It’s been a little more than five months since I last droned on about the fact that investors in John Wiley & Sons Inc. (NYSE:WLY) are taking on more risk while being paid less in an article with the mind-blowing original title: “John Wiley & Sons: Taking on More Risk, Being Paid Less.” Since then, shares have underperformed the overall market, as I expected they would. The stock itself is down about 1% since then, against a gain of about 12.8% for the S&P 500. I’ve obviously been comfortable buying this stock in the past, so I thought I’d review the name yet again to see if it makes sense to buy back in. I’ll make that determination by looking at the most recent financial results and by looking at the stock as a thing distinct from the underlying business. Finally, I want to prove once again that not all heroes wear capes or fight crime by making a prediction of the upcoming quarterly results. Your undying gratitude is all the thanks I need for this.

If you’re one of my regular readers, you know that I’m absolutely obsessed with making your reading experience as pleasant as possible. One of the ways I try to do this is by offering you a “thesis statement” paragraph near the beginning of each of my articles that gives you a quick synopsis of my thinking. This allows you to get out before you’re exposed to too much Doyle mojo. You’re welcome. I’m of the view that the company is mid-transition, and so there’s still risk here. The latest financial results have been underwhelming, and the company has not yet returned to pre-pandemic levels of profitability. I’m forecasting EPS of $0.70 for the upcoming quarter, but I urge you to take this forecast with a boulder of salt, given that it excludes restructuring charges that we know are coming. Thus, my TTM EPS forecast of $1.33 is quite optimistic. Even with this very optimistic EPS forecast, though, the shares are still expensive. I can’t potentially tolerate an expensive stock if the company is “firing on all cylinders” as the young people say. But for a company like this one, my tolerance disappears. Although the dividend yield has improved, it remains below the 20-year risk-free rate. In my view, taking on more risk and getting paid less is a recipe for inevitable disappointment, so I’m going to continue to eschew these shares. I’d recommend other investors do the same.

Financial Snapshot

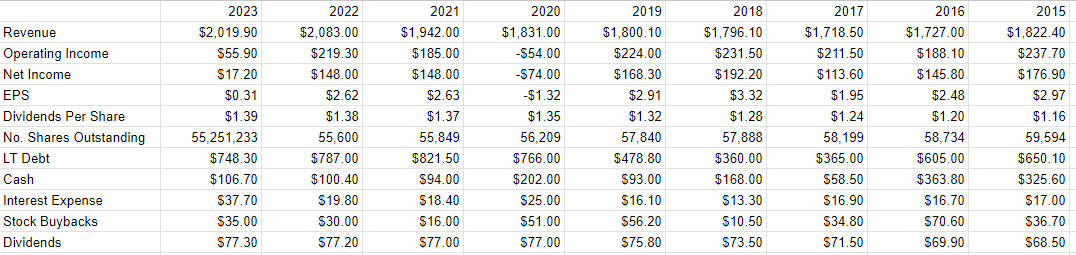

The company closed out FY 2023 on a bad note, in my view. Revenue was down slightly from 2022, while net income plummeted by about 88.4% from that year. The approximate $131 million drop in net income can be attributed to a $100 million uptick in various costs, including a $99.8 million goodwill impairment and a $49.4 million restructuring charge. A bull might argue that these are non-recurring, but I’m in the mood to point out that just because something’s “non-recurring” does not mean that it does not destroy shareholder wealth. There’s also the fact that sales dropped by about $63 million from the prior year, and interest expense exploded higher by 90%, or $17.9 million. On the bright side, long-term debt has come down by about $38.7 million, but remains about $270 million higher than it was in the pre-pandemic era. This is yet another company that has not yet returned to pre-pandemic levels of profitability.

Finally, for those of you who don’t care as much about accrual accounting, and care only about cash, I feel obliged to point out that cash from operations is down by about 18% or $62 million from 2022.

I’m sure many of my readers are fascinated by my retelling of financial history, but investors are, understandably, more interested in the future. For that reason, I want to spend some time trying to forecast what the next quarter will be like. Before leaving this section on financial history, though, I couldn’t live with myself if I didn’t point out that, in my experience, an alarming number of investors are actually unaware of the financial state of their investments, so I feel the need to write the “financial snapshot” section for their benefit.

John Wiley Financials (John Wiley investor relations)

First Quarter Forecast

Whenever I take it upon myself to make a prediction, I give myself an intellectual “get out of jail free” card by reminding investors of the old, apparently Danish, quip “It’s difficult to make predictions, especially about the future.” It’s particularly fraught in this case because of all of the so-called “one-time items” splashing around John Wiley’s financial statements. In spite of these challenges, I’m going to suit up and make a prediction for you. You’re welcome.

I’m of the view that the most likely path forward is the path we’re currently on. So, my forecast is going to look at Q1 of 2023’s revenue, and apply that to what’s going to happen in Q1 2024. I’m then going to assume most costs will be the same percent of that revenue as we’ve seen throughout 2024.

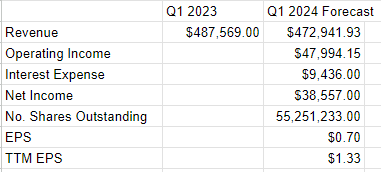

So, right off the bat, as I’m sure you remember, revenue in Q1 2023 was $487.569 million, and I’m going to assume sales drop 3%. So, I’m forecasting revenue for the upcoming quarter of about $472.9 million.

Next, I’m going to adjust operating expenses by stripping out the impairment of goodwill and restructuring charges we saw in 2023. This is a controversial move since the company has announced that there will be continued restructuring charges in 2024. I’m comfortable stripping these out for two reasons. First, the timing around these costs is uncertain. Second, I’m more interested in considering the business over the longer term. For that reason, I’m willing to discount the one-time storms that will pass. The company has stated that 2024 will be a transition year, and I see no reason to not take them at their word.

So, pulling these one-time items out of operating expenses for 2023 suggests that operating income “should” be about 10% of revenue.

To estimate net income, I’m going to ignore FX charges, results from gain on the sales of business, and “other income” because these are frankly impossible to predict. I will forecast an interest expense of about ¼ of the total of what we saw in 2023, or $9.436 million.

From all of that, I’m assuming net income of $38.5 million for the first quarter. I’m also assuming no change in shares outstanding from the prior period of 55,251,233. Inputting the relevant data into my simultaneously “handy” and “dandy” financial calculator, I’ve worked out that I’m forecasting EPS over the next quarter of $.70. This works out to a trailing twelve-month EPS figure of $1.33.

Now, I feel compelled to remind you yet again that this forecast assumes zero future write-downs and zero restructuring costs, so I’m going to remind you yet again that this forecast assumes zero future write-downs and zero restructuring costs. We know that there are more restructuring charges coming, though we’re uncertain of the timing. Thus, I think it’s reasonable to assume that my trailing twelve-month earnings forecast of $1.33 is on the high side.

John Wiley EPS Forecast (Author estimates)

The Stock

If you’re one of my regular victims, you know that I consider “the stock” to be a distinct thing from “the business” because the two are actually very different things. The business is a publisher, while the stock is a piece of virtual paper that gets traded around, and it moves up and down in price based on the ever-changing moods of an often capricious market for stocks. Those moves may be the result of things happening at the business, but the stock can move up and down based on changes in short-term interest rates, and changes in the appetite for “stocks” as an asset class.

If you’re still of the view that “we don’t buy stocks, we buy businesses” please consider two theoretical investors, the first of whom bought John Wiley stock on June 8, and the second who bought fifteen days later on June 23. The first is down 7.5% so far, while the latter is up about 20%. It goes without saying that not enough happened at the firm over these 15 days to account for a 27.5% variance in returns. We do buy stocks, and the price at which we acquire them massively influences whether our investment is “good” or “bad.” Second, the person who bought shares cheaper in this case, as in all cases, did better. This is why I strive to buy shares as cheaply as possible. I’d also note that shares should trade most cheaply when future expectations are relatively muted.

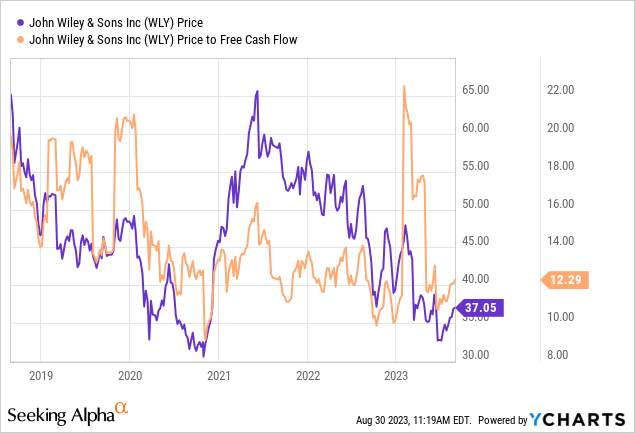

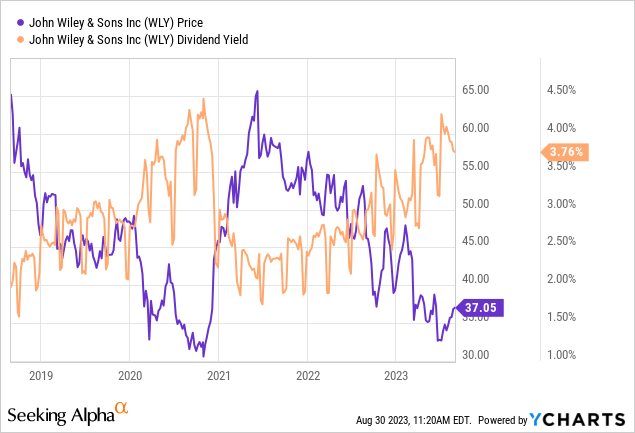

If you’re a regular, you know that I measure the cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I look at ratios of price to some measure of economic value, and I like to see a stock trading at a discount to both the overall market and its own history. When I last reviewed John Wiley, shares were trading hands at a relatively high price to free cash flow of 17.4 times and the dividend yield was about 2.75%. Things look much better today, since the dividend yield has crept up by about 100 basis points, and the shares are about 29% cheaper on a price to free cash basis, per the following:

Source: YCharts

Source: YCharts

There’s a problem, though. Cast your minds back to the earlier part of this article where I came up with a TTM EPS forecast of $1.33. As I type this, the share price is currently $37.11. Pulling out my handy dandy financial calculator once more, typing the correct keys in the correct sequence, I’ve worked out that this implies a TTM PE of ~27.9 times. Please also remember that I pointed out that my forecast was very much on the high side, given the absence of restructuring charges that we know will be coming down the pike. I think a PE of 28 is quite rich for a company that’s performing much better than this one, and is ludicrously expensive for a company with this operational history. Additionally, although the dividend yield is much better today, it remains about 65 basis points lower than the risk-free 20 Year Treasury Bond.

In my view, stocks in general, and this stock in particular, are more risky investments than government bonds. For that reason, I think it reasonable for investors to receive more in terms of cash flow from the stock. Higher risk and lower cash flow is what they’re getting with John Wiley, though, and, for that reason I’m going to continue to eschew these shares.

The company is about to report earnings, and the market may like what it sees and might drive the shares higher in price. In my view, any such gains will be short-lived, though. At some point, investors at current prices can’t escape the fact that they’re taking on more risk, and being paid less than they would with alternatives.

Read the full article here