Realty Income Corporation (NYSE:O) investors have suffered another meltdown, as the selling carnage forced a battering that took O back toward lows last seen in October 2022.

As such, despite posting a robust second-quarter or FQ2 earnings release in early August, investors weren’t amused, as the yield-driven volatility is back to haunt O holders. As a reminder, I highlighted such an opportunity in October 2022, as the capitulation created a highly remarkable setup that was hard for dip buyers to miss. Accordingly, O bottomed out in mid-October before buyers returned in force with a spectacular recovery toward its January 2023 highs.

As such, the recent stunning collapse that dissipated those gains has likely shocked holders. I looked closely at the FQ2 earnings scorecard of the leading retail-focused net-lease commercial REIT and found no significant concerns.

Portfolio occupancy rates remained high at 99%. The company’s rent capture rate for re-leased units was robust at 103.4%. Realty Income’s balance sheet also didn’t show significant red flags as its adjusted EBITDAre leverage ratio remains within the target range at 5.4x.

In addition, most of Realty Income’s debt profile is fixed at 92% with a weighted average interest rate of 3.79%. Its debt maturity profile is also well-managed, with only 10% of its debt maturing in 2023-24. As such, its rock-solid financials and risk profile gave management more confidence to telegraph a more optimistic investment outlook, raising its acquisition guidance to $7B.

Therefore, it seems strange that the market has decided to de-rate O further downward despite reporting robust fundamentals, with its rock-solid dividend payouts not in imminent danger of being slashed. Despite that, I believe it’s crucial for investors to assess why the market has decided to hammer O to determine whether the support zone defended by dip buyers in October 2022 could hold.

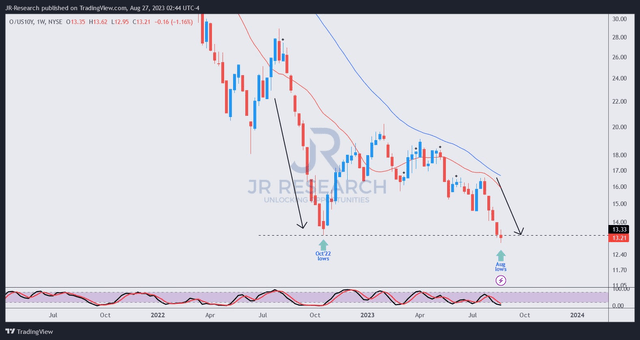

I believe Realty Income’s forward dividend yields (5.5%) are expected to remain robust. Seeking Alpha Quant’s dividend safety indicator also didn’t highlight the risks of an impending cut. However, income investors need to assess the relative appeal of O compared to what they could obtain from investing in Treasuries. I noted that the steep decline in O coincided with the upward inflection in the 10Y yield, which broke above the highs last seen in October 2022 before closing at 4.24% over the past week.

O/US10Y price chart (weekly) (TradingView)

As such, I believe the de-rating in O is likely associated with the surge in yields, as seen in the recent collapse of the O/10Y chart above. Therefore, investors must assess whether they have confidence that the Fed is likely at or close to its peak rate hikes, as market operators anticipated a still-hawkish Fed.

In other words, I believe the market has already priced in the FOMC maintaining the rates at a high level for longer than previously anticipated. As such, unless the incoming inflation data suggests that Fed Chair Jerome Powell and his team need to step up their inflation fight by a few more notches, it’s not likely to get worse from here.

As such, O could stage another sharp recovery if the Fed moves toward cutting rates earlier than expected, despite Powell’s cautious positioning in his recent Jackson Hole speech.

While I don’t expect O to regain its January highs anytime soon after the massive collapse, buying sentiments could improve if dip buyers return to defend the current levels robustly.

With O mired in a medium-term downtrend, I assessed that investors must be cautious in anticipating a rapid recovery similar to the surge in October 2022. Investors are likely baking in a prolonged downturn in commercial real estate while expecting interest rates to remain higher for longer.

However, the recent capitulation in O brought fresh memories of its previous October collapse, suggesting investors’ pessimism could be peaking again.

Rating: Maintain Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here