Introduction

It’s time to talk about Newmont Corporation (NYSE:NEM), the world’s second-largest gold mining corporation.

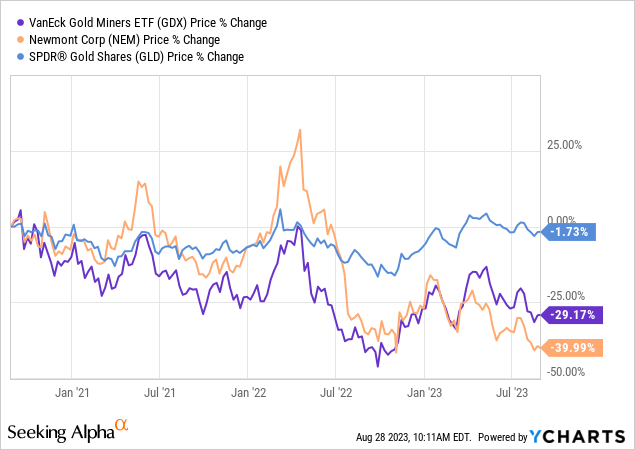

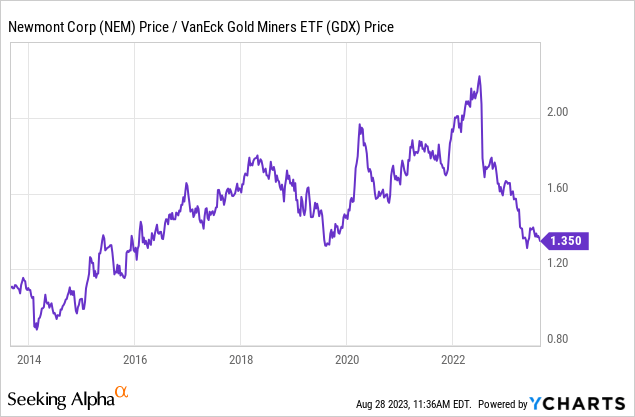

Over the past three years, shares have fallen 40% (excluding dividends), underperforming the VanEck Gold Miners ETF (GDX) by roughly 10 points. Gold prices are down less than 2% during this period. In this case, I’m using the SPDR Gold Shares ETF (GLD) as a proxy.

More recently, gold miners have been hurt by falling gold prices, sticky inflation, and related mining risks.

While we’re likely stuck in a period of sticky inflation, the single biggest bull case is further deteriorating economic growth, which could force the Fed to cut rates. Once that happens, I expect a very steep increase in NEM’s stock price.

Now, let’s dive into the details!

What’s Up With Newmont?

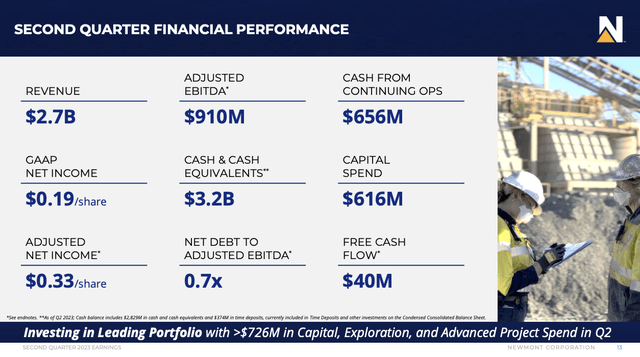

Newmont is a giant. In the second quarter, the company produced 1.2 million ounces of gold and 256,000 gold equivalent ounces from various metals.

This translated to nearly $1 billion in adjusted EBITDA and over $650 million in cash from continuing operations.

Newmont Corporation

Furthermore, the company has an attractive leverage ratio of 0.7x net debt to adjusted EBITDA. Solid margins were sustained due to higher realized gold prices and consistent direct costs.

Despite these achievements, the company had to acknowledge challenges during the quarter and make four pivotal decisions.

- Firstly, operations at Peñasquito were suspended due to a dispute with the Union regarding a profit-sharing agreement, leading to strike action.

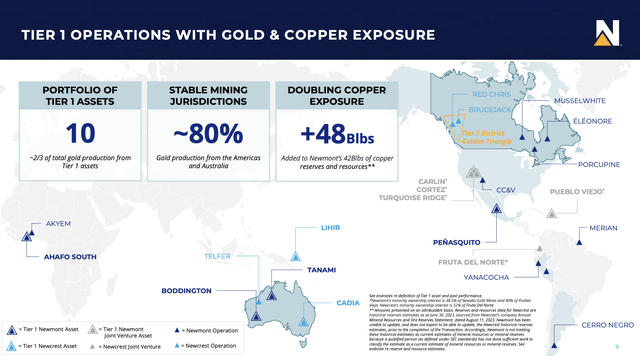

- Secondly, the Éléonore mine was evacuated due to wildfires, necessitating care and maintenance. As the map below shows, this mine is in Canada, where major wildfires are raging.

- Thirdly, safety inspections were carried out at Cerro Negro, temporarily pausing mining operations.

- Lastly, at Akyem, a decision was made to process lower-grade stockpiles earlier than planned for optimal mine plan execution.

Newmont Corporation

Having said that, and with regard to the map above, while the company saw challenges, I like NEM’s assets, as it’s one of the best mines with limited geopolitical risks. Most of its gold is produced in Tier 1 mines, with major production in low-risk jurisdictions.

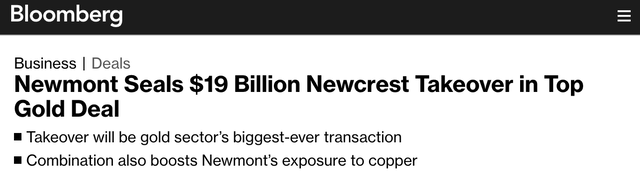

The company’s dominant position is also a result of the major A$28.8 takeover of Australian Newcrest Mining.

Bloomberg

It also comes with other major benefits in light of the energy transition.

According to Bloomberg (emphasis added):

Newmont’s acquisition adds more exposure to gold at a time when bullion is testing a record high, and the deal will crucially also boost its resources of copper — a metal where demand is expected to outpace supply as the transition away from fossil fuels gathers pace.

Furthermore, with regard to some of the challenges I mentioned in the introduction:

Gold miners worldwide are facing the prospect of stagnating production as they contend with harder-to-mine deposits and rising input costs. That’s seen as a catalyst for more mergers and acquisitions, as companies seek to increase their size to boost volumes and improve efficiencies.

Based on this context, Newmont believes it can ramp up production in the second half of 2023, primarily driven by increased grades and tonnes mined across various locations, including Subika underground and Ahafo open pit.

The Cerro Negro’s expansion and Tanami’s higher-grade ore also contribute to the positive outlook.

So, despite challenges, Newmont remains on track to meet its annual production guidance with the support of non-managed joint ventures Nevada Gold Mines and Pueblo Viejo.

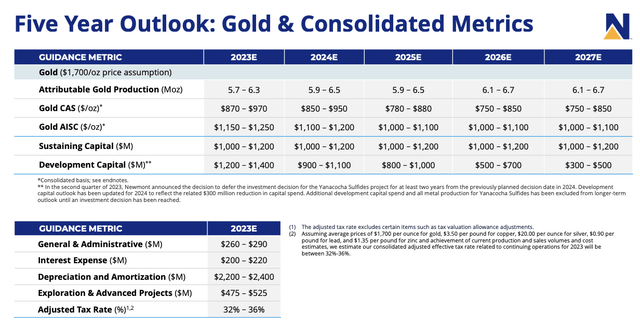

Looking at its five-year outlook, the company is looking to boost production to the range of 6.1 to 6.7 million ounces per year, lowering all-in-sustaining costs to no more than $1,100.

Newmont Corporation

With that in mind, NEM is also a source of income for many investors.

Dividend

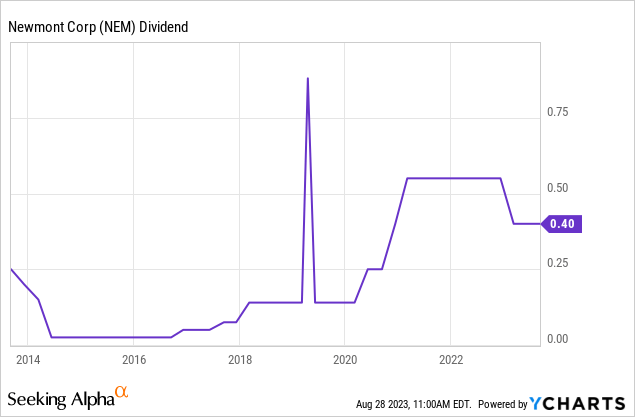

In the second quarter, Newmont declared a dividend of $0.40 per share or $1.60 per share annually, consistent with the previous two quarters.

This dividend translates to a 4.1% yield.

According to the company, the dividend falls within the 2023 dividend payout range of $1.40 to $1.80 per share.

While its dividend isn’t very consistent, Newmont has maintained a dividend yield exceeding 3% for 11 consecutive quarters, maintaining its position with the highest dividend per share in the gold sector.

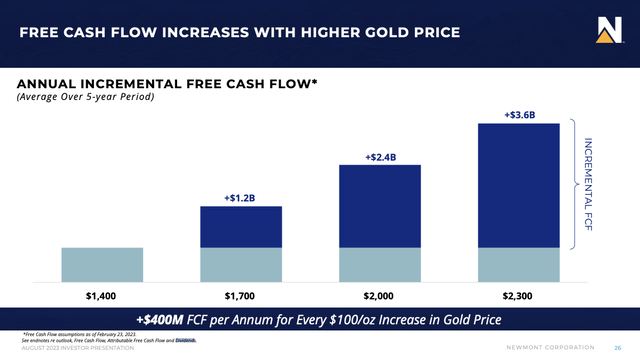

There’s also a lot of upside for the dividend if gold prices soar. Looking at the data below, we see that the company increases its free cash flow (operating cash flow after investments in its business) by $400 million for every $100 increase in the price of gold (per troy ounce).

Newmont Corporation

Looking at the overview below, we see the aforementioned $1.40 to $1.80 dividend range again.

In this case, the company has a $1.00 base dividend, backed by a gold price of $1,400.

The company adjusts its dividend based on $300 changes in the gold price. So, based on current gold prices (roughly $1,900), the dividend range is $1.40 to $1.80.

That number is likely to rise significantly to the $2.00 to $3.00 range if gold rises $100 – and remains elevated.

Based on this context, I believe that NEM could see a scenario of much higher gold prices.

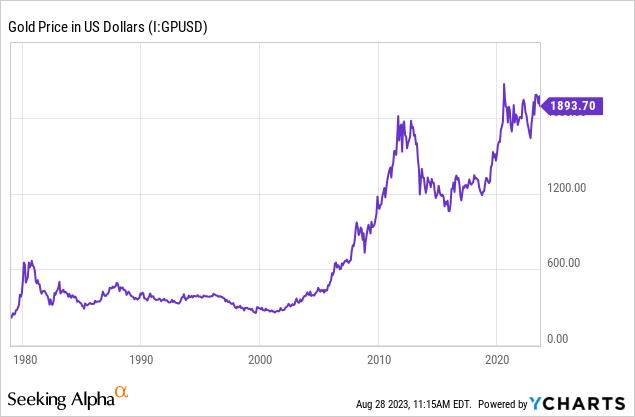

Why I’m Bullish On Gold

I have a bullish view on gold prices for one major reason: the Federal Reserve.

While I’ve been contrarian in my belief that both rates and inflation will remain elevated/sticky on a prolonged basis, we’re now at a point where economic growth might become so poor that the Fed may be forced to cut at some point.

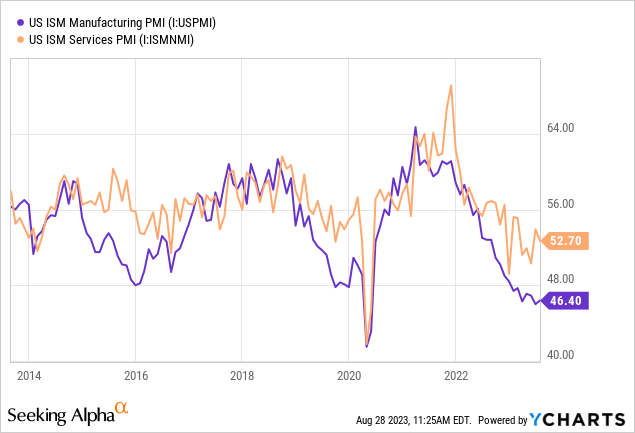

While housing and employment indicators are still holding up nicely, leading indicators like the ISM Manufacturing/Services Indices are pointing at significant weakness down the road.

At this point, it’s important to note that one major driver of gold prices is future rate expectations. The chart below compares the gold price (black line) to the difference between March 2025 SOFR futures and one-month forward SOFR futures.

TradingView (Gold, SOFT March 25 – SOFT Next Month)

Essentially, SOFR is the replacement of LIBOR. It’s a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities in the repurchase agreement (“repo”) market.

If the line increases, it means that investors expect borrowing costs in the future to decline relative to the short-term outlook.

This hints at easing financial conditions, which is bullish for gold.

Gold took off shortly after this line accelerated last year. It’s also falling in tandem with the spread this year.

Hence, if economic growth reaches a point where the market prices in more aggressive rate cuts, gold is the place to be – according to this theory.

In such a scenario, I expect gold prices to rise beyond $3,000 per troy ounce, which would be great for NEM and its dividend.

On top of that, NEM is currently in the worst period of underperformance versus its peers in more than a decade, which is fueled by M&A uncertainty.

I believe this offers opportunities – on top of my bullish view.

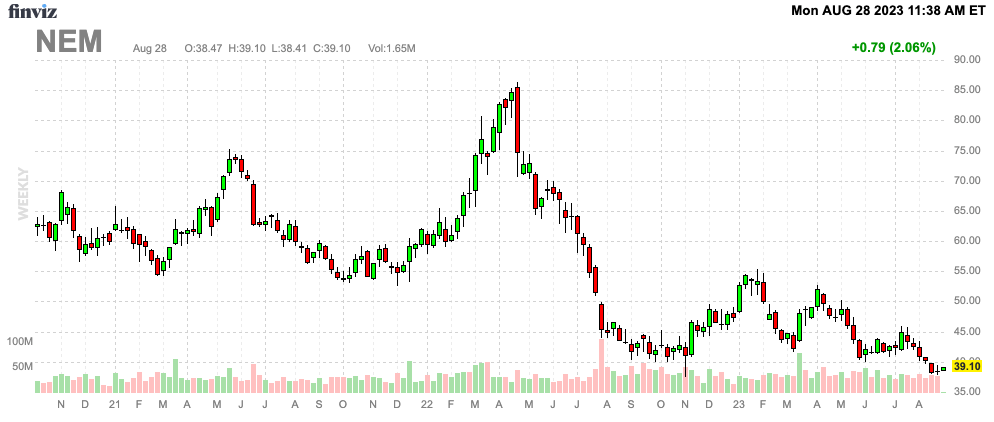

NEM shares are currently trading at $39. The consensus price target is $55. I believe that NEM is a $120 stock if my thesis turns out to be correct. If gold rises to $3,000, the company could get an additional $6-$7 billion in incremental free cash flow. That would warrant this valuation, as it would indicate a high-double-digit free cash flow yield close to 20%.

FINVIZ

However, that’s a longer-term outlook, which could take 2-3 years to unfold.

Even if I’m less bullish, I believe that NEM shares are significantly undervalued at current prices.

Takeaway

Despite recent challenges and underperformance, Newmont’s robust assets and strategic acquisitions position it for a promising future.

A blend of consistent margins, prudent decisions, and solid production levels form a solid foundation.

The potential for an economic downturn leading to rate cuts could prove to be the much-awaited trigger for NEM’s stock surge.

Amidst the complexities of gold prices and inflation, NEM also offers a promising income source with dividends and growth potential.

Given the bigger picture, I believe NEM offers a tremendous long-term risk/reward, which could lead to very high gains over the next 2-3 years.

I’m looking to add NEM to my trading portfolio soon.

Read the full article here