Overview

CRA International, Inc. (NASDAQ:CRAI) is a company that provides consulting services both throughout the United States and internationally. It serves in 11 different areas including:

- Antitrust & Competition

- Auctions & Competitive Bidding

- Energy

- Finance

- Financial Economics

- Forensic Services

- Intellectual Property

- Labor & Employment

- Life Sciences

- Marakon

- Risk, Investigations, & Analytics

The company was founded in 1965 and is headquartered in Boston, Massachusetts.

Even though CRA’s valuation appears high compared to its historical average, I feel that it is positioned nicely to reward long-term investors with significant returns moving forward based on its strong record of growth (both in revenue & earnings, as well as its dividend) and its overall financial strength.

Growth

CRA’s impressive growth is one of the reasons that I feel that CRA’s current price of $108.02 is a fair price for an entry position for long-term investors.

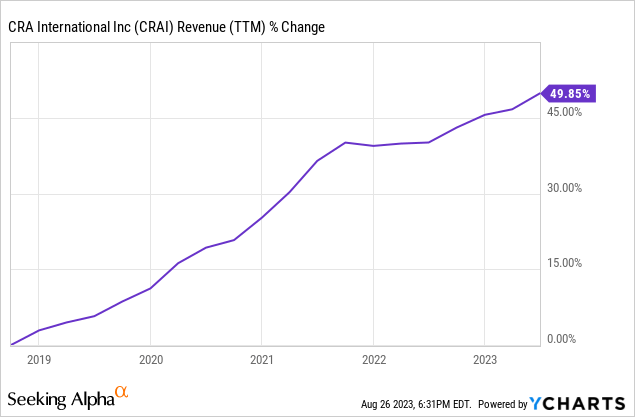

When looking at the chart below, you can see that CRA International has seen fairly steady growth of 50% over the past five years.

CRA’s most recent quarter saw an 8.6% year-over-year increase in revenue as the company saw its highest quarterly revenue in the company’s history. Just as impressive is the fact that the revenue grew across the company’s portfolio with seven of its eleven practices seeing growth and four of them seeing double-digit revenue growth.

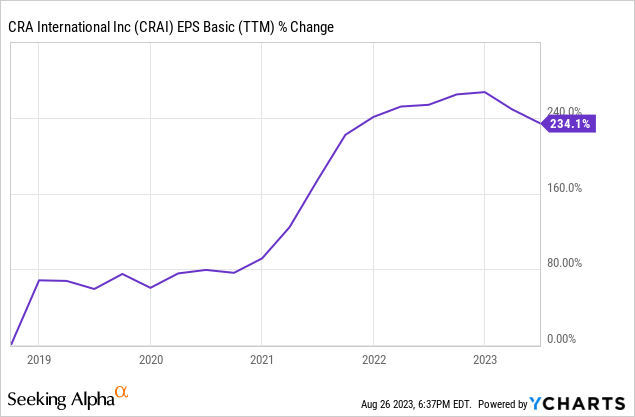

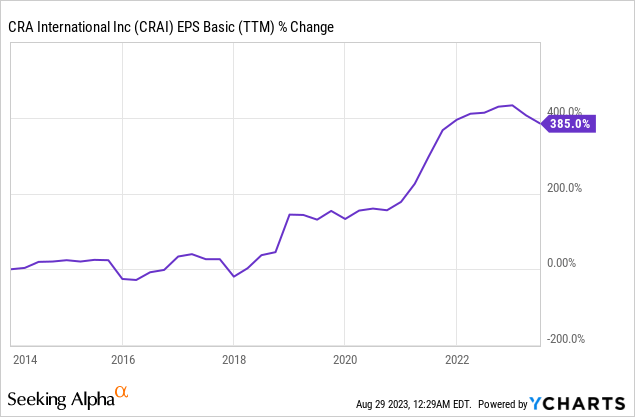

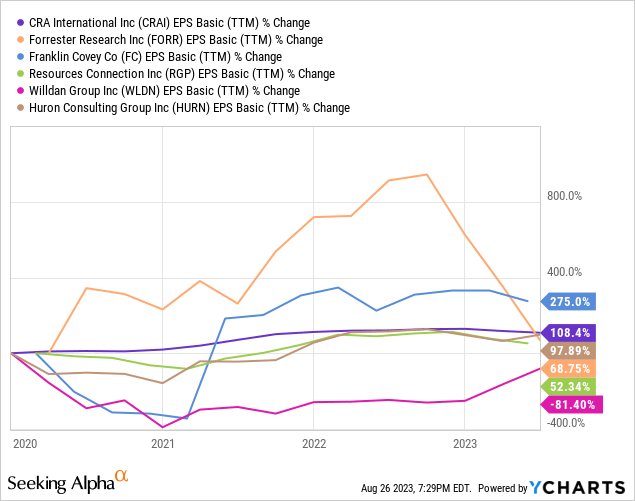

Just as impressive is CRA’s earnings growth over the past five years.

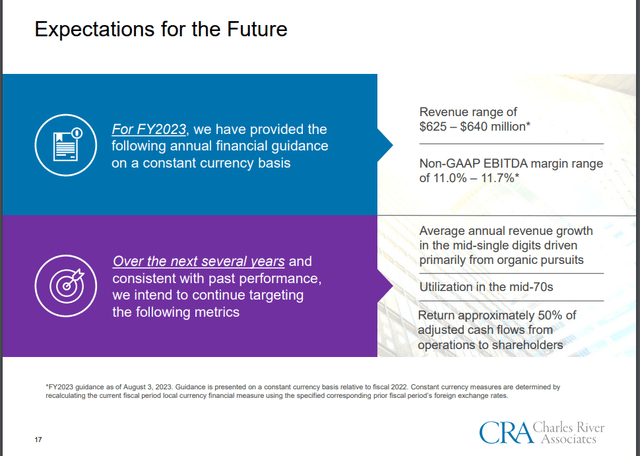

You can see that while, CRA’s earnings have seen a slight decline so far this year compared to 2022 its earnings remain well above its five-year average. This dip does appear to be a short-term issue due in part to increases in SG&A expenses as during its Q2 earnings call management increased its full-year revenue and profit guidance as follows:

Reflecting the continued strength and quality of our business, we are raising the lower end of our revenue guidance and increasing our profit guidance. For full-year fiscal 2023, on a constant currency basis relative to fiscal 2022, we expect revenue in the range of $625.0 million to $640.0 million and non-GAAP EBITDA margin in the range of 11.0% to 11.7%. This new guidance compares with a prior revenue range of $615 million to $640 million and a prior non-GAAP EBITDA margin range of 10.8% to 11.5%.

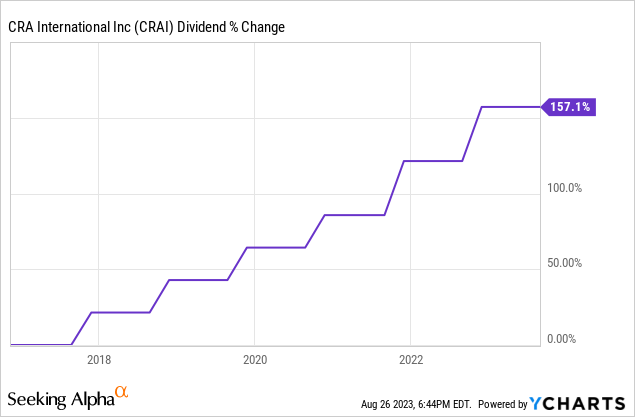

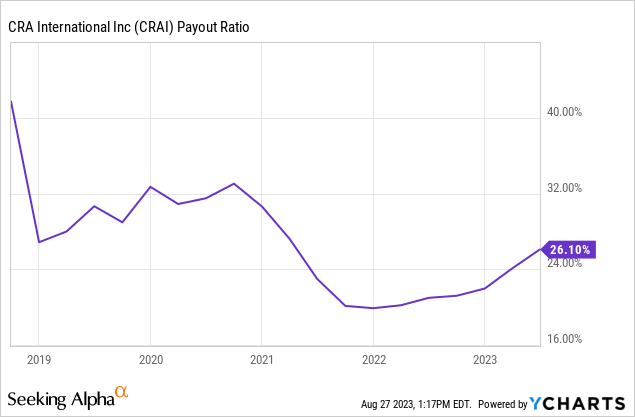

When discussing CRA’s growth, I can’t leave out its dividend. While its current yield of 1.33% might not be very impressive to dividend investors, its dividend growth most certainly is. CRA International is a Dividend Challenger with seven years of consecutive dividend growth. Dividend Challengers are stocks that have increased their dividends every year for at least five consecutive years. This list is maintained with the Dividend Champions (25+ years) and Dividend Contenders (10+ years). More information on these lists can be found here.

Looking at the chart below you can see that CRA’s dividend has easily more than doubled during these past seven years. In November of last year, CRA increased its dividend by 16.1%, the year before that, 19.2%, and the year before that 13%, which is the lowest yearly increase over these past seven years.

Valuation

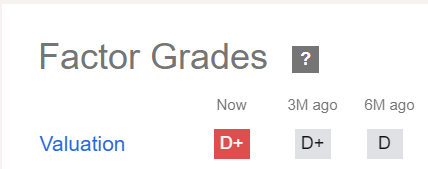

CRA International is priced high and that is reflected by its current grade at Seeking Alpha of a D+. Looking at the picture below, you can see that this is only a slight improvement from six months ago.

Seeking Alpha

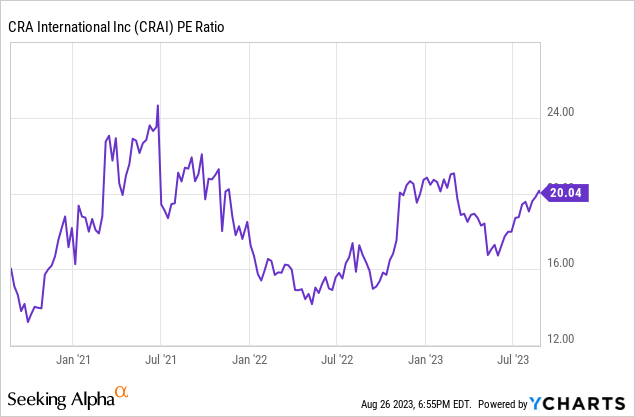

Looking at CRA’s PE ratio, you can see that the stock is expensive compared to its recent historical average.

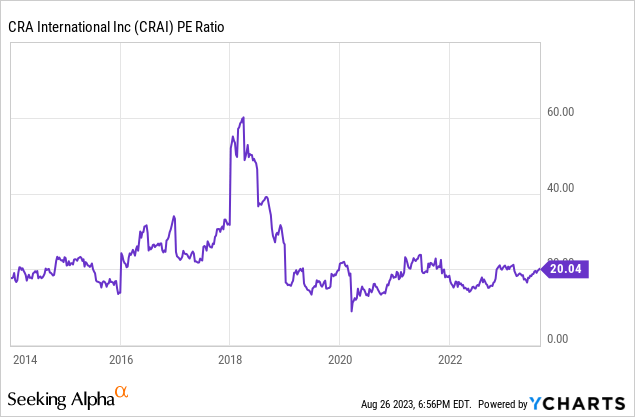

But when you look further back, the PE ratio does not appear to be out of the ordinary for this stock.

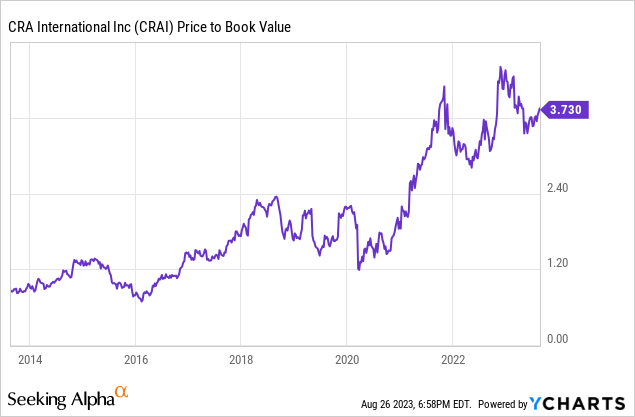

A similar trend is not seen when looking at the long-term Price to Book value of CRA International. Its current valuation remains at the high end of its long-term historical average.

So what is the fair value of CRA? A basic view can be derived by comparing its trailing PE ratio to its growth rate. For example, if in the long term, a company increases its earnings by 20% a year, its fair valuation is 20 times its earnings.

In the section above, you saw that CRA had grown its earnings by 234% over the past five years, which averages out to just over 46% a year. Looking at the past ten years, CRA has increased its EPS by 385% (a 38.5% yearly average).

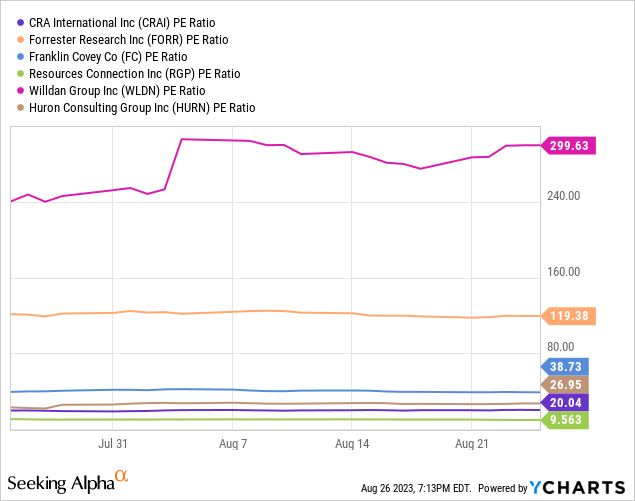

Both of these metrics put CRA’s fair value well above its current PE ratio of 20.04. But I also like to see how a company compares to similar companies in the same industry sector so let’s see how CRA International’s valuation stacks up with some of its peers within the Research and Consulting Services industry sector. Companies in this sector with similar market caps include Forrester Research (FORR), Franklin Covey (FC), Resources Connection (RGP), Willdan Group (WLDN), and Huron Consulting Group (HURN).

In terms of PE ratio, only Resource Connection has a lower PE ratio than CRA International.

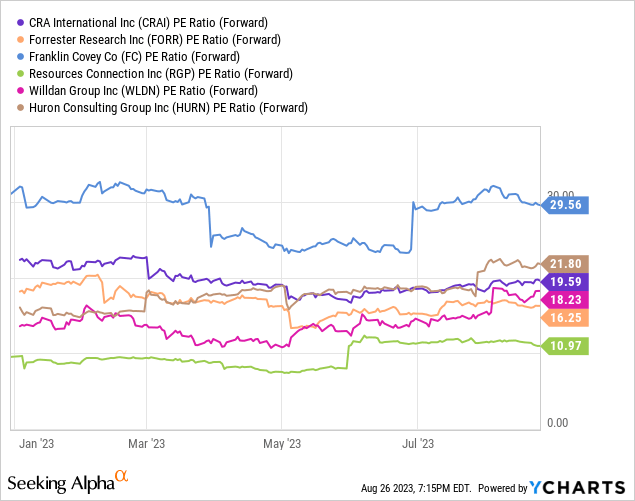

When looking at the forward PE ratio, CRA doesn’t stack up quite as well landing in the middle of the pack.

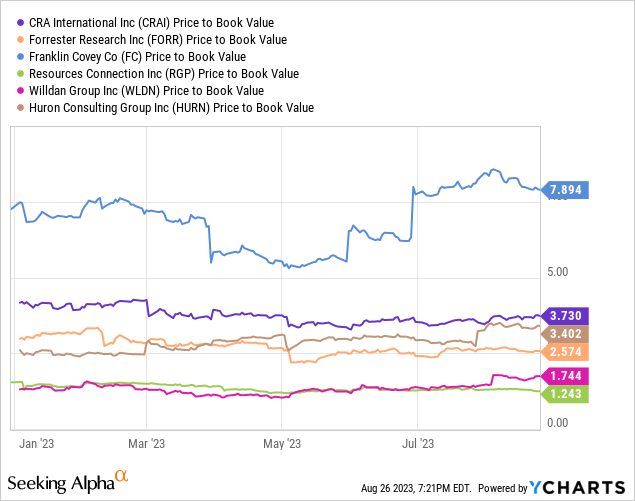

In terms of price-to-book value, CRA stacks up even worse with only Franklin Covey having a current higher price-to-book value.

When you look at these three valuations together, CRA International does seem priced higher than a few of its peers but not quite as high as others, specifically Franklin Covey.

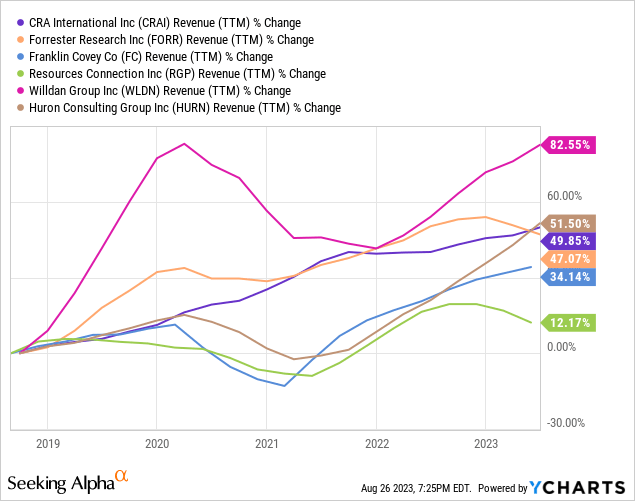

Let’s compare how these valuations compare to the five-year revenue and earnings growth of each stock.

In the chart below, you can see that two of the other stocks have seen higher revenue growth over the past five years, while three others have seen lower growth during this time period.

While CRA might not have the highest growth during this time, it does have one of the more consistent revenue growth lines over these past five years.

In terms of earnings growth, only Franklin Covey has seen higher earnings during this time period.

So in terms of its industry, I feel that CRA is priced appropriately compared to its peers and based on the fair value equation of the trailing PE ratio is equal to the long-term EPS growth rate, CRA is actually underpriced when looking at its five and ten year EPS growth rates.

Outlook and Conclusion

CRA International’s Q2 earnings call showed that the future continues to look promising. Several factors play a part in this including:

- 15% increase in CRA’s projected lead flow (the third straight quarter of double-digit project lead flow growth).

- 5% growth in new project originations

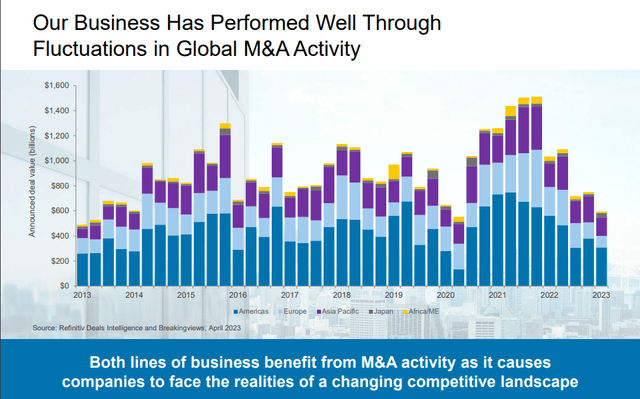

- 33% sequential increase in worldwide M&A activity

- 33% sequential increase in merger-related lead flow

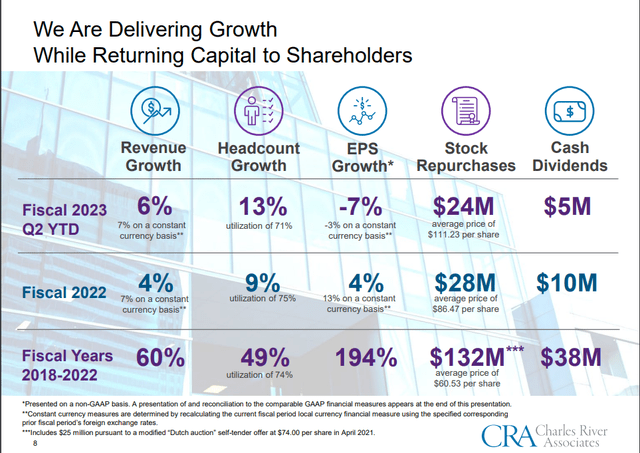

Looking at the graph below, you can see that in the past five years, CRA International has done a good job of returning value to stockholders, a trend I believe will continue moving forward.

CRAI International

Looking at the stock repurchases, the average share price for fiscal year 2023 YTD is $111.23 which is higher than the current price of $108.02.

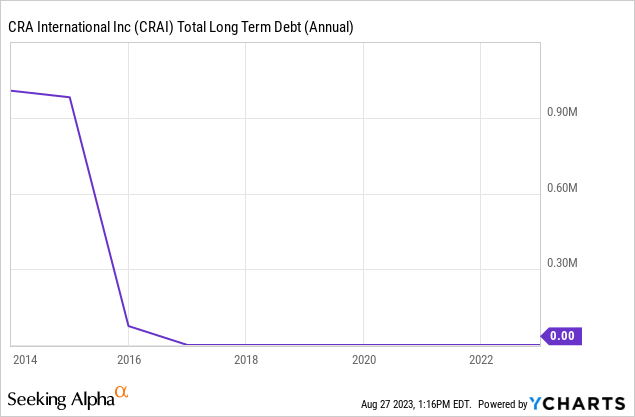

Taking into account the fact that CRA International has no long-term debt (as seen in the first chart below) and maintains a low payout ratio (as seen in the second chart below), the likelihood that CRA will continue to be able to see these types of returns is high.

Looking at the picture below, you can see what CRA’s expectations are for the future.

CRA International

I see no reason to believe that CRA won’t be able to meet or even exceed these expectations moving forward. The company maintains a solid balance sheet, a strong record of revenue/earnings growth, a fast-growing dividend, and a shrinking number of shares outstanding in regard to its stock.

I believe these factors will only increase the price appreciation of CRA’s stock moving forward. CRAI is down $12.28% YTD and I believe this has created a great opportunity for long-term investors looking for a solid entry position without overpaying.

As with any company, there are risks associated with the ability of a company to continue delivering revenue and earnings growth whether these are operational, market, or international risks.

One of the biggest risks associated with CRAI is global M&A activity as both of CRAI’s two lines of business benefit from increased M&A activity so any large drop in M&A activity could have a significant impact on revenue and earnings growth. Another risk that CRAI and most companies face is increased competition. A third risk associated with CRAI is uncertainty in global markets along with changing foreign currency rates. With CRAI’s international revenue growing at a faster pace than its United States revenue, the amount of international risk for CRAI will continue to climb.

However, I believe that CRAI is well positioned to react to and minimize such risks in part based on the fact that consulting services usually remain in demand during both positive economic times as well as challenging economic times. Also, the fact that CRAI provides services across a broad range of industry sectors helps minimize industry-specific risks such as the recent trend of flat legal spending.

Looking at the chart below, you can see that CRAI has a strong history of performing during both high and low overall global M&A activity.

CRA International

CRA also continues to focus on recruiting and maintaining a high-talent level staff, which will be crucial in its ability to compete and win in an increasingly competitive market. Because of these factors, I view risks associated with CRAI as minimal and consider it a great buy option for long-term dividend growth investors. As always, I suggest individual investors perform their own research before making any investment decision.

Read the full article here