Safe Bulkers (NYSE:SB) is a strong figure in the Dry bulk market. They have unveiled their Q2 2023 financial results last month and it showed strength despite a challenging chartering market. With new additions to their fleet, a maintained strong dividend of $0.05 per share, and a great balance sheet the company displays financial resilience. However, a comparison with Q2 2022 figures suggests potential headwinds, largely driven by external economic pressures and choppy charter rates. The rising global GDP growth forecasts offer a positive outlook for the shipping industry however we give our rating for SB as ‘hold’ with a price target of $3.50. This is largely driven by the lack of definition around share repurchases and the questionable strength of the charter rates.

Operational Review

Safe Bulkers reported their Q2 2023 financial results on July 26th, showing resilience despite a weakened chartering market, potentially due to economic growth uncertainties. The company added a fourth newbuild to their fleet during the quarter, supporting their revenue along with past charter contracts. A dividend of $0.05 per share of common stock was declared, reflecting the company’s strong balance sheet characterized by a conservative capital structure, significant cash, and developed capacity.

While global economic factors such as the sharp decline of commodity prices over the past few months and the global recessionary pressures have weighed on SB. There is a positive outlook with the expected global GDP growth for 2023 rising to 3% from 2.8% in April. With direct correlation between Global GDP and shipping, any slight increase in forecasts can translate well to the shipping market.

In Q2 2023, the company experienced a challenging operating environment, with a weakening charter market compared to the same period in 2022. This led to a decrease in revenues as a result of lower hires and decreased earnings from Scrubber fitted vessels. The situation was further exacerbated by an increase in operating and interest expenses due to rising interest rates. Consequently, the company’s adjusted EBITDA for the period stood at $33.3 million, a significant decline from the $66.5 million recorded in Q2 2022. In line with this, the adjusted earnings per share also fell to $0.12 from $0.40 in Q2 2022. Inflation is projected to be high at 6.8% in 2023 due to war-induced price pressures, but is expected to decrease to 5.2% in 2024. This should help with operating costs going forward but is still very volatile due to the state of the energy market and global geopolitical tensions.

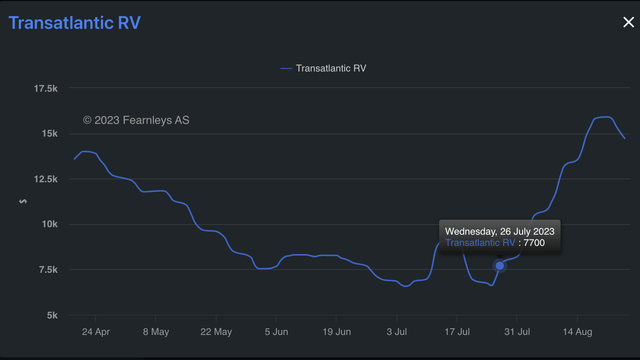

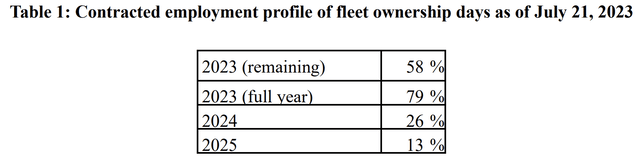

While the market has been considerably weaker this year vs last, their capital expenditure requirements are fully covered by their contracted future revenues. This allows them to upgrade and maintain their fleet even as fleet revenues have declined YoY. From their recent earnings they highlighted that they had 8 of their Capesize vessels on average daily charters of $22,000 and they highlighted the weakness in the market at that time. Since their earnings release on July 26th the Panamax charter market has responded significantly with rates more than doubling since then.

Fearnleys

At the time of the earnings call over 40% of the fleet’s available days were able to be contracted. Enabling them to capture the upside from the recent uptick in pricing. While still short of the $25,000 they were able to collect around this time last year the improvement in rates is set to benefit SB greatly and should translate well to their Q3 earnings.

SB

The State of the Fleet

Bimco

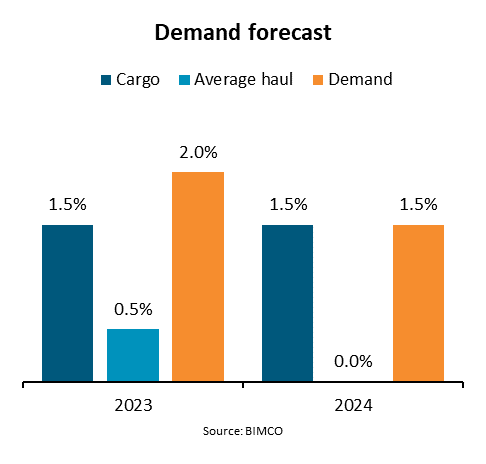

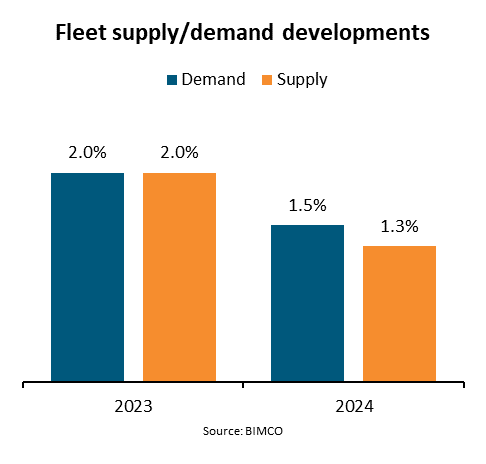

The drybulk demand growth globally is forecasted to be 2% for 2023, and the company is well positioned to meet this with their fleet of 44 vessels, including 12 eco-ships and 12 Phase 3 newbuilds. Seven of their newbuilds are expected to be delivered by the end of 2033. They also plan to complete environmental upgrades on 20 vessels by the end of 2023, further strengthening their eco-friendly stance and protecting them against regulatory risk. The company’s current fleet age is 10.6 years, which is expected to remain the same as new vessels are delivered over the next two years. With vessels typically having a productive life of 20-25 years SB is well positioned to handle any ship retirements. They have already paid $73.8 million in capital expenditures on the order book of the 8 newbuilds and the remaining capital expenditure is expected to be $210 million. This indicates the company is committed to maintaining its fleet while also investing in new vessels. They have already taken possession of four Phase 3 newbuilds, which are the highest performing vessels in the drybulk market globally and we see this is very likely to continue to strengthen the company’s position in the market and possibly lead to an increase in revenues.

Unlike the Oil tanker market we don’t see a massive disconnect between demand growth and fleet growth. Globally demand for Dry Freight is mostly inline with fleet growth and we expect strength in the shipping market to come from GDP growth overall.

Bimco

Balance Sheet

The company’s liquidity and capital resources stand at approximately $300 million, which should provide some significant financial flexibility. For context this level of liquidity is equal to roughly 12 months of revenue. Of this $300 million roughly ~$79 million is held in cash.

In addition to this contracted revenue stands at $232 million, which will provide stability to the company’s cash flows as markets are likely to remain turbulent. We expect net income to remain elevated ~15% mark so we expect these contracts to translate into ~$35 in earnings over the course of their contracts.

SB

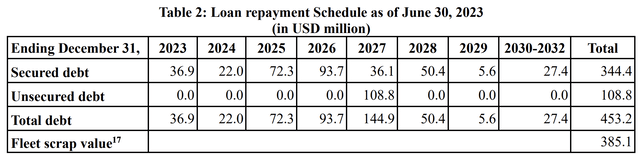

The company maintains a comfortable leverage of 35%, which should provide them with financial flexibility and safety going forward. Their cash on hand can cover the remainder of 2023 and all of 2024’s loan repayment schedule easily. With earnings being so volatile we believe the low leverage combined with the high contracts puts them in a good position to weather any storm in the market.

The company’s debt stands at $453 million, which is close to their fleet scrap value of $385 million, and it maintains a leverage of about 35%. The weighted average interest rates for the consolidated debt are slightly below 6% and a portion of €100 million of the debt is fixed at a 2.95% coupon in a secured five-year bond, indicating a very low cost of borrowing relative to inflation and current interest rates.

Share Buybacks

In June 2022, the Company authorized a program under which it may from time to time in the future purchase up to 5,000,000 shares of its common stock. In March 2023, the Company authorized the increase of the share repurchase to a total of up to 10,000,000 shares of its common stock, of which all had been repurchased and canceled. In May 2023, the Company authorized a program under which it may from time to time in the future purchase up to 5,000,000 shares of its common stock. As of July 21, 2023, 139,891 shares of common stock, representing approximately 3% of the program, had been repurchased and canceled, and the program has been suspended.

Taken from their most earnings we can see that starting in June 2022 SP has started to allocate earnings to not just dividends but also to stock buybacks. Currently SB has 64 million shares in the public float and 111.6 Million shares outstanding. At the present value of approximately $3 per share, buying back 5,000,000 shares would equate to roughly 10% of their net income from the past 12 months, which stands at $120 million. With the stock trading at such a low multiple any share repurchase has a compounding effect on NAV. Climent Molins has a great article discussing this.

While this program is temporarily on hold we believe that following the upgrades of some of their older ships and the rebound in market that we will see this program restart sooner rather than later. This is extremely dependent on continued dry bulk strength and low fuel prices but we believe that this is the key to equity returns with SB.

Valuation

The strength of SB is one of book value. The low leverage coupled with high ships prices and high scrap values ($385 million) present an interesting opportunity. SB currently trades at an EV of $710 million. As a reminder EV is Market Cap + Debt – Cash. If we modify this and subtract out the scrap value (not ship value) we get a mEV (modified Enterprise Value) of $325 million. We are subtracting that value because if we had the opportunity to purchase and liquidate the entire company at current valuations. We would have to buy the market cap of the stock and the total debt but we would be able to use the balance sheet cash and vessel scrap value to help fund the purchase. Which brings us to that $325 million value. Annualizing the most recent Net Income of $15.4 million we arrive at $61.6 million. This gives us a valuation of 5.3x Annualized Net Income/mEV. If we instead we take the TTM Net Income ($120.6 million)we arrive at a 2.7X ratio.

We believe that in all facets SP is a bargain they currently have a favorable balance sheet with net income easily covering debt payments despite a weaker YoY market. With a net debt per vessel of only $7.9 million SB has the opportunity to take advantage of the decline in drybulk ship values and expand their fleet at reasonable valuations. While the rest of the industry is heavily leveraged SP is in a position to capitalize. They have many layers of preferred shares and the combined preferred dividends impact is roughly a $2 million impact quarterly on Net Income available to common shareholders. With revenues and earnings coming down this impact is higher than this same time last year, this year with only $15 million in Net Income the $2 million draw down brings cash available to investors by 13% vs 4% last year but in order for preferred dividends to take away from common shareholders we would have to see net income fall by another 50%. A scenario that we see as very unlikely.

Conclusion

The dry bulk market is extremely volatile with rates all over the place and the overall commodity market struggling so far this year. With recessionary pressures a lot of downward pressure has been placed on Safe Bulkers. This negative sentiment has brought the stock down roughly 10% over the last year. While their earnings have also declined we see greater upside from current valuations. The dividend is currently around 6% while the Two Year Treasury Yield hovers around 5.1%. We believe that the dividend yield, coupled with the high inherent value of the fleet provide a backstop to any substantial further decline from current levels. We also believe that the contracts revenue and higher than expected rates in Q3 are more beneficial to the share price than currently valued. We see limited downside risk but are looking to see market rate stabilization and higher fleet transaction volumes before we enter a position. We are a are a hold at current prices and have a price target of $3.50. We don’t currently have a buy because we believe there is not enough relevant upside at current prices and that there exists stocks that have a greater upside potential. With that said, any substantial drop below $3, initiation of share buybacks, or market rate increases and we will become strong buyers. This is a company to keep a close eye on and we believe being patient will allow investors to find other opportunities while the water settle around SB.

Read the full article here