Thesis

Impala Platinum (OTCQX:IMPUY) is one of the world’s largest producers of PGM (read: Platinum Group Metals) having operational assets in South Africa, Zimbabwe, and Canada. The company will report its 2023 annual results on August 31, 2023. I anticipate substandard YoY performance in terms of critical financial and operational metrics (including HSE) which I believe is already factored in the share price.

With a stark decline in palladium and rhodium prices during the past 2 years, platinum remains the only PGM element supporting IMPUY’s medium-to-long-term growth prospects. IMPUY seems to have realized that the PGMs that were once banked on as the primary growth catalysts (palladium/rhodium) are no longer the fan favorites. Platinum will save the day for PGM miners like IMPUY and the company has done well to acquire 100% of RBPlats; a South African PGM miner with mining assets in close proximity to IMPUY’s existing South African assets. Interestingly, a greater proportion of RBPlats’ mineral reserves comprise platinum (followed by palladium and rhodium). Together with other potential future investments like increasing IMPUY’s exposure in the Waterberg JV operated by Platinum Group Metals (PLG), I believe IMPUY needs to play smartly on its platinum-dominated assets to weather the storm represented by a persistent downtrend in the prices of other key PGMs like palladium and rhodium, thereby paving way for suitable long-term growth. Let’s get into the details.

FY 2023 At A Glance

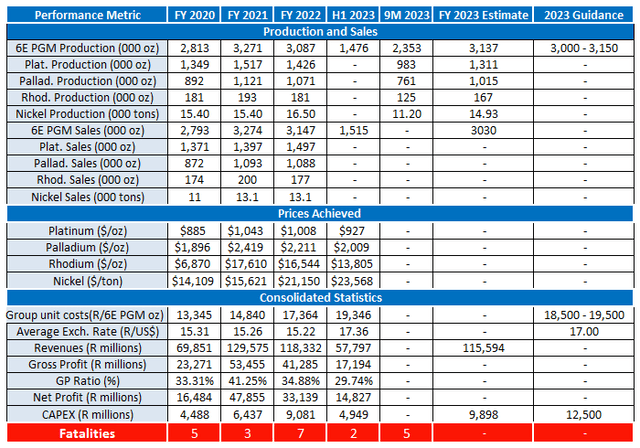

Before we discuss IMPUY’s performance during FY 2023 let’s quickly look at IMPUY’s key financial and operational performance metrics for the past 3 years (2020-2022).

Table 1: IMPUY’s 3-year Performance Summary – Source: Author

My Analysis and Expectations

1) 6E Metal Production: Based on 9M23 data, 6E PGM production (prorated) should be ~3.137 Moz. However, IMPUY’s CEO expects FY 2023 production to be at the lower end of the guidance range (Source: Q3 2023 report). However, since the production guidance ranges between 3.00 – 3.15 Moz, actual production may well be within the range of 3.00 – 3.08 Moz, implying that FY 2023 production will be largely flat with FY 2022.

2) Individual Metal Production: Using a similar estimation basis as above, I expect FY 2023 platinum, palladium, rhodium, and nickel production to be lower than FY 2022.

3) 6E Metal Sales: Based on H1 2023 data, 6E PGM sales (prorated) should come out at ~3.03 Moz, witnessing a YoY decline. At best, the sales volumes will be flat compared with last year. An overall downtrend in PGM prices supports this assumption since IMPUY may not be tempted to sell higher volumes of precious PGMs at the prevailing low prices.

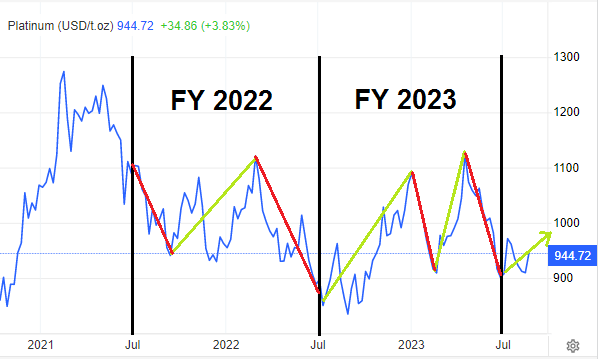

4) Platinum Prices: I expect average realized platinum prices to improve due to generally better platinum prices during H2 2023 (compared with H1 2023). Spot platinum last traded at $944.7/oz. I expect the 2023 average realized platinum prices to be in line with 2022. Look at the chart below.

Platinum Prices – FY 2022 and 2023 – Source: Trading Economics

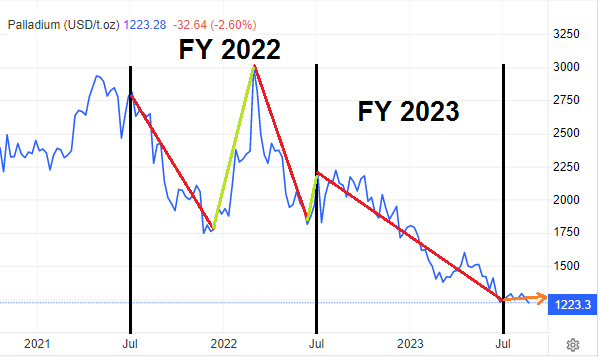

5) Palladium Prices: Spot palladium last traded at $1,229/oz representing a discount of ~$1,000/oz from their average levels witnessed a year ago. We should expect a notable decline in the average realized palladium prices on both YoY and HoH basis. Look at the chart below.

Palladium Prices – FY 2022 and 2023 – Source: Trading Economics

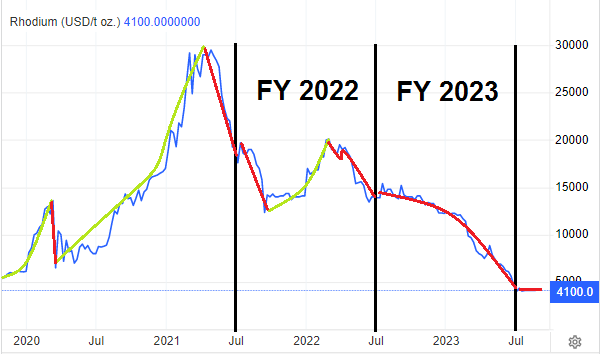

6) Rhodium Prices: Spot rhodium last traded at $4,100/oz representing that this PGM has shed by almost 3/4th of its 2022 average realized price (at ~$16,544/oz). Like palladium, we should expect a massive YoY and HoH drop in rhodium prices when the FY 2023 final results come out. Look at the chart below.

Rhodium Prices – FY 2022 and 2023 – Source: Trading Economics

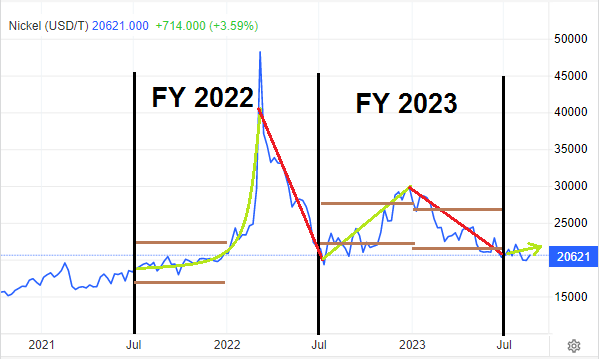

7) Nickel Prices: Spot nickel last traded at $20,621/ton revealing that the base metal did not witness a material change during FY 2023 (compared with FY 2022). In my view, the average realized nickel price should largely be flat with last year. Look at the chart below.

Nickel Prices – FY 2022 and 2023 – Source: Trading Economics

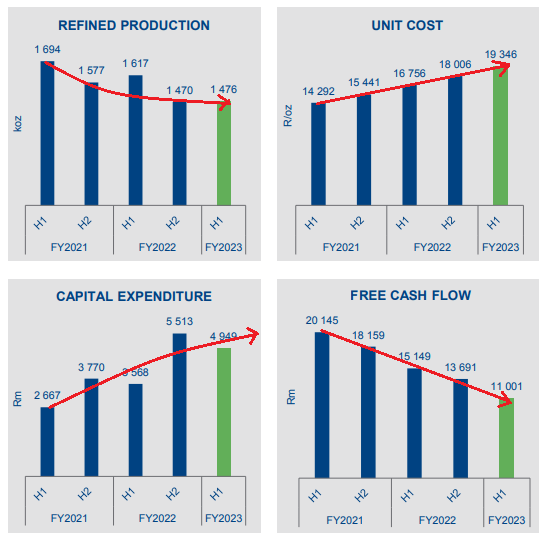

8) Group Unit Costs: The table shows that group unit costs per 6E PGM basket ounce have been on a persistent uptrend. Unit costs went up from R13,345/oz in 2020 to R14,840/oz in 2021 and further spiked to R17,364/oz in 2022. This trend continued during H1 2023 when unit costs further increased to R19,346/oz despite a weakening Rand against the US$ (which should typically reflect favorably on the labor and other local costs paid for in Rands and accounted for in the US$ for Impala’s ADR listing; IMPUY).

9) Revenues: 2021 was a stellar year for IMPUY (and many other PGM producers) due to a generally favorable trend in the prices of all three key PGMs (platinum, palladium, and rhodium). On that note, 2021 revenues almost doubled on a YoY basis thanks to a roughly 3x increase in rhodium prices during the same period. During 2022, a moderate decline in the production and average realized prices of both palladium and rhodium resulted in a mild decrease in 2022 YoY revenues.

As discussed above, an expected decline in production of 6E PGM ounces (during H2), together with adverse price variance for palladium and rhodium will negatively impact IMPUY’s revenue performance during FY 2023, on a YoY basis. Another point of concern is the gross profit ratio which has declined after FY 2021 onward depicting rising cost of sales. For FY 2023, I expect the GP Ratio to fall below the mark of ~30% witnessed during H1 2023 due to lower YoY revenues and rising unit costs.

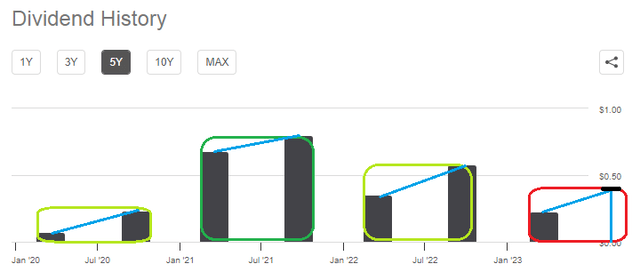

10) CAPEX and Free Cash Flows: During the past 3 years, IMPUY’s CAPEX investments have grown on a YoY basis and have increasingly limited IMPUY’s Free Cash Flow generation. The company remains cash flow positive and there is no reason to believe it will become FCF negative in the near term. However, the gradually declining trend in FCF generation is taking a toll on IMPUY’s dividend profile as seen below. Nonetheless, IMPUY has the most attractive dividend profile compared with South Africa-based large-scale PGM producers (more on this later).

IMPUY 5-Year Dividend History – Source: Seeking Alpha

11) Fatalities: Unfortunately, during the past 3 years (2020-22) IMPUY has witnessed an average fatality rate of 5. By the end of Q3 2023, IMPUY had already reported 5 fatalities on-site and needs to bolster its HSE initiatives to prevent such unfortunate incidents in the future, avoid negative media attention, and safeguard from the risk of labor strikes/work stoppages stemming from such incidents. Nonetheless, IMPUY’s recent 5-year wage agreement with AMCU (Association of Mineworkers and Construction Union) for the workforce employed at the Impala Rustenburg and Marula operations provides a cushion against the risk of labor-related work stoppages.

Section Conclusion

Long story short, IMPUY faces multi-faceted challenges. Declining palladium and rhodium prices coupled with flat YoY production, rising unit costs and CAPEX, and shrinking free cash flows point toward a troubling near-term outlook for IMPUY.

IMPUY’s financial/operational concerns – Source: Interim Results 2023

Meanwhile, nickel prices have come to the rescue but the impact won’t be material since nickel sales account for only a relatively smaller proportion of IMPUY’s revenues. However, platinum prices have remained relatively stable (and reliable) over the past few years, and in my view, IMPUY needs to enhance its platinum production to ensure YoY revenue growth over the medium-to-long term. The next section discusses this aspect in more detail.

RBPlats Acquisition – A Good Move

In January 2022, IMPUY made an offer (the Offer) to acquire all outstanding shares of Royal Bafokeng Platinum (RBPlats), a JSE-listed company operating PGM assets in the Merensky/UG2 Reefs on the Western Limb of the Bushveld Complex (in South Africa).

In a recent announcement, IMPUY confirmed that the Offer was accepted by RBP shareholders holding >90% of RBP shares (excluding RBP shares held by IMPUY prior to the offer). Accordingly, IMPUY now owns 98.73% of RBP’s outstanding shares. As contemplated in the Offer, IMPUY has decided to invoke the provision of Section 124 of the Companies Act to compulsorily acquire all the remaining shares not already acquired under the Offer. As a result, RBP will become a 100% owned subsidiary of IMPUY and will be delisted from the JSE on September 18, 2023.

RBPlats – Where’s the beef?

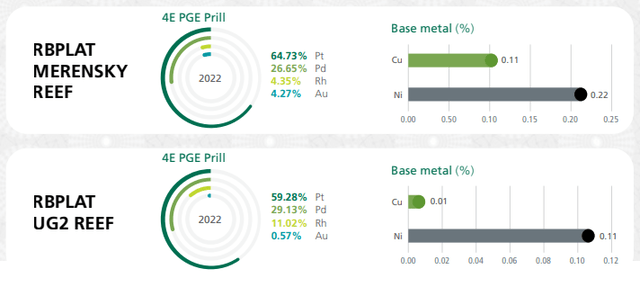

The Bushveld Complex is believed to contain the world’s largest PGM reserves. With this acquisition, IMPUY paved the way for geographical synergies through the addition of two mines (the Bafokeng Rasimone Platinum Mine, and the Styldrift Mine) to its assets in the Bushveld Complex. The RBPlats acquisition also adds mineral reserves of ~15.13 Moz 4E PGM (platinum, palladium, rhodium, and gold) together with mineral resources of ~65.69 Moz 4E PGM. Regarding the distribution of mineral resources, the Merensky Reef has a better reserves profile (9.64 Moz attributable 4E PGM at 4.36 g/t) than the UG2 Reef (5.49 Moz attributable 4E PGM at 3.88 g/t) in terms of both volume and grades. The same holds true for resources (33.69 Moz attributable 4E PGM at 7.31 g/t for the Merensky Reef versus 31.99 Moz attributable 4E PGM at 5.09 g/t for the UG2 Reef).

This indicates that a greater proportion of RBPlats’ assets comprises high-grade 4E PGM reserves/resources which is an uncommon characteristic for mining assets, in my experience. Generally, mining companies find a relatively lower grade attributable to a larger proportion of the underlying ore deposits of their mining assets, and vice versa.

What’s important is that platinum constitutes ~65% and ~60% of the mineral reserves underlying the RBPlats Merensky Reef and UG2 Reef respectively (check the chart below).

RB Platinum Reserves By Metal – Source: RBP 2022 Integrated Report

As noted earlier, during the past two years platinum prices have shown the most resilience to an overall declining trend in PGM prices. Notably, the spread between the high and low prices of the three PGMs under discussion is (in descending order):

- Rhodium: High=$29,500 Low=$4,100 Spread=$25,400/oz

- Palladium: High=$3,000 Low=$1,223 Spread=$1,777/oz

- Platinum: High=$1,274 Low=$835 Spread=$439/oz

In other words, the addition of the RBPlats assets will provide IMPUY the opportunity to enhance its production of platinum (which has proved to be the most resilient PGM element in terms of price performance) and this should reflect positively on IMPUY’s operating cash flows, free cash flows, revenues, costs, and profits over the long term. Notably, RBPlats produced approximately 450 Koz of 4E PGM during FY 2022 (year-ended December 31, 2022). With this acquisition, IMPUY’s consolidated production of PGMs can reach the mark of ~3.5 Moz per annum which is likely to put IMPUY in a leadership position in the PGM mining industry.

Waterberg Project – One for the future?

IMPUY owns a 15% interest in the Waterberg project which represents a shallow (low-cost) PGM resource located on the Northern Limb of the Bushveld Complex. On a 100% basis, the Waterberg Project has P&P reserves of ~19.50 Moz of 4E PGM and is expected to sustain an annual production of ~420 Koz 4E PGM for 45 years.

However, two headwinds currently limit the growth potential associated with the Waterberg project:

- Depressed palladium prices, as palladium constitutes 60%+ of Waterberg’s resources.

- The project operator, Platinum Group Metals Ltd. (PLG) has yet to enter into a financing agreement for the construction of the Waterberg mine (development CAPEX is estimated to be ~$1.1 BB). If PLG decides to move ahead with mine construction, it would also have to decide whether to construct a refinery for processing the Waterberg concentrate OR to enter into a concentrate offtake agreement with a third party. In case PLG decides to move with the latter option, IMPUY has the ROFR (Right of First Refusal) to match the terms offered for concentrate offtake by a third party.

According to the terms of the agreement between Waterberg JV, PLG, and IMPUY (the Implats Transaction), IMPUY has the option to increase its stake in Waterberg from 15% to 50.01% by acquiring 12.195% from JOGMEC (Japan Organization for Metals and Energy Security) against $34.8 MM and to acquire a further 22.815% stake by making a firm commitment to contribute $130.MM toward the project’s development CAPEX. If we can see a sustainable bullish momentum in palladium prices in the future, IMPUY would be well-positioned to take advantage of these clauses in the “Implats Transaction” by significantly adding to its palladium production potential. Check my most recent coverage on PLG here.

Market Outlook

Platinum: According to the World Platinum Investment Council’s 35th Platinum Quarterly Report, global platinum is expected to witness a deficit of 983,000 ounces during 2023 – the highest deficit level in almost 50 years. These numbers are based on the assumption of a primary platinum supply (refined platinum) of 5.511 Moz and a secondary platinum supply (recycled platinum) of 1.682 Moz against a global demand of 8.176 Moz. Notably, the power issues in South Africa are another headwind behind supply constraints. Meanwhile, autocatalyst demand growth in China is on a continuous rise, YoY. That said, I believe platinum’s recent price recovery may extend to the $1,000/oz mark.

Palladium: Palladium prices are currently at a 4-year low, and the pressure on palladium prices is likely to persist due to increasing platinum-to-palladium substitution in the automotive industry. Meanwhile, expectations of another rate hike in the upcoming FOMC of the FED (to control inflation) have led to a strengthening of the USD and adversely impacted palladium prices.

IMPUY Versus Peers – Valuation and Dividends

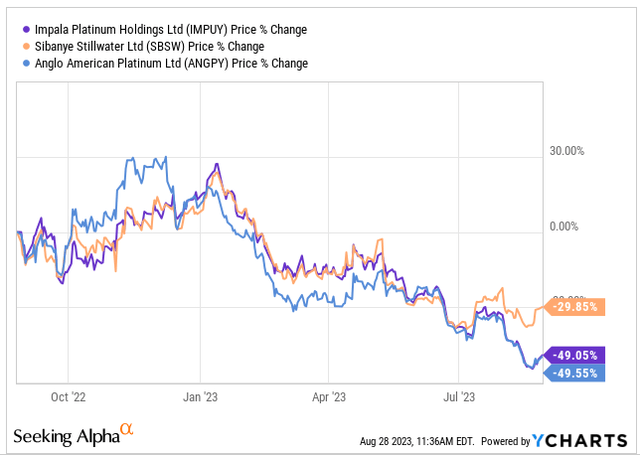

In terms of PGM production, Sibanye Stillwater (SBSW) and Anglo Platinum (OTCPK:ANGPY) are IMPUY’s competitors since they have a similar business model and geographical presence as IMPUY. At the time of writing, IMPUY last traded at $5.60 and the share price had witnessed a drop of ~50% during the past 12 months. In contrast, SBSW and ANGPY have also shed by ~30% and 50% respectively over the same period.

1-Year Price Change – IMPUY v/s peers – Source: YCharts

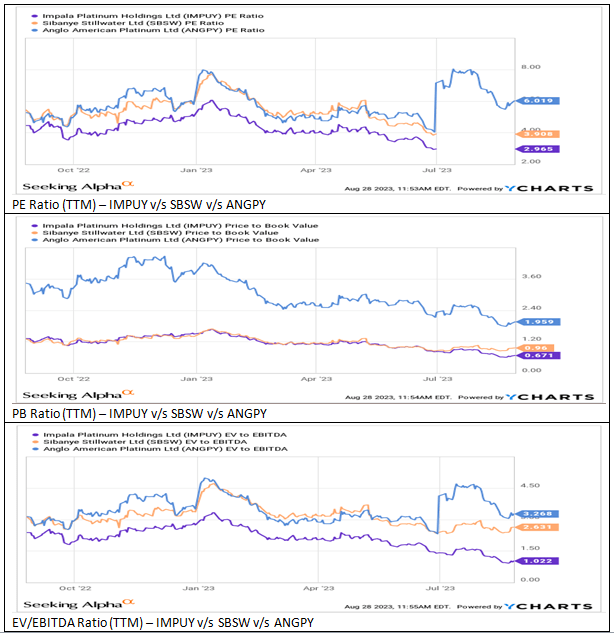

Valuation: Despite the significant price drop, IMPUY is trading cheaply compared with peers. This is evidenced by IMPUY’s favorable TTM PE, TTM PB, and TTM EV/EBITDA ratios versus peers. Given IMPUY’s acquisition of RBPlats and the future growth opportunities linked with Waterberg’s construction and development (together with the option to increase the Waterberg investment), we cannot term IMPUY’s low valuation multiples to be indicative of a low-growth stock. In my view, the stock is currently trading at an attractive valuation in relation to peers.

IMPUY – Valuation v/s peers – Source: YCharts

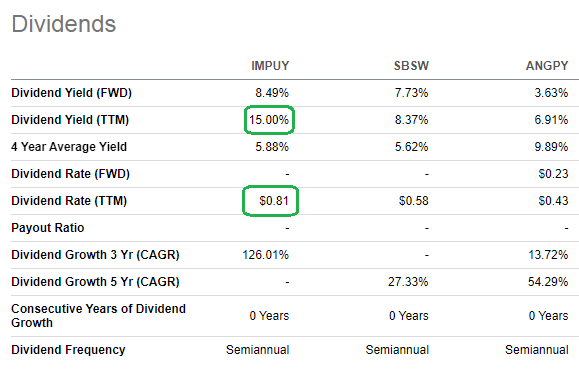

Dividends: In addition to the above, IMPUY’s price drop has significantly improved its dividend profile compared with its peers. For reference, note that IMPUY’s dividend payout during the past 12 months (at $0.81) far exceeded the TTM payout of SBSW (at $0.58) and ANGPY (at $0.43). Also, IMPUY’s TTM yield of 15% far exceeds that of its peers (8.37% for SBSW, and 6.91% for ANGPY).

Dividend Profiles – IMPUY v/s peers (Source: Seeking Alpha)

Investor Takeaway

The preceding analysis reveals that IMPUY’s FY 2023 results are likely to be impacted by a deterioration in YoY revenue and cost performance. An overall downtrend in the prices of PGMs (in particular, palladium and rhodium) is the main catalyst behind the dismal performance. However, by completing the acquisition of RBPlats, IMPUY has notably enhanced its annual PGM production capacity. With a 60%+ resource base attributable to platinum, RBPlats will help IMPUY weather the impact of declining palladium and rhodium prices since platinum prices have proved to be the most resilient during the past three years.

Meanwhile, increasing platinum-to-palladium substitution, autocatalyst demand growth in China, and an expected global platinum deficit during 2023 (and possibly beyond that period) are likely to add up to support the recent positive momentum in platinum prices. Keeping in view the option to increase IMPUY’s Waterberg holding from 15% to ~50%, together with the fact that the stock appears to be trading at a discount in relation to peers, I believe IMPUY is well-positioned to deliver suitable share price growth in the medium-to-long-term.

Nonetheless, it’s imperative to also consider the elements of risk associated with an investment in the company. IMPUY’s operations will continue to be impacted by power rationing from Eskom (the national power generation company of South Africa). Although this is a blessing for some businesses but is certainly a nightmare for mining giants like IMPUY; resulting in production losses. Besides the electricity shortage, South Africa’s political climate has given birth to multiple risks/challenges, and a potential change of government in the upcoming 2024 elections may have implications for the mining policy adopted by the new government, thereby adding to the risk profile.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here