I know what I have given you…I do not know what you have received.”― Antonio Porchia.

Today, we take a look at a transportation concern that is in the middle of a takeover battle and is in a very volatile industry. An analysis follows below.

Seeking Alpha

Company Overview:

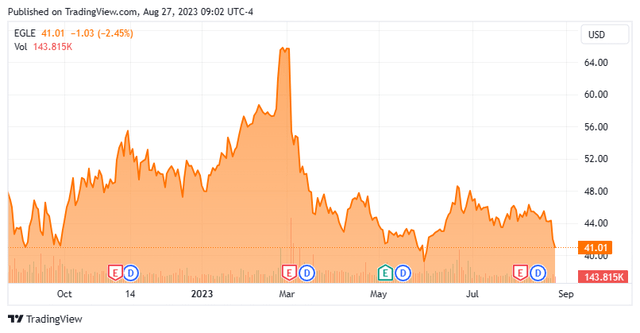

Eagle Bulk Shipping Inc. (NYSE:EGLE) is a Marshall Islands-domiciled, Stamford, Connecticut-headquartered shipowner-operator, providing global transportation of dry bulk goods for miners, traders, and end users. The company owns 52 Supramax/Ultramax medium size dry bulk vessels, with an aggregate carrying capacity of 3.21 million tons of dead weight [DWT] and an average age of 10.4 years (as of March 31, 2023). The company was formed in 2005 and went public the same year, raising net proceeds of $188 million at $142,669 per share after giving effect to four reverse stock splits that collectively equaled ~1-for-10,191. It filed for and emerged from bankruptcy in 2014, with the “old” shareholders receiving 0.5% interest in the “new” company. Its stock trades close to $41.00 a share, translating to a market cap of just over $400 million.

August Company Presentation

Dry Bulk Commodities

For those unaware, a dry bulk commodity is a raw material that – generally owing to its small and irregular shape – is shipped in large unpackaged parcels, not stacked into containers or pumped into tankers. Major dry bulk items, which are typically shipped in larger vessels, include iron ore, coal, and grain. They account for approximately two-thirds of the market. Minor dry bulk, such as fertilizers, cement, scrap, bauxite, salt, and coke (amongst others), comprise the balance.

Eagle’s top line is a function of the supply and demand of both its vessels and the commodities comprising the dry bulk sector, as well as the distance cargoes need to be transported. Another factor affecting its revenue is the type of charters it undertakes. Voyage charters involve the movement of cargo to a specific destination and are charged on a per-ton or lump-sum basis, whereas time charters can last several days to several years and are charged on a freight rate, which is typically remitted by charterer (customer) every quarter. Under the latter arrangement, the customer is responsible for fuel, port charges, canal tolls, and brokerage commissions.

In 2022, Eagle’s fleet was employed 55% of the time performing time-charters; 43% performing voyage charters; and the balance at drydock. Since the mix of charters can significantly affect the company’s top line, it employs a non-GAAP measure known as time charter equivalent (TCE) to compare the daily earnings of both streams. TCE is defined as net revenues minus voyage and charter hire expenses, adjusted for freight rate and fuel hedges, which is then divided by the number of owned available days. The last metric represents the number of total ownership days minus the aggregate number of days its vessels are off-hire for maintenance, upgrades, surveys, etc. Management compares the performance of its TCE to the Baltic Supramax Index {BSI}, a volatile (and challenging to locate) measure of the prevailing market rate for freight based on a 58,000 dwt, non-scrubber fitted Supramax vessel and ten trade routes across the world, to gauge its operating effectiveness.

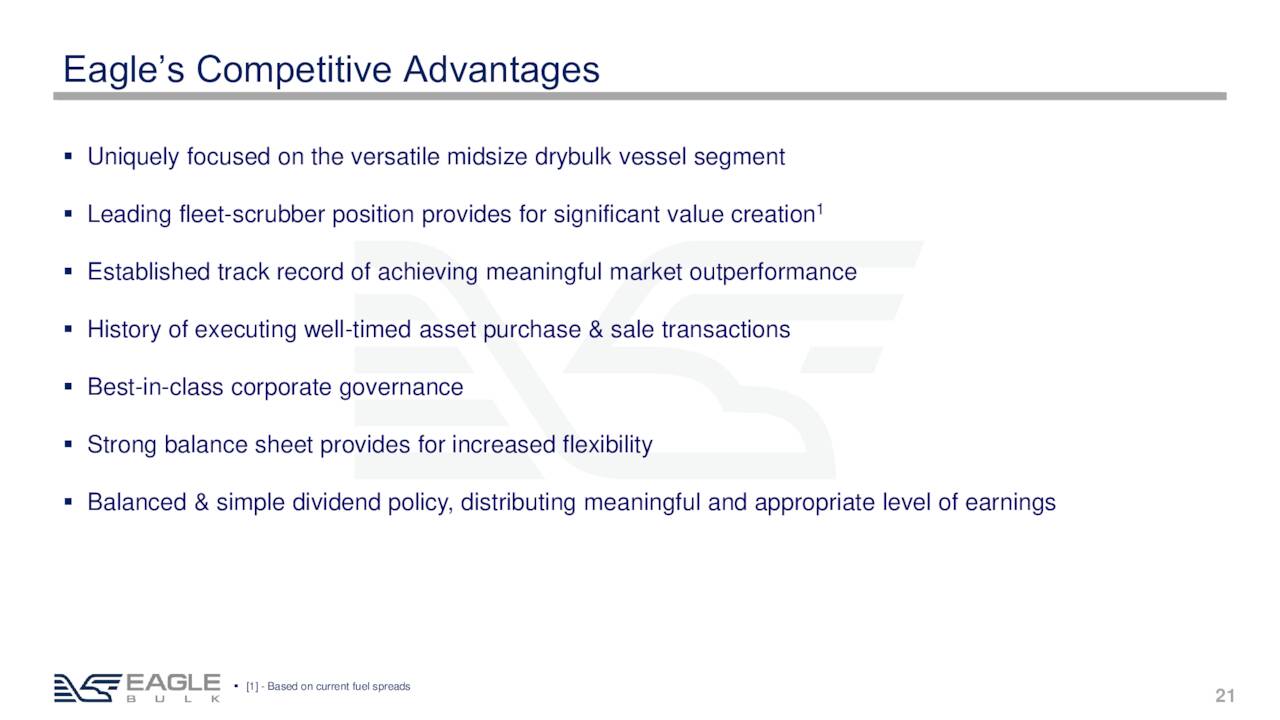

Eagle Bulk’s Fleet

Eagle’s fleet of Supramax/Ultramax vessels possess the versatility to transport both major and minor bulk items due to their size (50,000 to 65,000 dwt, ~660 ft. length) and ability to load and offload cargo using onboard cranes and grabs. This optionality is reflected in its cargo mix over the prior twelve months ending March 31, 2023: 15% grain; 15% metals & ore; 14% coal; 13% minerals; 9% cement; 9% coke; 7% fertilizers; 7% steel products, etc. The diversification dampens any volatility related to one specific commodity. Also, 96% of its fleet is fitted with scrubbers, which allow for the use of lower-cost high-sulfur fuel oil (as opposed to very low sulfur fuel oil), providing Eagle with operating leverage. Owing to the fact that the market for Supramax/Ultramax vessels is somewhat depressed (despite the fact that not many new ships are coming on line), Eagle sold three older (2011) vessels and purchased two 2020 vintages for a net cost of $10.4 million during 1H23. These transactions are nothing new for Eagle, having executed 55 transactions since 2016 in an attempt to both modernize and optimize its fleet.

Approach

From an operational perspective, the company does not contract out any aspect of its business to third parties, electing to handle strategic, commercial, operational, maintenance, repair, crewing, and administrative functions in-house in order to maximize TCE. On example of Eagle’s hands on approach is in its use of arbitrages. For example, it may lease a vessel from a third-party on a time-charter basis to cover a voyage charter commitment, so it can redeploy one of its own vessels to a more advantageous opportunity due to a shift in market conditions.

For its shareholders, owing to the very volatile and seasonal nature of the business, the board of directors instituted a policy (beginning in 2021) to target quarterly dividend payments equal to a minimum of 30% of net income but not less than $0.10 a share. Since this approach was instituted, the quarterly dividend has ranged from $0.10 to $2.20 a share.

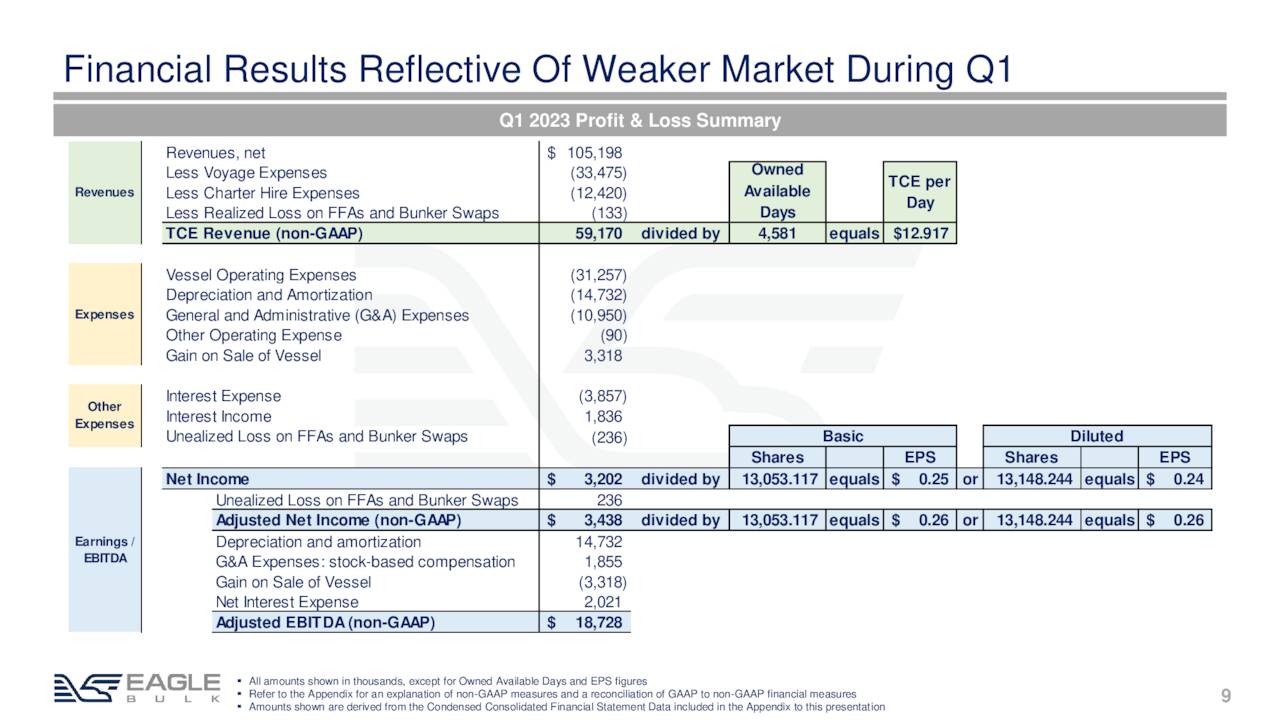

Q1 2023 Earnings & Outlook

The most recent dividend payment was $0.10 a share after Eagle reported its financials on May 4, 2023, posting earnings of $0.26 a share (non-GAAP) and Adj. EBITDA of $18.7 million on net revenue of $105.2 million versus $3.97 a share (non-GAAP) and Adj. EBITDA of $85.0 million on net revenue of $184.4 million. Even though the bottom line was down considerably year-over-year, it did beat Street consensus by $0.19 a share. TCE was $12,917/day based on TCE revenue of $59.2 million versus $27,407/day based on TCE revenue of $121.6 million in the prior year period, representing decreases of 53% and 51%, respectively. A “weaker market” was blamed. Although down significantly, Eagle’s TCE outperformed the BSI by an equivalent of $3,041 per day over the same period. That said, most of this outperformance is likely due to the fact that 96% of its fleet is fitted with scrubbers.

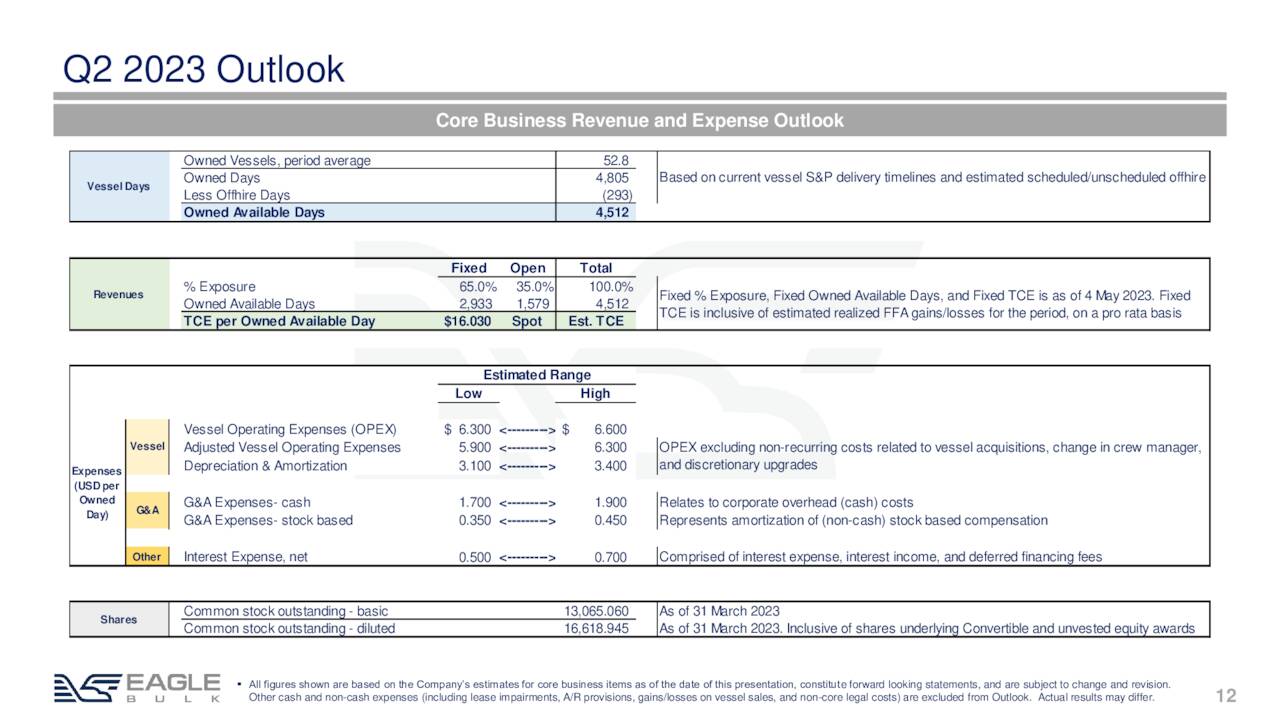

August Company Presentation

Management stated its belief that 1Q23 represented a bottom for freight rates in 2023, citing contango in the forward markets, with coverage for 2Q23 (at the time of its report) at 65% of owned available days at an average TCE of $16,030.

August Company Presentation

Balance Sheet, Share Repurchase, & Analyst Commentary:

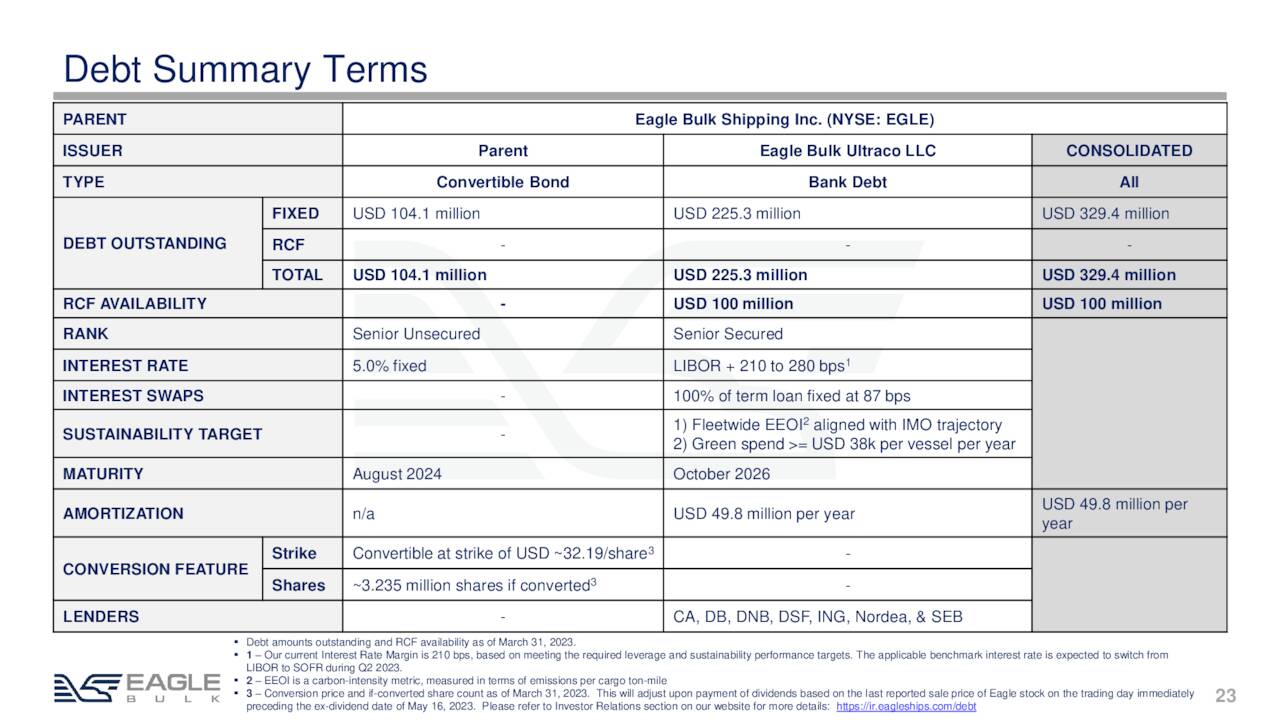

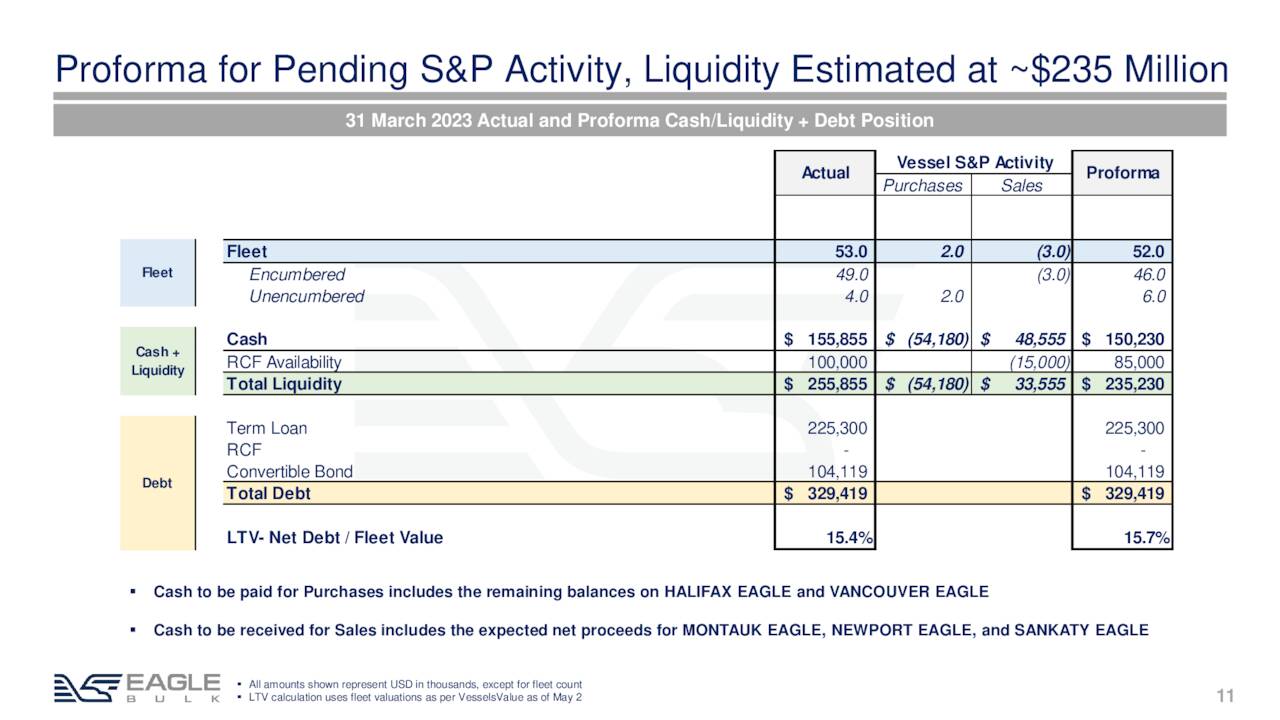

Despite the down quarter and minimum dividend, the company exited 1Q23 with a sturdy balance sheet, reflecting net leverage of 0.66. However, on June 22, 2023, Eagle announced that it had repurchased Oaktree Capital Management’s 28% ownership interest (3.78 million shares) at $58 per, representing an eye-popping 19% premium to that day’s close of $48.61 per share, for a total outlay of $219.3 million. This transaction was primarily financed by debt, leaving the company with cash of $127.6 million, liquidity of $187.6 million, total debt of $529.4 million, and net leverage of 1.5 on a pro forma basis.

August Company Presentation

The transaction, which reduced the number of outstanding shares to 9.3 million, was justified on two fronts. First, even though it represented a significant premium to the June 22, 2023 close, the $58 per share purchase represented a 16% discount to (management’s assessment of) net asset value of ~$69 per share; thus, it was accretive on an EPS and NAV basis in future periods. Second, it removed any potential substantial disruption in share price resulting from a 28% owner disposing of its position in the open market.

August Company Presentation

The actual reason is that containership concern Danaos Corporation (DAC) had been acquiring a significant stake in Eagle (10%) at the date of the Oaktree transaction – maybe looking to diversify into dry bulk – potentially putting the company in a bidding war for the Oaktree interest. If Danaos had purchased Oaktree’s stake, it would own a nearly controlling stake in Eagle. Factor in Cyprus-based shipper Castor Maritime Inc.’s (CTRM) now 15% stake and a case could be made the management was buying back their jobs. Further buttressing this case is that Danaos altered its investment status from passive to active on June 26, 2023, sending a letter to Eagle’s board expressing its dismay over the transaction, asking (possibly disingenuously) as to why other shareholders were not consulted in the transaction. It was also unhappy about the move by the company’s board to adopt a takeover-unfriendly one-year shareholder rights plan (poison pill) triggered by 15% ownership interest through transactions not approved by the company’s board, which effectively prohibits Danaos from purchasing additional shares.

Despite the head-scratching move, Street analysts are unanimously positive on Eagle, featuring six ratings of buy or outperform and a median price target of $56, $2 below the price paid for Oaktree’s stake. It should be noted that three analysts lowered price targets in mid-July, more or less citing poor dry bulk pricing dynamics. The one analyst firm that has projections for earnings on EGLE in FY2023 has the company earning 82 cents a share. The five analyst firms that have estimates for sales are all over the map ($233 million to $440 million). The seven analysts that have estimates for FY2024 similarly have wide variance for both earnings ($3.48 to $10.41 a share) and sales ($289 million to $538 million).

Also notable is that nearly a quarter of the outstanding float in this stock is currently held short.

Verdict:

Despite all the intrigue and extremely questionable (or self-preserving) purchase from Oaktree – who may have duped Eagle into believing Danaos was interested – from an operational perspective, Eagle is a well-run business. That said, its fortunes are more or less tethered to the very volatile BSI, with a trailing twelve-month average of $5.617 to $29,955 since July 2016. It is a more volatile version of a gold producer tied to gold prices. The accumulation by Danaos puts an interesting twist on affairs, but the poison pill effectively mitigates any shot of a buyout – at least for a year. It’s easy to say it’s a proxy for the global economy, but the volatility of the BSI makes this play a difficult one to assess and predict, rendering Street consensus outlooks relatively empty. As such, the recommendation is to stay to the sidelines with Eagle Bulk Shipping Inc. stock.

Peace, commerce, and honest friendship with all nations…entangling alliances with none”― Thomas Jefferson.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here