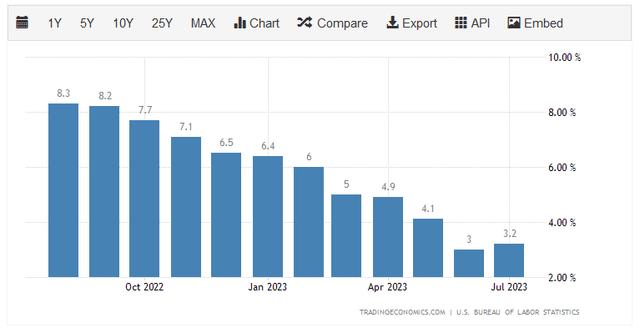

Pioneer High Income Fund, Inc. (NYSE:PHT) is a high-yielding closed-end bond fund, or CEF, that investors can use to obtain a high level of income today. This is immediately apparent in the fund’s 9.69% current yield. As I pointed out in my last article on this fund, investors need additional income today in order to maintain their lifestyles in the face of the highest inflation that we have experienced in four decades. This could be even more important now, as inflation seems to be getting worse. In July 2023, the headline consumer price index ticked up to 3.2% compared to 3.0% in the previous month:

Trading Economics

While this is still better than the 4.9% year-over-year inflation rate that the economy was experiencing the last time that we discussed this fund, inflation compounds just like common stock returns. The recent 3.2% year-over-year increase came on top of an 8.5% increase in July 2022, which means that prices were 11.1972% higher than in July 2021. That is a pretty steep increase in just two years, so it should be pretty obvious why a higher level of income is needed just to maintain the lifestyles that we have all become accustomed to. This closed-end fund is one way to obtain that income.

In the last article on the fund, I pointed out that the fund was almost completely covering its distribution with net investment income and traded at a very attractive discount to its intrinsic value. However, a few months have passed since that time so naturally a few things have changed. In particular, the bond market has gotten somewhat worse, and Chairman Powell’s speech at Jackson Hole last Friday certainly did not improve its mood. This article will, therefore, focus specifically on providing updates to the fund’s condition and outlook, as well as an update on the fund’s financial condition. Let us investigate and see if the Pioneer High Income Fund could be a worthwhile addition to your portfolio today.

About The Fund

As I pointed out in my last article on this fund, the Pioneer High Income Fund is one of the only closed-end funds that does not have a dedicated website. In fact, it is surprisingly difficult to find any information about this fund from its sponsor at all. The closest thing that the fund has to a website is this page, which provides information about all of the fund sponsor’s current closed-end fund offerings. This page does offer a fact sheet for the fund, so we will have to use the fact sheet and the annual report for our analysis, along with external sources.

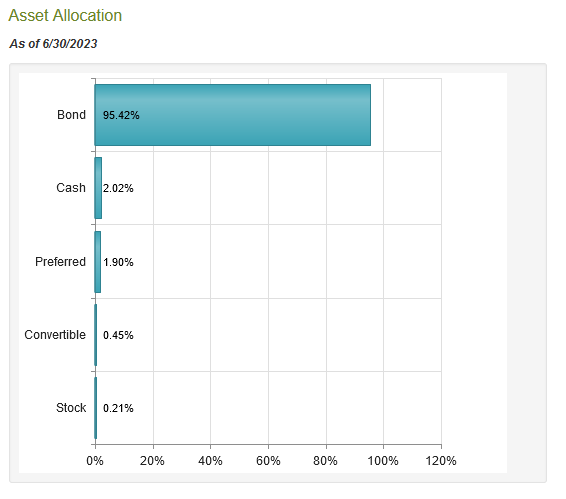

The fact sheet states that the fund’s primary objective is to provide its shareholders with a high level of current income, which is understandable considering the name of this fund. Its portfolio is also consistent with this objective, as 95.42% of the fund’s assets are invested in bonds. The fund also has small allocations to preferred stock, convertible securities, and of course cash:

CEF Connect

This is not exactly what would be expected when reading the fund’s description of itself as provided on the fact sheet:

“Pioneer High Income Fund, Inc. is a closed-end fund that invests for a high level of current income by investing in a portfolio of below-investment-grade bonds and convertible securities. It also seeks capital appreciation as a secondary objective.”

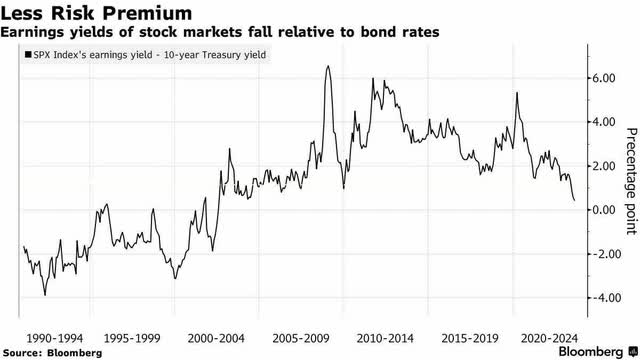

This description would certainly lead someone to expect that this fund would have a much higher allocation to convertible securities than it currently does. It is possible that the fund’s management is opting to keep its allocation favoring bonds as the opportunities there are better. There may be support for this. As Bill Gross pointed out in a recent interview, the equity risk premium is at the lowest level that it has been in about twenty years:

Zero Hedge/Original Chart from Bloomberg

This implies that the S&P 500 Index (SP500), which we are using as a proxy for common stocks, is overvalued relative to bonds. However, convertible securities are basically bonds with the upside potential of common stocks so they should not have the same overvaluation as the stock market does. As such, I do not really agree with management keeping the fund’s allocation to convertible securities as low as we see in the fund today. However, we can basically just think of this as a bond fund and ignore the fund’s own statement with respect to investing in convertible securities.

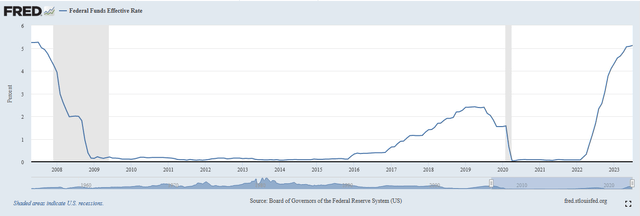

One of the defining characteristics of bonds is that they are highly sensitive to interest rates. In short, when interest rates go up, bond prices decline and vice versa. As everyone reading this is likely well aware, the Federal Reserve has been aggressively raising interest rates over the past eighteen months or so in an attempt to reduce the incredibly high level of inflation that is pervasive in the economy. As we can see here, the effective federal funds rate is now at the highest level that has been seen since 2007:

Federal Reserve Bank of St. Louis

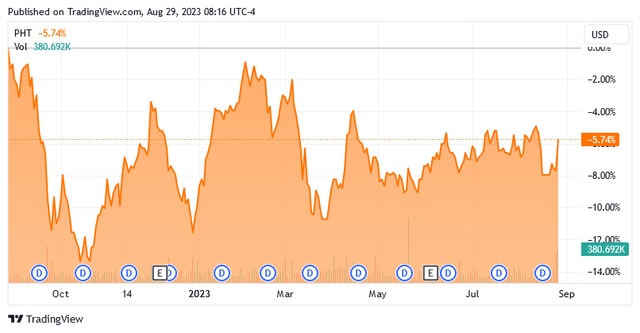

The target federal funds rate is even higher. At 5.50%, it is at a level that has not been seen since 2001. That has had a devastating effect on bond funds, including this one. The Pioneer High Income Fund is down 5.74% over the past twelve months:

Seeking Alpha

However, the fund’s yield is actually higher than the fund’s share price decline. As such, the fund has actually delivered a positive total return over the period:

Seeking Alpha

As we can see, the Pioneer High Income Fund delivered a 4.42% total return over the past twelve months. That is actually higher than the reported change in the consumer price index, so this fund has delivered a positive real return over the period, albeit a small one. That is better than the negative 2.20% total return that the Bloomberg U.S. Aggregate Bond Index (AGG) delivered over the same period.

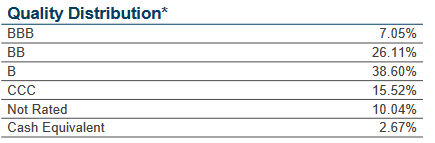

However, as I noted in my previous article on this fund, the Pioneer High Income Fund invests primarily in high-yield bonds. These are colloquially known as “junk bonds,” and as such they have both a higher return and a higher risk of default than the investment-grade bonds that comprise the Aggregate Bond Index. This is something that may concern risk-averse investors, such as many retirees. However, we should be able to assuage our concerns somewhat by looking at the credit ratings that have been assigned to the bonds in the portfolio. Here is the summary of that provided by the fund’s fact sheet:

Fund Fact Sheet

An investment-grade bond is anything rated BBB or higher. As we can clearly see, bonds with that rating only comprise 7.05% of the fund’s portfolio. However, the cash equivalent securities can also be considered to be investment-grade. These securities are things like short-term Treasury bills, agency securities, and other things that might be held by a money market fund. They are largely free of default risk, so in reality, we have 9.72% of the fund invested in very high-quality securities. That might still be lower than many investors would like considering the high risk of default losses from speculative-grade bonds. However, the fund has 310 unique issuers represented in its portfolio and no individual issuer represents more than 1.29% of the fund. As such, any default should have a relatively negligible impact on the fund.

The only real concern here would be if a large number of companies default all at once. In that situation, the economy obviously has much worse problems than just a few investors losing some money.

One thing that we note above is that the fund has somewhat improved the quality of its portfolio in terms of credit rating since we last discussed it. In particular, the fund’s allocation to B and CCC-rated bonds has gone down while its allocation to BB bonds has gone up. This might be a sign that the fund’s managers are anticipating a recession. After all, defaults tend to go up during a recession, so improving the credit quality distribution of the bonds in your portfolio is one way to reduce your risk of losses in such an event. Another possibility is that the fund’s managers are thinking that the probability of near-term rate cuts is lower than it once was. This is the reason why bonds and stocks in general have been declining since the start of August. Chairman Powell’s Jackson Hole speech reinforced the “higher for longer” narrative that the central bank has been pushing, and it appears that the market may be waking up to the possibility that the Federal Reserve will not be cutting rates in the near future.

Higher rates tend to increase the probability of defaults among speculative-grade securities, so improving the credit quality distribution could be the fund’s way of protecting itself against that. Admittedly, I can only speculate what the fund’s management team is actually thinking, but it does appear that they are worried that defaults may start to increase and are hedging the fund against that risk.

Leverage

Closed-end funds like the Pioneer High Income Fund have the ability to employ certain strategies that can boost their effective yields beyond that of any of the underlying assets. One of the ways through which this is accomplished is the use of leverage. I explained how this works in my previous article on this fund:

“In short, the fund is borrowing money and using that borrowed money to purchase junk bonds and similar assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will usually be the case. However, it is important to note that this strategy is not as effective today with rates at 6% as it was eighteen months ago when rates were essentially 0%. This is because the difference between the rate at which the fund can borrow and the yield on the purchased securities is much narrower than it once was.”

As of the time of writing, the fund’s leveraged assets comprise 32.07% of the portfolio, which is reasonable. In fact, this is slightly better than the leverage ratio that the fund had the last time that we discussed it. Overall, it does appear that the balance between the risk and the reward here is very reasonable so we should not have to worry too much about the fund’s use of leverage.

Distribution Analysis

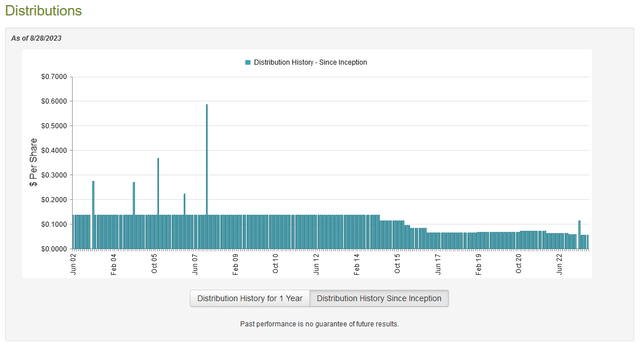

As mentioned earlier, the primary objective of the Pioneer High Income Fund is to provide its shareholders with a high level of current income. The fund seeks to achieve this objective by purchasing speculative-grade bonds and similar securities. Most junk bonds tend to have relatively high yields, which are necessary to entice buyers given the risks that these bonds have over investment-grade securities. This fund then applies a layer of leverage to boost the portfolio yield above that of the underlying securities. As such, we can assume that the fund will have a fairly high yield itself. That is certainly the case as the Pioneer High Income Fund pays a monthly distribution of $0.0550 per share ($0.66 per share annually), which gives it a 9.69% yield at the current price.

Unfortunately, the fund has not been particularly consistent with its distribution over the years. It had a good track record up until 2015 when it instituted its first distribution cut. The fund’s distribution has bounced around a bit since then, although the fund did have to cut it twice in the past year:

CEF Connect

This recent history will likely be something of a turn-off to any investor who is seeking a stable and secure source of income to use to pay their bills or finance their lifestyles. However, it is hardly out of the ordinary as most fixed-rate bond funds had to cut their distributions over the past year due to the carnage that the Federal Reserve’s interest rate increases have had on bond prices.

As I pointed out before, the important thing is how well the fund can sustain its current distribution at the current yield. After all, anyone buying today will not be affected by the bond’s distribution changes in the past. Let us investigate this.

Fortunately, we have a very recent document that we can consult for the purposes of our analysis. The fund’s most recent financial report corresponds to the full-year period that ended on March 31, 2023. This is a much newer report than the one that we had available to us the last time that we discussed this fund, so it should give us a good idea of how well this fund managed to handle the turbulence in the bond market around the end of last year. It will also give us a better idea of how well the fund is covering its distribution, which is critical to understanding how sustainable the distribution is likely to be.

During the full-year period, the Pioneer High Income Fund received $25,912,500 in interest and $1,004,148 in dividends from the assets in its portfolio. This gives the fund a total investment income of $26,916,648 during the period. It paid its expenses out of this amount, which left it with $20,318,603 available for shareholders. That was, unfortunately, not enough to cover the $21,272,685 that the fund actually paid out in distributions during the period, but it did get pretty close. This is likely to be concerning, as we normally like a fixed-income fund to be able to completely cover its distributions out of net investment income. This one did get very close, though, and the recent distribution cut might bring it pretty close to being in line with its income going forward.

The fund does have other methods that it can employ to obtain the money that it needs to cover the distribution. For example, it might have some capital gains that could be paid out. Unfortunately, the fund was not successful at this during the period. It reported net realized losses of $9,368,199 and had another $28,686,218 net unrealized losses. Overall, the fund’s net assets declined by $39,008,499 after accounting for all inflows and outflows during the period. This is concerning as it indicates that the fund cannot afford its distribution. However, as long as the distribution is fully covered by net investment income, then it is probably sustainable. This appears to be the case following the most recent distribution cut. We shouldn’t have to worry about any further cuts, but as always, we want to keep an eye on the fund’s finances as another large rate hike could force the fund to cut again in response to losses.

Valuation

As of August 28, 2023 (the most recent date for which data is currently available), the Pioneer High Income Fund has a net asset value of $7.69 per share but the shares currently trade for $6.81 each. That gives the fund a discount of 11.44% on net asset value right now. This is not as attractive as the 12.10% discount that the fund has averaged over the past month. However, any time a fund trades for a double-digit discount, it is usually a very reasonable price to pay. Thus, the current price appears to be very acceptable.

Conclusion

In conclusion, the Pioneer High Income Fund appears to offer a very reasonable way for investors to earn a high level of income today. The additional income provided by this fund can help offset the deleterious effect that inflation has had on our purchasing power and lifestyle. The fund is investing in high-yield bonds, which makes it a bit riskier than some other bond funds but it is managing that risk well and should not be exposing investors to huge losses from defaults.

The biggest concern here is the sustainability of the distribution, but the Pioneer High Income Fund should be able to cover it out of net investment income following the cut earlier this year, so it should be fine. Overall, this fund might be worth considering today.

Read the full article here