On the surface, Ford Motor Company (NYSE:F) is firing on all cylinders. The automaker is experiencing an improved supply chain, better earnings, and should be positioned well as price stability begins to spread throughout the economy. With a business as cyclical as Ford, investors need to be mindful of the potential headwinds facing the company, and in this case, there are three large ones worth mentioning. In my previous coverage on Ford, I gave a sell rating.

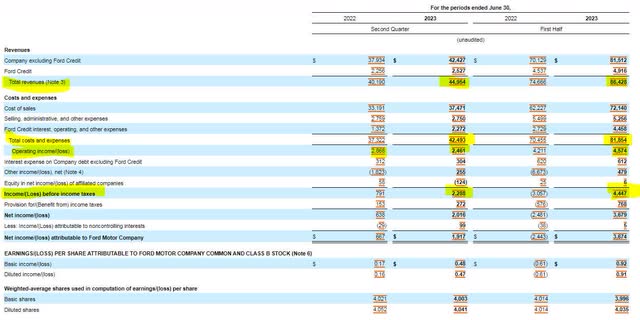

Ford’s sales and operating income results were mixed for the first half of 2023. The company grew revenue by $12 million in the first half compared to the same period a year ago. Inflationary pressures did affect the cost of sales and appear to have eroded profitability as second-quarter operating income declined $400 million compared to the second quarter of a year ago. A $7 billion swing in other income is mainly responsible for Ford’s increase in net income for 2023.

SEC 10-Q

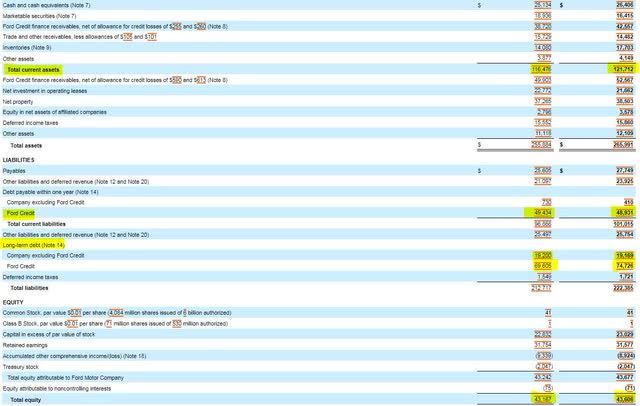

On the balance sheet side, Ford’s equity has grown by more than 1% or close to $500 million during the first half of 2023. An increase in working capital (finance receivables and inventory) is the leading driver behind the increase in assets. Short term debt is relatively the same but long-term debt has grown by $5 billion, led by Ford Credit. It is important to note that Ford Credit liabilities, which tend to be tied to sales, currently outpace total receivables by approximately $16 billion.

SEC 10-Q

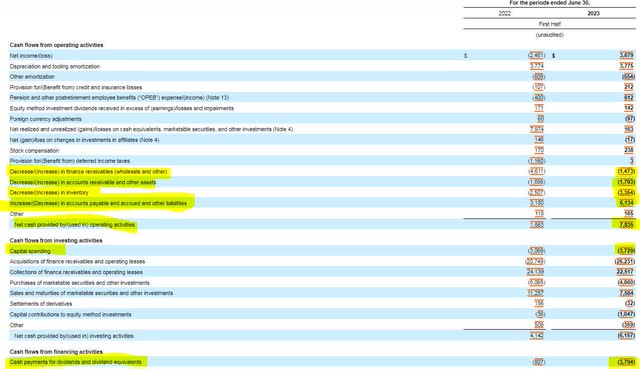

Ford’s cash flow statement shows the greatest improvement. Operating cash flow increased by $6 billion compared to the same period a year ago. It’s important to note that $3 billion of this variance was due to additional growth in accounts payable and accrued liabilities. While free cash flow exceeded Ford’s dividend obligations, it comes at the expense of borrowing from vendors and will need to be paid in future quarters.

SEC 10-Q

In the case of the three headwinds facing Ford Motor Company, two are actively impacting the organization now and are expected to intensify, and the third has yet to materialize.

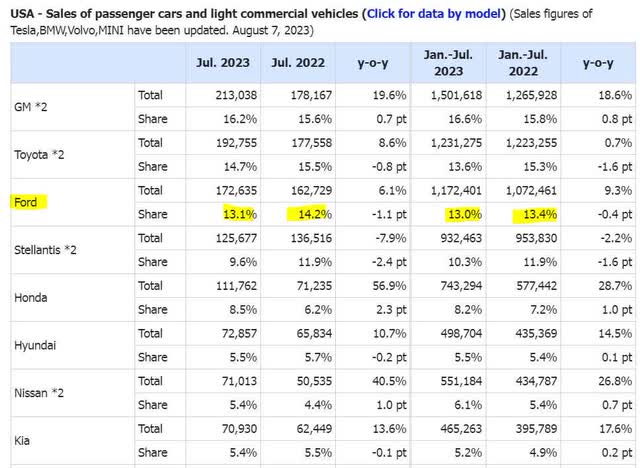

First, Ford is losing market share in the passenger car and light commercial vehicle market. While the decline through the entire year is less steep, the year-over-year market share decline in the month of July is down by more than a full point. General Motors, Honda, and Nissan are gaining against the backdrop of Ford’s decline in this space. While Ford’s position with pickup trucks remains strong, it covers less than half of their revenue.

MarkLines

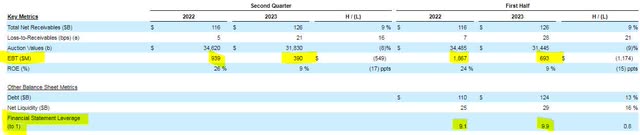

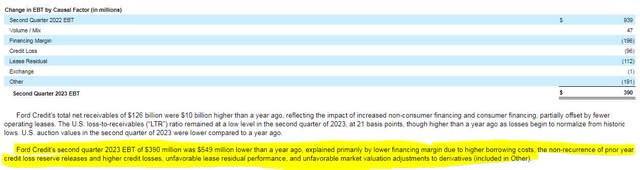

The second headwind impacting Ford and expecting to grow is higher interest rates. During the first half of 2023, Ford Credit saw a greater than $1 billion decline in earnings. The two-thirds decline in earnings was also mirrored in the second quarter results. Ford explained the lower margins had several causes, but the leading cause was lower margins driven by higher financing costs.

SEC 10-Q SEC 10-Q

Interest rate conditions for Ford and Ford Credit will continue to worsen for the remainder of the year as low interest rate debt matures and is refinanced by much higher rates. For example, next month, Ford Credit has several bonds maturing with coupon rates of under 4%. Recently, the company issued $1.75 billion in new notes with a 6.1% coupon. Debt refinancing will continue to erode earnings until interest rates decline.

FINRA

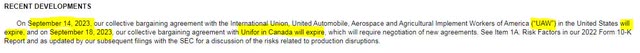

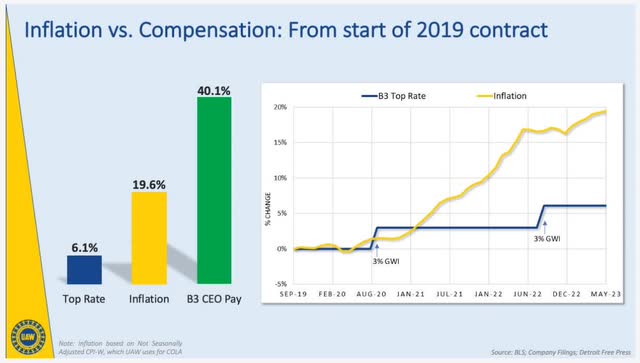

The third headwind facing Ford is the labor unions. In the latest 10-Q filing, Ford disclosed that the collective bargaining agreements in Canada and the United States were set to expire in the third quarter of this year. The UAW has requested 40% pay increases as part of the collective bargaining process, citing the pay increases of the Big three CEOs since the start of the 2019 contract. While everyone is holding out hope that there won’t be a labor stoppage, Ford’s recent underwriting of a new $4 billion revolving credit facility shows that the automaker is preparing itself financially for the worst.

SEC 10-Q UAW Website

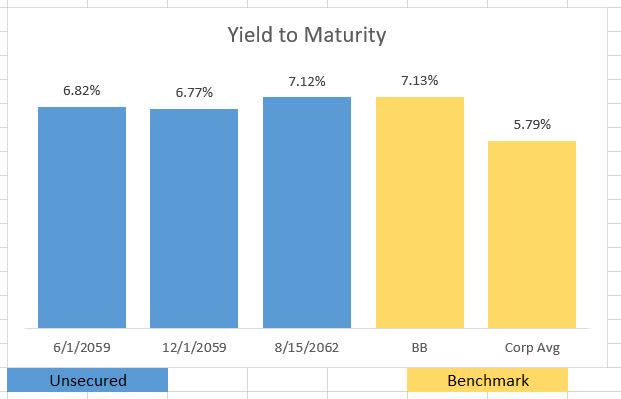

All three of these headwinds cast doubt regarding Ford’s ability to maintain its dividend, but could income investors utilize the company’s debt as a good investment? Ford has three baby bonds that mature between 2059 and 2062. Each of these bonds is currently trading with yields to maturity of between 6.77% and 7.12%, just below the benchmarks for BB rated debt. Based on the risks being presented, I believe that both Ford’s stock and bonds are overpriced.

Author Spreadsheet of Current Yields

The risk of a work stoppage is the cherry on top of two already present headwinds threatening Ford Motor Company’s earnings. The company’s dividend is clearly in danger of being eliminated to preserve cash flow through these trials. While I expect the company’s debt to be honored through maturity, it is currently overpriced compared to its peers. Should Ford’s debt selloff and yields rise, it may be worth another look, but until then, I am passing on the company’s shares and debt.

Read the full article here