It’s been a volatile week for the S&P 500 (SPY), and already the May range is larger than April’s. There were four lower closes in a row into Friday’s open, but NFP saved the bulls. Cancel the recession. But then, wouldn’t this also cancel the expected pause and rate cuts? What would this mean for the S&P 500?

In an attempt to answer that, a variety of technical analysis techniques will be used to look at probable moves for the S&P 500 in the week ahead. The S&P 500 chart will be analyzed on monthly, weekly, and daily timeframes. I will then provide my own conclusions and make a call for the week ahead. My calls may not always be correct, but they will be based on solid evidence and made without bias.

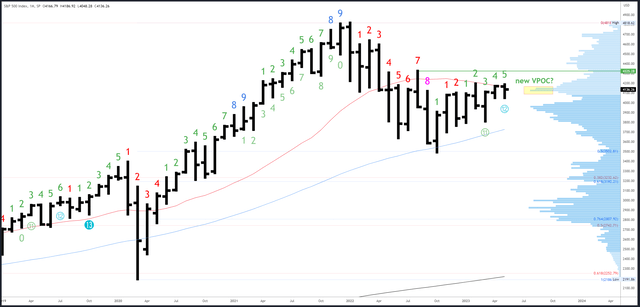

S&P 500 Monthly

Several weeks ago, I pointed out the tiny April range and said, “contraction should lead to expansion in May.” That has already played out, but a new high over the April high was rejected, then a marginal new low under the April low was also rejected. That leaves a neutral bias for now. However, the coiling under 4195 resistance is bullish overall.

SPX Monthly (Tradingview)

Resistance is at 4195, followed by 4325 at the high of August.

Support comes in at 4048-49 and at the March low of 3808, with the 50MA a distant 3725.

There are no exhaustion signals in either direction (using Demark methods). An upside exhaustion count will be on bar 5 (of 9) in May.

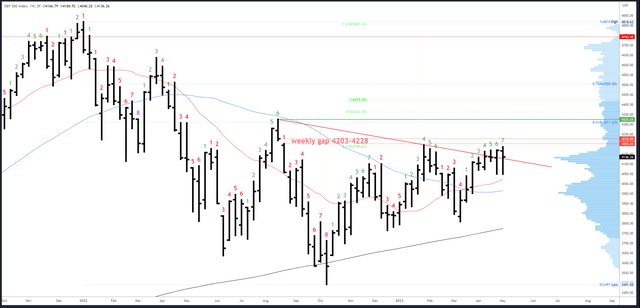

S&P 500 Weekly

A neutral bar with a lower close does not give any strong bias for next week. However, dips are getting smaller and the chart does look to be consolidating for a break of 4195. If the price were to rally and test this area again, it should be a genuine break-out this time. However, in a similar vein, another test of the 4048-49 area would likely break this support.

SPX Weekly (Tradingview)

If 4195 is cleared, the 61% Fib retrace of the 2022 bear market is at 4311, with the August high of 4325 just above.

If 4048 breaks, 3960 is the next decent support.

There is an upside (Demark) exhaustion count underway and will be on bar 8 of a possible 9 next week.

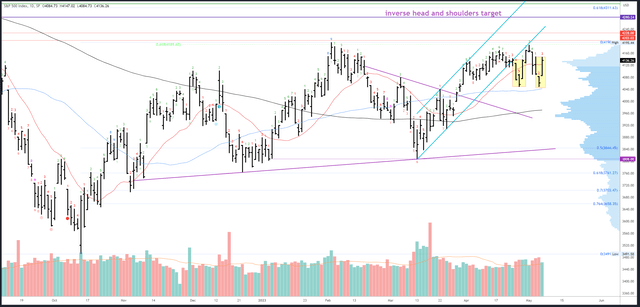

S&P 500 Daily

This week’s reversal from 4048 was very similar to the reversal from 4049 the week before. It was accompanied by a similar pattern in Regional Banks (KRE) following a capitulation bottom on Thursday. This sector should recover over the coming weeks, and improved risk sentiment should be a tailwind to the S&P 500.

SPX Daily (Tradingview)

The daily chart still has an active head and shoulders with a target of 4280. Given the overall bullish bias, it should be reached this quarter.

The 50dma will rise to the 4048-49 area next week, adding support there. A break of this area should lead to 3960.

No Demark exhaustion signals are possible next week.

Events Next Week

CPI on Wednesday and PPI on Thursday are the main releases. Hot inflation data would likely weigh on the S&P 500 as it heightens the probability of further rate hikes from the Fed, especially after the better-than-expected employment data this week.

On the other hand, weak readings could drive the S&P 500 higher. Perhaps the bulls really can get everything they want: a strong economy, falling inflation, a Fed pause, and cuts later this year.

Call me skeptical, but I don’t think this perfect scenario adds up over the longer-term. That said, markets don’t care what I think and could ignore the flawed logic as they chase a rally higher. I am reminded of the old adage, ‘markets can remain irrational longer than you can remain solvent.’

Probable Moves Next Week

Next week is effectively split into two sections. Pre-CPI trading on Monday and Tuesday should be slower, and a failure around 4160 could lead to a dip back to 4090-96.

Post-CPI is trickier to call, as this week’s action was neutral. There is a bias for more expansion this month, which means this week’s range is not likely to hold. But which way?

After this week’s dip, the door is now open higher. With the overall bullish bias in multiple timeframes, this is the probable move and as long as any early dip is mild and does not close weak below 4090, it should set up a test and break of 4186-95 later in the week.

However, I would not want to see any sharp decline towards this week’s lows. Expansion through 4048 would target 3960.

Read the full article here