Foreword

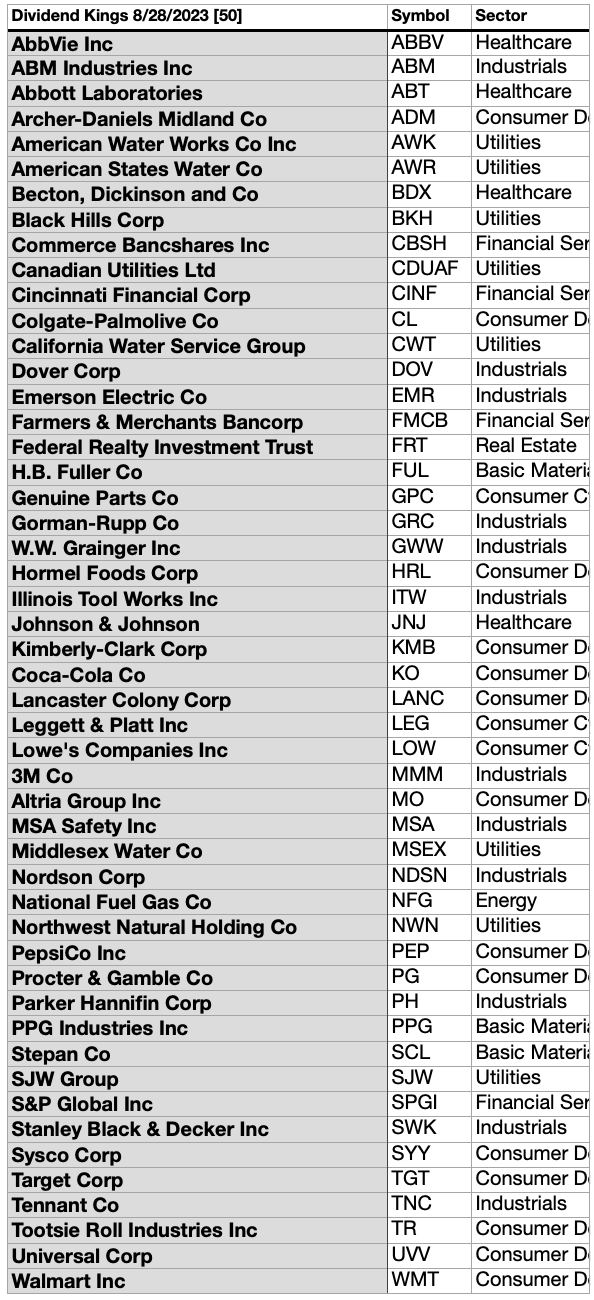

As supplement to this article, please note that Dogs of the Dow has published a 2023 list detailing the latest 50 Dividend Kings. The article, entitled 2023 Dividend Kings List, is online now. Yes, VFC is no longer a dividend king, and four new ones have emerged. Warning: you may have to click on a second link under Live Dividend Stock Screens at the bottom of the Dogs of the Dow landing page to bring up the “Dividend Kings List.”

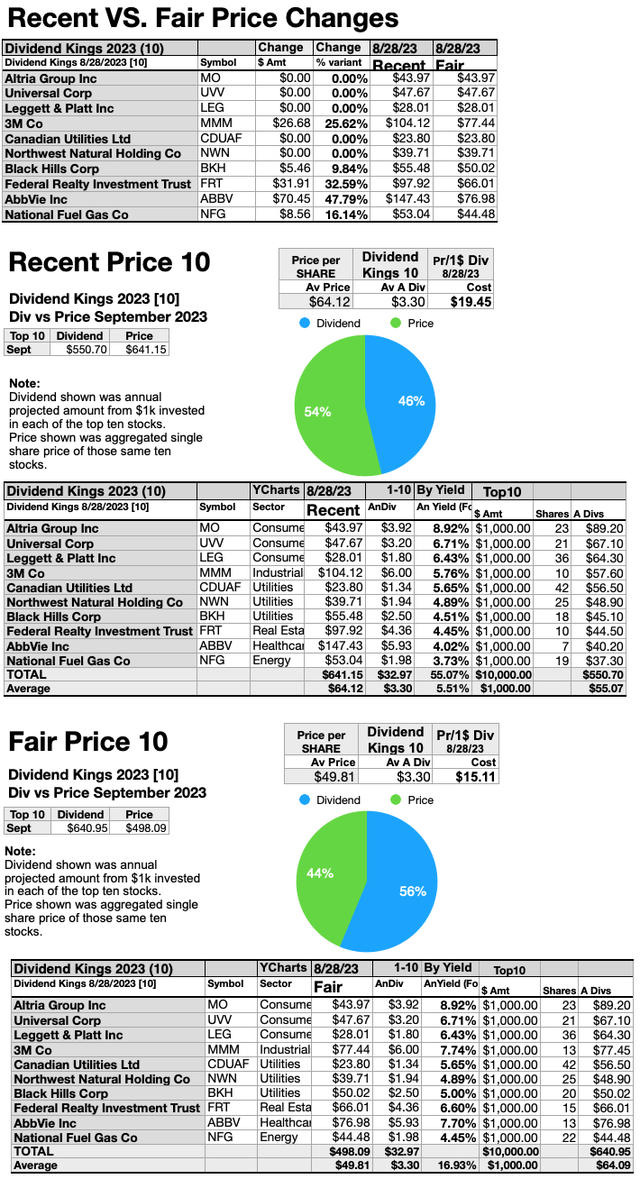

While most of this collection of 50 Kings is too pricey to justify their skinny dividends, five of the top ten, by yield, live up to the ideal of offering annual dividends (from a $1K investment) exceeding their single share prices, and this month there are four more to watch.

In the current market adjustment, it is now possible for Altria Group Inc (MO), Universal Corp (UVV), Leggett & Platt Inc (LEG), Canadian Utilities Ltd (OTCPK:CDUAF), and Northwest Natural Holding Co (NWN), to stay fair-priced with their annual-yield (from $1K invested) meeting or exceeding their single-share prices.

The four to watch are: Black Hills Corp (BKH); National Fuel Gas (NFG); 3M Corp (MMM); Federal Realty Investment Trust (FRT).

BKH can drop $5.46 and NFG can shed $8.56. MMM is $26.68 overweight, and FRT needs to lose $31.91 in price to join the ideal five.

As we are long past the three-year and one third mark of the 2020 Ides of March dip, the time to snap-up those five lingering top-yield dividend King dogs is at hand… unless another big bearish drop in price looms ahead. (At which time your strategy would be to add to your position in any of those you then hold.)

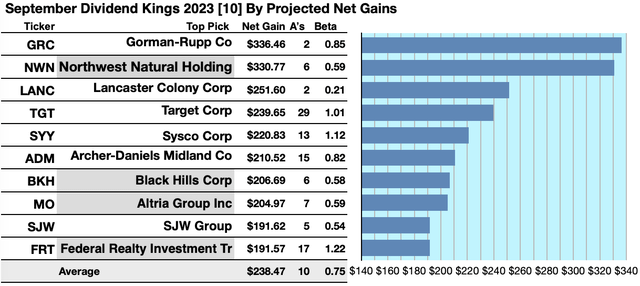

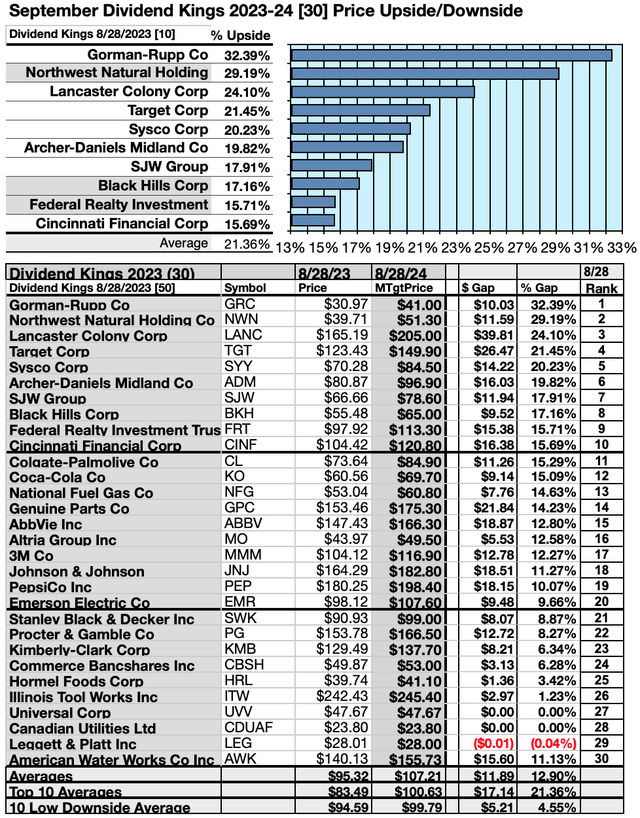

Actionable Conclusions (1-10): Analysts Predict 19.16% To 33.65% Top Ten Kingly Net Gains To September 2024

Four of the ten top Kings by yield were verified as being among the top ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below.) Thus, this yield-based August 28 forecast for September Kings (as graded by Brokers) was 40% accurate.

Estimated dividend returns from $1000 invested in each of these highest-yielding stocks and their aggregate one-year analyst median target-prices, as reported by YCharts, produced the following 2023-24 data points. (Note: target-prices from lone-analysts were not used.) Ten probable profit-generating trades projected to September, 2024 were:

Source: YCharts.com

Gorman-Rupp Co (GRC) was projected to net $336.46, based on dividends, plus the median of target price estimates from 2 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 15% under the market as a whole.

Northwest Natural Holding Co was projected to net $330.77, based on a median of target estimates from 6 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 41% less than the market as a whole.

Lancaster Colony Corp (LANC) was projected to net $251.60 based on target price estimates from 2 analysts, plus annual dividend, less broker fees. The Beta number showed this estimate is subject to risk/volatility 79% less than the market as a whole.

Target Corp (TGT) was projected to net $239.65, based on dividends, plus the median of target price estimates from 29 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 1% greater than the market as a whole.

Sysco Corp (SYY) was projected to net $220.83 based on dividends, plus the median of target price estimates from 13 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 12% greater than the market as a whole.

Archer Daniels Midland Co (ADM) was projected to net $210.52, based on the median of target price estimates from 15 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 18% less than the market as a whole.

Black Hill Corp netted $206.69 based on a median target price estimate from 6 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 42% less than the market as a whole.

Altria Group Inc was projected to net $204.97, based on the median of target price estimates from 7 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 41% less than the market as a whole.

SJW Group (SJW) was projected to net $191.62, based on the median of target price estimates from 5 analysts, plus the estimated annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 46% less than the market as a whole.

Federal Realty Investment Trust was projected to net $191.57, based on dividends, plus the median of target price estimates from 17 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 22% greater than the market as a whole.

The average net gain in dividend and price was estimated to be 23.85% on $10k invested as $1k in each of these ten stocks. The average Beta ranking showed these estimates subject to risk/volatility 25% under the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs,” even if they are “Kings” and “Princes.”

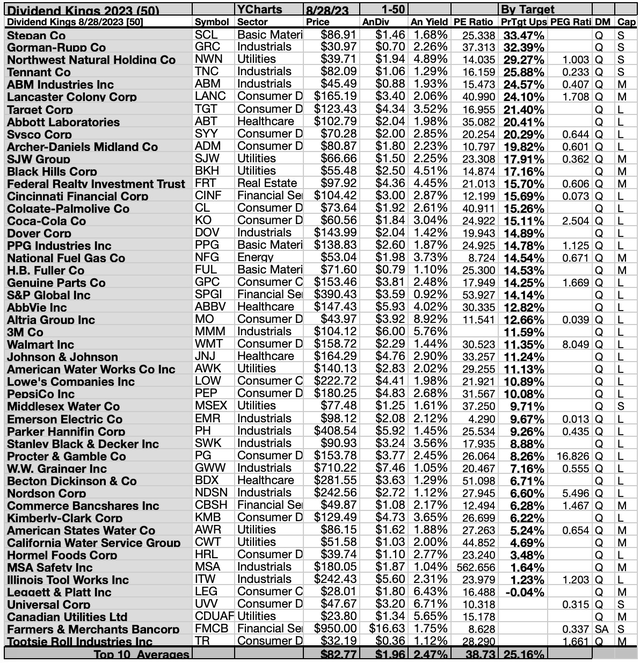

Top 50 Dividend Kings By Broker Targets

Source: dogsofthedow.com/YCharts.com

This scale of broker-estimated upside (or downside) for stock prices provides a measure of market popularity. Note: no broker coverage or single broker coverage produced a zero score on the above scale. These broker estimates can be seen as the emotional component (as opposed to the strictly monetary and objective dividend/price yield-driven report below). As noted above, these scores may also be regarded as contrarian.

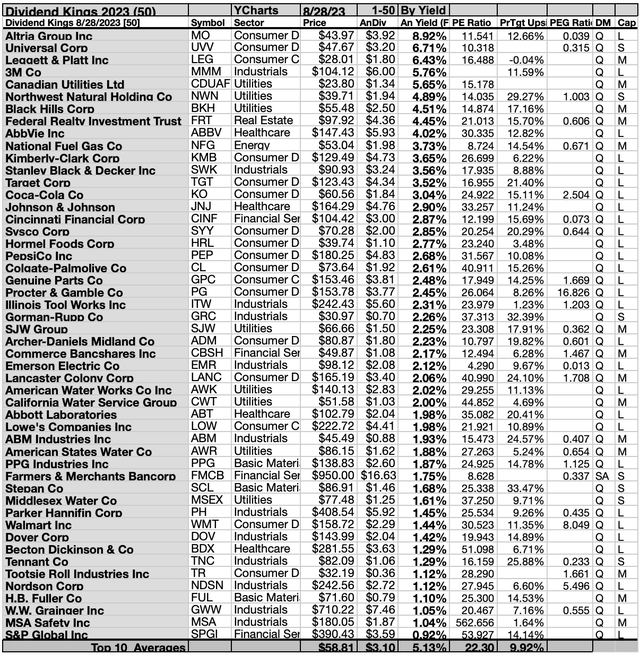

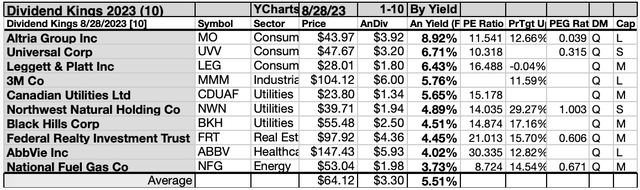

Top 50 Dividend Kings By Yield

Source: dogsofthedow.com/YCharts.com

Actionable Conclusions (11-20): Ten Top Stocks By Yield Are The September Dogs Of The Dividend Kings

Top ten Kings selected 8/28/23 by yield represented seven of eleven Morningstar sectors. In first place was Altria Group Inc. [1], the tops of two consumer defensive representatives listed. The other placed second, Universal Corp [2].

Then, one consumer cyclical representative took third place, Leggett & Platt Inc [3]. The lone industrials sector representative placed fourth, 3M Co [4].

In fifth place, was the first of three utilities, Canadian Utilities Ltd [5]. Thereafter, in sixth and seventh places, were Northwest Natural Holding Co [6], and Black Hills Corp [7].

Eighth place was claimed by the lone real estate representative, Federal Realty Investment Trust [8]. Then, the lone healthcare representative in the top ten placed ninth, AbbVie Inc (ABBV) [9].

Finally, to complete these September top-ten Kings, by yield, the lone energy representative in the top ten placed tenth, National Fuel Gas Co [10].

Source: YCharts.com

Actionable Conclusions: (21-30) Top Ten Kings Showed 15.69% To 32.39% Upsides Into September 2023; (31) On The Downside Was One -0.04% Loser

To quantify top-yield rankings, analyst median price-target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analyst median price-target-estimates became another tool to dig-out bargains.

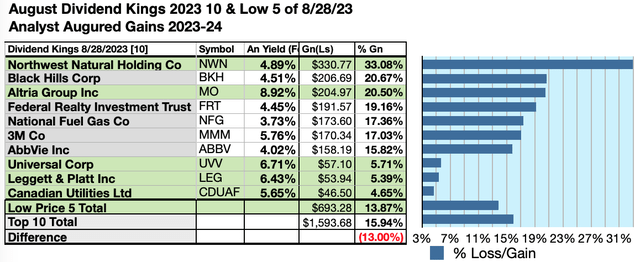

Analysts Estimated A 13% Disadvantage For 5 Highest Yield, Lowest Priced, of Top-Ten Dividend Kings By September, 2024

Ten top Kings were culled by yield for their monthly update. Yield (dividend/price) results verified by YCharts did the ranking.

Source: YCharts.com

As noted above, top ten Kings selected 8/28/23 showing the highest dividend yields represented seven of eleven in the Morningstar sector scheme.

Actionable Conclusions: Analysts Estimated The 5 Lowest-Priced Of Ten Highest-Yield Dividend Kings (32) Delivering 11.02% Vs. (33) 12.27% Net Gains by All Ten by September, 2024

Source: YCharts.com

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten Dividend Kings kennel by yield were predicted by analyst 1-year targets to deliver 13% LESS gain than $5,000 invested as $.5k in all ten. The third lowest-priced top-yield King stock, Northwest Natural Holding Co, was projected to deliver the best net gain of 33.08%.

Source: YCharts.com

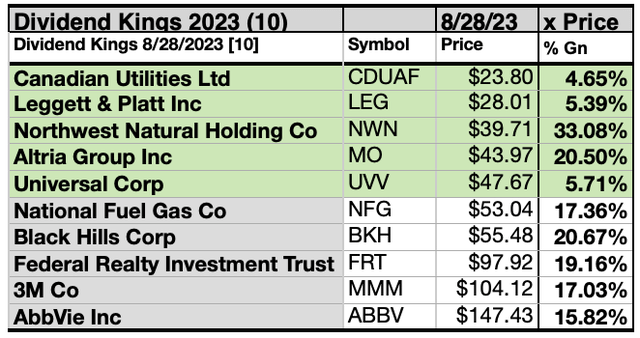

The five lowest-priced top-yield Dividend Kings as of August 28 were: Canadian Utilities Ltd; Leggett & Platt Inc; Northwest Natural Holding Co; Altria Group Inc; Universal Corp, with prices ranging from $23.80 to $47.67

The five higher-priced top-yield Dividend Kings for August 28 were: National Fuel Gas Co; Black Hills Corp; Federal Realty Investment Trust; 3M Co, and AbbVie Inc, whose prices ranged from $53.04 to $147.43.

This distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, however, since analysts are historically only 15% to 85% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

Afterword

If somehow you missed the suggestion of the seven stocks ripe for picking at the start of the article, here is a repeat of the list at the end:

The following 5 (as of 8/28/23) realized the ideal of offering annual dividends from a $1K investment exceeding their single share prices: six of the top-ten, by yield, live up to the ideal of offering annual dividends (from a $1K investment) exceeding their single share prices, and there are four more to watch.

In the current market adjustment, it is now possible for Altria Group Inc, Universal Corp, Leggett & Platt Inc, Canadian Utilities Ltd , Northwest Natural Holding Co, to stay fair-priced with their annual-yield (from $1K invested) meeting or exceeding their single-share prices.

The four to watch are Black Hills Corp; National Fuel Gas; 3M Co; Federal Realty Investment Trust.

BKH can drop $5.46 and NFG can shed $8.56 in price. MMM looks to drop $26.68, and FRT needs to lose $31.91, to join the ideal five.

Price Drops or Dividend Increases Could Get All Ten Top Dividend Kings Back to “Fair Price” Rates For Investors

Source: YCharts.com

Since five of the top ten Dividend K&P shares are now priced less than the annual dividends paid out from a $1K investment, the top chart below shows the dollar and percentage differences between recent and fair prices. Note that five others are within $5.50 to $70.50 of being there. The middle chart compares the five ideals with five at recent prices. Fair pricing (when all ten top dogs conform to the ideal) is displayed in the bottom chart.

September Dividend Kings Alphabetical by Symbol

Source: Dogsofthedow.com

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your Dividend Aristocrats dog stock purchase or sale research process. These were not recommendations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here