Let’s face it. The significant decline in the value of many bank stocks during the latest banking crisis is going to leave a lasting impression on the appeal of investing in banks for the latest generation. And this is nothing new. Just a decade and a half earlier we had the great financial crisis which again scarred a whole generation of investors. Before that, it was the savings and loans crisis; before that, it was something else. Modern banking history is replete with stories of failed banks.

Additionally, as investments, they are not known the be “exciting” either. With a history spanning centuries, the banking industry’s fundamental operations have remained relatively consistent. Despite introducing new products and variations, their core business model remains consistent: gathering deposits, providing loans and deriving revenue from interest rate differences.

So in my analysis of banks, I try to be very direct. I look for safety and determine how reliable their income would be. In analyzing HSBC Holdings (NYSE:HSBC), I have seen that their metrics are solid and they rank well in terms of safety. However, I have rated it as a Hold because I am not sure how reliable their future income would be. Their long-term strategy revolves around divesting their operations in other countries and focusing more on China (China is a big profit driver and they are also facing increasing pressure from their biggest Chinese shareholder)

But this strategy is a double-edged sword. What is making them look good may potentially make them look bad and in my opinion, this is short-sighted thinking at its best.

HSBC – A Global Bank

HSBC is a global banking and financial services institution headquartered in London, United Kingdom. It operates as one of the largest and most influential banks in the world with a long history dating back to 1865 when it was founded in Hong Kong.

The bank provides a wide range of financial services, including retail banking, commercial banking, investment banking, and wealth management services, and serves millions of customers, businesses, corporations, governments, and international organizations.

What differentiates HSBC is its significant global presence and its commitment to serving diverse markets. Its operations span more than 60 countries and territories, making it truly international. The bank’s extensive network allows it to cater to the banking needs of clients across different regions, making it a preferred choice for multinational companies, expatriates, and international investors. HSBC’s ability to offer seamless banking services across various countries contributes to its status as a global financial powerhouse.

The Good

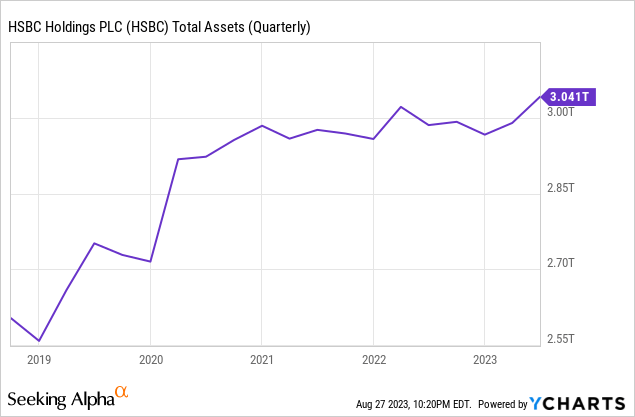

It has seen its assets increase by close to 15% in the last 5 years and recently saw it surpass the $3T mark. The bank is in the top 10 largest banks by assets list which is impressive but what is more important is to look at the quality of its growth.

Koyfin Koyfin

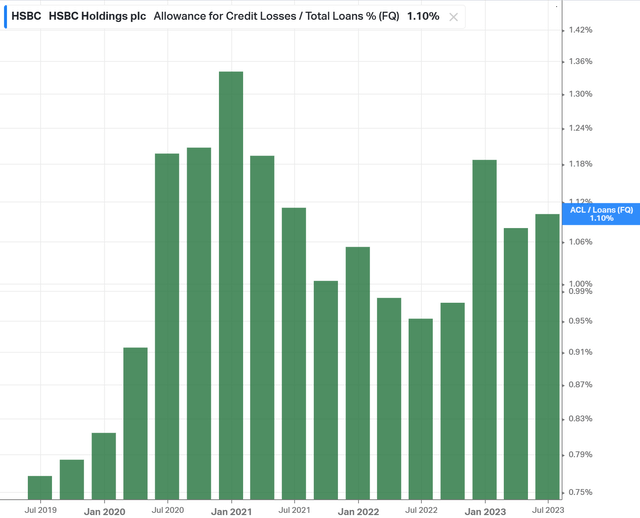

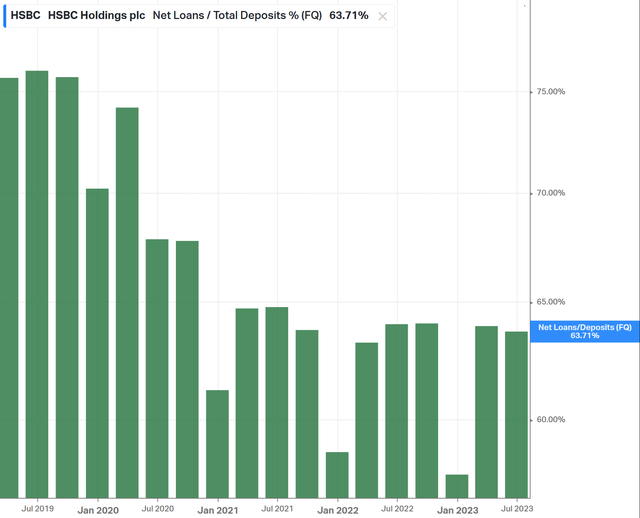

Allowance for credit losses is less than 2% of total loans and has been steady. Net Loans to total deposits have been falling gradually and are presently at 63%. This is a good number and suggests that the bank is in a safe position. These are the additional characteristics I deem attractive for HSBC.

1. Its assets to equity is close to 16x which indicates the portion of the company’s operations that are funded by debt versus equity

2. Close to 60% of the bank’s liabilities are made up of primarily customer deposits which is less riskier than external borrowing

3. It has a high dividend yield of 5.7% and its dividends are well covered by its earnings (payout ratio is close to 36%)

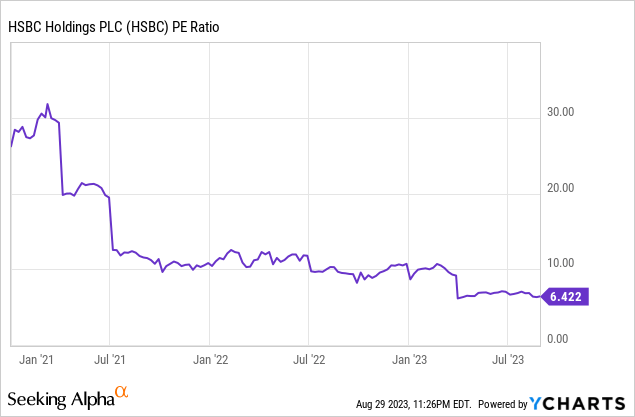

4. It trades at a price-to-earnings multiple of 6x and trades at less than its book value (0.9x). When compared to other banks that trade at a similar market cap you realize that it is certainly trading at a discount. Citigroup is the only bank in this list that is trading below HSBC in terms of valuation but the problems at Citigroup could easily fill a book and its valuation appropriately reflects that.

| Bank | P/E | P/B | Dividend Yield |

| JPMorgan Chase (JPM) | 9.4x | 1.5x | 2.7% |

| Bank of America (BAC) | 8.1x | 0.9x | 3% |

| Citigroup (C) | 6.5x | 0.4x | 5% |

| Wells Fargo (WFC) | 10.4x | 0.9x | 3% |

| Royal Bank of Canada (RY) | 11.3x | 1.5x | 4.4% |

| Toronto-Dominion Bank (TD) | 10.1x | 1.3x | 4.7% |

In light of the risks involved, I believe the bank is trading at a fair valuation based on the latest results alone.

It has to be mentioned that the bank has not always been trading at such low valuations. Improvement in its operating results but continued pessimism in its stock price (over a ten-year period, absolute returns are at -30%) have dented its valuation.

The Bad

Recapping the first half of 2023, there is no denying that their results have been great compared to the first half of 2022. Profit before tax rose by $12.9B to $21.7B and revenue also increased by $12.3B to $36.9B (a majority of this growth came from higher net interest income due to interest rate rises). They even raised the 2023 full-year guidance for net interest income to above $35B. Also, Customer accounts increased by $25B while lending balances increased by $36B.

You may be wondering at this point what is the bad here? The bad is that they are increasingly looking at China to expand their business and I disagree with this approach. At a time when businesses are looking to disinvest from China due to the nature of the risks involved, HSBC believes Asia expansion as a key part of their growth strategy highlighted in their H1-2023 review.

We are investing in growth in a strategic and targeted way. We have invested further in our Wealth business in Asia. We now have a total of 1,400 digitally enabled wealth planners in our Pinnacle business in mainland China…

We are working to diversify our revenue. A key strategic priority has been to grow fee income by investing in our Wealth business, especially in Asia. We saw the continuing benefit of this in the first half as we grew net new invested assets by $34bn, of which $27bn were in Asia

HSBC is also planning significant investments in its asset management arm in China, which includes launching specialized teams focused on green assets and fixed income. Ever since the news from the end of last year that it was selling off its Canadian operations, HSBC has been reviewing a possible exit from as many as a dozen countries to sharpen its focus on Asian expansion. This follows mounting pressure from its Chinese shareholder Ping An Insurance, which wants HSBC to prioritize growth in Asia, where the bank generates 78% of its total profit.

China’s problems with its credit is an ongoing scenario and the company would not have much control over this. My issue lies with China’s increasing belligerence towards Taiwan in the last few years with the ultimate goal of reunification. Taiwan is of significant national importance to the U.S. and a possible scenario would be China moving towards a war not just with Taiwan but with a bigger part of the world. If history is any indication, we saw what happened with Russia’s war on Ukraine when many businesses essentially had to write down their assets in the region. In my view, the bank’s decision to pull out of other markets to focus on China is very short-sighted. True it may be able to boost shareholder returns through this move but over the long term it goes against my idea of safety and against the reliability of future income.

My rating

As I mentioned in the beginning, banks have a history of blowing up and I especially dislike situations where banks are not thinking about the long-term consequences of their actions. I find HSBC going down the same road and would prefer to be on the sidelines. I like its financials, love its dividends and its valuations seem on point. But I disagree with its strategy. I could be wrong and the risk may never materialize but as of this point, multiple indicators say otherwise and therefore rate this as a Hold.

When would this change? Although highly unlikely, if the bank walks back on its strategy of expanding in China and instead focuses on operations outside of China that would be a positive development in my opinion. But this is difficult mainly due to how involved it is in the region and a strategy switch of that nature would take a much longer timeline than most investors anticipate. However painful, the bank’s strong brand should allow it to navigate such a transition but investors would be left frustrated in the short term leading the bank to give subpar returns.

Read the full article here