Carvana’s (NYSE:CVNA) latest quarter was touted as the best in company history. It was surely an eventful quarter as the company was able to use the magic of financial engineering with its debt holders to inject liquidity into its balance sheet. I won’t get into the details of Carvana’s debt restructuring as this has been discussed in detail by other Seeking Alpha authors. My main concern is whether or not “new Carvana” can survive or thrive moving forward.

Looking Under The Hood of its Quarterly Results

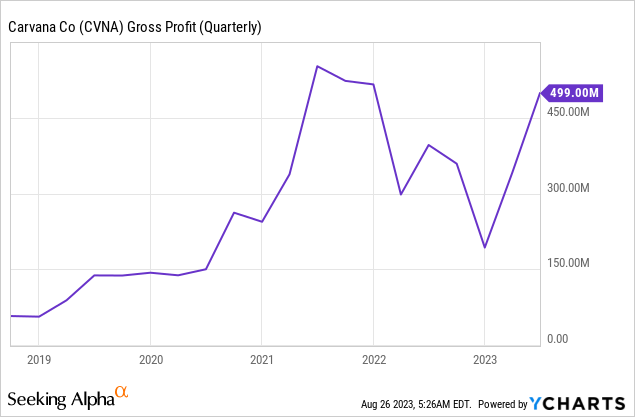

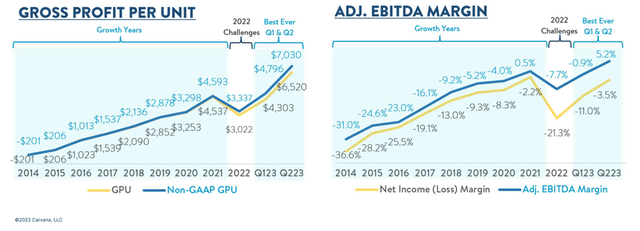

Simply reading the headlines and press releases the company has put out could make you believe that the company is in the midst of a fantastic turnaround. Carvana reported a Total gross profit per unit of $6,520 which is 94% higher than the second quarter. Total Non-GAAP GPU was even higher at $7,030 as the measure adds back $900 per unit of non-recurring items. I don’t really like it when companies use their own defined metrics for success. I prefer to check the actual GAAP measurements. Gross profit for the latest quarter was $500 million. This had been the highest it has been since Dec 2021 and a 26% improvement from Q2 2022.

Carvana’s Net loss margin dropped to 3.5% which was a massive improvement to the 11.3% in 2022. It is a bit misleading though to compare current numbers with 2022 numbers due to the challenges in the used car market that year. Still, a Net loss of 3.5% is an improvement to its pre-covid Net loss of 9.3%.

GPU, Net Income (Investor presentation)

The main driver in improving the company’s EBITDA and Net Income has been the aggressive cutting of SG&A expenses. This is because total revenues have been on a decline. The company cut annual SG&A costs by $1.1 billion. Moving forward the company identified other areas where it could cut costs. Areas of improvement in efficiency and technology. Moving forward the company is able to cut down on advertising by $21 million. However, that wouldn’t necessarily help the company’s main issue its failing business.

Carvana’s business model is still failing

There was a time when Carvana had a legitimate chance of disrupting the used car buying industry. However, I believe this chance may have passed. The innovator’s dilemma which is the formula for disruption states that large corporations have a disincentive to innovate due to the fear that new products would cannibalize existing operations.

The Covid-19 pandemic though has forced larger companies and other incumbents to embrace online delivery of vehicles. As businesses were forced to remain closed and people practiced social distancing, Car Dealers began selling used cars online. They have done this without necessarily a dedicated platform using services like Facebook (META) or Zoom (ZM). The pandemic basically forced the used car industry to adopt online selling.

What should be worrying for Carvana is that CarMax (KMX), the nation’s largest used car retailer, has also moved a portion of its business online. CarMax can also deliver your purchased car to your address, a practice that started with contactless curbside pickups during the pandemic.

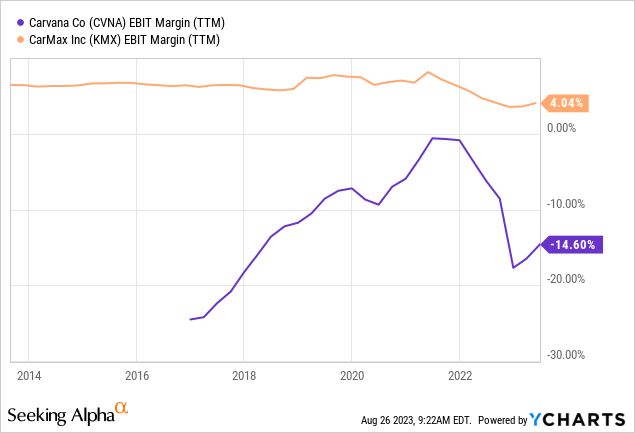

So right now there really is no reason to own Carvana compared CarMax as the former is overvalued and doesn’t have the necessary financial metrics to support its business.

First of all, CarMax is actually profitable, unlike Carvana which has been losing money year after year for the last 10 years. CarMax is trading at a P/E ratio of 26x. Not exactly cheap, but at least the business is profitable. More importantly, on an EBIT level, CarMax actually makes a decent margin, unlike Carvana which is still trying to figure out its business model.

With most local dealers having their own online capabilities, Carvana would need a stronger brand presence in order to capture market share. However since the company is in cost-cutting mode, it wouldn’t surprise me to see Carvana losing market share to other online car dealerships.

Carvana has a bunch of other gimmicks like the car vending machine. However, I am not sure that it would add anything to the car-buying experience. Purchasing through Carvana in the past had resulted in such a poor experience (for example car registrations would come very late) that multiple states had banned the company from operations. It had begun to fix those issues but again I wonder how the customer experience would be purchasing from Carvana given that the company is in the midst of very aggressive cost-cutting.

Conclusion

In order to succeed as a business Carvana would need to aggressively scale its business. The company has never been profitable and is starting to cut costs at a time when its sales are declining. The company is currently trading at 2.5x Sales. Carvana had a chance to be disruptive with its online car sales model. However, most local dealers already have online capabilities, thanks to the pandemic. There really isn’t anything to make Carvana stand out apart from the memes.

Read the full article here