At first glance Financial Institutions (NASDAQ:FISI) looks like a bargain:

- P/E of 5.31x while the industry median is 9.45x.

- P/B of 0.66x while the industry median is 1.03x.

- Dividend yield of 6.73% while the industry median is 3.82%.

In short, it seems that we are dealing with an undervalued bank that provides ample remuneration to its shareholders. However, I believe the truth lies in the middle, and in this article I will highlight the aspects that I consider most important before investing in Financial Institutions.

Dividend analysis from a long-term perspective

The first aspect I would like to consider is the dividend, as it is uncommon for the dividend yield of Financial Institutions to be so high.

Seeking Alpha

As we can see from this graph, in the past 10 years the dividend yield has exceeded 6 percent only during the pandemic and after the failure of SVB and FRC. Thus, based on this ratio, this bank is undervalued assuming the dividend is not cut, but its sustainability depends on the performance of the business cycle.

Based on the data of the past 20 years, Financial Institutions’ dividend has had ups and downs, and I think it is crucial to analyze both periods in order not to draw hasty conclusions.

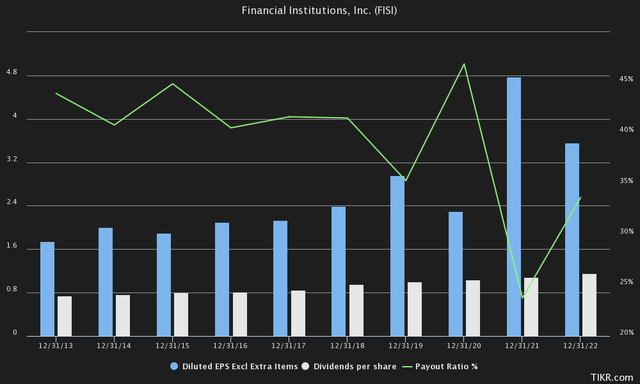

Regarding the first period, I am referring to the last 10 years, 2013-2023.

Capital IQ

Diluted EPS increased steadily over the long run, the dividend per share increased year by year. What’s more, the payout ratio has gradually become more sustainable as EPS has increased faster than dividends.

If we wanted to judge the future sustainability of the dividend based on what has happened over the past 10 years, there would clearly be little doubt about it. But this is a bank that has more than 200 years of history, relying only on the last 10 years would be reductive in my view, not least because the last decade has been characterized by unconventional monetary policy choices.

Years of QE and fiscal stimulus have increased liquidity in the financial system; in addition, the Fed Funds Rate has often been close to 0%. Borrowing money was convenient, deposits had a negligible cost, and inflation was not a problem. In short, nothing like the current situation.

To claim that the Financial Institutions dividend is sustainable in the future because this has been the case for the past 10 years may in my opinion prove to be a mistake. I do not think it is plausible that the macroeconomic environment of the future will be the same as that of the past.

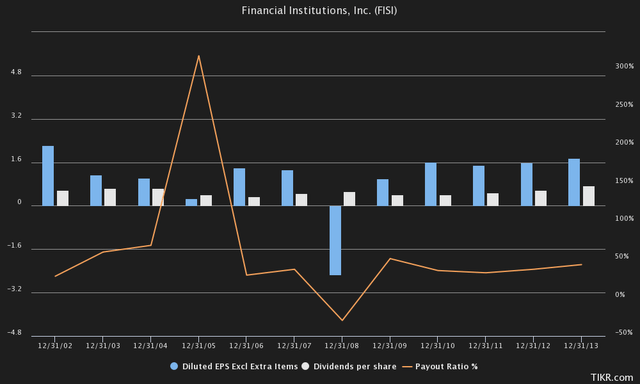

Let us now take a look at a different period, 2002-2012.

Capital IQ

In this case we are toward the end of the dotcom bubble and during the great financial crisis. This is definitely a more complex period than the last 10 years, in fact the performance was quite different.

EPS was at a standstill, except for the big loss in 2008, the dividend was cut and it took years to return to the previous level.

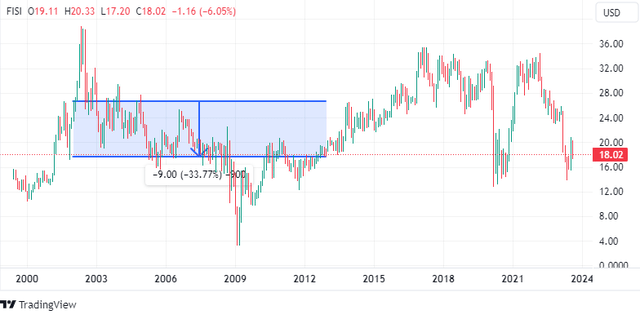

TradingView

In short, the performance has been poor in terms of both dividends and capital gains.

By this I am not implying that the future ahead is similar to what happened between 2002-2012, but that it is good to know the worst possible scenario as well as the most favorable one.

I personally do not believe there will be a new crisis of this magnitude any time soon, but I am not optimistic either. The inflation problem persists despite the Fed Funds Rate being at 5.25-5.50 percent, and the yield curve is experiencing one of the most pronounced inversions in history. After years of expansionary monetary policy the banks are under pressure and Financial Institutions is no less.

Dividend analysis from a short- to medium-term perspective

As mentioned, following the Fed’s change in monetary policy, banks are facing new challenges; above all the cost of bank funding.

For the dividend to be growing and sustainable it is necessary for EPS to improve, but this has not been the case in recent months.

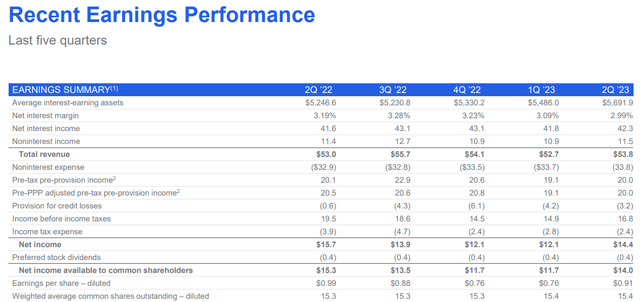

Financial Institutions Q2 2023

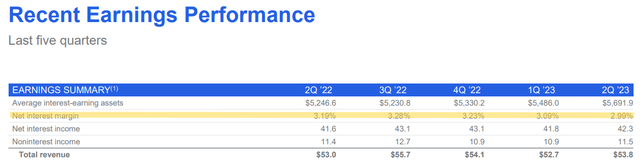

Based on the latest quarterly report, we can see that EPS experienced an 8 percent decrease compared to the same quarter last year. Overall, Financial Institutions has been struggling to grow over the past 12 months.

Financial Institutions Q2 2023

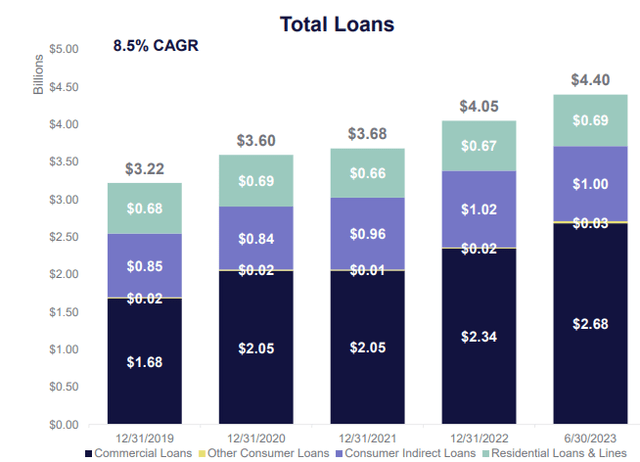

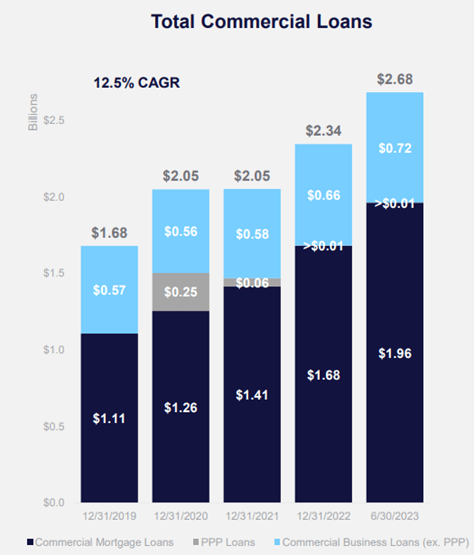

Yet, taking a look at loans, the latter are growing quarter by quarter. The problem, is that their yield is not increasing at the same rate as the cost of liabilities.

Financial Institutions Q2 2023

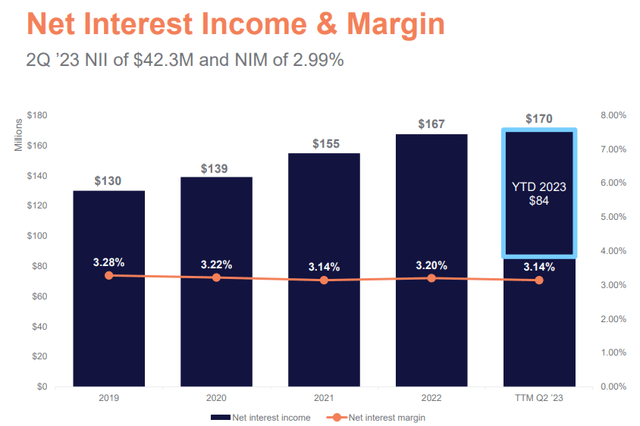

The result is a steadily deteriorating net interest margin, quarter after quarter. This decline is most visible when looking at the quarters individually.

Financial Institutions Q2 2023

Different discussion for net interest income, which improved slightly from 2022. The main component of this improvement was the increase in LDR from 82% in 2022 to 87% today. In 2021 it was only 76%.

Basically, to offset the increasing weight of the cost of deposits, Financial Institutions increased the weight of total loans relative to total deposits. In other words, loans provided were larger than new deposits. At present, this ratio is still at reasonable level, but if it were to increase too much and reach 100 percent, the financial structure could become too rigid. The higher it is, the more liquidity risk increases.

Overall, Financial Institutions as well as many other banks are struggling to operate in the current economic environment where money market rates are so high. The scenario of “higher for longer” rates could deteriorate the situation even more and make EPS worse.

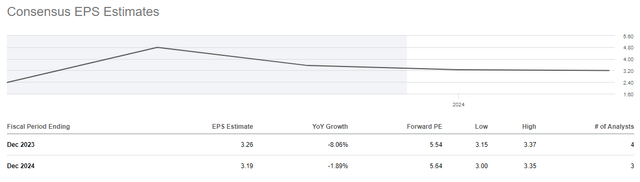

Indeed, Street estimates are not rosy.

Seeking Alpha

EPS is expected to be downward at least until the end of 2024, and in this scenario I doubt a recession is discounted.

On the positive side, even if these estimates turn out to be correct, the payout ratio would remain sustainable based on the current dividend per share: 36 percent in December 2023 and 37 percent in December 2024.

In other words, in the case of a slight decline in EPS, the dividend is not at risk; a different matter in the case of a sharp drop due to a recession. At that point, based on the performance achieved between 2002-2012, I doubt that Financial Institutions will be able to avoid cutting the dividend.

Financial Institutions Q2 2023

Moreover, over the past few years it has increased its exposure to CRE loans, which are typically less resilient in an economic slowdown: in 2019 they accounted for 35 percent of total loans, today 45 percent. Since at current rates demand for mortgages from homebuyers has fallen to a 28-year low, I expect that this exposure may increase in the coming months (as indeed it has in recent months).

Conclusion

Based on valuation multiples, Financial Institutions is at a discount. Its dividend for the time being is sustainable even assuming that EPS declines slightly in the coming years. Anyway, assuming that the future will be similar to the past 10 years could prove to be a serious mistake since the macroeconomic environment is totally different.

For those who believe that the worst is behind us and the rate hike will not lead to a recession, buying Financial Institutions at this price is probably a bargain. But for those like me who are more pessimistic, then it might be wise to wait before buying, given this bank’s track record during a period of economic contraction. Certainly the dividend yield at 6.73 percent is tempting, but the opportunity cost should not be overlooked: what am I giving up to invest in Financial Institutions?

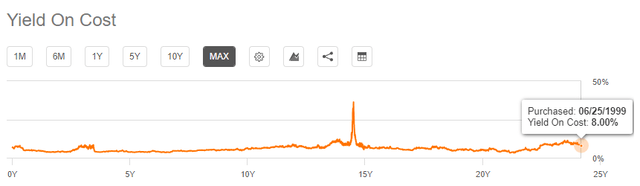

Beyond my concerns about the “higher for longer” scenario, an additional reason for me to avoid this bank also comes from its dividend growth rate.

Seeking Alpha

By buying Financial Institutions in June 1999 the dividend yield on cost is only 8 percent, a disappointing result for a 24-year investment. Over the very long term, dividend growth is limited by the long recovery time whenever a recession occurs and the dividend is cut.

Seeking Alpha

Making a comparison with another not-so-popular bank, for Prosperity Bancshares (PB) the dividend yield on cost is almost double assuming you invested in it in June 1999. By this I am saying to invest in this bank, but simply to look at the opportunity cost of an investment in Financial Institutions.

Seeking Alpha

If an investor’s goal is simply to earn a sustainable and growing dividend year after year, then the scope is even broader. Staying in the financial sphere, T. Rowe Price (TROW) is another interesting solution: a 26.88 percent dividend yield on cost assuming an investment in June 1999.

In conclusion, Financial Institutions has an attractive and sustainable dividend yield for the time being, but in the event of a recession I expect a dividend cut. For those who are more optimistic about future economic trends – not my case – at the current price it may be a good investment. Finally, keep an eye on opportunity cost, it is better to have a 360-degree view on where to invest your money.

Read the full article here