Like many other mortgage REITs, MFA Financial (NYSE:MFA) has reached lows previously set during the early 2020 pandemic panic. The stock is down 30% over the last year as the outlook for 2023 looks set to be driven by a Fed funds rate that has been hiked to new highs at a 5% to 5.25% range. However, it looks likely that the Fed is about to embark on a dovish pause with the next inflation reading before the end of spring to set the tone for the June 13 to 14 FOMC meeting. This is important as the mREIT’s portfolio and distribution have been entirely disrupted by the current macroeconomic environment.

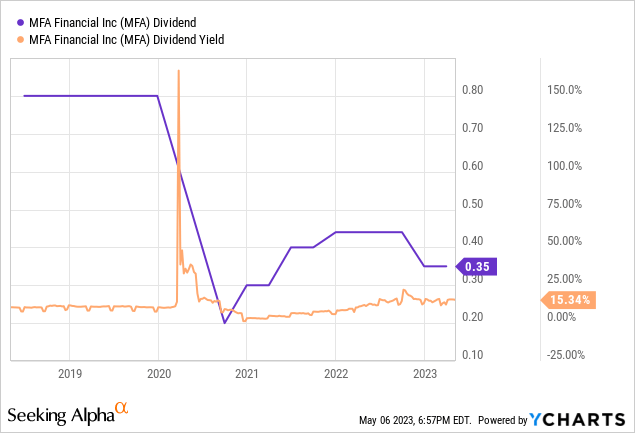

MFA last declared a quarterly cash dividend of $0.35 per share, in line with its previous payout and for a 13.6% forward yield. The payout had previously been reduced from $0.44 per share after three hikes over two years. The recovery from its pandemic-era collapse has been entirely reversed and the risk here is that the quarterly payouts continue to fall. How likely is this? Highly. The mREIT recently reported fiscal 2023 first-quarter earnings that saw dual misses on revenue and earnings with the dividend not fully covered by distributable earnings.

Dual Misses As Distributable Earnings Fall

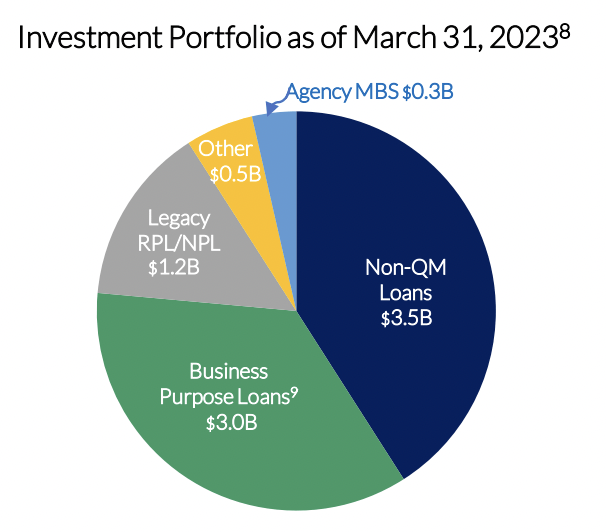

MFA reported net interest income for its first quarter of $39.37 million, a 37.6% decrease from its year-ago comp and a miss by $15.11 million on consensus estimates. This was driven by an $8.4 billion investment portfolio, a growth of 5.5% over the prior quarter. The mREIT acquired $174 million of agency mortgage-backed securities, bought $90 million of non-qualified mortgages, and funded $364 million of loans through Lima One Capital, its wholly-owned real estate lender during the first quarter. Portfolio runoff stood at around $323 million for the quarter.

MFA Financial

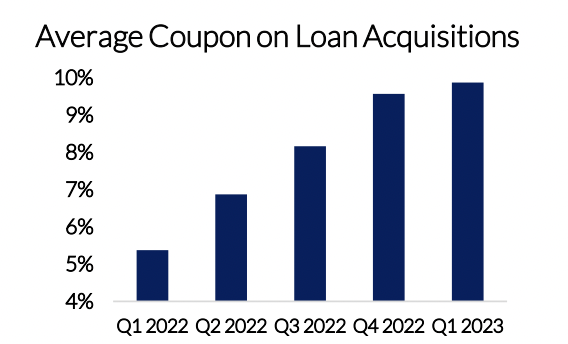

Non-qualified mortgages, which charge higher rates and sometimes require a more substantial deposit from their borrowers, formed the largest component of MFA’s portfolio at $3.5 billion. These are quite esoteric in that they sit beyond traditional agency mortgage guidelines and include loans to borrowers with low FICO scores and interest-only payments. The mREIT’s average coupon on acquired loans continues to move up and reached 10% during the first quarter with Lima One Capital originating business purpose loans with a coupon north of 10%.

MFA Financial

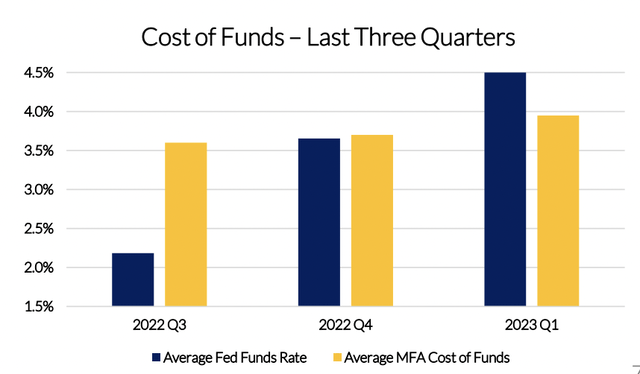

The average coupon on loan acquisitions has almost doubled from its year-ago figure to help boost the mREIT’s net interest spread. This was 174 basis points during the first quarter, exceeding the 150 basis point watermark for the third consecutive quarter. MFA’s cost of funds was at 3.95%, rising just 25 basis points from the fourth quarter and lower than the average Fed funds rate during the first quarter due to hedging activities, mainly interest rate swaps, undertaken by its internal management.

MFA Financial

Distributable earnings came in at $30.8 million, around $0.30 per share, and down around $0.18 per share from the prior fourth quarter. This was also a miss by $0.02 on consensus estimates. This significant 37.5% sequential decline has unfortunately set the backdrop for a dividend that’s left uncovered and likely privy to another cut. The mREIT’s payout ratio now stands at 116.7%. Further, whilst bulls would be right to flag the mREIT cash, cash equivalents, and restricted cash of $547.6 million as of the end of the first quarter, this is capital required for operations and investments. The mREIT will likely have to rightsize its dividend if distributable EPS continues to trend down.

The Discount To Book Value

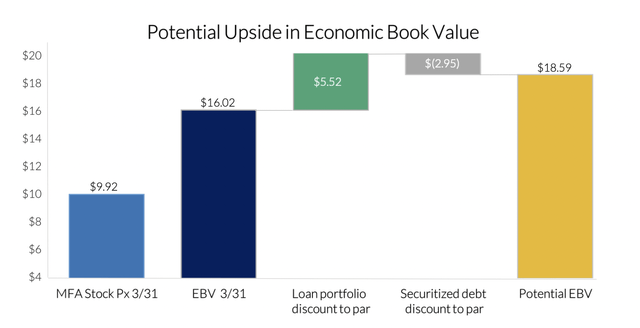

MFA’s common shares are currently trading at $10.30, this is versus a GAAP book value of $15.15 per share as of the end of the first quarter. Hence, the mREIT is swapping hands at a roughly 32% discount to its book value. Book value was also a 1.9% growth sequentially and meant a partial stabilization of what has been a general downtrend. Critically, there currently exists a marked disparity in the loan portfolio’s fair value and realizable par value.

MFA Financial

This fair value at the end of the first quarter was marked at $563 million below par, around $5.52 per share. When added to an economic book value of $16.02 per share, less the securitized debt discount to par, the potential economic book value rises to $18.59 per share. The mREIT should be able to reverse current unrealized losses in book value as its borrowers make principal repayments and pay back their loans. This will set the context for a potential closing of the current discount. The broader macroeconomic environment looks like it could be about to normalize with the US economy likely set to stage a soft landing as job growth and overall employment remain positive. However, I’d wait for the next dividend announcement for certainty as the dividend safety was not raised during the first quarter earnings call. MFA stock is a hold until this confirmation.

Read the full article here