis, I also compared G-III Apparel Group to five similar firms as shown in the table below. In it, you can see that, using the price to operating cash flow approach, G-III Apparel Group ended up being the cheapest of the group. And if we rely on the EV to EBITDA approach, only one of the five companies was cheaper than our prospect.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| G-III Apparel Group | 3.3 | 4.1 |

| Movado Group (MOV) | 6.8 | 3.7 |

| Ralph Lauren (RL) | 12.4 | 7.2 |

| Delta Apparel (DLA) | 13.1 | 39.3 |

| Capri Holdings (CPRI) | 9.9 | 9.1 |

| Tapestry (TPR) | 8.2 | 6.3 |

Takeaway

At this point in time, it is clear to me that G-III Apparel Group is contending with some pain. Clothing and accessory data seem to back the view that the market is fine, so that does make the first quarter release a bit perplexing. It is always possible that one brand or another can see ebbs and flows of popularity. So I don’t think investors should read too much into this for now. But it is something that should be looked upon every time new data comes out.

For now, management seems optimistic about the current fiscal year. As long as they can come through on this guidance or something close to it, G-III Apparel Group, Ltd. shares do look cheap enough to still warrant a “buy” rating. But I would be lying to you if I said that the company isn’t on watch for a downgrade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here