Overview

My recommendation for Brinker International (NYSE:EAT) is a hold rating as I await the business to print results that support management’s confident outlook for FY24. My expectation for FY24 is that it is going to be a pivotal year, which should convince investors that it is on the right track to reaching normalcy. However, headwinds like labor, possible margin volatility, and concern over the sustainable traffic trend could continue to pressure the share price in the near term.

Business

EAT operates as a casual dining restaurant company. The business generates revenue from all around the world, with $4.1 billion in sales over the last 12 months. 88% of revenue comes from the Chili’s brand, and the remainder is from Maggiano’s. Chili’s is a widely known American restaurant chain, while Maggiano’s focuses on Italian food.

Recent results & updates

EAT’s 4Q23 revenue was $1.076 billion, with a co-owned SSS of 6.6%, thanks to an increase in price of 9.4% and an increase in product mix of 4.1%, which were partially offset by a decrease in traffic of 6.9%. Putting aside the headline numbers, the key takeaway here is that traffic trends improved across the board in the quarter and carried over into 1Q24. This is important as EAT is going to lap its price increase implemented in FY23, so recovery in traffic should be the driver for growth in FY24. If traffic continues at this rate, I consider the middle range of FY24 guidance, which indicates sales between $4.27 billion and $4.35 billion, along with moderate single-digit growth in same-store sales, as attainable, especially with the additional strategic efforts aimed at enhancing in-store productivity. These efforts encompass the introduction of a new kitchen display system, operational enhancements through investments in labor and technology, as well as the introduction of new products. Furthermore, management’s plan to increase marketing should mitigate the impact of the downward pressure on foot traffic caused by less discounting and the absence of sales of the Maggiano’s Italian Classics virtual brand.

Positive food costs were partially offset by higher labor expenses, resulting in restaurant-level margins [RLM] of 13.4%. Regarding the latter, I anticipate it will persist in FY24, which, in addition to the increased marketing expenditure, may result in volatility for RLM. To be exact, management claims wage inflation will stay firmly within the mid single-digit range for the foreseeable future. I expect this impact will be most felt in 1H24 as the total number of manhours worked will be much higher than in 1H23 on a like-for-like basis due to the new labor management model implemented in 2H23. Still, with price and expected commodity inflation of just 1% for the year, I am growing incrementally more optimistic that food costs will remain materially favorable y/y at least through 1H24. Keep in mind that 1H24 commodity price expectations are deflationary, so this should aid RLM in the short term.

Whether or not the recent uptick in traffic is sustainable will likely remain a contentious topic in the near future. Management has indicated that FY24 will be a good year for the stock as a result of the initiatives being implemented. The bull case here is that the stars appear to be in favorable alignment. Finally, food costs are decreasing, initiatives to improve operations should boost productivity, and increased marketing investment should lead to expansion. Regarding marketing expenditures, I think it is clear and evident that EAT’s marketing strategy worked, as the SSS increased to 6.3% (from 4Q22’s 0.3%) after EAT returned to national advertising. The success of this marketing has me concerned that rivals will interpret it as a sign that consumers’ health is improving and increase their own advertising spending to keep up, which will pressure EAT’s margin as it also needs to match ad spending. Despite being a persistent problem, labor should become less of an issue as the economy eventually improves (as the economy improves, it would encourage more labor participation, which should ease the wage inflation situation). EAT’s new method of controlling worker hours should lead to higher profits once the labor market stabilizes. That said, the bull case would only gain attention if EAT can show results in the next 1 or 2 quarters that are performing as expected.

Valuation and risk

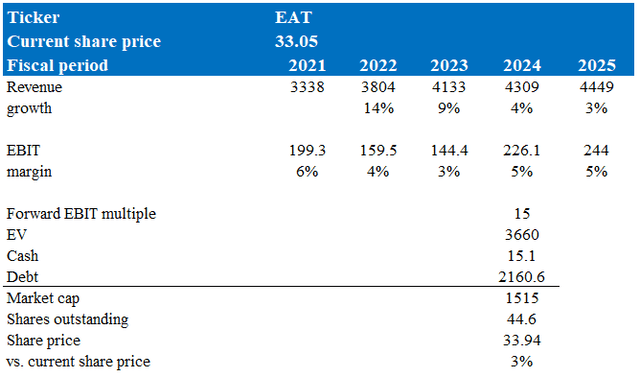

Author’s valuation model

According to my model, EAT is valued at $33.94 in FY24, indicating the current share price is fair value. This target price is based on my growth reverting back to historical low single digits over the next 2 years, with EBIT margin on track to return to its high single-digit level as everything normalizes. EAT is now trading at 15x forward EBIT, which I expect to remain at a discount to the S&P Composite 1500 Restaurants Index as it is expected to grow much slower and have a lower margin profile.

Summary

I recommend a hold rating for EAT. Challenges like labor issues, margin volatility, and traffic sustainability concerns could continue to impact the stock price in the short term. EAT’s recent performance showed improvement in traffic trends, a crucial factor as it laps the FY23 price increase, making traffic recovery a growth driver for FY24. Strategic initiatives, such as a new kitchen display system and operational enhancements, further support growth prospects. While concerns persist, positive trends in food costs and operations, alongside increased marketing investment, provide positive signals. Nonetheless, sustained positive results in the next one to two quarters will be crucial to gain investor confidence.

Read the full article here