NVIDIA Corporation (NASDAQ:NVDA) reported a monster second quarter, with sales and earnings blowing away expectations. In our view, the results were strong enough to shut the lid on any suggestion by some that generative artificial intelligence (“AI”) or the trends in GPU-driven data center infrastructure are simply a fad.

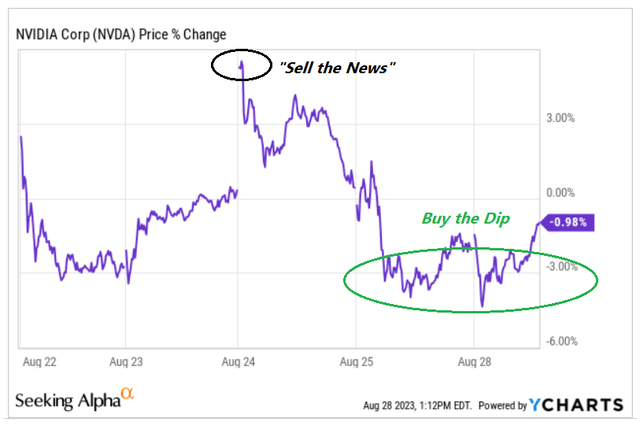

While shares initially spiked on the report to a high above $510, the stock gave up those gains, which we connect to a sort of sell-the-news dynamic or short-term profit-taking market repositioning. Simply put, a healthy pullback was in order following what was already a breathtaking rally from the start of the year.

The good news is that we see this selloff as a buy-the-dip opportunity. We last covered the NVDA back in June, taking some flack in what was a lively comment section for suggesting “shares looked cheap.” The update here is that the Q2 trends have reinforced our bullish take and we see room for upside in NVDA going forward.

source: YCharts

NVDA Q2 Earnings Recap

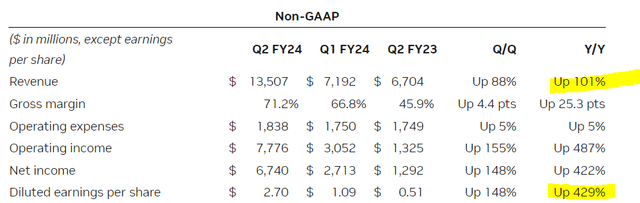

NVIDIA reached Q2 revenue of $13.5 billion, up 101% year-over-year and 88% just from Q1. What stands out from that headline is that the company managed to exceed the consensus estimates by $2.4 billion, with Wall Street looking for a sales figure closer to $11 billion.

This bonanza reflects the strong market response to the company’s slate of new products, including the HGX data center platform used for large language models and generative AI applications.

So, when CEO Jensen Huang describes a “new era for computing,” the idea here is that companies worldwide are moving away from general-purpose CPUs to accelerated computing powered by NVIDIA GPUs.

Within the press release, Amazon.com (AMZN) and Microsoft Corp (MSFT) were cited as launching the general availability of NVIDIA’s GPUs on the leading cloud services. Major customers or “partners” covering the who’s-who of software categories between Adobe Inc (ADBE), ServiceNow (NOW), Snowflake Inc (SNOW), and VMware, Inc. (VMW) are all moving forward with AI initiatives.

The setup is a windfall for earnings, as EPS of $2.70 in Q2 climbed from $1.09 in the period last year, a 429% increase. This was achieved as operating expenses are up just 5% over the period, with the premium pricing of this next generation of AI Superchips, driving margins significantly higher and flowing into the bottom line.

source: company IR

Another important development here was the announcement of a new $25 billion share repurchasing authorization. For context, NVIDIA generated $6.0 billion of free cash flow (“FCF”) in Q2, ending the quarter with $16 billion in cash against $8.5 billion in long-term debt.

The annualized free cash flow rate highlights a solid level of financial flexibility that will likely further improve considering an expectation for even stronger earnings going forward.

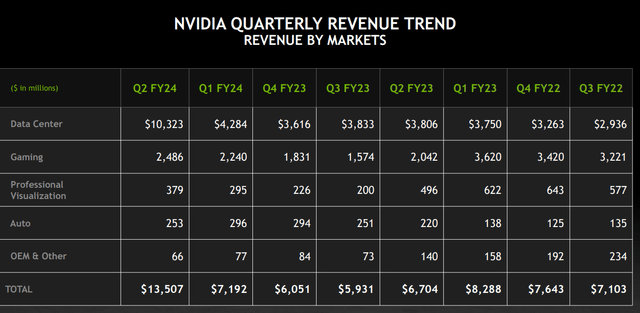

NVIDIA is guiding for Q3 revenue to approach $16 billion, representing a sequential 19% increase over Q2 and up 170% from $5.9 billion in the period last year. A gross margin target between 71.5% and 72.5% is also a tick higher from 71.2% this last quarter.

source: company IR

What’s Next For NVDA

Without getting too deep into hyperbole, it’s clear to us that NVIDIA has the “Classic Coke” in terms of AI chips, while the competition will attempt to play catch-up with their store brand.

The company’s leadership represents a powerful market advantage with early industry adopters likely committing to the platform. Research firm “Omdia” suggests NVIDIA has a 70 percent share of AI chip sales and an even larger part of the systems responsible for training AI models.

Even as competitor Advanced Micro Devices, Inc. (AMD) is set to launch the “MI300 GPU” AI accelerator chip later this year, there simply isn’t a reason to see why companies already moving forward with the NVIDIA architecture and ecosystem of AI learning models would choose to make the switch given the costly infrastructure investments.

To be clear, we see the market as big enough for multiple players over time, but the momentum for NVIDIA is just getting started. Companies like AMD and Intel Corporation (INTC) will find their place, but should be seen as second-tier solutions in this key category.

If we consider that GPU-accelerated computing and generated AI are the future of tech, the backdrop is for all data center infrastructure in the world to move in that direction over the next decade. The bullish case for NVIDIA is that the company is at the forefront of these themes, and well positioned to capture a large part of a major industry upgrade investment cycle for the foreseeable future.

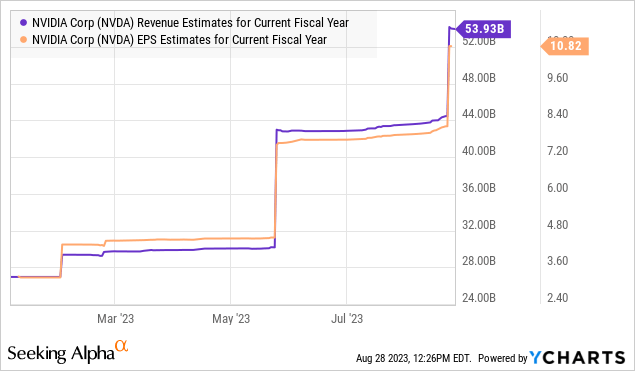

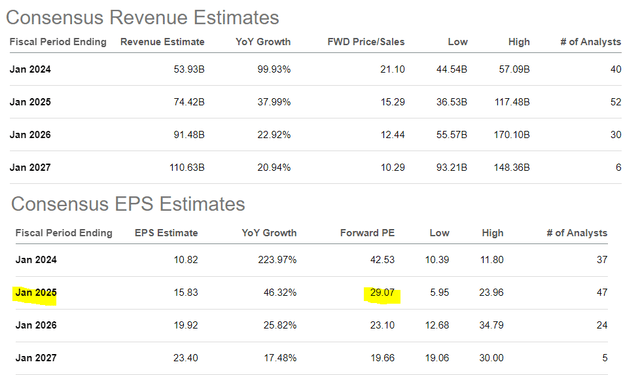

That view is part of the current consensus estimates. The market forecasts NVDA will reach $54 billion in revenue this year, up 100% y/y while EPS of $10.82 is 224% higher than the 2022 result. Keep in mind that both measures were revised sharply higher given the Q2 strength and positive management guidance.

The expectation is for the momentum to continue over the next several years, even if the growth rate moderates against a high benchmark of comps. The market sees fiscal 2025 revenue climbing another 38%, while EPS estimate for next year at $15.83 implies shares are trading at a 1-year forward P/E of 29x.

Seeking Alpha

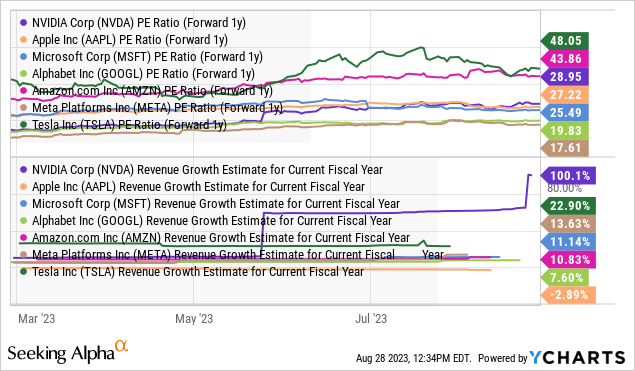

Putting all these forecasts together, and circling back to our last NVDA article, the argument we make is that shares look attractive next to other mega-cap market leaders.

In our view, 29x for next year’s earnings is a bargain compared to names like Tesla, Inc. (TSLA), Amazon.com, Inc., or even Apple Inc. (AAPL) which trade at a similar or even higher premium.

We can argue about the trends in margins or the dynamics of a long-term economic moat, but it would be intellectually dishonest to look at the chart below and claim NVDA is in some type of valuation bubble. It’s not.

NVDA Stock Price Forecast

We rate NVDA stock as a buy with a price target of $700 over the next year, representing a P/E multiple of 45x on the current fiscal 2025 EPS estimate of $15.83. This level would price the stock on an earnings basis between Tesla and Amazon, which we believe is justified by its AI leadership.

The way we see it playing out is that a further string of strong quarterly results with the potential to exceed expectations should work as a catalyst for NVIDIA Corporation stock. A scenario where the macro environment turns more positive alongside low and stable inflation, opening the door for the interest rates to pull back should be positive for market risk sentiment overall. We also see an upside to the company’s smaller gaming segment that should be incremental to earnings.

In terms of risks, even amid what we see as a secular tailwind, NVIDIA remains exposed to macro uncertainties. While not our view, the possibility of a deterioration in global economic conditions with a rise in financial market volatility would open the door for a reassessment of the company’s growth momentum. Monitoring points for NVIDIA Corporation over the next few quarters include cash flow trends and the evolution of the gross margin.

Read the full article here