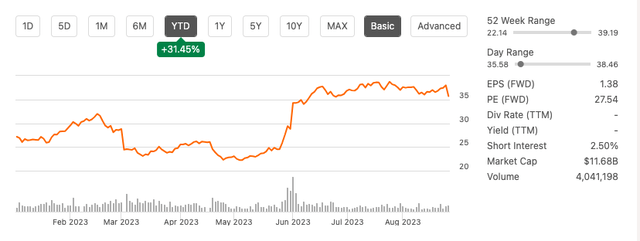

At the beginning of this year, I wrote an article focusing on Pure Storage, Inc. (NYSE:PSTG) and its strategic positioning within the data-driven landscape. The company has consistently exceeded EPS expectations for the past sixteen quarters and is set to release its Q2 2024 financial results on August 30. As a leading figure in flash storage technology, Pure Storage has gained momentum, achieving strong Q1 2024 results and delivering a 31.45% year-to-date return for investors, while maintaining a low short interest of 2.50%.

Stock trend year to date (SeekingAlpha.com)

Despite the significant stock momentum, Pure Storage still possesses untapped growth potential ahead of earnings and for the full financial year due to the release of recent innovations, a substantial increase in enterprise customers, a clear competitive advantage over outdated technologies and management have maintained the FY2024 guidance. Although cautious of ongoing macroeconomic headwinds, I maintain a long-term bullish stance on this stock ahead of its upcoming earnings release.

Compelling storage company

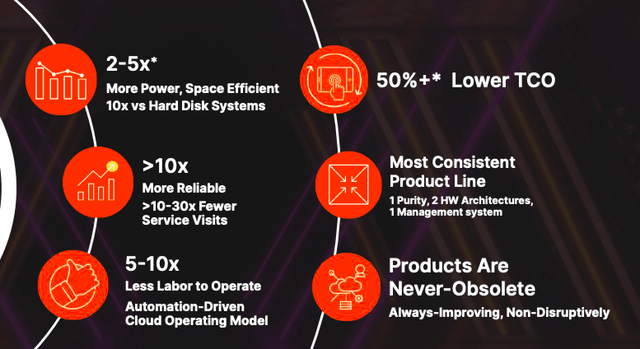

In my previous article, I gave an overview of Pure Storage, which delivers an increasingly important service in our data-driven world. Efficient data storage is more critical than ever, and Pure Storage stands out for its high-performing solutions that surpass older hard disk systems. In the previous quarter, we saw the company onboard 276 customers, introduce innovations and expand existing solutions. Solutions have clear competitive advantages over older technological solutions, which can give us confidence in the company’s potential to continue to grow its top and bottom-line fundamentals.

The company has consistently demonstrated financial strength, as evidenced by exceeding EPS and revenue expectations in Q1 2024 despite headwinds in the IT industry. Pure Storage has also launched innovative products such as Evergreen-One and FlashBlade-E that are in high demand. The company’s focus on AI infrastructure and a cloud operating model further enhances its competitive edge, providing customers with competitively priced and high-performance solutions. Pure Storage has also formed significant partnerships, including a recent long-term agreement with Microsoft (MSFT) to offer storage capabilities.

Competitive advantage (Investor presentation 2023)

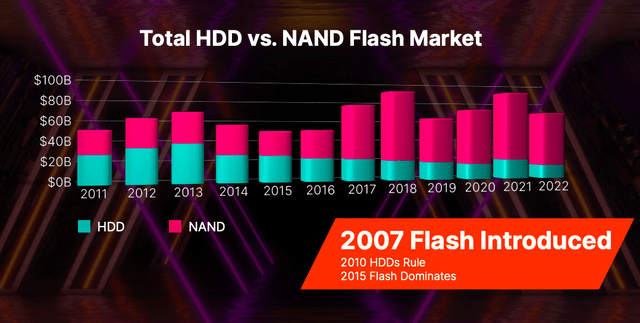

As a leader in Storage recognised by Gartner, Pure Storage draws from its comprehensive platform, modern approach, and storage-as-a-service pricing model to attract customers. The popularity of flash storage has dramatically reduced the demand for hard disk drives (HDDs). It is predicted that by 2028, there will be no further HDD sales.

HDD versus Flash (Investor Presentation 2023)

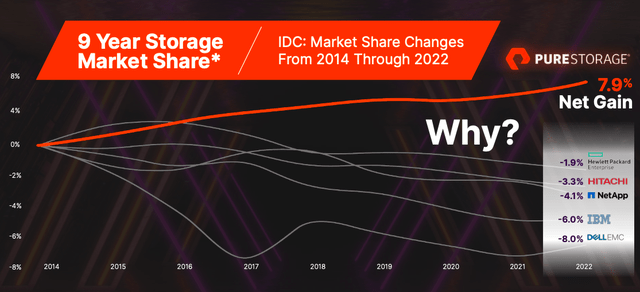

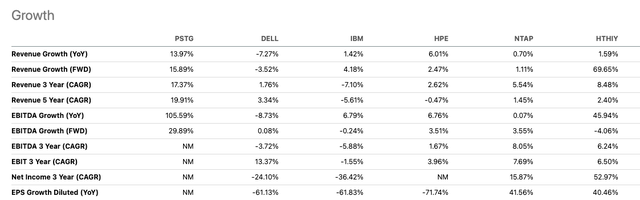

When comparing Pure Storage to other companies in the storage industry, such as Dell Technologies (DELL), International Business Machines (IBM), Hewlett Packard (HPE), NetApp (NTAP), and Hitachi (OTCPK:HTHIY), it is evident that Pure Storage has been gaining market share over the past nine years while the larger plays have lost momentum.

Market growth versus peers (Investor presentation 2023)

This company has a projected EPS growth rate of 15.2%, which is higher than the industry’s rate of 13.8%. This shows that the company has strong potential for performance in the long-term. Additionally, the company regularly buys back its own shares. In Q1, it invested $70 million to repurchase 2.9 million shares, demonstrating its commitment to its shareholders.

Upcoming Earnings

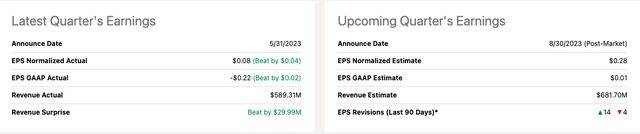

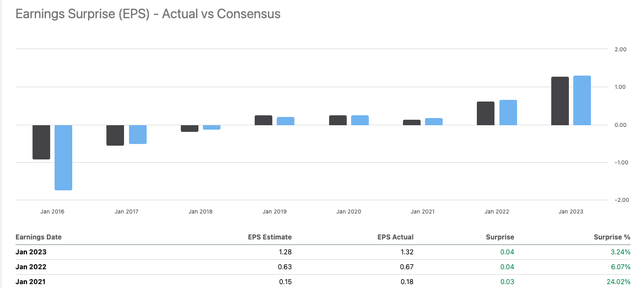

Pure Storage has exceeded EPS expectations for the past sixteen consecutive quarters. The normalised EPS for the upcoming quarter is estimated to be $0.28, with revenue reaching $681.70 million. The management team has set a medium to high growth target for FY 2024, which they confirmed in the first quarter of this year.

Upcoming earnings (SeekingAlpha.com)

The company has consistently improved its annual EPS results in the past five financial years, with consecutive growth over the last three years.

Annual EPS results (SeekingAlpha.com)

Valuation

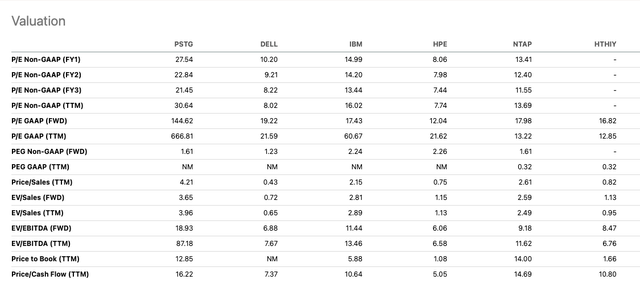

The stock has seen a recent increase in value, but it still offers potential for further growth and remains priced below its average target of $41.03. I have compared Pure Storage to other storage companies such as Dell Technologies, International Business Machines, Hewlett Packard, NetApp, and Hitachi, using the Seeking Alpha Quant Factor Grades system for a relative assessment. Pure Storage’s high price-to-earnings ratio suggests it may be overvalued, but its faster growth rate than its peers makes comparisons challenging. However, if we consider growth and focus on the FWD PEG, Pure Storage appears to be an exciting choice with a ratio of 1.61, which is lower than several of its peers.

Relative peer valuation (SeekingAlpha.com)

Pure Storage is the only company to achieve a double-digit year-over-year revenue growth along with a notable increase in EBITDA. Sustaining this remarkable momentum is crucial for the company’s ongoing success.

Growth versus peers (SeekingAlpha.com)

Risks

While Pure Storage has shown impressive top and bottom-line growth, investors should be cautious that macroeconomic uncertainties could impact future demand and slow down sales cycles, affecting its performance. Furthermore, the company relies on the success of innovative solutions, which have created much interest, but there may be a risk if initial interest does not relay into predicted sales. Furthermore, the company’s role in critical client solutions for global enterprises raises the stakes, as technical glitches, data breaches, and regulatory complexities pose risks. Evolving data storage dynamics require constant innovation to stay competitive. While onboarding customers, vulnerabilities in the supply chain pose risks, potentially impacting financial operations and customer satisfaction.

Final thoughts

Pure Storage has achieved impressive financial results in recent quarters, driving its stock performance to new heights this year. As we approach the Q2 2024 earnings release, it’s notable that management is confident about both near-term and long-term growth. The company has onboarded many new customers, and the company’s direct-to-flash technology is well-positioned to respond to the growing need for efficient data storage. Furthermore, the business model has attractive gross profit margins and long-term revenue insights. While there is some caution about how uncertain macroeconomic conditions could impact sales cycles, there is clear interest in the solution from large enterprise organisations, such as the recent partnership with Microsoft. Therefore, I maintain a long-term bullish stance.

Read the full article here