Investment thesis

The current macroeconomic landscape is negatively impacting the operations of Standard Motor Products (NYSE:SMP) as profit margins remain slightly contracted and sales are stalling (and are expected to remain weak in 2023 and 2024) due to unfavorable weather conditions during the first half of 2023 and the bankruptcy of a significant customer. During the last quarter, profit margins showed some improvements boosted by pricing and cost-saving initiatives, but margins remain below usual levels due to unabsorbed labor as the company is using its inventories, and demand is expected to remain weak in 2023 and 2024 at a time when a higher debt exposure and higher interest rates have caused a significant increase in interest expenses, which has caused a 35% decline in the share price.

Despite this, the company started reducing its debt levels during the second quarter of 2023 thanks to destocking as inventories are more than two times the size of long-term debt, which suggests the company should be able to eventually pay down its debt pile and continue with its M&A strategy to boost long-term growth. Also, profit margins are still relatively high despite recent contraction as the company is reporting positive net income quarter after quarter. For these reasons, I believe that the recent fall in the share price represents a good opportunity for long-term dividend growth investors as the dividend yield surpassed the 3% mark.

A brief overview of the company

Standard Motor Products is a global leading manufacturer and distributor of premium automotive parts used in the maintenance, service, and repair of vehicles in the automotive aftermarket industry. The company was founded in 1919 and its market cap currently stands at $795 million, employing almost 5,000 workers. Currently, 11.23% of the company’s shares outstanding are owned by insiders, which means the management benefits from the good performance of shares.

Until the first quarter of 2023, the company operated under two main business segments: Engine Management and Temperature Control. Under the Engine Management segment, which provided 71% of the company’s total revenues in 2022, the company manufactures automotive engine parts, including ignition, emission control, fuel, electrical and safety-related system products, and wire and cable parts, and under the Temperature Control segment, which provided 28% of the company’s total revenues in 2022, the company manufactures automotive temperature control systems parts, including air conditioning compressors and other climate control parts. In 2023, the company added a new business segment called Engineered Solutions, which includes all non-aftermarket business from the existing Engine Management and Temperature Control operating segments.

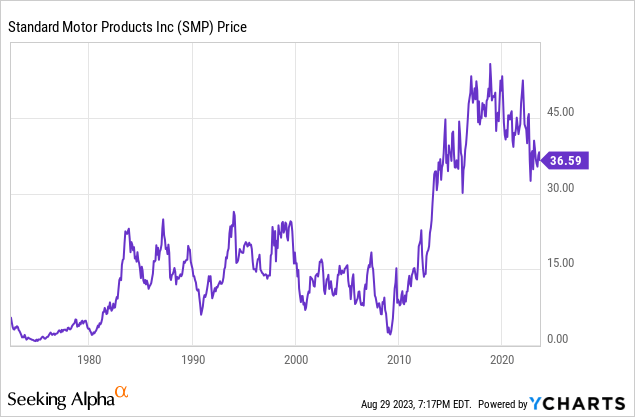

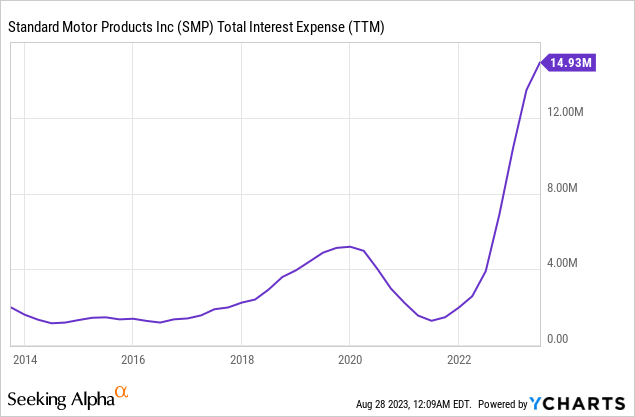

Currently, shares are trading at $36.59, which represents a 35.28% decline from all-time highs of $56.54 reached on November 1, 2018. In my opinion, this decline is caused by (but not limited to) the following factors: stagnant sales after two years marked by relatively strong growth, margins negatively affected by inflationary pressures and unabsorbed labor, increased interest expenses due to higher debt exposure and higher interest rates, a weaker U.S. dollar in against the Mexican peso as the company has manufacturing capacity in Mexico, and growing fears of a potential recession due to recent interest rate hikes. Starting with the recent increase in debt levels, this increase has been caused by recent acquisitions as the company continues to make efforts to expand its business.

Recent acquisitions

To expand operations, the company makes acquisitions on a regular basis, which have enabled revenue growth in the last few years.

In April 2019, the company acquired certain assets and liabilities of the Pollak business of Stoneridge (SRI) for ~$40 million. Later, in August 2019, the company acquired a 29% minority interest in Jiangsu Che Yijia New Energy Technology Co., Ltd, a Chinese manufacturer of air conditioning compressors for electric vehicles, for ~$5.1 million.

After deleveraging the balance sheet, in March 2021, the company acquired certain Soot Sensor product lines from Stoneridge for $2.9 million, and two months later, in May 2021, the company also acquired Trumpet Holdings, a leading provider of power switching and power management products to Original Equipment customers in various markets, for $111.7 million.

In the past 2 years, the company has performed two more acquisitions. In September 2021, the company acquired Stabil, a German manufacturer of commercial and light vehicle components, including electronic sensors, control units, and clamping devices, for $16.3 million. And lastly, in October 2022, the company acquired Kade, a European supplier of temperature control products, for $2.7 million.

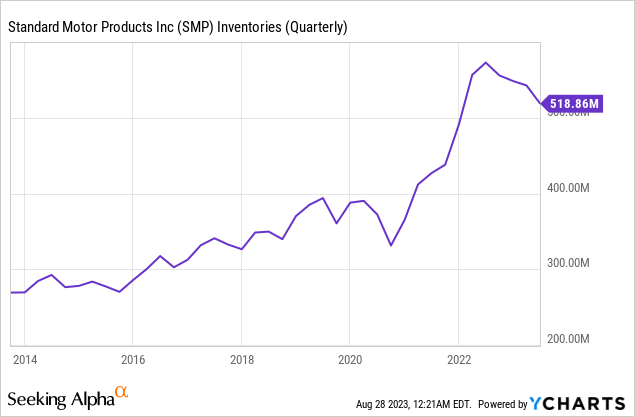

Certainly, the pace of acquisitions shows management’s intent to continue expanding the company’s operations, but I expect this pace to slow down in the near future as the company’s debt exposure is beginning to put some pressure on the company’s operations due to relatively high interest expenses. Nevertheless, this debt pile should be eventually paid down with relative ease as the company’s inventories are over two times the size of long-term debt.

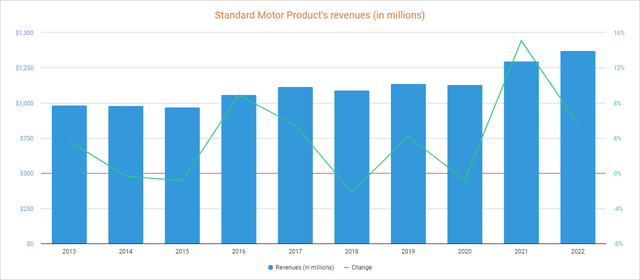

Revenues are stabilizing after some recent growth

The company has managed to increase its sales over the years thanks to acquisitions and the continuous launch of new products, and despite the disruptions derived from the coronavirus pandemic, revenues declined by just 0.82% in 2020. In the two subsequent years, 2021 and 2022, revenue growth was significant as it increased by 15.08% and 5.62%, respectively, boosted by the reopening of the world’s economy and product price raises.

Standard Motor Products revenues (Seeking Alpha)

Nevertheless, revenue growth has stalled in 2023 as sales increased by 1.61% year over year during the first quarter and declined by 1.76% (also year over year) during the second quarter as one of the company’s largest aftermarket customers declared bankruptcy in January, but some of these volumes are expected to return in the long run as the bankrupt company has been acquired by another company. Also, an unseasonably cool and wet start in 2023 caused an 8.1% decline in demand in the Temperature Control segment, which represents a headwind that eased by July. In this regard, the management expects revenues to show weak increases in the foreseeable future as revenues are expected to increase by 1.46% in 2023 and by a further 3.60% in 2024.

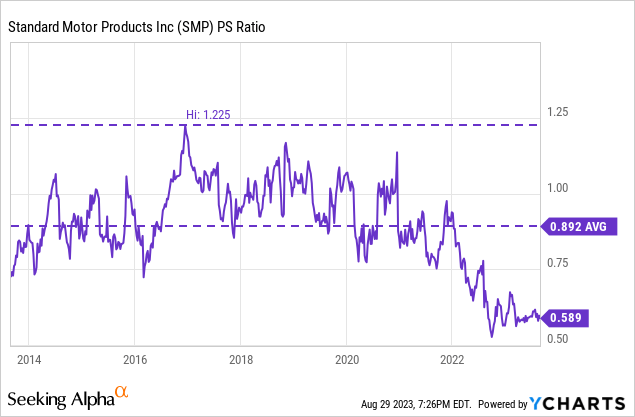

Nevertheless, the recent decline in the share price coupled with stable sales has caused a significant drop in the P/S ratio to 0.589, which means the company generates annual revenues of $1.70 for each dollar held in shares by investors.

This ratio is 33.97% lower than the average of the past 10 years and represents a 51.92% decline from the spike of 1.225 reached in 2016, which reflects growing pessimism among investors as they are placing significantly less value on the company’s sales due to slower growth expectation, current margin contraction, an increased debt exposure caused by recent acquisitions, increased interest rates, and growing recessionary risks.

Margins are still negatively impacted by headwinds, but the company is profitable

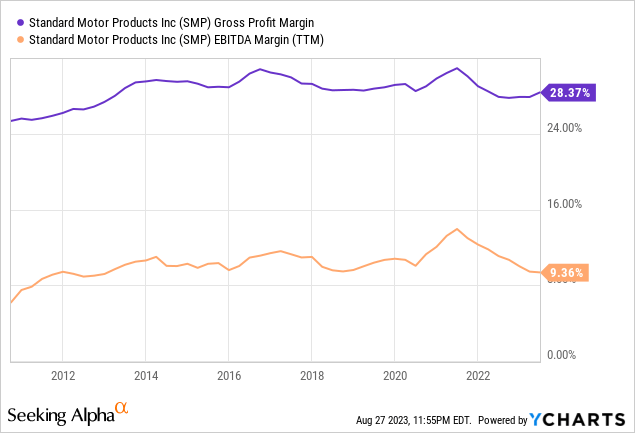

Historically, the company has remained profitable year after year as the gross profit margin has steadily danced at around 30% while the EBITDA margin has remained above 10%. In recent quarters, both gross profit and EBITDA margins have suffered a significant contraction caused by inflationary pressures, supply chain issues, labor shortages, and unabsorbed labor, and the trailing twelve months’ gross profit margin currently stands at 28.37% and the EBITDA margin at 9.36%.

During the second quarter of 2023, the gross profit margin improved slightly to 28.68%, and so did the EBITDA margin, which stood at 9.92% boosted by pricing and savings initiatives while supply chain bottlenecks are easing and transportation costs are declining. Still, stagnant volumes and lower production related to inventory reductions are currently limiting profit margins and are expected to keep impacting profit margins in the near future, but despite this, we must not forget that the company continues to be profitable as it reports positive net income quarter after quarter, which is making it possible to start a deleveraging phase that should open the doors to further future growth opportunities.

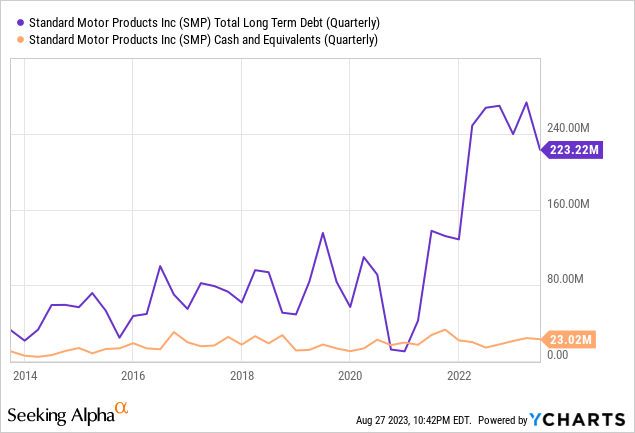

The deleveraging phase has begun and the company has enough inventories to fully pay down its debt pile

In general, the company has maintained low debt levels, relative to sales and cash from operations, over the years. Even so, the debt pile began to increase significantly in the last few quarters due to the latest acquisitions carried out. Besides, negative cash from operations in 2022 and during the first quarter of 2023 has contributed to an increase in debt greater than the cost of recent acquisitions as the company has built up significant inventories. In this regard, total long-term debt currently stands at $223 million and cash and equivalents are currently low in comparison at $23 million.

Nevertheless, the management managed to reduce inventory levels by $17 million in the third quarter of 2022 and by $7.4 million in the fourth quarter, and the destocking continued through 2023 as inventories declined by $5.7 million during the first quarter and by a further $23.8 million during the second quarter, which has enabled positive cash from operations of $59.8 million during the quarter that made some deleverage possible. Despite this, inventories remain at unusually high levels at $519 million, which dramatically reduces the risk that debt poses for the company as inventories are over two times higher than long-term debt.

It should be said that said deleveraging will be very important to improve the company’s prospects as a higher debt exposure and higher interest rates have caused a dramatic increase in total interest expenses to $15 million, and the management expects to pay around $16 million per year in interest expenses (at current debt levels) due to increasing interest rates, which are putting some pressure on the company’s operations.

Despite this, interest expenses are expected to eventually come down as the management should be able to keep generating strong cash from operations as it keeps reducing the company’s inventories, which should provide some room for future dividend raises as the company will then be able to benefit of the operations of newly acquired businesses without having to pay interest on the debt incurred to carry out said acquisitions.

The dividend is safe as the cash payout ratio is low

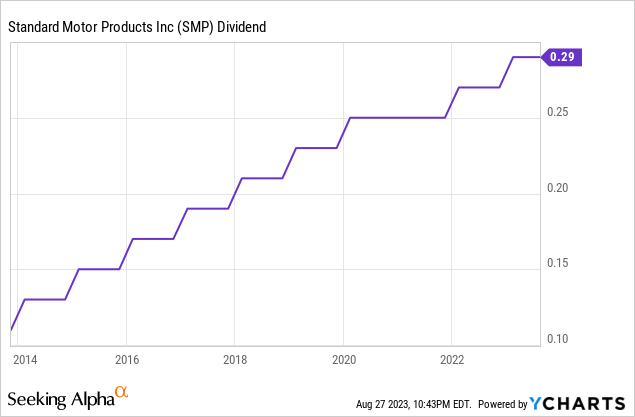

As a consequence of the economic impact and the uncertainties of the coronavirus pandemic crisis, the management decided to temporarily cancel the dividend in April 2020, but the dividend was reinstated during the fourth quarter of 2020 and kept increasing since then. The latest dividend increase was announced in February 2023 when the management decided to raise the quarterly dividend by 7.4% to $0.29 per share, and the dividend almost tripled in the past 10 years.

If we add the recent share price decline to increasing dividends, we have a dividend yield of 3.17% at current share prices, which is significantly higher than the average of 2.11% over the past 4 years. This dividend yield could be considered too low for some investors, but has enormous potential to grow thanks to a historically low cash payout ratio. Furthermore, it is accompanied by a small buyback yield as the company periodically performs share repurchases with excess cash. In the following table, I calculated the percentage of cash from operations allocated to dividends paid and dividend expenses.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|

Cash from operations (in millions) |

$47.0 | $65.2 | $97.8 | $64.6 | $70.3 | $76.9 | $97.9 | $85.6 | -$27.5 |

| Dividends paid (in millions) | $11.9 | $13.7 | $15.4 | $17.3 | $18.9 | $20.6 | $11.2 | $22.2 | $23.4 |

|

Interest expenses (in millions) |

$1.6 | $2.3 | $1.6 | $2.3 | $4.0 | $5.3 | $2.3 | $2.0 | $10.6 |

|

Cash payout ratio |

28% | 25% | 17% | 30% | 33% | 24% | 14% | 28% | – |

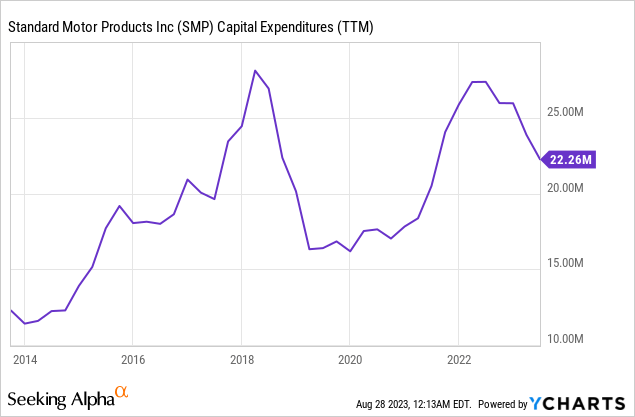

As one can see, the company has allocated a relatively small amount of cash from operations to cover interest expenses and dividend payouts over the years, which suggests that the dividend is safe in the long run, and despite negative cash from operations of -$27.5 million in 2022, the company’s trailing twelve months’ cash from operations currently stands at $107.2 million thanks to inventory destocking. Nevertheless, investments in the recently leased Shawnee, Kansas manufacturing facility are expected to increase capital expenditures by $2.5 million in 2023, and $7 million to $8 million in 2024, which means capital expenditures should remain at levels above $20 million at least for quite some time, and even $25 million.

However, increased efficiencies and transportation cost savings are expected to offset a big portion of these expenses, and capital expenditures should decline once the company sells its Edwardsville facility, which is expected to happen in late 2025. For this reason, and considering the company’s capacity to generate strong cash from operations of over $60 million year after year, I consider that capital expenditures of over $20 million and dividends paid of $25 million should be covered with relative ease as the company pays down its debt pile by using inventories, and for this reason, I consider that the recent dividend yield surge represents a good opportunity for long-term dividend growth investors to begin with a relatively high dividend yield on cost.

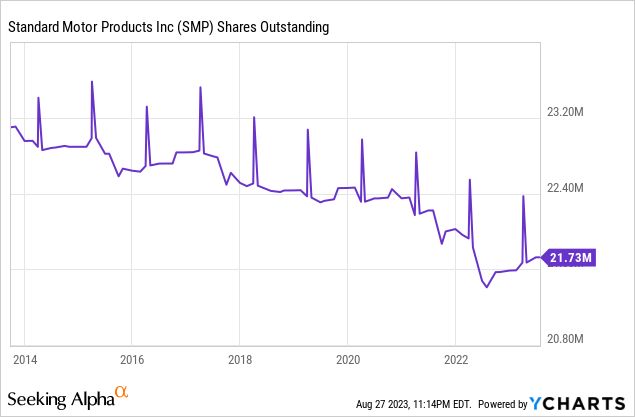

Buybacks are slowly reducing the total number of shares outstanding

Over the past 10 years, the company has managed to steadily reduce the total number of shares outstanding by 5.95% through share repurchases, which, despite representing a slight decline, adds a small buyback yield to the current 3.17% dividend yield.

This means that, with fewer shares outstanding, per-share metrics improve as the company’s results are divided into fewer shares. Essentially, investors can expect their position to slowly grow over the years (in terms of the percentage of the company owned) for as long as the management keeps repurchasing shares, which is always welcome.

Risks worth mentioning

In general, I consider the company’s risk profile to be quite low as its products are essential for the automotive aftermarket industry and it has been operating for over a century. But despite this, I would like to highlight some risks I think investors should closely monitor, especially for the short and medium term.

- The company lacks geographical diversification as 88% of net sales were provided by operations in the United States in 2022, and 5% came from Canada, which means it is highly dependent on the performance of the U.S. automotive industry.

- Profit margins could continue deteriorating if inflationary pressures do not ease to expected levels or rise again.

- The company may not recover volumes from the bankrupt customer, thus having to offset the drop in volumes by seeking new customers or making acquisitions and moving production to existing manufacturing facilities in order to keep healthy profit margins.

- Due to the high debt exposure and the uncertain future of the world’s economy, I see it as very difficult for the dividend to continue increasing at similar rates to those of the past 10 years, and this is reflected in the currently higher dividend yield.

- Recent interest rate hikes could trigger a global recession, which would not only negatively impact revenues, but also profit margins due to unabsorbed labor.

Conclusion

Certainly, Standard Motor Products’ prospects have worsened in the past few quarters boosted by weakening demand and contracted margins, but I consider current headwinds to be of a temporary nature due to their direct link to the current macroeconomic landscape. Increased interest rates and a higher debt exposure have caused a significant increase in interest expenses, but the balance sheet has enough inventories to enable strong cash from operations to pay it down fully. Furthermore, the company remains profitable despite recent margin contraction as it reports positive net income quarter after quarter, and recent pricing and cost-saving initiatives have translated into some profitability improvements despite weakened demand. For these reasons, I believe that the recent 35% decline in the share price represents a good opportunity for long-term dividend investors as it caused a spike in the dividend yield to 3.17% compared to the average of 2.11% over the past 4 years.

Read the full article here