Introduction

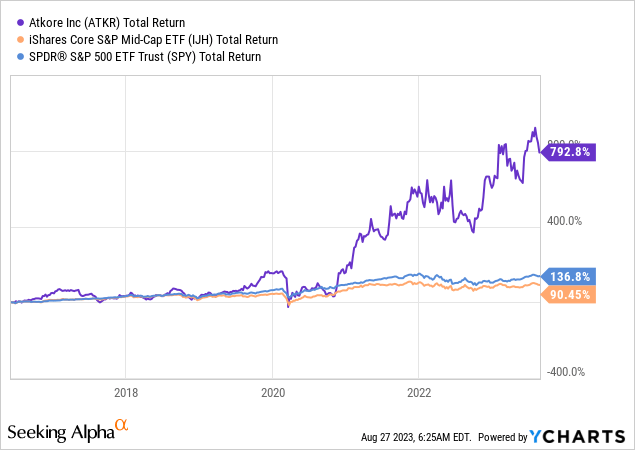

It’s time to discuss Atkore Inc. (NYSE:ATKR). This industrial midcap player with a market cap of $5.4 billion has become a high-flying outperformer during the pandemic, turning every $1.00 invested into more than $7.00.

What makes this Illinois-based company so special is its focus on margin enhancements in the Electrical Equipment and Parts industry.

While ATKR does not pay a dividend, it efficiently uses free cash flow to grow its business. Year-to-date, shares are up 26% despite weakening economic growth.

Even better, the company recently hiked its guidance thanks to strong secular tailwinds and its ability to target specific demand.

In this article, we’ll discuss all of this and why I believe that bottoming growth in the future could give this stock another major boost – far beyond prior highs.

So, let’s get to it!

What’s Atkore?

While Aktore’s roots go back to the 1950s, Atkore Inc. was established as a Delaware company in 2010. It’s the parent company of Atkore International Holdings and Atkore International.

The company is a leading manufacturer serving the non-residential construction, residential, and industrial markets.

Atkore Inc.

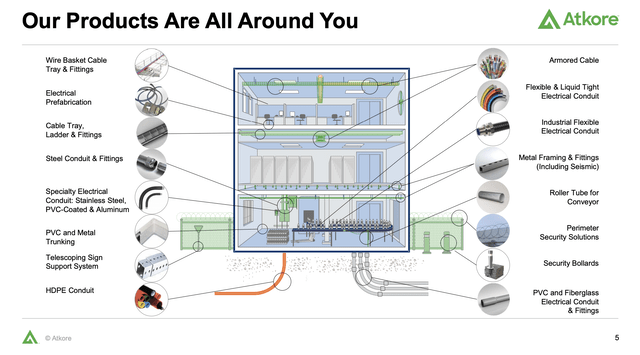

Atkore operates in two core segments:

- Electrical products for the construction of electrical power systems

- Safety and Infrastructure products for critical infrastructure protection

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Electrical |

2,230 | 76.2 % | 3,014 | 77.0 % |

|

Safety and Infrastructure |

698 | 23.8 % | 900 | 23.0 % |

Atkore believes that its competitive edge lies in product quality, strong brands, national presence, and commitment to customer satisfaction.

As one can imagine, the company serves a wide customer base, including electrical, industrial, and specialty distributors, contractors, OEMs, and more.

With an extensive distribution network, the company’s products are essential components for over 13,000 electrical distributor branches in the United States.

Distribution-based sales account for a significant portion of net sales, with an emphasis on value-added services like ReliaRoutes fixed trucking lanes and a mobile app for order tracking.

Its main suppliers include steel companies like Cleveland-Cliffs (CLF), Steel Dynamics (STLD), and Nucor (NUE).

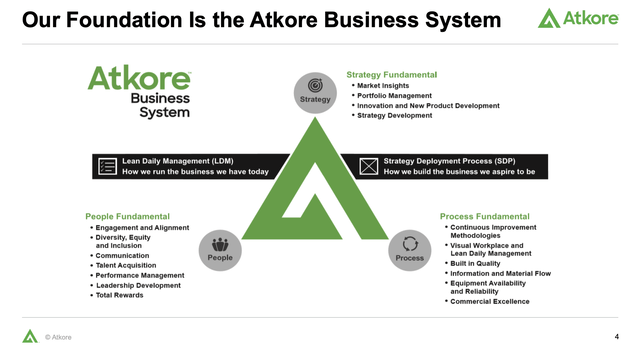

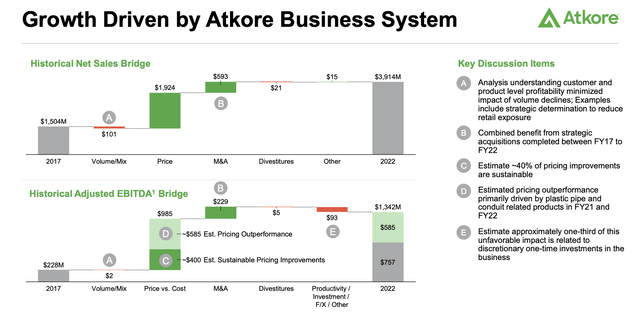

Furthermore, the company operates the Atkore Business System, which prioritizes Strategy, People, and Processes. It’s a culture-shaping approach to streamline the company.

Atkore Inc.

So far, this has borne fruit.

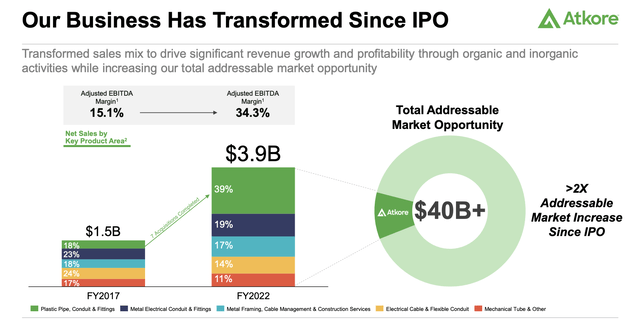

Between 2017 and 2022, the company has grown its net sales from $1.5 billion to $3.9 billion, which includes seven acquisitions.

The company also boosted its adjusted EBITDA margin from 15.1% to 34.3% while increasing its addressable market by widening its footprint.

Atkore Inc.

Looking at the overview below, we see that pricing was the main contributor to higher margins. It dwarfs the impact of M&A on adjusted EBITDA growth. Volume/mix remained unchanged.

Atkore Inc.

Having said that, as most know, the economy isn’t doing too well right now.

This begs one question.

What’s Atkore Up To Now?

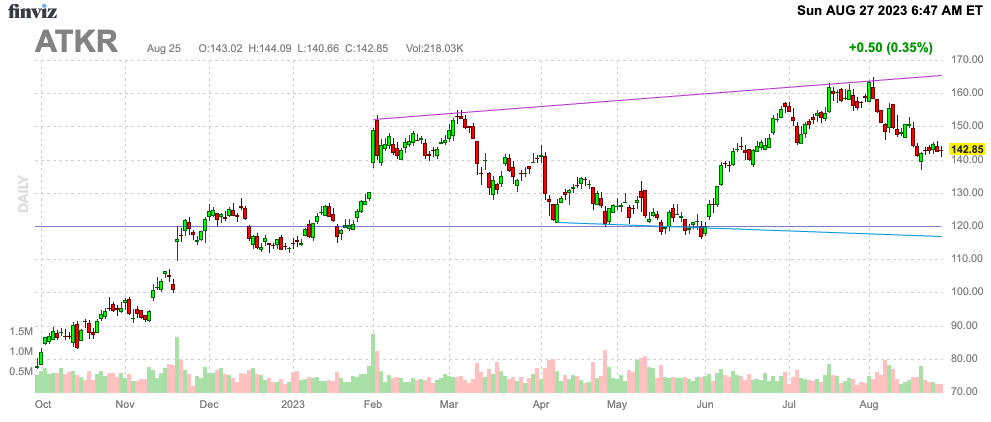

While I’m writing this, ATKR shares are trading 13% below their 52-week high. Shares are up 26% year-to-date.

FINVIZ

While shares have encountered increasing volatility this year, it’s hard to make the case that the company is struggling.

This is confirmed by its numbers so far.

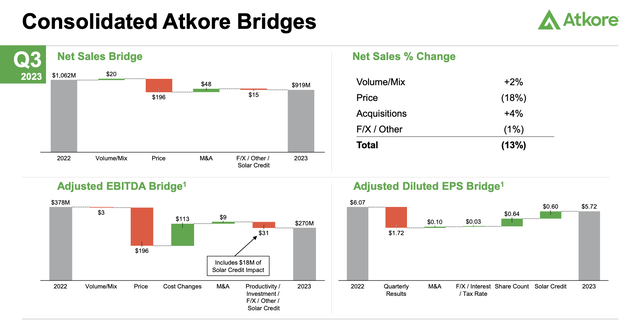

In its third fiscal quarter of 2023, the company saw a 2% increase in volume, aligning with its projection of mid-single-digit volume growth for the entire year.

Atkore Inc.

Furthermore, PVC volumes experienced an anticipated decline due to normalization trends compared to the strong 3Q performance of the previous fiscal year.

However, excluding PVC’s impact, Atkore’s volume would have risen by approximately 7%, which is a big deal in this environment.

Sequential growth in 3Q23 was observed in PVC products, with a quarter-over-quarter volume increase of 11%. Total pricing was an 18% headwind.

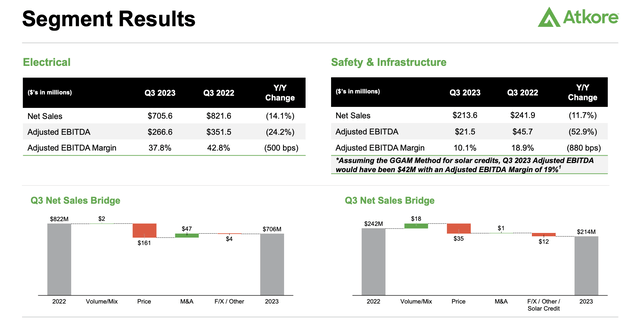

- The electrical segment experienced margin compression, which was attributed to pricing normalization and year-over-year volume declines in PVC-related products. Nonetheless, margins exceeded expectations, which shows the company’s resilience when it comes to protecting its bottom line.

- The steel conduit products benefited from resolving recent supply chain challenges.

- The S&I segment saw net sales decline due to lower average selling prices, reflecting changes in steel input costs.

- Adjusted EBITDA and margins compressed due to solar credit adjustments, but the GGAM method would have led to a strong 19% adjusted EBITDA margin.

Atkore Inc.

So, what’s GGAM?

During its 3Q23 earnings call, the company discussed a significant change in accounting treatment related to solar credits due to the Inflation Reduction Act.

The company previously planned to apply the government grants accounting model (“GGAM”) for transferring a majority of solar credits to customers, but a recent determination shifted this approach.

For fiscal year 2023, ending on September 30th, the solar credits will no longer be recognized as a reduction of cost of sales; instead, they will contribute to the company’s income tax provision.

However, starting from the fiscal year 2024, the GGAM will be adopted to record credit benefits as the cost of sales reduction.

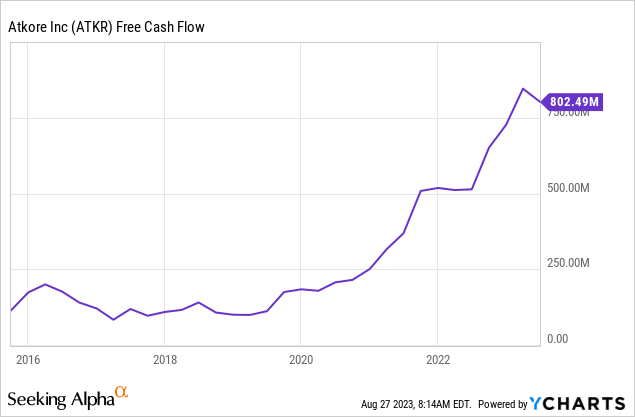

Having said that, the company also excels at free cash flow generation.

Free cash flow is operating cash minus capital expenditures. Free cash flow can be used to reduce debt, buy back stock, pay a dividend (ATKR doesn’t pay a dividend), or acquire other companies.

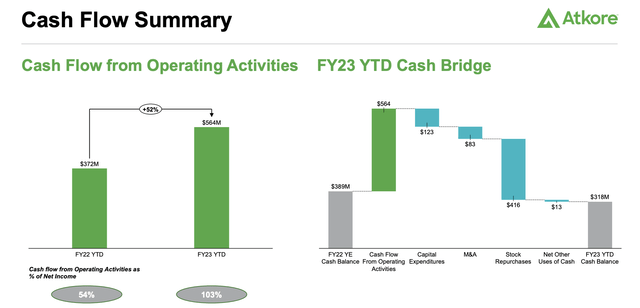

Year-to-date, cash flow from operating activities surpassed 103% of net income, which is a 52% increase compared to the same period in the previous fiscal year.

Atkore Inc.

The company invested more than $120 million in capital expenditures, primarily directed toward facility expansions and growth initiatives.

More than three times that amount was spent on buybacks.

As we continue to drive strong results against the record highs of last year, the strength of our cashflow and balance sheet provides an important foundation for our company’s future. – ATKR 3Q23 Earnings Call

Outlook & Valuation

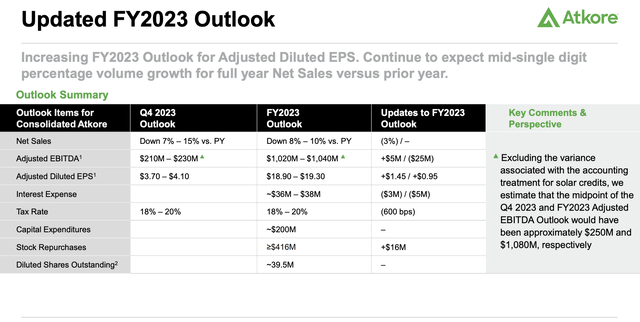

As a result of a strong performance in the first three quarters of this fiscal year, the company boosted its full-year guidance.

According to the company (emphasis added):

We are encouraged by the performance in the first three quarters of fiscal year and have increased our full year outlook for adjusted EPS. The results released today reflect not only the strength and stability of our underlying business model, but the determination of our team to execute and deliver on our strategic growth initiatives. When I take a step back and compare our results from this quarter versus those of several years ago, we have structurally improved this business and we are demonstrating the sustainability of our earnings into the future.

Atkore Inc.

In other words, there are three takeaways here:

- The company sees stronger-than-expected developments despite worsening economic growth expectations.

- Structural business improvements continue to pay off.

- The company is attractively valued.

To be fair, my last takeaway needs more context.

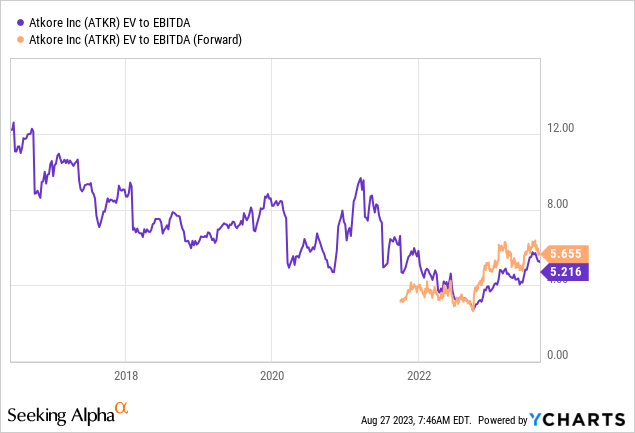

Using NTM EBITDA, ATKR shares are trading at just 5.7x NTM EBITDA, which is cheap/attractive for a company with an implied FY2024E free cash flow yield of 7%.

The problem is that the market isn’t willing to bet on a new bull market in ATKR’s industry.

Next year, the company is expected to generate $15.20 in EPS, down from $17.5 in 2023E.

Eventually, I believe that ATKR will reach an 8x multiple with higher EBITDA.

That could pave the way for a market cap of $8 billion in the next 2-3 years (50% upside).

For now, the consensus price target is $178, which is 25% above the current price.

I agree with that target.

However, I believe that economic weakness could provide another buying opportunity below $120. If I were in the market for more exposure in this segment, I would be looking for a first entry at these prices.

The reason I’m not currently investing in ATKR is because I have invested in Carlisle Companies (CSL). Although not a direct competitor, it is also dependent on building and construction demand.

I’ll need a steep sell-off opportunity in order to expand my exposure in cyclical areas even further, as I really try to keep as few positions in my portfolio as possible.

Takeaway

Atkore stands out as a post-pandemic success story, multiplying investments by over sevenfold.

Its focus on margin enhancement within the Electrical Equipment and Parts industry has paid off, evidenced by a 26% share price rise this year despite economic challenges.

The company’s strategic focus, commitment to quality, and broad customer base drive its growth.

Key highlights include resilient margins, smart adaptation to industry changes, and impressive cash flow generation.

The company’s value proposition is compelling, trading at a low EBITDA multiple and offering a robust free cash flow yield.

While current conditions may present a wait-and-see approach, the consensus price target of $178 aligns with my assessment.

Yet, I’m vigilant for a potential entry point under $120 due to economic uncertainties.

Read the full article here