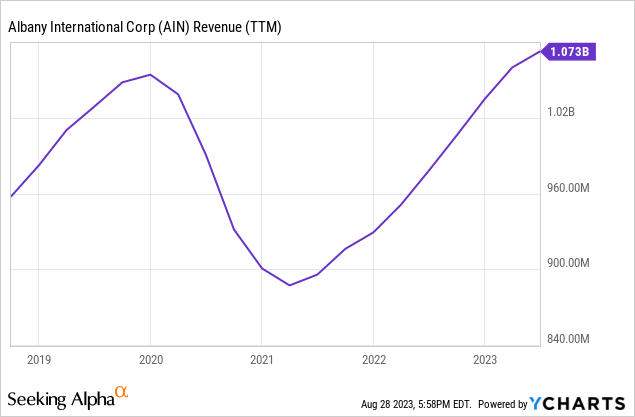

Albany International Corp. (NYSE:AIN) was starting to hit its stride prior to the pandemic as growth, margins, and returns on invested capital were all improving. These improvements led to solid returns for its stock as both earnings and its earnings multiple rose. In 2020 however, revenue declined 14% primarily due to decreased sales of its composite fan blades and fan cases in its Albany Engineered Composite (“AEC”) segment. These parts are used in LEAP engines which are used in various commercial aircrafts. As plane manufacturers shut down due to the uncertainty of the pandemic, demand for these engine parts declined. The Machine Clothing (“MC”) segment was not as affected by the pandemic as was the AEC segment.

It’s taken a few years but sales are now back to where they were prior to the pandemic.

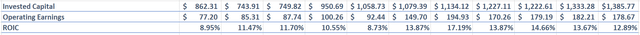

Where will Albany go from here? The stock looks expensive at first glance as it trades at a high multiple of earnings but if recent trends hold up, I believe the stock could trade higher. However I wouldn’t blame investors for moving on from the stock as the company has a history of low returns on invested capital over the past decade, it currently has low insider ownership, and there’s not much upside with my price target estimate. I believe there are better small-cap opportunities available so the opportunity costs of buying or holding Albany equity could be high.

Albany’s Returns on Invested Capital (Created by Author)

In this article I’ll provide an overview of the business, I’ll review recent acquisition and company news, and I’ll discuss the assumptions in my SOTP valuation that lead to my price target.

Business Overview

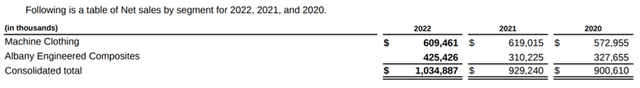

Albany’s Revenue by Segment (2022 Annual Report)

Albany operates two very distinct segments. The legacy MC segment provides machine clothing for manufacturers of paper and cardboard products. Albany has the largest market share of any company in this industry at 30%, which gives it the benefit of scale as it continues to roll-up more of the industry through acquisitions.

Machine clothing represents a small cost of a much larger operation for paper product manufacturers. This is often a good position to be in for a business because the manufacturing client is more willing to accept small price increases as long as quality is exceptional and products are always delivered in a timely manner. There is little incentive for the manufacturer to risk the entire operation for a small part.

This is a video made by Heimbach Group, the paper machine clothing business that Albany just acquired and it gives a good overview of the paper manufacturing process and why machine clothing is so important for it. The screenshot below is from the video and it shows the scale of the operation.

The MC segment is the low growth, cash generating segment of the overall business. It operates at high margins, is not capital intensive and provides high returns on invested capital although there are fewer opportunities to make these investments at high returns. Albany will likely gain more market share by acquiring smaller machine clothing businesses. Given its scale, these acquisitions should provide high returns as they can make the operations of the acquired businesses more efficient.

Screenshot from Heimbach’s Paper Machine Clothing Video (Heimbach GmbH – Paper Machine Clothing)

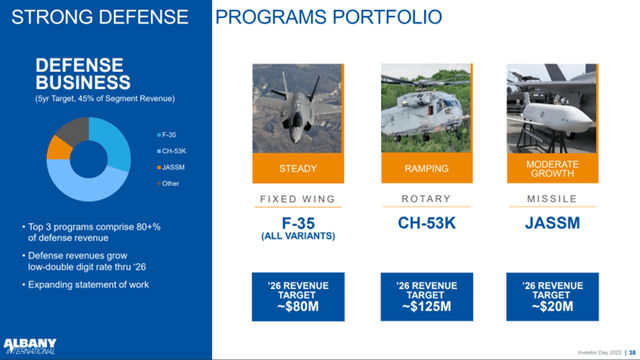

The AEC segment provides highly engineered, advanced composite structures to customers in the commercial and defense aerospace industries. AEC is an exclusive supplier of composite fan blades and fan cases for LEAP engines which are utilized in a variety of commercial aircrafts. 16% of segment sales in 2022 were attributed to these parts. Besides these parts for LEAP engines, this segment generally supplies a variety of parts and structures for many different types of aircrafts in the commercial and defense industries. 46% of segment revenue in 2022 was from U.S. government contracts or programs.

AEC Segment Summary (2022 Investor Presentation)

This segment has higher growth but lower margins, high capital intensity, and lower returns on invested capital. As I will discuss later, Albany seems to be focusing more of its efforts on this segment as the MC segment is more of a well-oiled machine.

Recent News

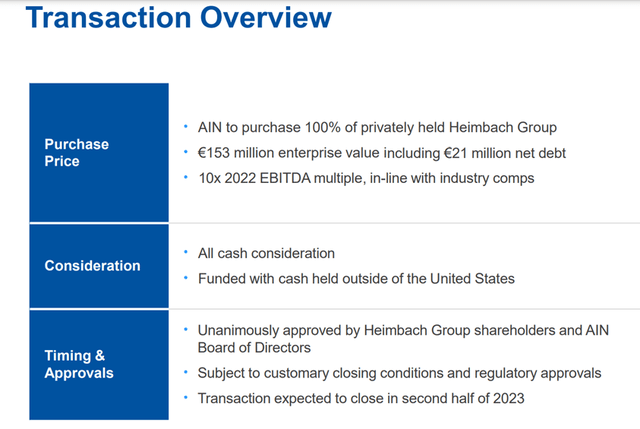

Albany recently acquired Heimbach Group, another paper machine clothing supplier based in Germany. As I mentioned above, these types of acquisitions make sense for Albany as it continues to gain market share by acquiring smaller competitors and rolling-up the machine clothing industry. This is a common business strategy that often creates a lot of shareholder value as the larger companies in the fragmented industry have advantages of scale and better financing options.

Heimbach Transaction Overview (Heimbach Acquisition Investor Deck)

After reviewing some of the details of this deal, I believe it will be a good one for Albany. Albany is paying €153 for Heimbach operations and debt, when Heimbach generated €15 million of EBITDA and €161 million of revenue in 2022. This means that Heimbach was operating at a 9.3% EBITDA margin, which is far below the MC segment’s 37% EBITDA margin. Albany is also increasing its net leverage ratio by a very modest amount with this deal.

If Albany is able to make Heimbach’s operations more efficient, the returns from this acquisition will be quite high and it will be very accretive to EBITDA once the integration is complete. The implications of this will be clear in my valuation below.

Albany also recently appointed a new president and CEO, Gunnar Kleveland. Kleveland was most recently CEO of Textron Specialized Vehicles, Inc., which is a segment within Textron Inc. (TXT). Besides this experience, Kleveland has experience in other industrial industries and most importantly, in the aviation industry.

It’s not surprising that Albany went with a CEO that has an expertise that aligns with the AEC segment. The MC segment is likely “easier” to run as it owns a majority of the machine clothing industry market share, and it has high margins and low capital intensity. This means that there is less competition, and fewer investment decisions to make.

The AEC segment on the other hand operates with a lower margin, with higher capital intensity, and in an industry where they have less market penetration. This means that there will be plenty of investment decisions to make and many competitors to beat. As it’s inherently more difficult to earn a higher return on investments as the number of investments go up, this is a more difficult segment to run with less room for error. If Kleveland is able to effectively use his industrial and aviation expertise to effectively grow the AEC segment, Albany’s long term prospects will be much brighter.

Valuation and Price Target

Given the company’s low returns on invested capital and low growth over the past decade along with the stock’s high earnings multiple, Albany’s stock looks very expensive. Investors are forward looking however, and they clearly believe that Albany will have more success in its future than it did in its past. I think investors are right to think this. While ROIC over the past decade was low, it’s been much higher over the past 5 years and as long as they are able to maintain these returns while growing modestly, the stock will prove to be more fairly valued than it looks.

Additionally, the recent Heimbach acquisition should be very accretive to EBITDA and should provide high returns on investment. These acquisitions are necessary to grow in the paper machine clothing industry because it is a low growth industry that is facing some headwinds due to technology improvements that are making machine clothing last longer. If they are able to continue to make acquisitions like this, earnings growth and high returns going forward should support a higher valuation.

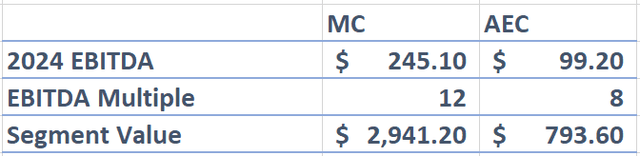

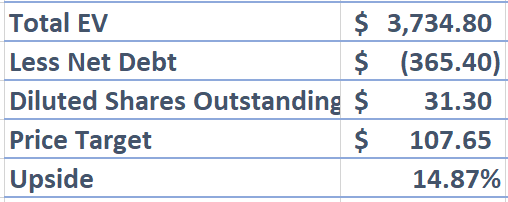

Albany SOTP Valuation (Created by Author) Albany SOTP Valuation Continued (Created by Author)

I am basing this SOTP valuation on my estimates of 2024 EBITDA which I believe are reasonable given 2023 guidance, the company’s financial history, and the Heimbach acquisition.

For the MC segment, I am assuming EBITDA is $245.1 million in 2024. This is based on no growth over 2023 EBITDA which I am assuming comes in at the midpoint of guidance, or $217.5 million, and the addition of $27.64 million of EBITDA from Heimbach. I discussed details of the acquisition above, but I am assuming that Heimbach’s EBITDA margin rises from 9% to 15% in 2024 as Albany makes its operations more efficient. I am using a 12x EBITDA multiple for the MC segment based on the 10x EBITDA multiple of the Heimbach acquisition and a premium due to Albany’s massive scale and efficient operations. While this is a high multiple relative to where the business traded when the MC segment was the only segment for Albany, it is not an unprecedented multiple.

For the AEC segment, I am assuming EBITDA grows 14% over the midpoint of 2023 EBITDA guidance of $87 million to $99.2 million. Using an 8x multiple of 2024 EBITDA, I am estimating the segment is worth $793.6 million. I am getting to this multiple by looking at the multiple that TransDigm Group Incorporated (TDG) has traded at over its history, and applying a hefty discount to that multiple. TransDigm operates in the same industry but it will always trade at a premium due to its scale, pricing power, extremely efficient operations, effective use of leverage, and shareholder friendly capital allocation.

The AEC segment is smaller, capital intensive and more unproven. An 8x EBITDA multiple seems appropriate based on TransDigm’s 15x average EBITDA multiple. With $99.2 million of EBITDA in 2024 and an 8x multiple, I estimate that the AEC segment is worth $793 million.

Combining the two, Albany’s EV would be $3.73 billion. Assuming $365 million of net debt, and 31.3 million diluted shares outstanding, I am assigning Albany a price target of about $107 which would provide 14% upside over today’s price.

Final Thoughts

Albany’s equity may look expensive due to its high earnings multiple, its history of relatively low returns on invested capital, and its history of low growth, but I believe it is fairly valued and potentially even slightly undervalued if recent trends continue. I am coming to this conclusion with a SOTP valuation estimate based on my 2024 EBITDA assumptions for the two segments. If Albany is able to make more great acquisitions like the recent Heimbach acquisition, and if the AEC segment, with the help of the new CEO who has experience in the aviation industry, is able to grow earnings at a low teens rate for a long period of time, I believe my $107 price target is reasonable.

While I believe the stock could trade higher, I also believe that there are more opportunities available in the small cap realm that can provide higher returns. Additionally, the two distinct and very separate segments makes the company less appealing to an acquirer. Acquisitions are a right-tail benefit of investing in small-cap stocks and this lower likelihood of being acquired makes Albany’s stock less appealing as an investment. With this in mind, I am initiating coverage with a hold rating despite my $107 price target that would provide 14% upside from the stock’s current price.

Read the full article here