Legendary investor Howard Marks of Oaktree Capital Management famously wrote in a 2014 memo to clients titled Dare To Be Great II that “most great investments begin in discomfort.” While he was at the time referring to his firm’s focus on distressed debt – which has proven to be a highly successful strategy over the years—his observation holds true in many different scenarios in today’s markets. One such scenario that exemplifies this market truism, in my opinion, is Bitcoin (BTC-USD) miner Riot Platforms (NASDAQ:RIOT), which I cover in this article.

While holding RIOT over the past few years has been a decidedly uncomfortable experience for some investors, there is immense potential for outsized returns for risk-tolerant investors who take advantage of the Bitcoin miner’s misunderstood risk profile to build long term positions at current prices.

Three major issues weighing on the stock

There are three key factors that make RIOT an uncomfortable investment and potentially explain why it is, in my view, in bargain territory. Firstly, RIOT is a notoriously volatile stock. The evidence to support this is overwhelming. For example, despite being up 210% YTD (August 28) it is down 50% from its 52 week high of around $20.65 reached on July 13th. The stock has a 24-month beta of 3.29, as per SA data. Beta is a concept that measures the expected move in a stock relative to movements in the overall market. A beta greater than 1.0 suggests that the stock is more volatile than the broader market, and a beta less than 1.0 indicates a stock with lower volatility. RIOT’s volatility is further compounded by its high short interest of 16.84%. The risk of unrealized gains evaporating in a few trading sessions cannot be overstated when investing in volatile stocks.

The second reason RIOT is a difficult stock to hold is the almost impossible task of valuing the stock, considering it makes losses and its revenues are inherently unpredictable (since they largely depend on the sale of Bitcoin mined, meaning returns are subject to Bitcoin price fluctuations). An example of this is the fact that it posted a decline in revenue in the first half of 2023 vs the first half of 2022 despite increasing the number of Bitcoins mined by 1,090 coins over this period. Its latest Form 10-Q for the quarter ended June 30 notes that Bitcoin mining revenue for H1 reduced to $97.8 million from $104.1 million a year earlier due to lower Bitcoin values in the 2023 period, which averaged $25,132 per coin as compared to $37,177 for the 2022 period.

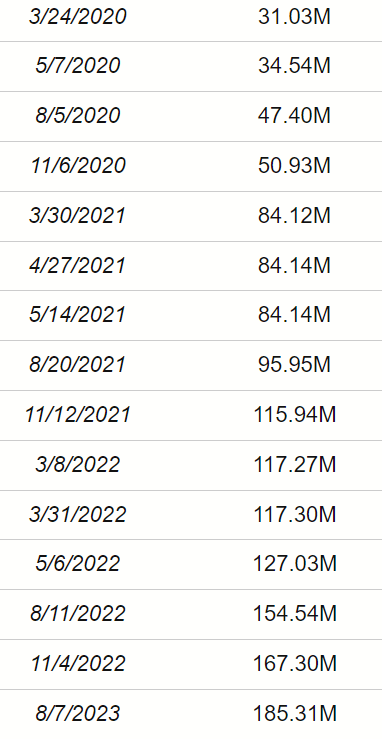

Thirdly, RIOT is held back by the continued issuance of new shares, a practice that dilutes existing stockholders and weighs down on the share price. Between March 2022 and June 30 2023, it issued $500 million in new shares, its 10-Q states. Equity financing remains the most viable means to fund operations and investments as the business is loss making, having racked up operating losses of $277 million for the trailing twelve months. The table below shows how the number of RIOT’s outstanding shares has increased since 2020.

sharesoutstandinghistory.com

While these factors are sufficient to put off risk averse investors, those with more tolerance for risk could do well to overlook them and instead focus on the main factor that drives RIOT’s share price – the price of Bitcoin.

Focus on what matters: Bitcoin’s price outlook

It’s no exaggeration to state that the fate of Bitcoin mining stocks relies disproportionately on the prevailing price of Bitcoin. This is not only the case for RIOT, but also true for other large peers such as Marathon Digital Holdings (MARA) — in the interest of full disclosure, I am long MARA and view it to be the top pick among Bitcoin miners (though this piece is about RIOT).

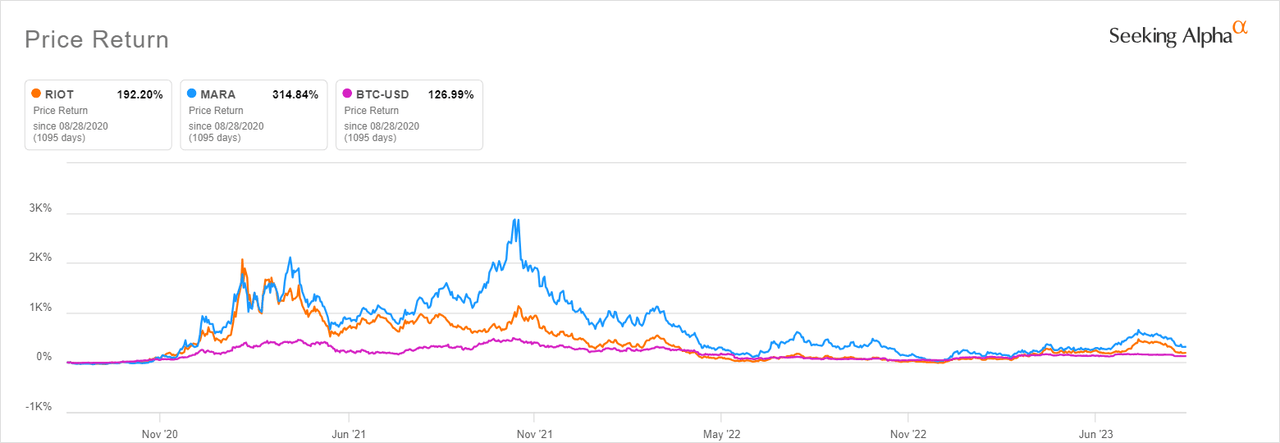

The chart below covering the past 3 years shows this strong correlation between the price return of Bitcoin and the return of miners MARA and RIOT.

Seeking Alpha

Interestingly, RIOT and MARA have been better investments in terms of returns than holding actual Bitcoins. This dynamic has played out yet again YTD, with both RIOT and MARA delivering a 210% return vs Bitcoin’s 52% return.

Given the correlation between Bitcoin’s price and RIOT’s stock return, the increasingly bullish Bitcoin price outlook is a strong reason to build a position in RIOT before Bitcoin takes off. Several important developments are taking place on both the demand and supply side of Bitcoin that could potentially lead to a historic bull run in the flagship cryptocurrency.

On the supply side, we are approaching an event that experts call “halving”. It is scheduled to take place from May 2024. Halving usually reduces the reward for mining Bitcoin by half. This reduced supply tends to push the price of Bitcoin higher, which is a positive for players like RIOT.

On the demand side, there is unprecedented institutional demand for Bitcoin. News of BlackRock (BLK) and other leading asset managers recently filing for spot Bitcoin ETFs with the SEC have dominated financial headlines for weeks, and Grayscale’s legal victory vs. the SEC has fueled optimism that a Bitcoin spot ETF will be approved. There’s a change in attitudes toward Bitcoin by many of the world’s largest asset managers. In prior years, these institutions were notably skeptical of Bitcoin. Today, BLK’s CEO Larry Fink says that crypto is digital gold and calls Bitcoin “an international asset,” as per a recent Fox Business interview.

Commenting on BlackRock’s interest in the sector, the CFA Institute blog recently published an article stating: “BlackRock’s interest in a Bitcoin ETF is not an outlier. Crypto’s integration into conventional finance and portfolio allocation will only gather speed in the months and years ahead.” The article also linked the imminent halving to a possible bull run, noting that: “As Bitcoin’s supply growth is cut in half in May 2024, a more exuberant phase of the crypto adoption cycle will likely commence again.”

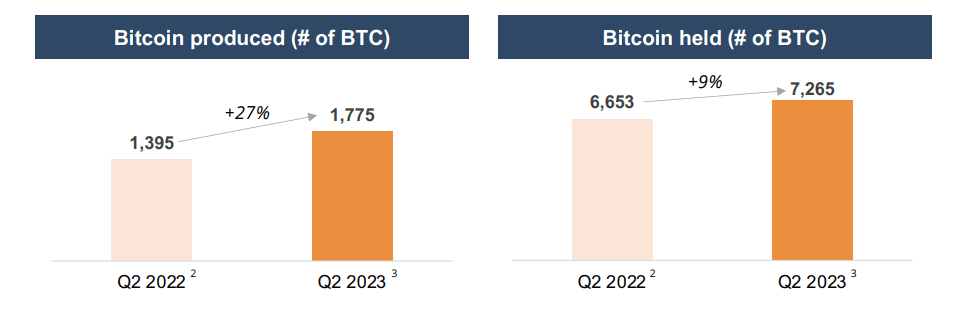

The demand-supply dynamics of Bitcoin point to the possibility of a new bull market, which is constructive for RIOT. The fact that the miner increased the number of Bitcoins produced and held in Q2 is also positive sign (if momentum is maintained) in view of the likely increase in the price of Bitcoin going forward.

RIOT Q2 earnings presentation

Dilution is a lesser evil in view of available financing options

With the price of Bitcoin projected to soar amid improving demand and supply dynamics, RIOT investors who take advantage of the current share price will likely benefit from superior stock returns. The big concern that remains, however, is dilution. Even after issuing $500 million worth of shares between March 2022 and June 30 2023, it is likely that RIOT will continue issuing more shares in order to fund new investments ahead of the halving event in May 2024. The next few quarters could therefore see further expansion in the share count.

Because halving reduces the supply of new Bitcoins, miners need to invest in new hardware to increase their hash rate and mine more Bitcoins. Measured in Exahashes per second (EH/s), the hash rate refers to the computational power used by miners. It represents the efficiency and performance of a mining machine, so a higher hash rate potentially results in more Bitcoin production. As at Q2, RIOT had a hash rate capacity of 10.7 EH/s. It aims to increase this to 12.5 EH/s in the second half of 2023. Moreover, it aims to invest in new mining machines to increase this even further to 20.1 EH/s in the second half of 2024. The new mining machines are expected to be received and deployed by mid-2024 in time for the halving. This endeavor is expected to cost $162.9 million and the agreement with the vendor was entered into this June, according to statements in the company’s latest 10-Q. These investments are mainly being funded by the issuance of new shares.

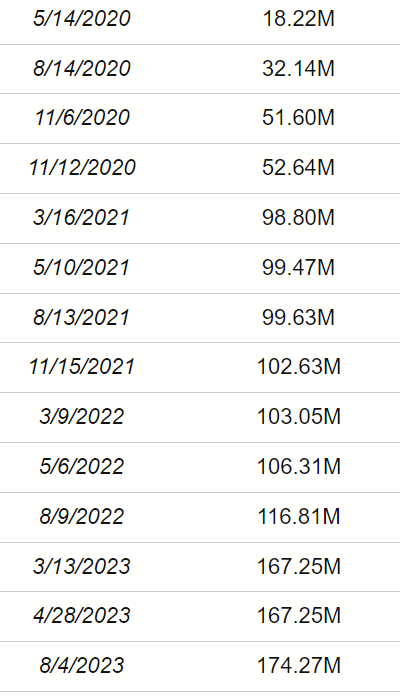

While two wrongs don’t make a right, the key thing to note is that most miners are also issuing new shares to fund growth, which in a way offsets the impact to investors since it’s an industry-wide phenomena. Take a look at MARA’s outstanding share history below as an example.

MARA’s share count through the years (sharesoutstandinghistory.com)

The alternative to issuing new shares is taking on debt or selling most of the Bitcoin produced instead of holding it. Both are not feasible options. Relying on debt in a competitive, unpredictable and evolving business like Bitcoin mining can easily lead to financial trouble. This was the case in 2022 when many companies in the crypto space that had overleveraged in the 2021 crypto bull market ended up going bankrupt when the market tanked the following year. “Riot chose to refrain from engaging in debt-financing activities during this period and, as a result, has not been subject to the significant debt-service shortfalls some of our competitors are experiencing,” RIOT stated in its Management’s Discussion and Analysis section of its latest 10-Q

Selling most of the Bitcoin produced is also not smart given the outlook for Bitcoin, with banks like Standard Chartered saying the flagship cryptocurrency could rise to $120,000 per coin by end of 2024.

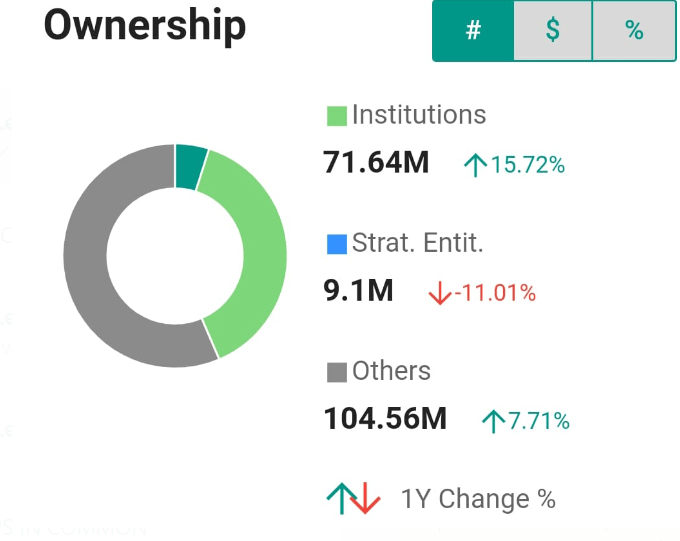

It is also important to look at the issuance of new shares from the point of view of existing shareholders. If key shareholders such as institutions are increasing their ownership amid stock dilution, it can be a bullish sign as it means they want to keep their stake undiluted and are looking at the longer-term picture. This is the case with RIOT, with institutional investors having increased shareholding by 15.72% in the past 1 year to 71.64 million shares, as per Refinitiv data on the Interactive Brokers online trading platform. Institutions own around 38.66% of the company, with Vanguard leading with 17.9 million shares, followed by BlackRock’s 10.75 million shares and State Street’s 4.96 million shares.

Institutions have increased their control over RIOT (Interactive Brokers)

Risk management is key

While I am bullish on RIOT, I think it’s appropriate to reiterate that the risks are elevated due to the aforementioned issues such as volatility, difficulties valuing the stock, and dilution. The price of Bitcoin, which remains the main driver for the stock price, is also highly unpredictable. I would be shocked but not surprised if Bitcoin failed to live up to the current hype and instead traded sideways or lower for an extended period. This can lead to a decline in the price of RIOT, which has in the past year traded at lows of $3-4 per share, more than 70% lower than current prices.

It goes without saying that investing in RIOT without a proper risk management strategy suited to your trading style and abilities can be a costly misadventure. The risks notwithstanding, I view RIOT as an uncomfortable investment worth getting into before Bitcoin really takes off. If the price of Bitcoin reaches new all-time highs in the next 12 months, RIOT could easily become a multi-bagger for investors who buy at current levels given the stock’s history of outperforming Bitcoin’s price return.

Read the full article here