Introduction

CRISPR Therapeutics (NASDAQ:CRSP) focuses predominantly on ailments such as transfusion-reliant beta thalassemia (TDT) and acute sickle cell disease (SCD). In collaboration with Vertex Pharmaceuticals (VRTX), the company is making strides with exa-cel, a therapy using CRISPR gene-editing. Prominent regulatory bodies, like the FDA and European Medicines Agency, are currently evaluating the potential approval of this therapy.

In my previous analysis, I highlighted CRISPR’s role in gene-editing, with exa-cel showing immense potential for SCD and TDT. Despite the promise, they face fierce competition. Regulatory approval is unpredictable, and the healthcare sector evolves rapidly. Considering the risks, I viewed CRISPR as a speculative investment at its current valuation. I advised a ‘Hold’ stance for those willing to take risks in the gene-editing arena, emphasizing the importance of monitoring upcoming data and regulatory outcomes.

The following article details CRISPR’s gene-editing advancements, especially exa-cel’s potential for certain genetic diseases, and its financial implications for investors.

Q2 Earnings Report

Looking at CRISPR’s most recent earnings report, cash on hand and accounts receivable dropped by $25.4M to $1,843M in June 2023 from $1,868.4M in December 2022, driven mostly by operating costs. This decrease was cushioned by a $100M payment from Vertex and a $70M receivable from a research milestone. Revenue from collaborations was $70M, largely attributed to a deal with Vertex. R&D expenses decreased to $101.6M, and G&A costs went down to $19M. Collaboration expenses rose to $44.6M due to the exa-cel program. The net loss reduced to $77.7M from $185.8M in 2022.

Cash Runway & Liquidity

Turning to CRISPR’s balance sheet, as of June 30, 2023, the combined assets under ‘Cash and cash equivalents’, ‘Marketable securities’, and ‘Investments’ totaled $1.77B. Over the last six months, the “Net cash used in operating activities” stood at $124.4M, translating to a monthly cash burn of approximately $20.7M. Considering this burn rate, CRISPR has an estimated cash runway of roughly 85.5 months or just over seven years. However, it is important to caution that these values and estimates are based on past data and may not be indicative of future performance.

In terms of liquidity, the company seems well-positioned with a robust asset base, especially when considering the total current assets of $1.86B. CRISPR appears to have no debt, a positive sign for potential investors or lenders. Given the current assets and absence of significant liabilities, securing additional financing, should the need arise, seems feasible for CRISPR. These observations and/or estimates are my own and might vary from other analyses.

Valuation, Growth, & Momentum

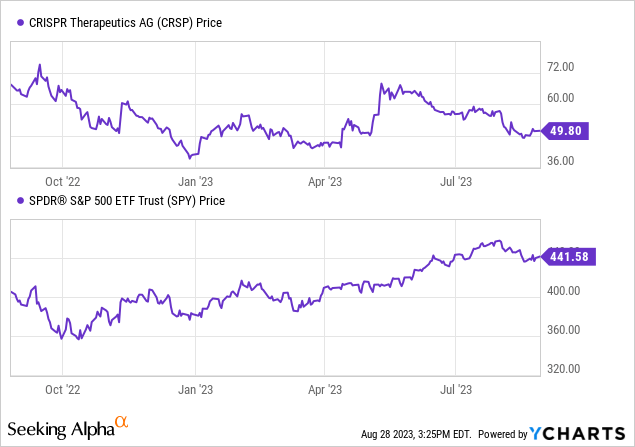

According to Seeking Alpha data, CRISPR’s capital structure includes a moderate debt level, with “lease liabilities” being classified as debt—this explains the difference between my analysis of CRISPR’s financial health and the data from Seeking Alpha. The firm maintains a sizable cash reserve relative to its market capitalization, resulting in an enterprise value of $2.42B. When evaluating its valuation, criteria such as EV/Sales indicate a premium price tag. Yet, the company’s transition from a pre-revenue stage coupled with significant year-over-year sales growth underscores its promising growth trajectory. This reflects its developmental phase and the anticipated income from its gene-editing solutions, especially exa-cel. Momentum has been mixed with the stock underperforming the broader market, witnessing a decline over the past year.

ICER Evaluations: Lovo-cel and Exa-cel’s Market Implications

CRISPR, in partnership with Vertex, has made substantial progress with exa-cel in its development pipeline. As it stands, the U.S. Food and Drug Administration (FDA) is actively reviewing the Biologics License Applications (BLAs) for exa-cel’s potential in addressing severe sickle cell disease [SCD] and transfusion-dependent beta thalassemia (TDT).

ICER’s Analysis and Implications for the Sickle Cell Disease Market:

The Institute for Clinical and Economic Review (ICER) is pivotal in guiding pricing for emergent therapies by juxtaposing their clinical merits with financial outlays. In the race between CRISPR’s exa-cel and bluebird bio’s (BLUE) lovo-cel:

-

Lovo-cel clinched a “B+” rating, denoting its significant advantages over conventional treatments.

-

Exa-cel received a “C++” rating, implying its effects could be commensurate with or even surpass existing care benchmarks.

Both therapies come with an approximate $2M price sticker, and ICER recommends a Health-Benefit Price Benchmark that oscillates between $1.35M and $2.05M.

Nuanced Insights:

-

Decoding the Grades: The distinction between a “B+” for lovo-cel and a “C++” for exa-cel, while nuanced, carries weight. Lovo-cel promises a more uniform enhancement over standard care. Meanwhile, exa-cel’s outcome spectrum seems broader, hinting at potential variability in its efficacy for individual patients.

-

Navigating the Market Landscape: With both therapies jostling at comparable price echelons, factors like demonstrable efficacy, patient accessibility, post-treatment support, and holistic experiences for both patients and healthcare professionals (HCPs) become paramount in determining market dominance.

-

Stakeholder Implications: The tight race in terms of price and ICER evaluations necessitates stakeholders, including insurers and healthcare institutions, to lean heavily on empirical data and anecdotal patient narratives. These insights will become instrumental in crafting reimbursement frameworks, preferred treatment modalities, and comprehensive patient counseling.

Broadening the Lens on the Sickle Cell Disease Market:

Sickle cell disease, a chronic condition with limited treatment options, has long sought innovative therapeutic avenues. The introduction of gene therapies like exa-cel and lovo-cel heralds a potential paradigm shift in management. However, the pathway is not devoid of challenges:

-

Patient Reception: The promise of potentially curative treatments is alluring. Still, the high costs and unknown long-term effects could induce hesitation among patients, necessitating robust patient education and engagement strategies.

-

HCPs’ Approach: For healthcare professionals, balancing the enthusiasm of groundbreaking gene therapies with the pragmatism of safety, efficacy, and cost will be pivotal. There might be a learning curve involved in assimilating these therapies into clinical practice.

-

Gene Therapy in the Market: As gene therapies venture into uncharted waters, they’ll grapple with skepticism, rigorous post-market surveillance, and evolving regulatory landscapes. Crafting a balance between patient accessibility, affordability, and sustainable business models will be a formidable challenge.

In essence, while ICER’s evaluations provide a compass, the journey for gene therapies like exa-cel and lovo-cel in the sickle cell disease market is intricate, necessitating adaptive strategies and proactive stakeholder engagement.

My Analysis & Recommendation

The fervor surrounding gene therapies, notably within the realm of CRISPR Therapeutics’ pioneering advances, cannot be overstated. The groundbreaking potential these therapies harbor to reshape the landscape of genetic diseases, specifically SCD and TDT, is undeniably significant.

However, the recent ICER assessment paints a slightly more nuanced picture for CRISPR’s flagship product, exa-cel. The subtle grading differential between exa-cel and lovo-cel introduces an element of variability and uncertainty in terms of patient outcomes. This disparity has implications not just for investors, but for patients, healthcare professionals, and the broader healthcare ecosystem. It’s essential to remember that the true metric of success in the healthcare sector lies beyond mere ratings – it hinges on real-world outcomes, patient experiences, and the actual value delivered to the health system.

For investors, the coming weeks and months will be crucial. Not only will the regulatory decisions set the pace, but the market uptake of CRISPR’s therapies and gene therapies at large remains an enigma. It’s one thing to receive approval, and another to achieve widespread adoption, especially when patient perceptions, long-term efficacy, and post-therapy support come into play. The uncertainty underscored by ICER’s assessment adds another layer of complexity to an already challenging landscape.

So, where does this leave CRISPR from an investment perspective? Given the combination of tremendous upside potential juxtaposed with palpable risks, particularly in the wake of the ICER ratings and the unpredictability of market adoption, my recommendation remains unchanged. I advise investors to maintain a “Hold” position on CRISPR. This stance allows room for observing how the evolving dynamics pan out, especially as the interplay between regulatory outcomes, market adoption, and competitive pressures comes to the fore. CRISPR undeniably remains a force to reckon with in the gene-editing domain, but a cautious optimism, underpinned by a discerning assessment of unfolding events, is warranted.

Read the full article here