By Blu Putnam

At A Glance

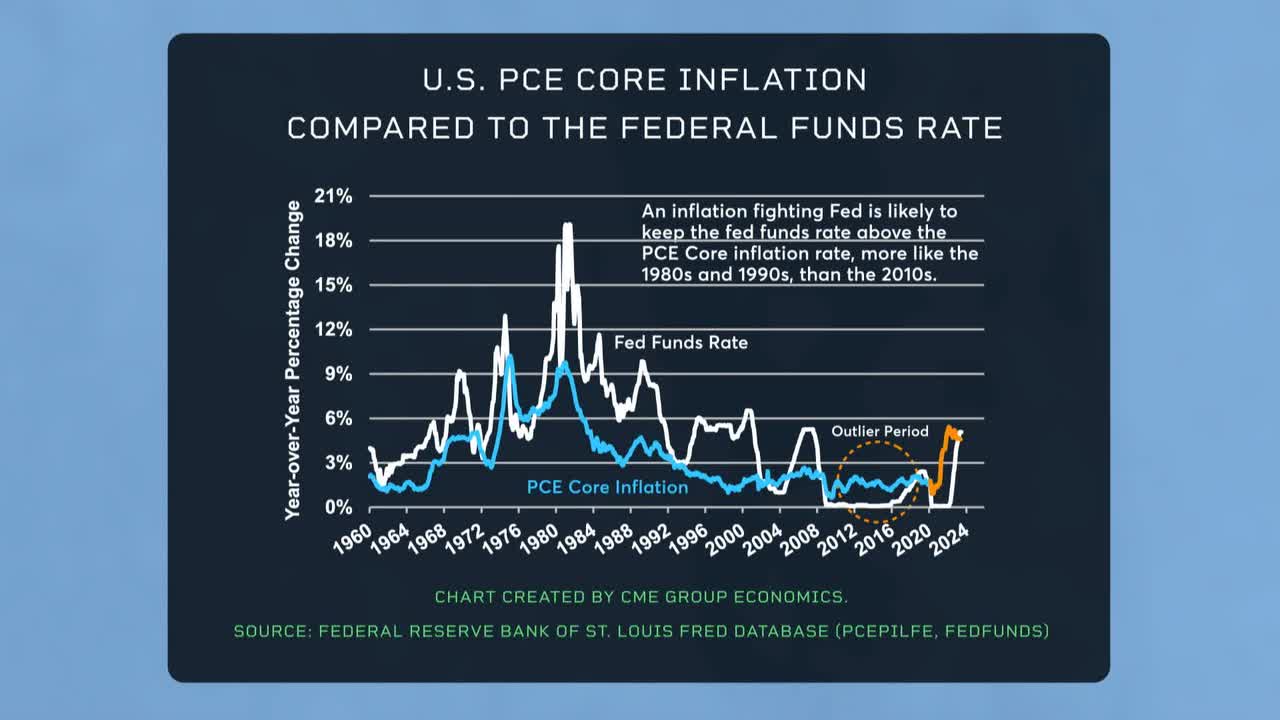

An inflation-fighting Federal Reserve is likely to keep the fed funds rate above the core PCE inflation rate, more like the 1980s and 1990s than the 2010s

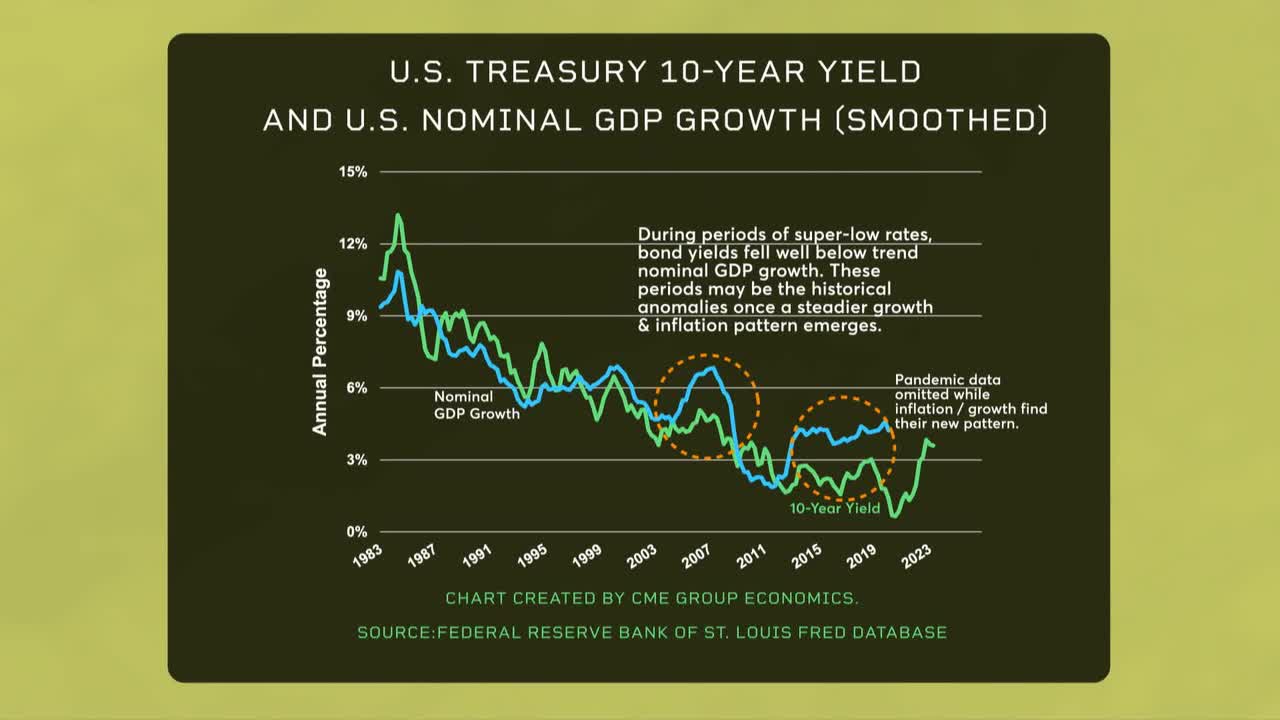

There appears to be a loose relationship between the growth of nominal GDP and long-term Treasury yields

The U.S. interest rate debate changed dramatically in August 2023.

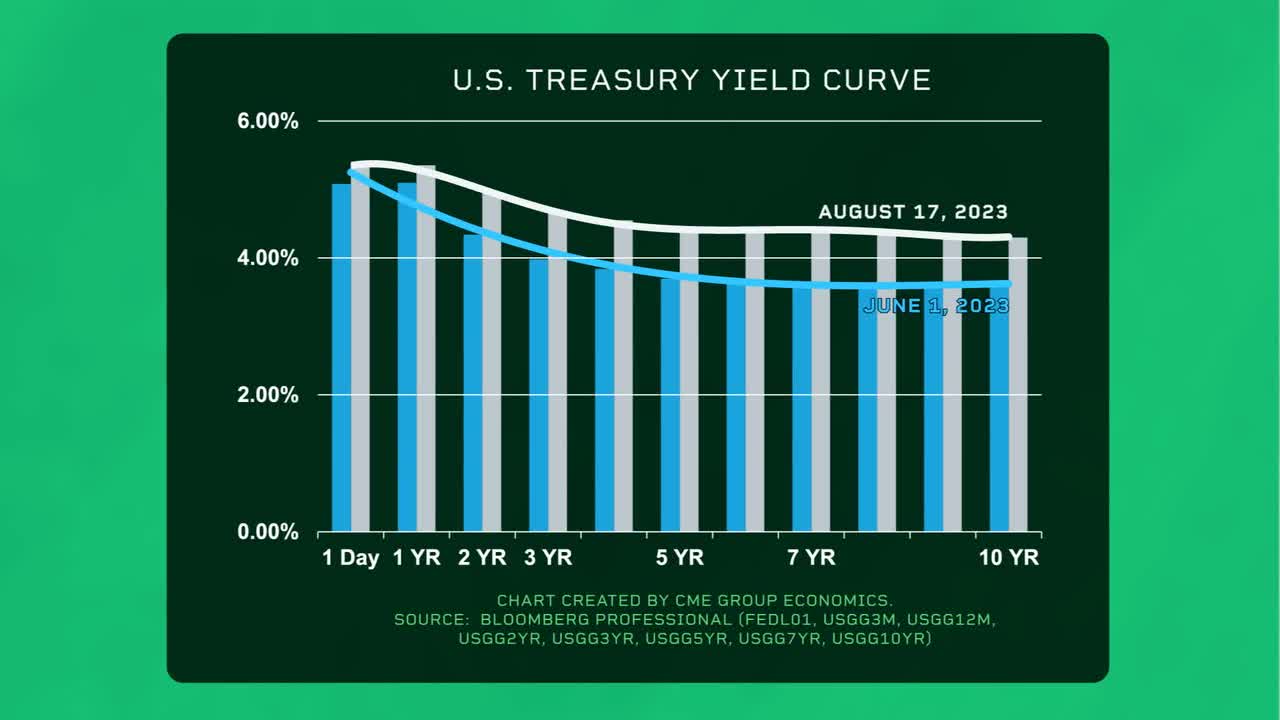

The economic debate shifted gears with diminishing concerns about a recession, leading U.S. long-term Treasury yields to rise sharply. And the debate over future Federal Reserve policy transitioned from trying to call the peak in short-term rates to discussing the length of time rates might remain elevated. The net result was a less inverted U.S. yield curve, not because short-term interest rates fell, but because long-term yields rose.

With the no recession view becoming the more popular base case, there has also been a shift in the longer-term inflation debate. Without a recession, many economists are coming to the view that core inflation, which the Fed targets, will remain well above the Fed’s 2% target throughout 2024 and possibly longer.

We studied extended periods where short-term rates held above the prevailing inflation rate. There appears to be a loose relationship between the growth of nominal GDP and long-term Treasury yields. This makes sense if one thinks about nominal GDP growth as part inflation and part real economic activity, and it helps explain why bond yields have moved higher.

Put another way, the period of 1% fed funds rates under the Greenspan Fed in the early 2000s and then the near-zero fed funds rates introduced by the Bernanke Fed after the 2008 Great Recession are historical outliers. These super-low rates encouraged a search for yield and popularized the view that the Fed has the market’s back, artificially supporting both equities and bond prices (that is, lower bond yields). The Powell-led Fed is guiding us that those days are in the rearview mirror, and market participants are starting to agree. In his closely watched Jackson Hole speech, Powell highlighted the economic uncertainty ahead and how risk management remains key moving forward.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here