Research Brief

In today’s analysis, I will be covering Garmin (NYSE:GRMN), which is in the technology & innovation sector, and consumer electronics subsector.

The company had its most recent quarterly earnings result on Aug. 2nd, and that will be the reference data used in some parts of today’s analysis.

For readers less familiar with this company, some relevant points to mention from their website are: does business in 35 countries globally, operates across multiple business segments including automotive / aviation / fitness / marine & outdoors, known for GPS navigation & wearable tech devices. US headquarters in Kansas City metro area. Most recent quarterly results showed $1.32B in revenue.

A few key peers of this company include VIZIO (VZIO) and Panasonic (OTCPK:PCRFY).

Personally, I have used one of their automotive GPS devices some years ago, with great delight as I love trying new tech gear that has a valuable purpose, but the goal today is not a review of their consumer products but a wholesome look from an investor & analyst perspective, to see if the stock is a valuable investment potential.

Research Methodology

To determine a holistic rating for this stock of buy, sell, or hold, I split my research into the following 5 categories: dividends, valuation, share price, earnings growth, capital strength.

Each category has equal weight. If I recommend the stock in at least 4 of 5 categories, it gets a buy rating. 3 out of 5 will get a hold rating, and below that earns a sell rating.

This process is aimed to simplify things, focus on financial fundamentals, and to analyze an equity from multiple angles.

Dividends

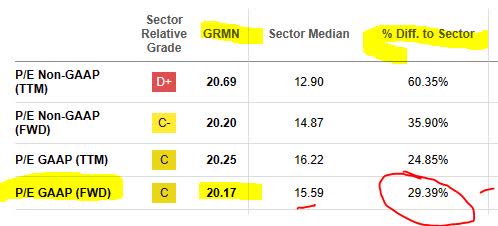

In this category, I will discuss whether this stock should be recommended for dividend-income investors, by analyzing official dividend data from Seeking Alpha.

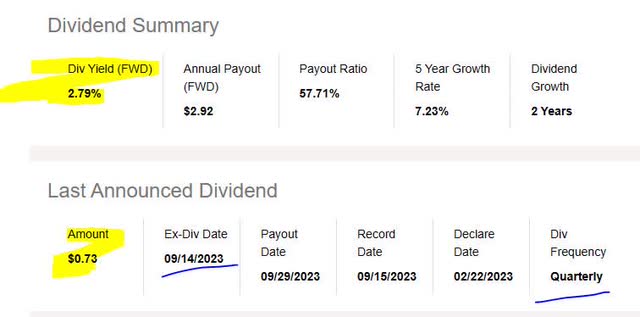

As of the writing of this article, the forward dividend yield is 2.79%, with a payout of $0.73 per share on a quarterly basis. A potential opportunity to take advantage of soon is the ex-date on Sept. 14th.

Garmin – dividend yield (Seeking Alpha)

In comparing the yield vs the sector average, this stock is above the sector average by almost 60%. I think that is a positive for the dividend investor to think about in terms of this stock vs the overall sector it is in and in my opinion it presents an opportunity.

I would also mention that in my research, many technology-oriented stocks do not pay a dividend at all actually, and have not done so for years. So, it is always attention-grabbing when a tech-focused company does pay dividends.

Garmin – dividend yield vs sector average (Seeking Alpha)

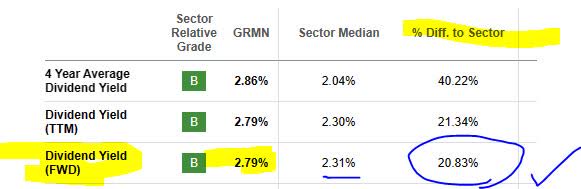

Next, in comparing the current dividend to the last 5 years, this company has been on a lopsided trend when it comes to dividend growth. However, after 2020 the trend has reversed and showed an uptick since then. I think this is also a positive for dividend investors as it points to the recent capacity of this company to return capital back to shareholders, though not necessarily a guarantee of future dividends.

Garmin – dividend 5 year growth (Seeking Alpha)

Based on the evidence found, I would recommend this stock in the category of dividends. In the section on share price later on, I will show how annual dividend income can play a role in putting together my investment idea for this stock.

Valuation

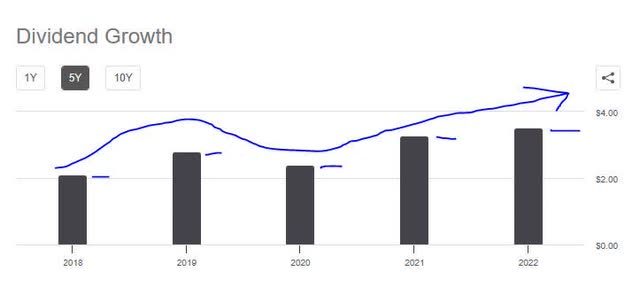

In this category, I will discuss whether this stock presents an attractive valuation for investors who are value-oriented. To analyze this, I will use today’s valuation data from Seeking Alpha and specifically the forward P/E ratio and forward P/B ratio.

This stock’s forward P/E ratio shows the price being 20.17x forward earnings, which is 29.39% above the sector average that is hovering just under 16x forward earnings. I am looking for a valuation in a range that is up to 30% below the average or in line with it, and up to 5% above average. In this case, this stock is somewhat overvalued on price-to-earnings, in my opinion.

Garmin – PE Ratio (Seeking Alpha)

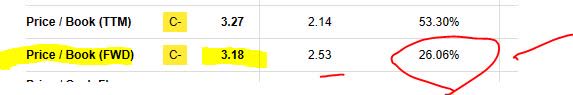

This stock’s forward P/B ratio shows the price being 3.18x forward book value, which is 26% above the sector average that is hovering around 2.5x forward book value. My target is a valuation in a range that is up to 30% below the average or in line with it and up to 5% above the average. In this case, this stock is somewhat overvalued on price-to-book value.

Garmin – P/B ratio (Seeking Alpha)

Since this stock appears overvalued on both of the ratios studied, I would therefore not recommend it in the category of valuation, based on the evidence researched.

Share Price

In this category, I will decide if the current share price presents a value buying opportunity or not.

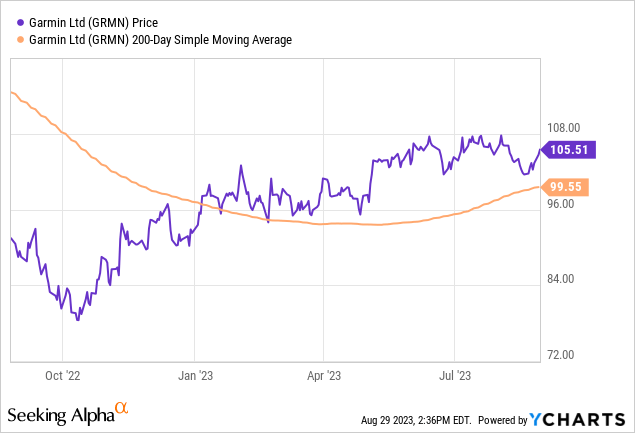

First, I pulled the most recent YCharts as of this article writing. It shows a share price of $105.51 and compares it to its 200-day simple moving average “SMA” of $99.55, tracked over the last year.

Then, I created a simple trade scenario in which my profit goal is a +10% return on capital invested.

I simulate buying a fictitious 10 shares at the current share price shown above, hold the shares for 1 year in which time I earn the full-year dividend income, and then sell the shares to generate a capital gain. This scenario assumes the SMA will go up by 10% in a year and that will be my target sell price.

The following spreadsheet illustrates this trade, which projects a 6.55% positive return. This falls short of my +10% goal. I should mention that it also creates two potential tax events, dividend income and capital gains, which I recommend investors research further with their tax pro and avoid relying on the comments section for tax tips.

Garmin – trade simulation 1 (author analysis)

Besides a profit goal I also have a risk tolerance level and plan for potential capital loss as well. In the following scenario, I anticipate a -10% negative return on capital, which is my maximum risk tolerance.

The same scenario as in the first trade however now I assume the current SMA will drop by 10% in a year and this will be my sell price should I have to sell then. The following spreadsheet illustrates this trade, which projects a -12.32% negative overall return, since the potential capital loss offsets any dividend income gains.

Garmin – trade simulation 2 (author analysis)

Because the two trading simulations came short of the profit goal and exceeded risk tolerance, I would not recommend the current share price as a buying opportunity, considering it overpriced.

This investing idea, however, may not fit all investors’ portfolio goals or risk tolerance, and should only be considered an oversimplified way to think about this stock as a long-term investment and in terms of potential gains as well as potential losses that could occur, and anticipating trends in the longer-term moving average as a guide.

Earnings Growth

In this category, I will analyze the earnings growth trend for this company over the last year, using data from the income statement on Seeking Alpha as well as the most recent company quarterly earnings release, presentation and commentary.

First, the top-line revenue data shows YoY growth vs the same quarter a year ago, which is impressive.

Garmin – revenue YoY growth (Seeking Alpha)

Next, the bottom line also showed YoY growth, which I believe is a sign that expenses are being managed efficiently along with revenue growth.

Garmin – net income (Seeking Alpha)

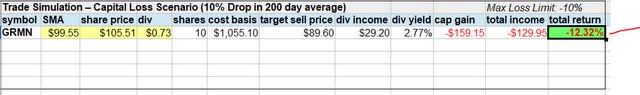

In drilling further down into the regions and segments providing tailwind to this firm, I see a highly diversified firm by region and market vertical.

Key drivers of YoY growth were the fitness, aviation, and auto segment, while key growth regions were EMEA (Europe/Middle East) and APAC (Asia Pacific). This points to Garmin being a truly global brand by now. The growth segments more than offset those than saw YoY declines.

Garmin – YoY gains by segment & region (company Q2 presentation)

One market segment in particular I would highlight is the fitness segment, which appears to have a strong demand for Garmin’s products. I think the numbers show that this brand could be one of the leaders in this space.

According to Q2 commentary:

Revenue from the fitness segment grew 23% in the second quarter, with growth across all categories led by strong demand for advanced wearables. Gross and operating margins were 52% and 16%, respectively, resulting in $54 million of operating income.

Though not a cyclist myself, I am interested in what innovations a company has come up with, and turns out part of the demand in the fitness space comes from their cycling computers, one of which is shown below.

Garmin – Edge 540 bicycling computer (company product site)

I bring up this specific product, the Edge 540, because it was mentioned in earnings commentary as one of their new innovations launched in Q2.

According to the commentary, “advanced yet compact cycling computers add dynamic performance insights, advanced mapping capabilities, solar charging and more to help cyclists ride smarter and train more effectively.”

Again, my question is usually can a brand become a leader in its space and out-innovate the competition, since for an investor & analyst this means potential continuing revenue growth for that company, and potential better stock performance.

Based on the evidence, I would recommend this stock in the category of earnings growth.

Capital Strength

In this category, I will analyze the capital strength for this company using data from the company recent quarterly presentation and earnings release, that shows financial viability of this firm.

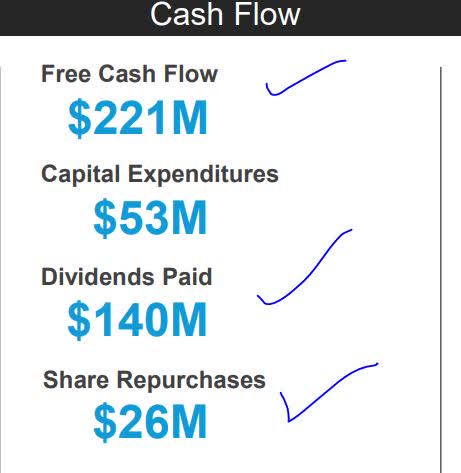

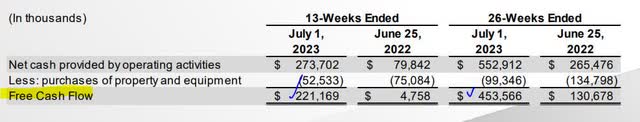

To keep it brief and simple, we will look at the following. This company in Q2 has $221MM in free cashflow, and a did a considerable amount of share repurchases and dividend payouts. This in my opinion is a sign of the financial strength required to return capital back to shareholders.

Garmin – free cashflow (company Q2 presentation)

According to the company in their presentation, they highlighted the importance of free cashflow to a company like this:

Management believes that free cash flow is an important liquidity measure because it represents the amount of cash provided by operations that is available for investing and defines it as operating cash flows less capital expenditures for property and equipment.

If you look in more detail, you can see that the free cashflow has remained positive but also has seen YoY improvements as well. It of course is known to fluctuate as cash gets allocated to capital purchases and so forth, so this alone should not be the sole metric relied on, but nevertheless a vital one.

Garmin – free cashflow – detail (company Q2 presentation)

Besides positive cashflow, the company also has a long record of positive equity on its balance sheet as well, with $6.1B in positive equity at the end of Q2.

Based on the evidence, I would recommend this stock in the category of capital strength.

Rating Score

Based on passing 3 of my 5 rating categories above, this stock earned a hold / neutral rating today. This rating is less bullish than the consensus from analysts and in line with the quant system, as shown by the graphic below.

Garmin – rating consensus (Seeking Alpha)

Risk to my Outlook

My neutral outlook on this stock could be impacted by the risk that investors & analysts become increasingly more bullish on this stock, thereby making my rating overly cautious and not optimistic enough. This could be driven by new data that demand for consumer electronics is improving, despite inflation.

For example, today’s article in Bloomberg highlights how major electronics retailer Best Buy is now seeing easing up in its recent sales slump.

According to the article:

Best Buy Co. rose the most in nine months after executives said that a painful sales slump in consumer electronics and household appliances is showing signs of easing.

A similar sentiment was published by Barron’s today as well, which quoted the Best Buy CEO as saying that “next year the consumer electronics industry should see stabilization and possibly growth.”

Since Garmin makes so many consumer electronic products, particularly GPS devices and wearables, the larger macro environment is certainly relevant to this stock. I already mentioned that the fitness segment has seen a tailwind in demand, but also the company mentioned in its Q2 release the growth in demand for “adventure watches.”

Nevertheless, despite this tailwind to consumer products and revenue growth, I think the overvaluation of this stock as I have shown along with the current share price still does not make it a great “buy” opportunity right now but also not a great “sell” opportunity either as the share price could rise further.

We also don’t know for sure what the autumn will bring in terms of continuing consumer demand, considering that the Fed does not appear to be lowering interest rates anytime soon, which logically-speaking is making buying on credit much more expensive.

BBC highlighted this dilemma in an article a few days ago, since the Fed has a mandate to lower inflation but in doing so is also making borrowing more expensive.

According to the article:

Unfortunately, a more resilient than expected economy implies higher rates may or will be needed to cool things enough to reach the 2% inflation goal, said Cary Leahey, economist at Columbia University.

So, I reiterate my hold rating for this stock and would not be overly bullish just yet but also not overly bearish either.

Analysis Summary

To wrap up today’s analysis, let’s go over the key points discussed:

This stock received a hold rating today.

Its positive points included: dividends, earnings growth, capital strength.

Headwinds I identified included: valuation, share price.

The risk of growth in consumer product demand impacting my cautious rating has been addressed.

My concluding thoughts on this stock are that this company has proven itself as an “innovation” leader in its space for years and has been able to survive several periods of market turbulence in that time.

Although I am giving it a hold rating today, it should not be looked at as a negative, as current investors who bought at an earlier price point are likely seeing some positive gains by now, particularly if you bought during the price dip of Oct. 2022. However, I don’t see it as a great buying opportunity this very moment.

Read the full article here