Ubiquiti Inc. (NYSE:UI) is a stock that I have followed for a long time now. You can see my first article written about the company was 9/15/2014. I was a believer in the stock as a long term investment at that time. I turned out to be very right. I also betrayed my own analysis and sold out of the stock at a gain, albeit not near the gain I could have seen if I had held the stock for the longer term. It is one of the investing lessons that sticks with me to this day. I have not repurchased shares in the stock since selling my shares years and years ago. I have continued to watch it though, mostly kicking myself for not holding for the longer time like I had planned on doing.

The recent stock price drop has brought me back to reconsider purchasing the shares once again. Many of the reasons I liked the stock all those years ago are still true today. The company has stuck to its business model and been successful. I want to see if now is a good time to jump back in on a stock that taught me some important investing lessons.

A Long Long Time Ago….

I originally invested because I liked the business strategy and the way the company was run. The business was run with a long term view in focus. The cost structure continues to impress me. It allows the company to have a high profit margin in the industry. It has high insider ownership which is probably a main reason why the company does not focus on the short term demands of the market.

There was also the growth story that I liked about the stock. They were an up and coming company in the space and looking to gain market share. They did see strong growth since I first invested in the company in 2014. Revenues grew from $572.5 million in 2014 to $1.9 billion for the year ended 2021. That is a 231% increase in revenues and a CAGR of approximately 19%. That growth potential is one of the reasons that drew me into the stock from the beginning.

Company Strategy

One of the main reasons that I liked the stock, and this has not changed, is the business strategy and how the company is run. It often sounds cliche when talking about business culture and strategy, but the way Ubiquiti runs their business is very different from competitors. I believe this strategy is why the company was able to grow and has been successful. I believed in their business strategy years ago and I still believe in it now.

The company does not spend much money on marketing and sales. Their R&D budget is double their SG&A (remember SG&A is not just marketing and sales but also includes your general and admin costs). The company puts its time and money into the engineering and making of products. The company hires smart people to make good products and let those products speak for themselves in the market. They also sell those products at a very competitive price since their cost structure is less than many competitors. They also mostly sell through distributors so they don’t have to worry about a large number of employees and in house costs for sales and distribution. Their gross margin is often times lower than competitors for this reason. They do not have a large and expensive sales arm to capture market share. Rather than put company focus on sales and distribution they do what they think they do best and that is R&D.

This business strategy allows the company to run very lean. They do not have nearly as burdensome payroll as many companies and allow them to be more nimble and adjust easier with the market. It also means they get very strong returns on capital and assets. The contrast in costs with competitors is pretty dramatic. I have outlined in the chart below the SG&A spend as a percentage of revenue for Ubiquiti and compared to some competitors in the marketplace.

|

Company |

Revenue (thousands) |

SG&A (thousands) |

SG&A to Sales |

|

Ubiquiti Inc. |

$1,691,692 |

69,859.0 |

4.1% |

|

Juniper Networks (JNPR) |

$5,301,200 |

1,382,900.0 |

26.1% |

|

Cisco (CSCO) |

$51,557,000 |

11,186,000.0 |

21.7% |

|

F5, Inc. (FFIV) |

$2,695,845 |

1,201,149.0 |

44.6% |

|

Extreme Networks (EXTR) |

$1,112,321 |

363,167.0 |

32.6% |

|

Ciena Corporation (CIEN) |

$3,632,661 |

645,947.0 |

17.8% |

The difference in SG&A spend to that of competitors is drastic. You can quickly see there is a difference in company strategy between Ubiquiti and competitors. I liked it years ago and still like what Ubiquiti is doing. They are spending their time on developing products. I think this is a long run winning strategy. As sales grow SG&A is likely to become an even smaller piece of the pie. UI does not have a large sales team that is getting big commissions that increase with sales. As they grow revenues I would not expect the SG&A to increase much from where it currently sits.

There is the catch where you can have the best product in the world but if no one knows about it (marketing) then it does you no good. That is a potential risk with this go to market strategy. You are also fairly reliant upon third parties to distribute your products. You lose a lot of control over your sales and distribution channel.

There is give and take to whatever approach you choose. I personally think the Ubiquiti strategy is a winning one.

Insider Ownership

This company strategy is based upon the founder, Robert Pera. Robert is an engineer. He graduated with a degree in electrical engineering and worked for Apple. He built a low cost WiFi module and started Ubiquiti from there. He is an engineer and built his products. The company is run as if it were run by an engineer. Efficient and no fluff.

He also owns a massive share of the company. Currently 93% of the shares are held by insiders. I think this allows the company to take a longer view with their investments and decisions. They are not as worried about meeting next quarterly numbers as they are about doubling the size of the company over the next 5 years. Insiders are not worried about a quick but more so the long haul. I can also see how some could see this as a negative. It can create a silo where too much is controlled by one individual. What if that person starts making some irrational decisions.

I think overall the fact the founder still owns such a large percentage of the company is a positive. It allows the company to make better decisions for the company over the long run.

Competitor Analysis

I have talked about the cost structure and the difference between Ubiquiti and competitors. We see how the SG&A is drastically different. Now we can look to see how that passes through to other aspects of the company as compared to peers. The first metric we will look at is sales.

|

Company |

Market Cap (billions) |

Revenue (thousands) |

P/S |

|

Ubiquiti Inc. |

9.62 |

$1,691,692 |

5.7 |

|

Juniper Networks (JNPR) |

9.04 |

$5,301,200 |

1.7 |

|

Cisco (CSCO) |

228.12 |

$51,557,000 |

4.4 |

|

F5, Inc. (FFIV) |

9.39 |

$2,695,845 |

3.5 |

|

Extreme Networks (EXTR) |

3.59 |

$1,112,321 |

3.2 |

|

Ciena Corporation (CIEN) |

6.28 |

$3,632,661 |

1.7 |

Ubiquity seems to have a rich valuation when compared with peers on a price to sales ratio. It has a much higher P/S ratio than many competitors. There are a few reasons for this. One is that people consider the growth potential in revenues for Ubiquiti to be much better than competitors. The other answer is based upon what we have previously discussed. The company runs extremely efficiently. Their cost structure allows them to be much more profitable. We need to look at a few other metrics.

|

Company |

EPS |

P/E |

Operating Income |

OM |

|

Ubiquiti Inc. |

$6.14 |

25.9 |

$462,264 |

27.3% |

|

Juniper Networks (JNPR) |

$1.46 |

19.3 |

$539,300 |

10.2% |

|

Cisco (CSCO) |

$2.83 |

19.8 |

$13,975,000 |

27.1% |

|

F5, Inc. (FFIV) |

$5.34 |

29.6 |

$411,701 |

15.3% |

|

Extreme Networks (EXTR) |

$0.34 |

82.6 |

$72,945 |

6.6% |

|

Ciena Corporation (CIEN) |

$1.01 |

41.6 |

$257,230 |

7.1% |

When looking at some of the profitability metrics Ubiquiti looks much more reasonably valued. The company does have a P/E ratio that is in the middle of the pack. The operating margin for the company is phenomenal in comparison with its competitors. Cisco is actually very impressive itself. Obviously, the behemoth in the market. They have a lot of pricing power due to their size. I debated whether or not to include them as a competitor due to the massive size difference. The market cap is nearly 20x that of Ubiquiti. The fact is they make competing products so I thought it would be good to include them and see how Ubiquiti matches up on certain metrics.

The OM or EBIT or EBITDA margins (all three of these show similar percentages for the analysis above) are critical for a company. Profitability is oftentimes overlooked in the age of chasing revenues and the next big thing. It can be seen so starkly when comparing the figures above. For example, Ubiquiti has 32% of the revenues as JNPR, but their operating profit is 86% that of JNPR. It only needs ⅓ the revenue of JNPR in order to produce the same profit.

The last metric that shows the efficiency at which Ubiquiti operates in comparison with competitors is the profit per employee. The chart below shows the operating profit per employee for each of the companies.

|

Company |

Employees |

Op. Income/Employee (thousands) |

|

Ubiquiti Inc. |

1,377 |

$335.7 |

|

Juniper Networks (JNPR) |

10,901 |

$49.5 |

|

Cisco (CSCO) |

79,500 |

$175.8 |

|

F5, Inc. (FFIV) |

6,550 |

$62.9 |

|

Extreme Networks (EXTR) |

2,643 |

$27.6 |

|

Ciena Corporation (CIEN) |

8,000 |

$32.2 |

When you first see Ubiquiti on a P/S ratio it looks expensive. A good reason you don’t want to put your faith in one metric. Once you look at the profitability of Ubiquiti and compare other metrics you see that it is not expensive compared to its peers.

The other part to consider with the current value on UI is that it only has 60 million shares outstanding. It does not take a lot of revenue growth with its profit margins to be able to increase the EPS. You can see this in the expectations for UI. Analysts expect to see EPS of $8.99 a share next year (June 2024). A significant jump from the $6.87 expected this year (June year end so these results will be available soon).

Price Action

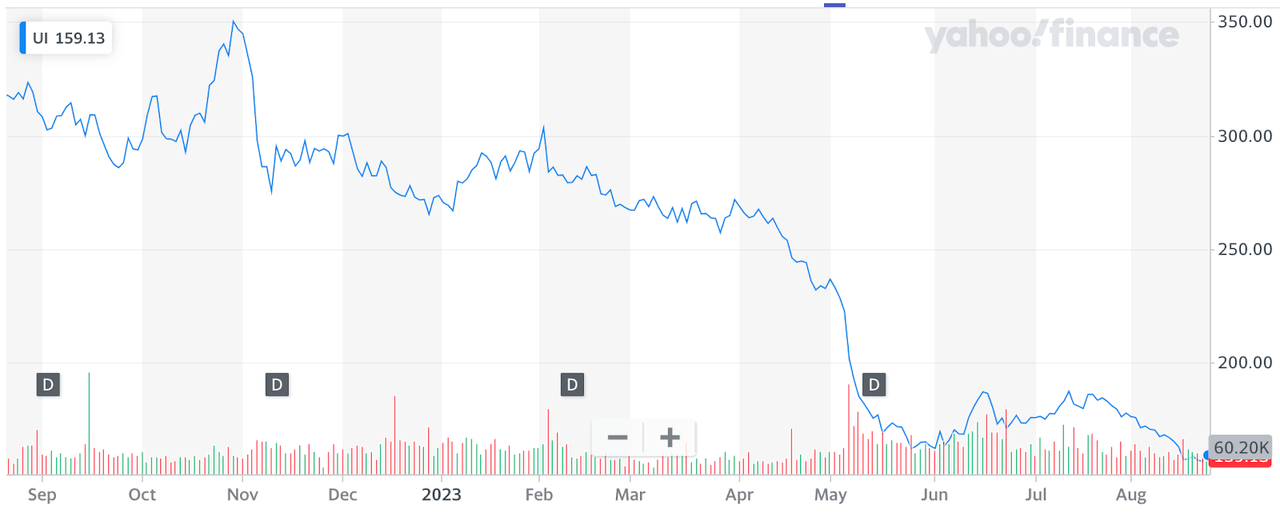

One of the reasons I have become interested in Ubiquiti again is due to the price drop that the stock has experienced. The stock price hit a high of $350.63 on October 28, 2022. Since that time, it has dropped to a low of $155. That is a drop of over 55% in the price of the stock. You can see in the chart below the steep drop experienced right around earnings at the beginning of May. Investors were not too happy with the results.

Yahoo.com

The stock seemed a little overvalued at its peak. But a 55% decline is a major drop for the stock price. What is the cause of the drop and is it a business model problem or something that is more short term? That decline may well be warranted, or it could also be an overreaction from the market and present a buying opportunity.

Present and Future

I am not going to pull out my tea leaves and tell you the future, but I do want to review why the company most likely saw a drop in share price and also what to expect going forward.

Revenues have consistently grown year on year, up until 2022. Revenue in 2021 was $1,898 thousand and in 2022 revenue fell to $1,691 thousand. That is an 11% decline in revenues. This is what spooked investors and caused the stock price to drop. Rightfully so as well. The stock had been priced for growth and all of a sudden it turned negative. The company had up until 2022 been a growth story and that changed in 2022. The other part that I believe caused the stock price drop was the fact that the company reported negative cash flow in the quarter. The cause for the revenue declines leads into the reasoning behind the negative cash flow as well. The cause of that decline seemed to be explained by the company in their company filings, a couple of excerpts are included below.

“While components and supplies in the past have been generally available from a variety of sources, we and our contract manufacturers currently depend on a single or limited number of suppliers for several components for our products and the impact of COVID-19 and the current shortage of chips has limited our ability to meet demand….. Our inability to procure sufficient quantities of certain components during fiscal 2022, including chipsets, has had a negative impact on our ability to manufacture our products and increased the costs associated therewith, and we expect these supply constraints, and their negative impact on our manufacturing output and associated costs, to continue. We do not stockpile sufficient components, particularly the chipsets, to cover the time it would take to re-engineer our products to replace the components which comprise the raw materials for our product offerings and we generally do not have any guaranteed supply arrangements with our suppliers for these components (including the chipsets).”

“During fiscal 2022 our revenues were negatively impacted by our inability to fulfill demand due to the global component supply shortage and the continued outbreaks of COVID-19 around the world. These factors have limited our ability to meet demand, caused us to delay introducing new products, prioritize which products are manufactured, what regions receive products, and significantly increased our backlog of orders and we expect to continue during fiscal 2023.”

Anyone who has tried to buy anything over the last 3 years is well aware of the disruptions in the supply chain from COVID. This makes sense to me and I believe company management. There are a few reasons that I believe them and see things turning back to growth. First is that the company has already returned to growth. The company has seen positive year over year growth in each of the last three quarters. The trailing twelve months show revenue of $1,892 thousand, that is nearly back to the 2021 revenue levels. As long as the company sees year over year growth in the 4th quarter then it will surpass the revenue of 2021. Second is that analysts are projecting that the company will have revenue of over $2 billion next year. Not that taking an analyst’s estimate is reason enough. But if the company has a history of meeting estimates, then it is something that should be taken into consideration. The last reason is that the company has already taken measures in an attempt to eliminate the issue they described. As the saying goes, put your money where your mouth is.

In an attempt to have enough supply on hand to meet demand and not lose out on revenue the company has made very large inventory purchases. The large amounts of inventory purchased are what caused the company to have negative cash flow in the prior quarter. Inventories were at 262 million in March of 2022 and in March of 2023 inventories were 743 million. That is a $489.5 million increase in inventory. It was not that the company suddenly became a poor margin business and started to operate at a negative cash flow rate. They made a business decision to purchase more inventory to help ensure they can get the inventory they need to meet demand.

The provide their reasoning for this large purchase in inventory in the company filings:

“We have experienced significant supply constraints caused, in part, by the COVID-19 pandemic. Our efforts to mitigate these supply constraints have included, for example, increasing our inventory build in an attempt to secure supply and meet customer demand, paying higher component and shipping costs to secure supply and modifying our product designs to leverage alternate suppliers. Although these mitigation efforts are intended to optimize our access to the components required to meet customer demand for our products, they have increased, and are expected to continue to increase, our balances of finished goods and raw material inventories. The increasing balance of finished goods and raw material inventory significantly increases the risks of future material excess, obsolete inventory and related losses. We believe that we are taking the right actions to mitigate these continuing supply constraints, however, we recognize the associated risks.”

The company explains it very clearly here and also outlines the negatives to this strategy. There are additional costs to purchasing large amounts of inventory and some newly associated risks. The inventory could easily become obsolete and cost the company a lot of their upfront money. One cost they do not mention is interest. The company had to draw on their credit lines in order to make the large inventory purchases. They are going to be paying high interest rates on that inventory.

The inventory purchase is definitely not without risk. It also has costs connected to it that can affect the profitability of the company. Overall it comes down to trusting management that the benefits from the decision will outweigh the new risks that will come from it. I trust management to know their business and know that this is the right decision going forward.

Either way I do not see the issues that caused the decline in revenues and cash flow to be long term problems. They are not problems with the fundamentals of the business. It is outside circumstances that have affected the performance of the company. Hopefully, the steps they have taken will mitigate these risks, if not I consider them to be short term in nature. While it may cause the price to drop in the short term, over the long haul it should not affect the company.

Risks

The first risk that comes up with UI is what was just barely discussed. The company is carrying very large amounts of inventory on its balance sheet. This inventory was financed. If the inventory is to become obsolete the company will be stuck with the loss and also have to pay the interest and principal on a loan for a product that is no longer of value.

The company experienced a decline in revenues last year. The reasons for this decline still persist. While management has formulated a plan to mitigate the issues from the supply chain, there is no saying their strategy will be successful.

Conclusion

I have always liked UI as a company. The company operates in a very different way than competitors. The cost structure is great for the company. It is able to operate very lean and profitable. It operates much more efficiently and profitably than its competitors. I once upon a time was a buyer of the stock with a long term position. I sold for a gain but did not hold on long enough. I have not jumped back into the stock during its run up over the past years. The recent pullback in the stock price provides an opportunity to reevaluate my position, or lack thereof, in the stock.

The pullback in the stock is due to negative revenue growth and also negative cash flow. Both of these issues stem from supply chain problems that I consider to be short term problems. Management has taken a position to try and mitigate these issues. This strategy has its risks as well as some additional costs. I think management is doing what it needs to in the short term to continue to grow the company. I am a buyer of UI at current prices.

Read the full article here