Introduction

Methanex (NASDAQ:MEOH) (TSX:MX:CA) is the largest producer of methanol in the world with an estimated market share of around 12%. Methanol is an important element in for instance building materials and medical equipment but more recently it’s also gaining traction as a marine fuel as it’s a cleaner fuel which can reduce the sulfur emission by ç5% and the NOx emissions by up to 80% compared to the fuels that are currently used.

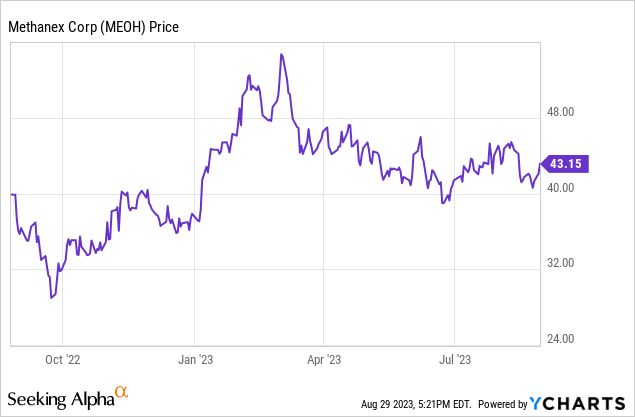

As Methanex is wrapping up the construction of a production line with a capacity of 1.8 million tonnes per year, I thought this was a good moment to have a closer look at Methanex, despite the low methanol price.

The sustaining free cash flow remained strong in Q2 and H1

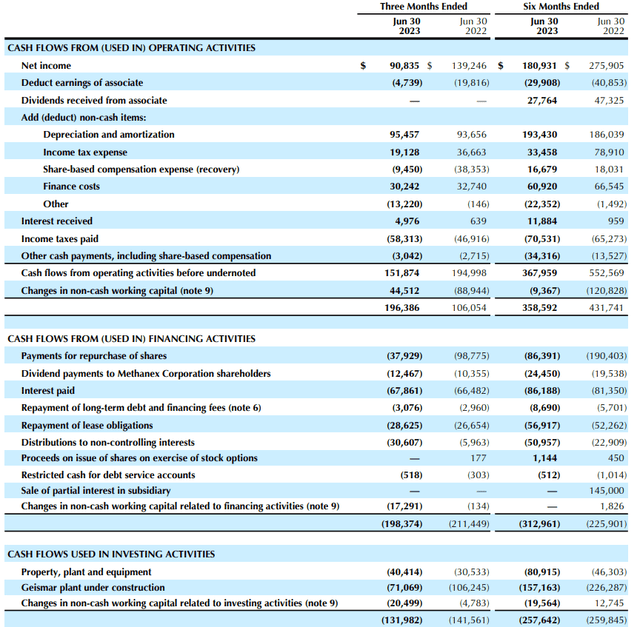

As Methanex is a cash flow story, I focused on the company’s cash flow results. The reported operating cash flow before changes in the working capital was $152M but this includes a cash tax payment of $58.3M while only $19.1M is due. Additionally, we still need to deduct the $68M in interest payment and $29M in lease payments while there was a $31M payment to non-controlling interests.

Methanex Investor Relations

This means the adjusted operating cash flow was approximately $94M. Keep in mind the Q2 interest payments are traditionally very high due to the timing of the coupon payments on the bonds. It’s better to use the average quarterly interest payment of around $43-45M per quarter to get a more accurate understanding of the underlying cash flows. This means that using those average interest payments, the operating cash flow in the second quarter was $115M.

The total capex was $111M but as you can see in the image above, the vast majority was related to the construction of Geismar 3. The normal capex was $40M per quarter and the company has guided for an additional $ 80M to be spent on sustaining capex in the second semester. This means the $40M quarterly capex should be considered to be the realistic sustaining capex. And that also means the underlying free cash flow in the second quarter was approximately $75M or $1.10 per share. And that’s what attracted me to start writing put options on Methanex even at the current relatively low methanol price, the underlying cash flows are pretty strong.

While the H1 free cash flow result doesn’t sound too exciting, the market is obviously counting down for Methanex to start its Geismar 3 production line which should be online in the final quarter of this year. When the company disclosed its Q2 financial results, the Geismar 3 line reached a 90% completion rate.

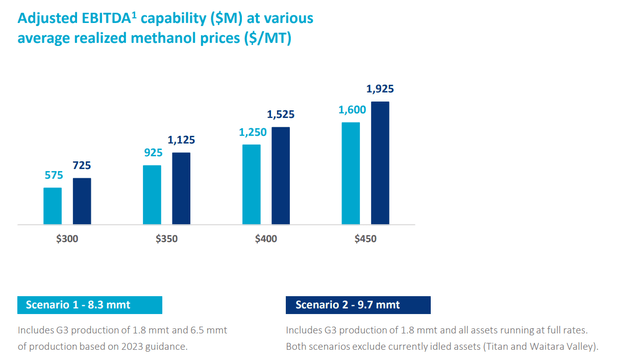

Meanwhile, Methanex’ corporate presentation is still showing the EBITDA and cash flow potential of the company including Geismar 3. As you can see below, at an average realized methanol price of $350/t the anticipated EBITDA in the 8.3 million tonne per year scenario is US$925M (the 9.7 million tonne per year scenario assumes all plants are running at full capacity, so that’s the “optimistic” scenario).

Methanex Investor Relations

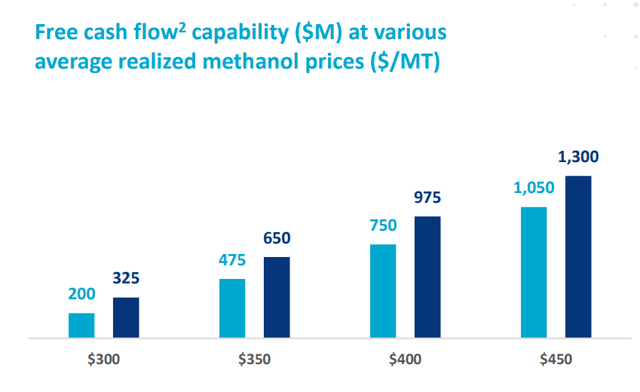

Translating that into free cash flow would result in $475M at the base case scenario of 8.3 million tonnes per year.

Methanex Investor Relations

As there are 67.4M shares outstanding, the $475M in free cash flow would result in a free cash flow of $7.04 per share. And even in the $300/t pricing scenario the free cash flow result would still be around $3/share.

Looking at an optimistic scenario using a realized methanol price of $400/t and assuming the entire production capacity is up and running, the $975M in free cash flow would result in a free cash flow result of in excess of $14/share.

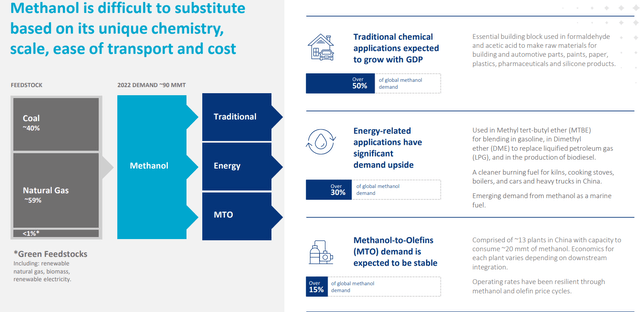

Methanex is quite bullish on the methanol market (which makes sense) and the image below provides a better understanding of why Methanex expects the methanol market to remain strong.

Methanex Investor Relations

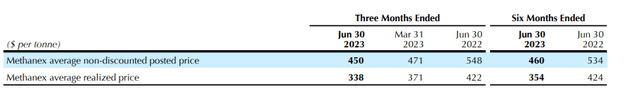

While the normal market prices for methanol are interesting, it would be wrong to use those to calculate Methanex’ potential income. As you can see below, Methanex offers its customers a discount to the methanol prices and that discount usually hovers around the $100/t level. So in the second quarter of this year, the market price for methanol was $450/t but the realized price by Methanex was just $338/t.

Methanex Investor Relations

And while the methanol price is not necessarily easy to find, Methanex has a dedicated section on its website. As you can see below, the prices for Q3 in Europe are 395 EUR per tonne (around $440) but the August prices for North America and specifically Asia are very far away from each other’s price points.

Methanex Investor Relations

Based on these prices and the discounts issued by Methanex, it’s probably best to assume the realized methanol price will remain flat or slightly lower this quarter. In the Q2 conference call, management indicated its realized price in July and August would be just $300/t.

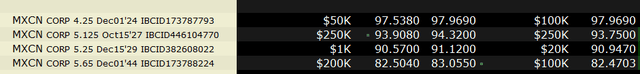

The bonds offer an interesting opportunity for income-focused investors

While the common shares pay a quarterly dividend of $0.185 per share for a yield of around 1.75%, income-oriented investors may want to have a look at the bonds. The image below shows the four bonds issued by Methanex that can easily be traded (the screenshot was taken from my Interactive Brokers account).

Interactive Brokers Screenshot

The bond with the nearest maturity date is the December 2024 bond which is currently available for just under 98 cents on the dollar for a yield to maturity of 5.95. Meanwhile the December 2029 bond (with a remaining life of six years and three months) has a yield to maturity of 7.02% based on the 91.12 asking price. And for investors looking for some long-term exposure, the 2044 bonds are trading at 83 cents on the dollar despite offering a 5.65% coupon. This means the yield to maturity on those 21 year bonds is approximately 7.2%.

That’s relatively high and I expect the bond prices to increase on the back of A) a normalization of the interest rates in the next few years and B) a successful commissioning of the new Geismar 3 production line.

Investment thesis

While I started to dig into Methanex from the perspective of potentially becoming a shareholder, I’m now also intrigued by the income opportunity offered by the company’s bonds. I think a dual approach is warranted and I started to write put options on Methanex (using an exercise price of $40 at various expiry dates) and although I have no position in the company’s bonds just yet, I’m charmed by all series of the available bonds. I can park some cash in the 2024 bond at a yield to maturity of almost 6% while my long-term return needs are covered by the 2044 bond. Meanwhile, the yield to maturity of the 2027 and 2029 bonds also is appealing with a slight preference for the 2029 bonds where the yield to maturity exceeds 7% versus less than 6.7% for the 2027 bonds.

While the methanol market isn’t very strong right now, I’m considering Methanex to be a “contrarian” pick. Even at $300 methanol (the realized price) Methanex will still be making $200M per year in free cash flow which will be a tremendous help to rapidly reduce the net debt ($1.5B as of the end of June) on the balance sheet.

Read the full article here