Prime Time for Small-Cap Stocks

Large-cap stocks experienced boom and bust in 2022 and 2023, with Mega-tech and energy leading the way; the bigger they are, the harder they can fall.

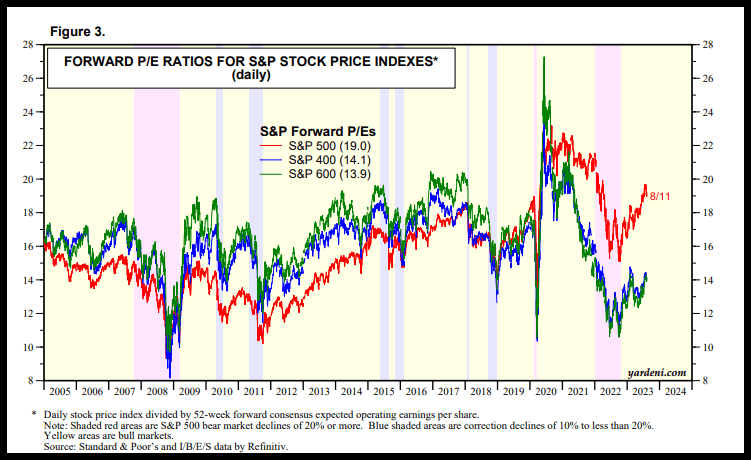

S&P Small-, Mid-, and Large-Cap P/Es (Yardeni Research)

Small-cap stocks can offer rapid growth and positive portfolio prospects, especially in a growing U.S. economy. With stronger-than-expected second-quarter GDP, the Russell 2000 (IWM) gained 7% YTD, and simply put, cheap companies are cheaper than they’ve been in decades. With the S&P Small-Cap 600 trading at a 26.8% discount versus large-caps’ premium valuations, my quant-based stocks under $10 with above-average growth, strong balance sheets, and attractive valuations may be the reward worth the risk you’ve been awaiting.

Is now a good time to invest in small-cap stocks?

Small-cap capitulation may be nearing, and there is potential for a reversal in small caps’ fortunes, considering the market’s reduced inclination toward a challenging economic scenario or severe recession. Over the last 52 weeks, the underperformance of small-cap stocks compared to large-cap stocks can largely be attributed to the speculation of a recession due to higher interest rates. Over the last four weeks, as the general market and tech stocks have dipped, small-cap losses have widened. Servicing debt and rising interest rates can be taxing for a small company and cut into profits. The diminishing concerns about a recession and Fed interest rate increases could lay the groundwork for a resurgence in small-cap stocks.

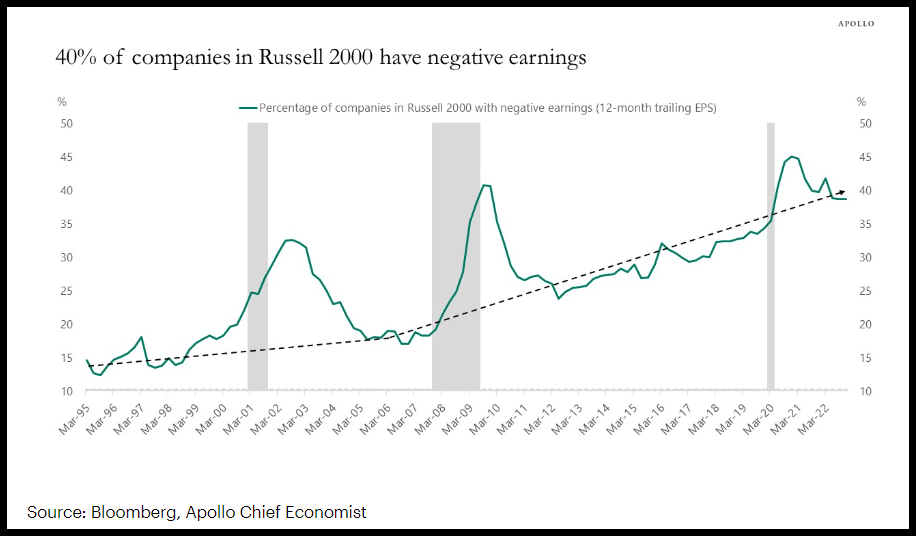

According to the Small Business Administration, small companies – the backbone of our economy – employ 61.7 million Americans, contributing to 46% of U.S. economic activity and laying the groundwork for why stocks under $10 may be ripe for investment. The labor market continues to be strong, and stronger-than-expected economic activity may have the Fed wondering how to slow the economy. With momentum having shifted in 2022 as Big Tech fell from glory from a relative valuation standpoint compared to mega-cap, cheaper stocks are appealing. Over 40% of Russell 2000 companies are zombies – non-profitable with negative earnings.

40% of Companies in the Russell 2000 have negative companies (Bloomberg, Apollo Academy)

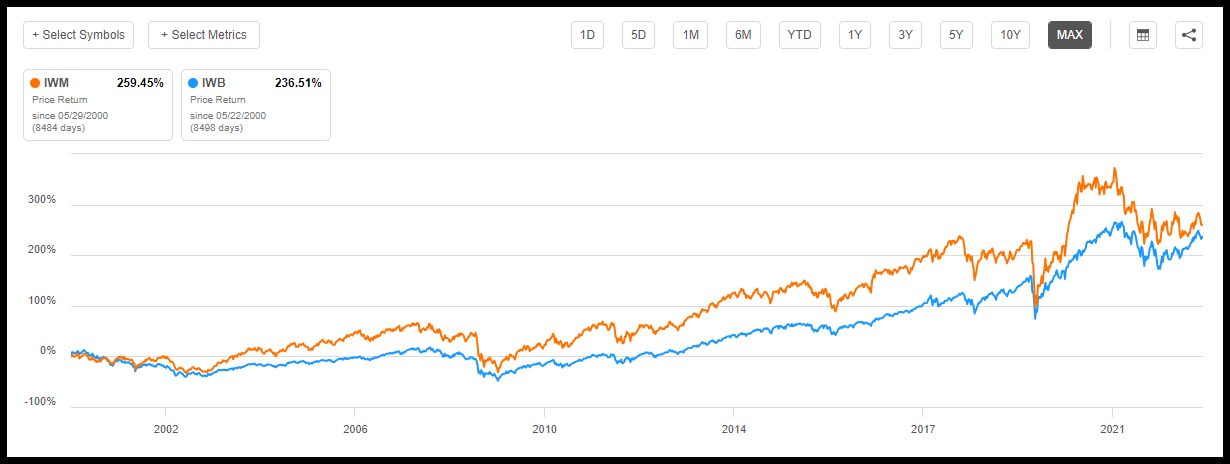

With U.S. Q2 GDP surging past consensus, smaller companies may lead the charge in the early stages of recovery or economic growth. Small-cap stocks possess market capitalizations between $300M and $2 billion, so they tend to be riskier investments than large-cap stocks. Historically, they have outperformed large-caps, especially during periods of inflation. Over the last 20 years, the small blend of Russell 2000 (IWM) companies has outperformed the large blend of Russell 1000 (IWB) companies, as showcased in the chart below.

Small Caps (IWM) have historically outperformed Large Caps (IWB)

Small Caps (IWM) have historically outperformed Large Caps (IWB) (SA Premium)

While elevated interest rates have created headwinds for many companies, and the posturing of a potential October government shutdown may cause some volatility leading up to the decision, so far, the damage from elevated interest rates is less than anticipated. In terms of growth, smaller companies on an uptrend with rapid growth have more accessible opportunities to sustain high growth than large companies. Given the ease of attracting talent, there is less red tape for innovation, more investment for growth, and swifter technology integration. The key is finding the right tools for researching and selecting companies of interest in diversifying portfolios.

10 Cheap Stocks Under $10 To Invest In

With a resilient economy and signs of growth, why wait until a full recovery to invest in cheap stocks? Large companies have an established foothold in their respective industries; their business strength allows them to absorb downturns better. Year-to-date, the iShares Russell 2000 (IWM) gained nearly 7%. As Goldman Sachs stated,

“The Russell 2000 should rise by 14% during the next 12 months…“One reason that the Russell 2000 appears attractive is that its valuation is below the historical average. P/E multiples have typically been weak indicators for Russell 2000 performance because many companies are not profitable or lack analyst forecasts.” While there may be a potential upside for the Russell 2000, Goldman noted that it does not come without risks.

Focusing on stocks with attractive collective financial traits like valuation, growth, EPS revisions, profitability, and momentum can offer upside for a portfolio. It is crucial to rely on these characteristics in the following ten stocks under $10.

1. Crawford & Company (NYSE:CRD.B)

-

Market Capitalization: $482.23M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 08/28/23): 15 out of 703

-

Quant Industry Ranking (as of 08/28/23): 1 out of 20

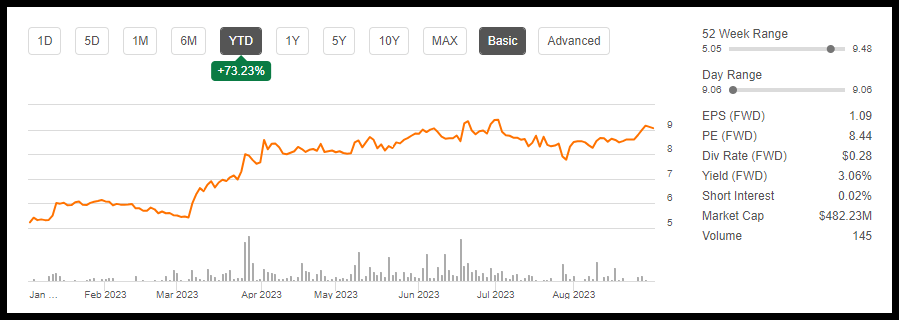

Atlanta-headquartered insurance broker Crawford & Company (CRD.B) offers third-party claims management solutions through technology and expertise. Managing $18B in claims annually with over 10,000 employees in more than 70 nations, CRD.B is an industry-leading financial focused on its people and the innovative tools that empower them. Crawford is +73% YTD despite financial crisis headwinds and has remained resilient, +50% over the last year.

Crawford & Company Stock YTD Performance (SA Premium)

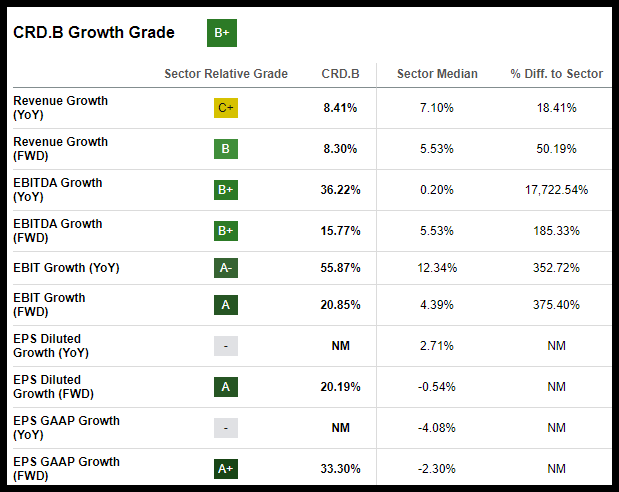

Considered a “hidden gem” among insurance stocks, Crawford & Company has strong momentum, outperforming sector peers quarterly while relatively undervalued. With a C+ Valuation grade, CRD.B’s forward PEG is discounted by more than 43% compared to its sector peers. Its forward P/E ratio of 8.98x versus the sector median of 9.81x and, forward EV/Sales of 0.59x versus the sector 2.87x, and forward Price/Sales all showcase this stock comes at a solid discount.

Crawford has consecutively beaten earnings, improved margins, and possesses strong growth and profitability grades. Over the last 90 days, two analysts have revised their estimates up with zero downward revisions.

CRD.B Stock Growth Grade (SA Premium)

Crawford showcases fundamentally sound metrics that allow it to rank in the top 1% of its sector. Delivering solid Q2 2023 earnings that included an EPS of 0.24, beating by $0.01, and a revenue increase of +9% year-over-year has solidified its ability to continue paying dividends. With significant improvements in their cash generation and $27M in operating cash flow, Crawford & Company raised its quarterly dividend to $0.07. During the Q2 Earnings Call, CEO Rohit Verma said,

Two years ago, we communicated our strategic commitment to grow organically and improve margins across our business. Our subsequent financial results have demonstrated progress across our organization, a reflection of the continual execution of our strategy.

Although the company’s progress has been slow and steady over the years, its ability to offer a hedge against inflation in an industry resilient in times of uncertainty continues to show strength. Solid execution of strategies marked its 11th consecutive quarter of revenue growth, reflecting top-line momentum and its ability to increase profitability. Consider this small cap for a portfolio.

2. Yext, Inc. (NYSE:YEXT)

-

Market Capitalization: $1.05B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 08/28/23): 21 out of 584

-

Quant Industry Ranking (as of 08/28/23): 10 out of 204

The technology sector has bounced back, +40% YTD (XLK), and capitalizing on this popular sector by diversifying into smaller tech companies offers the potential for significant upside. But where there’s reward potential, small-cap companies may be more risky, especially following declines in 2022. With 2023’s first-quarter tech rally, growth stocks have an opportunity to recover, as the rise in cloud computing, AI, and semiconductor demand is encouraging investors to consider “smart” investments. As such, I’m highlighting a quant Strong Buy tech stock for long-term investors.

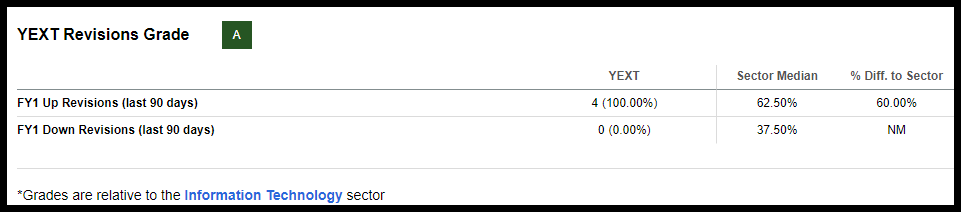

Yext, Inc. (YEXT) is a cloud-based application software company offering its customers the digital experience they need to iterate the world’s leading brands as customer and business needs change. Using AI-led platforms and “best-in-breed tools,” brands including Samsung, Subway, and Verizon are building on Yext. Over the last two years, Yext has beaten EPS estimates 100% of the time and reported another record first quarter Non-GAAP EPS of $0.08, beating by $0.03 along with a revenue beat, resulting in four analyst upward revisions.

Yext Stock Revisions Grade (SA Premium)

Following the latest Q1 results, Yext CEO and Chair of the Board Michael Walrath said,

“Our results demonstrate our continued commitment to driving efficiency and executing on our operational and financial goals. Yext is ideally positioned to help enterprises use generative AI, search, content management, and related technologies to deliver world-class digital experiences.”

With a growing customer count and 474% forward EBITDA Growth, a more than 5,000% difference to the sector indicates that this small cap’s metrics highlight strong buy qualities. In addition, Seeking Alpha’s Factor Grades showcase why Yext is a great consideration for a portfolio.

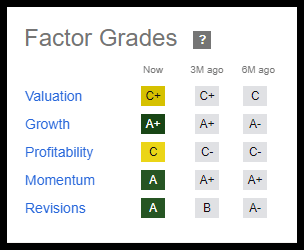

Yext Stock Factor Grades

Yext Stock Factor Grades (SA Premium)

Factor Grades rate investment characteristics on a sector-relative basis. Excellent growth, solid profitability, and bullish momentum complement this stock trading at a relative discount, up 34% YTD and 95% over the last year. EV/Sales are more than a 15% discount with room for upside following Q1 results. Where Yext organizes content knowledge and leverages complementary products, services, and technology, my second tech stock is in high demand.

3. Arlo Technologies, Inc. (NYSE:ARLO)

-

Market Capitalization: $935.85M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 08/28/23): 35 out of 584

-

Quant Industry Ranking (as of 08/28/23): 2 out of 51

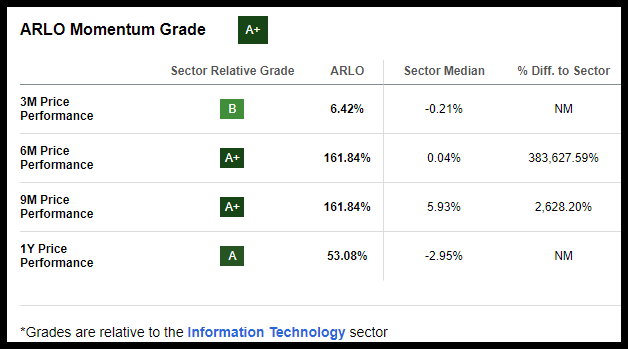

Together with its subsidiaries, Arlo Technologies, Inc. (ARLO) is a cloud-based platform offering the intelligent infrastructure to connect with smart devices. Focused on advanced security controls, Arlo has industry-leading features for home security and is quant-rated a Strong Buy while maintaining bullish momentum. Up 172% YTD, Arlo outperforms its sector peers’ quarterly price performance. As highlighted below by the six- and nine-month price performance, the difference to the sector is astounding.

ARLO Stock Momentum Grade (SA Premium)

While Arlo trades at a relative premium with a D+ valuation grade, forward EV/Sales and forward Price/Sales are trading at a 37% and 27% discount, respectively. Factoring in a solid growth grade with consecutive top-and-bottom-line earnings beats going back to 2018; that’s not a small feat. The latest earnings included an EPS of $0.06 that beat by $0.02 and revenue of $115.08M that beat by $4.9M, resulting in two analysts revising estimates up.

Drivers of its outstanding Q2 financial performance were a 55% growth in paid accounts to 2.3M subscribers. Revenue grew 54% Y/Y and reached a record $50M. Annual recurring revenue grew 66% Y/Y to $194M. During the Q2 Earnings Conference Call, Arlo CEO Matthew McRae said,

“We expect full-year service revenue to grow nearly 50% year-over-year and now exceed our $200 million target. Our non-GAAP service gross margin for the full year will be roughly 75% and should propel us to our target of 5% non-GAAP operating margin for the full year, a more than six percentage point improvement compared to 2022. It is an exciting time at Arlo as we witnessed the years of hard work begin to materialize in a meaningful way across the business. Congratulations, and thank you to the whole Arlo team for the milestones we passed and the ones we are focused on next.”

Arlo Technologies Consecutively Beats Top-and-bottom-line Earnings

Arlo Technologies Consecutively Beats Top-and-bottom-line Earnings (SA Premium)

With strong demand, inventory decreases, and in anticipation of greater margins, profitability, and cash position throughout 2023, Arlo raised its full-year guidance. Although the challenging macroeconomic environment and increasing costs have prompted the company to adjust hardware pricing and subscriptions to drive shareholder value, lowering hardware prices to sell more units while increasing subscription prices to accelerate service revenue has been beneficial. With positive free cash flow and service revenue forecasted to continue its growth, Arlo is the “thoughtfully designed” small-cap literally offering security for your portfolio. Consider this strong buy pick along with my next.

4. Travelzoo (NASDAQ:TZOO)

-

Market Capitalization: $103.77M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 08/28/23): 8 out of 249

-

Quant Industry Ranking (as of 8/28/23): 6 out of 61

With over 30 million members, including 8 million app users, Travelzoo (TZOO), the pioneering internet media company, offers exclusive travel and entertainment deals and has generated strong growth and profitability. Together with its subsidiaries, TZOO’s latest investment in fantasy travel allows its members to let their imagination run free in the Metaverse. Benefitting from AI demand, Travelzoo members can take past, present, future, and beyond trips to never-before-seen marvels.

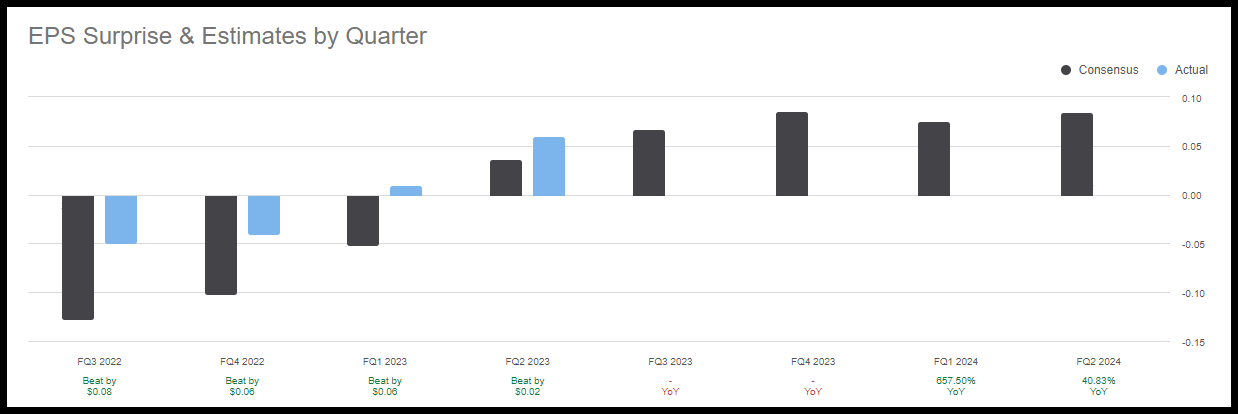

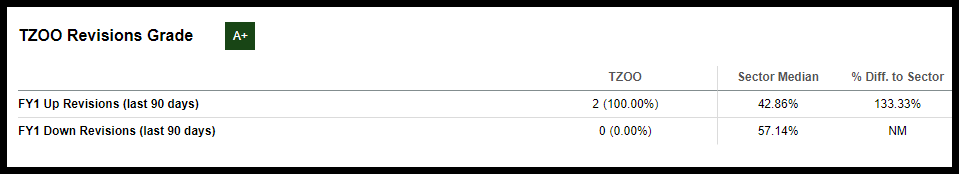

Despite missed second-quarter earnings, Travelzoo experienced year-over-year growth rates in all business segments. Operating margin reached 15%, up 10% from last year, and revenue was still up 19%, with operating profit up 84% year-over-year.

Travelzoo Stock Q2 Revenue & Operating Profit (TZOO Q2 2023 Investor Presentation)

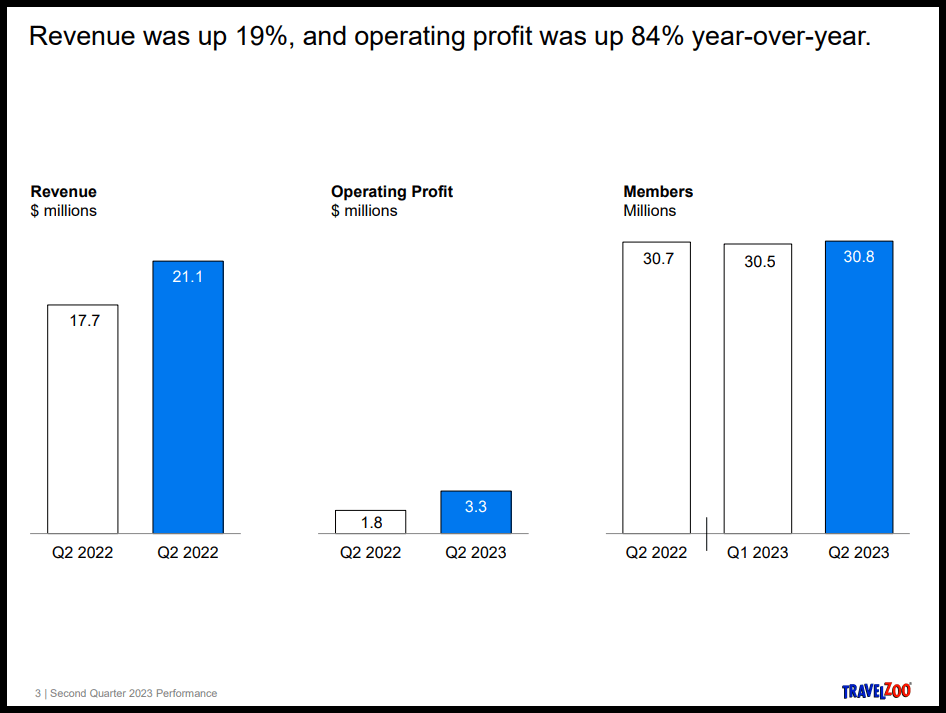

By keeping fixed costs low and leveraging trusted brands and strong relationships with top travel suppliers, Travelzoo accelerated growth in Europe and North America. Loved by travel enthusiasts around the globe, where some investors see the recent selloff after missed earnings as a risk, others consider the stock at its current valuation as a buy-the-dip opportunity. According to the quant ratings, TZOO has an A+ revisions grade according to the quant ratings, and two Wall Street analysts have revised estimates in the last 90 days.

TZOO Stock Revisions Grade (SA Premium)

Up nearly 50% YTD and +17% over the last year, the stock is trading near its mid-52-week range. A forward P/E ratio of 9.53x compared to the sector median of 17.91x indicates a 46% discount. Additionally, its trailing PEG ratio is a -91% difference. Consider this undervalued stock that could literally take you on the adventure of a lifetime.

5. Tetra Technologies, Inc. (NYSE:TTI)

-

Market Capitalization: $687.95M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 08/28/23): 6 out of 246

-

Quant Industry Ranking (as of 8/28/23): 3 out of 46

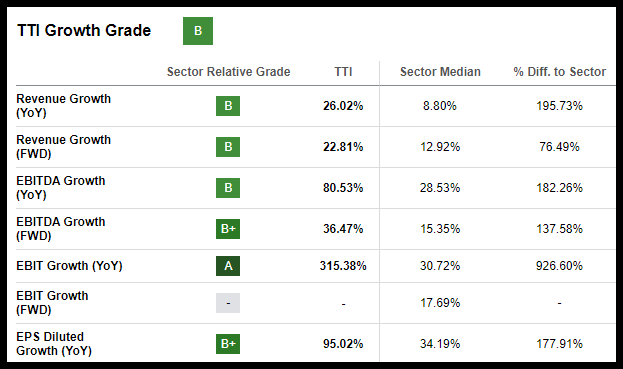

A Strong Buy stock pick with less-than-ideal valuation and profitability grades, Tetra Technologies, Inc. (TTI) captures the essence of a small-cap in high-growth. The Texas-based energy services and solutions company operates on six continents through two business divisions: Completion of Fluids & Products and Water & Flowback Services.

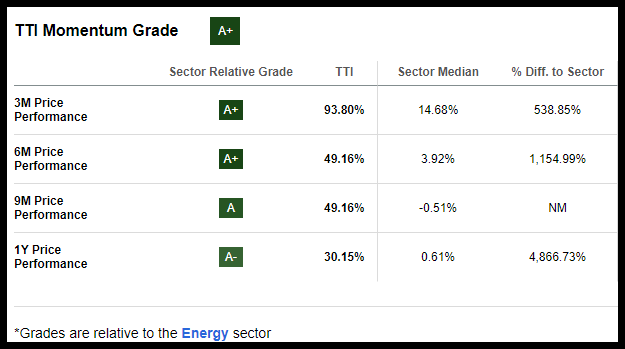

Showcasing bullish momentum, the stock has been on an uptrend, +63% YTD and +34% over the last year, with TTI as a beneficiary of OPEC’s cuts in production.

TTI Momentum Grade (SA Premium)

As highlighted in a Seeking Alpha news report:

Despite oil’s six-week spike, instead of saying overbought conditions are emerging, some analysts believe the latest announcements of more production cuts by major producers mean further gains are possible. UBS analysts said, “Saudi Arabia and Russia have extended their supply reductions into September. Meanwhile, OPEC+ stands ready to take further actions if market conditions warrant it…With the oil market expected to be in a deficit, we retain a positive outlook [and] therefore continue to advise risk-taking investors to add long exposure.”

Revenues are expected to climb for TTI, who experienced a tremendous second-quarter top-and-bottom-line earnings beat. EPS of $0.13 beat by $0.04, and revenue of $175.46M beat by nearly 25%. Improving its supply chain to allow for increased production volumes, TTI’s extensive portfolio of high-value eco-friendly solutions and focus on margin enhancement has proven successful. In addition to additional contracts for expansion and debt reduction, strong revenue growth, and forward EBITDA growth, have showcased Tetra’s industrial calcium chloride business, which produced its strongest quarter in history.

TTI Stock Growth Grade (SA Premium)

Although most of the company’s Profitability grades are below the sector median, Tetra has a strong Asset Turnover Ratio (TTM), indicating that the company is efficient in capitalizing on its resources to generate revenue and sales. While the stock comes at a bit of a premium, TTI’s forward EV/Sales and Price/Sales are a 38% and 29% difference compared to the sector, respectively. Although the energy sector can be quite volatile, and some prudence is required if entering a position at TTI’s current price, the stock possesses some strong fundamentals, which include upward analyst revisions and tailwinds from the oil and gas industry.

6. Heritage Global Inc. (NASDAQ:HGBL)

-

Market Capitalization: $114.76M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 08/28/23): 41 out of 701

-

Quant Industry Ranking (as of 8/28/23): 8 out of 95

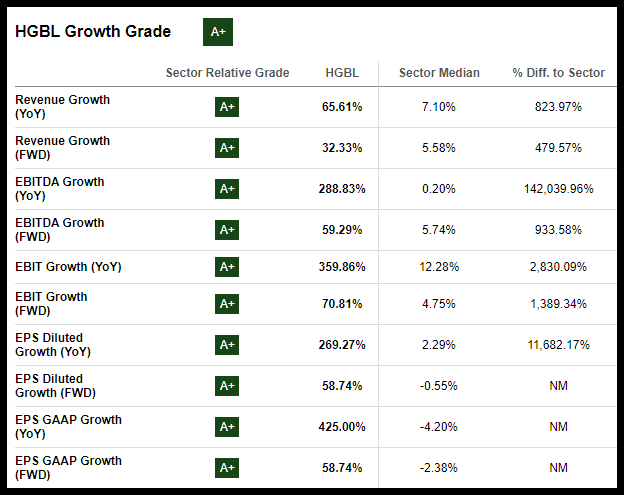

Heritage Global Inc. (HGBL) and its subsidiaries act as financial advisors, offering innovative financial and industrial asset solutions. Reaching its $100M milestone, HGBL has leveraged opportunities, despite the difficult macro environment, to grow in an effort to become a premier lender. With a strong network and strategic acquisitions, Heritage has been on an uptrend, showcased by A+ Momentum and A+ Growth supported by consecutive earnings beats.

HGBL Growth Grade (SA Premium)

Despite a Q2 revenue miss, HGBL EPS of $0.07 beat by $0.01 and generated a record $7M operating income. Lending opportunities have increased as consumer spending has remained strong and the growing amount of credit card debt has increased, prompting Heritage to boost its borrowing capacity. As stated by Heritage CEO Ross Dove,

We now have $1 trillion in credit card debt. Think about that, $1 trillion. So the huge growth in the debt is fueling more and more product into our marketplaces, and with more and more product going into our marketplaces, there is an increase in the purchasing by our onboarded buyers.

They’re very active now. And as they’re active, they’re basically coming to us more and more for the lending opportunities. So we’re growing both the brokerage business on the financial side and the lending business, and we think that really bodes well for not just the second half of this year but ongoing into next year and beyond.

Heritage Global is +29% YTD and +84% over the last year. Undervalued, HGBL’s trailing P/E ratio of 6.51x comes at a discount of 31%, and its trailing PEG of 0.02x versus the sector’s 0.41x is a whopping 94% difference. As equity markets have rallied, asset managers like Heritage have experienced robust AUM gains in the first half of 2023. Consider this small-cap that aims to provide result-driven solutions in the financial sector.

7. Evolution Petroleum Corporation (NYSE:EPM)

-

Market Capitalization: $281.10M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 08/28/23): 31 out of 246

-

Quant Industry Ranking (as of 8/28/23): 6 out of 74

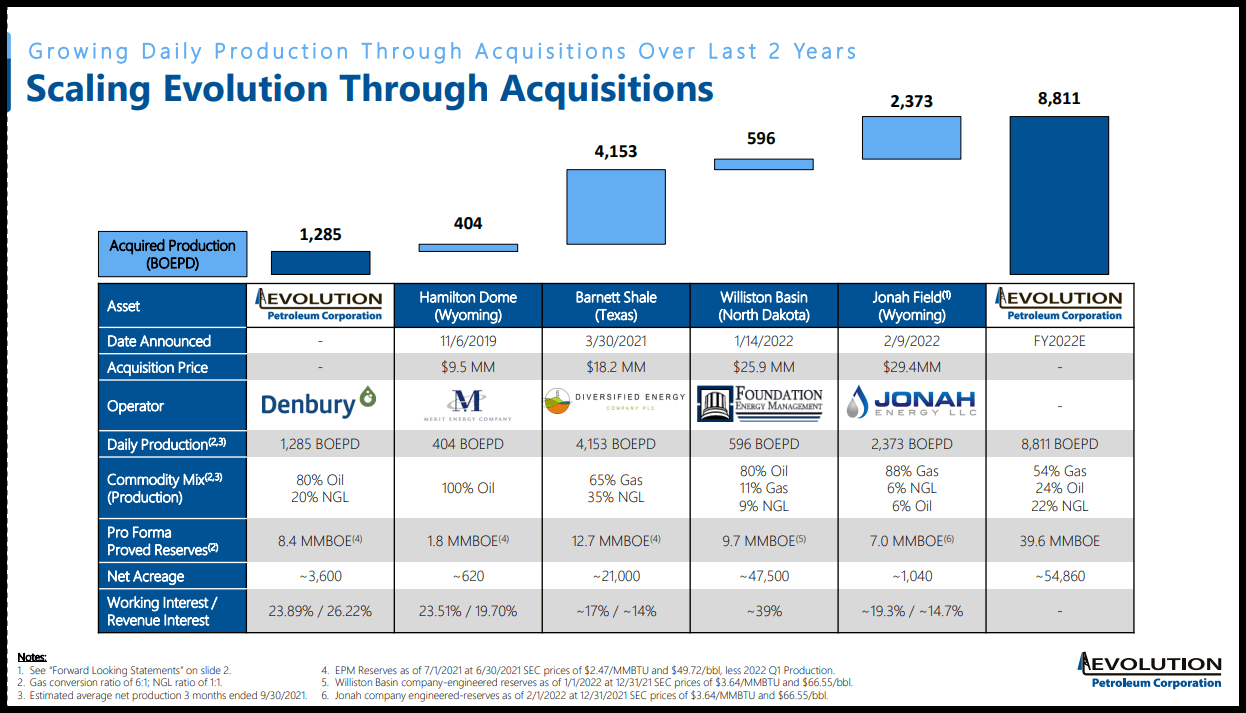

Among the notable energy companies added to the Russell 3000, Evolution Petroleum Corporation (EPM) is a quant strong-buy rated stock capitalizing on the energy rebound. With energy (XLE) up nearly 5% YTD and over the last year, Evolution’s focus on natural gas and acquiring mature, long-life production assets to support accretive cash flow and its dividend strategy has been positive. Despite headwinds from an angry oil industry in the Gulf of Mexico, EPM continues to showcase its diversified portfolio and scale through acquisitions.

EPM Stock Scaling Through Acquisition Table (EPM Acquisition – Williston-Jonah)

EPM’s recent Williston Basin and Jonah Field purchase has delivered positive performance. Additionally, EPM maintains strong free cash flows, a Q3 EPS of $0.41, beating by $0.11, revenue of $36.87M beating by nearly 44%, and dividend payments make this small-cap attractive. Paying a cash dividend of $0.12 per common share, 20% higher than the same period for 2022, this small cap’s growth and profitability are strong. Trading at a discount, with a forward P/E ratio of 25% difference to the sector and a trailing PEG nearly a 64% difference, the potential upside for this stock is very attractive, along with my next pick, a consumer staple.

8. Mama’s Creations Inc. (NASDAQ:MAMA)

-

Market Capitalization: $126.53M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 08/28/23): 1 out of 182

-

Quant Industry Ranking (as of 8/28/23): 1 out of 53

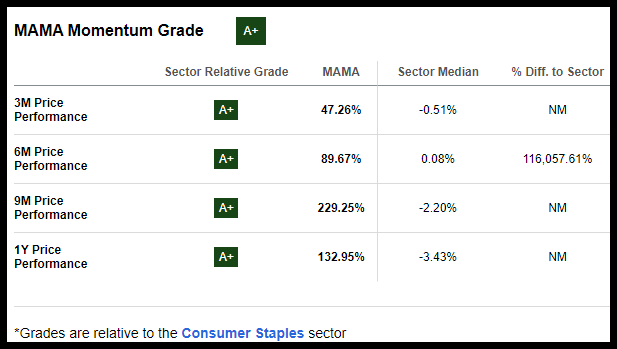

The one-stop-shop deli solutions company, Mama’s Creations Inc. (MAMA) manufactures and markets premade refrigerated foods. Currently ranked #1 in its sector and industry, Mama’s has experienced tremendous growth. Up 96% YTD and +140% over the last year, the stock’s bullish momentum and quarterly price performance significantly outperform its peers.

MAMA Stock Momentum Grade (SA Premium)

Continuing to execute its goal of expanding and accelerating its family of brands, Mama has experienced sequential improvements in profitability to its net income, which totaled $1.4M in Q1. EPS of $0.04 beat by $0.03, and revenue of $23.12M beat by $770.82K. Showcasing strong profitability, growth, and EPS revisions grades, Mama showcases strong prospects. Undervalued, the stock has forward EV/Sales of 1.31x compared to the sector of 1.72x and an overall C- valuation grade. Having recently acquired the remaining stake in Chef Inspirational Foods, investors may want to taste what this small cap is cooking.

9. SunCoke Energy, Inc. (NYSE:SXC)

-

Market Capitalization: $768.04M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 08/28/23): 9 out of 286

-

Quant Industry Ranking (as of 8/28/23): 3 out of 29

The largest North American merchant coke supplier, SunCoke Energy, Inc. (SXC), is a cokemaking company, providing the essential ingredient in the blast furnace production of steel. Used to power customers throughout the Americas (including Brazil), SunCoke offers metallurgical and thermal coal and has been cultivating growth through strategic partnerships like US Steel Corporation (X).

Despite the fluctuations in energy prices and headwinds in the industry, SXC delivered stronger-than-expected second-quarter results. On the back of six consecutive top-and-bottom-line earnings beats, Q2 EPS of $0.24 beat by $0.05, and revenue of $534.40M beat by $111.75M. This record Q2 performance resulted in a 25% increase in its quarterly dividend. Given its strong performance for the first half of 2023, the company indicates it is positioned to deliver Domestic Coke adjusted EBITDA on its high end of guidance range of $234M to $242M. With analyst consensus projecting an average one-year target price of $11, presenting a potential 20% upside. Although the stock is up 8% YTD and +30% over the last year, the stock continues to trade at a discount. Forward P/E of 11.61x is a -23% difference to the sector, and trailing EV/Sales and EV/EBITDA are more than a 50% difference to the sector. With a long-term outlook, consider this strong buy dividend-paying stock for a portfolio.

10. Barings BDC Inc (NYSE:BBDC)

-

Market Capitalization: $982.08M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 08/28/23): 24 out of 701

-

Quant Industry Ranking (as of 8/28/23): 3 out of 95

Barings BDC, Inc. is an externally managed business development company, aka BDC, focused on debt investments in middle market companies. Investing primarily in senior secured loans, first lien debt, equity co-investments, and many others, with its partnership through Barings, LLC, a $351B global investment manager, BBDC also offers flexible financing solutions and resources in building long-term portfolios and relationships.

Boasting a top capital structure within defensive industries, BBDC had strong Q2 earnings, showcased by an EPS of $0.31, beating by $0.02, and revenue of $75.30M, beating by +35% year-over-year. During Q2, the company repurchased 1.4M shares of stock at an average price of $7.75 and raised its quarterly dividend by 4%.

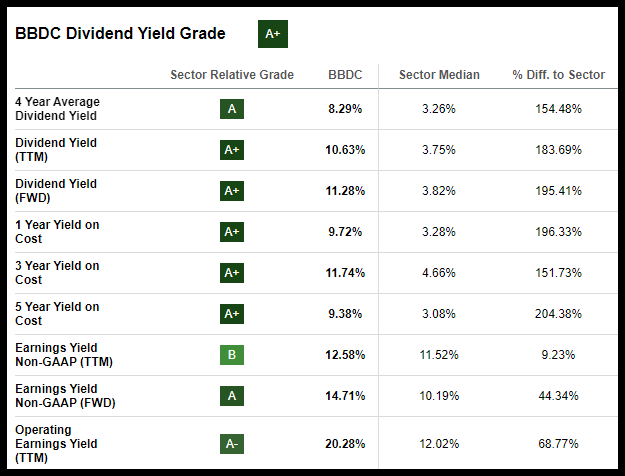

BBDC Stock Dividend Yield Metrics (SA Premium)

One of my only picks that pays a dividend, BBDC’s 11.28% forward dividend yield, is very attractive. With an 84.48% payout ratio and A+ grades, this small-cap stock offers steady income, solid growth, and profitability to complement its extreme discount.

Although BBDC has faced some headwinds due to the macroeconomic environment, recession fears, and banking crisis concerns, YTD the stock is up 13%. With room for upside, its forward P/E ratio of 6.80x versus the sector median of 9.81x and discounted trailing PEG, an 86% difference to the sector, leaves much room for growth.

With the economy showing stronger-than-expected growth, consider an investment in small-cap stocks before an economic boom. The ten stocks I’ve highlighted showcase above-average growth, solid profitability, and strong momentum and are undervalued.

Small-cap stocks Under $10 can look attractive

Seeking Alpha’s quantitative model is a quantitative stock selection system that recognizes stocks demonstrating strength in areas like Value, Profitability, Growth, Momentum, and EPS Revisions. Seeking Alpha’s ‘Strong Buy’ quant ratings result from powerful computer processing and our special ‘quantamental’ analysis. Many of the stocks on this list have had a lot of momentum. In theory, momentum means we pick past winners and pass on past losers. Empirical data, numerous investment research studies, and Nobel Prize-winner Daniel Kahneman support momentum as a positive investment factor. In addition to momentum, Profitability is a key metric for small-cap stocks as a measure of protection against rising interest rates.

Stocks under $10 offer a great price point for investment, especially when the small-cap stock picks offer similar features of large caps, including strong collective characteristics, periods of high growth, and Wall Street analysts presenting upward revisions. While small caps involve greater risk than their counterparts, the stocks featured here, CRD.B, YEXT, ARLO, TZOO, TTI, HGBL, EPM, MAMA, SXC, and BBDC may help diversify your portfolio.

With an array of investing options, consider some of the underappreciated small caps. With the U.S. economy growing stronger than expected, don’t miss out on the best opportunities by waiting to capitalize until the economy is strong. We have dozens of Top Stocks Under $10 for you, including Top Small Caps with a market cap under $1B. Alternatively, if you’re seeking a limited number of monthly ideas—curated from a list of Top Quant stocks—consider exploring Alpha Picks.

Read the full article here