In a recent quarter, General Electric Company (NYSE:GE) showcased an impressive financial resurgence, recording a significant uptick in total orders. Its revenue streams also witnessed marked growth. This financial renaissance was mainly propelled by heightened demand in the company’s Aerospace sector and a surge of orders in the Renewable Energy domain. Moreover, the commendable performance had General Electric’s Chairman and CEO, H. Lawrence Culp, Jr., spotlighting the robust growth in orders and revenues. As the company persists in its positive trajectory under H. Lawrence Culp’s skilled leadership, General Electric’s stock has substantially risen in the past year. This transformative phase in its financial metrics and stock performance prompts intrigue about the company’s future potential. This article offers a technical analysis of General Electric’s stock price to gauge its future trajectory and identify potential investment prospects. The stock appears to maintain a robust upward trend, hinting at a possible rise in the upcoming months.

A Glimpse into GE’s Financial Turnaround

In the second quarter of 2023, General Electric displayed impressive financial results. The company reported a significant surge in total orders to $22.0 billion, a 59% increase. Total revenues (GAAP) reached $16.7 billion, up 18%, while adjusted revenues displayed a 19% organic growth at $15.9 billion. The GAAP profit margin was 8.3%, a jump of 1,510 basis points, with the adjusted profit margin reflecting an 8.8% growth or a 160 basis point increase organically. The Continuing EPS (GAAP) stood at $0.91, a substantial increase by $2.00, with the adjusted EPS at $0.68, up by $0.32.

Furthermore, Cash from Operating Activities (GAAP) was $0.3 billion. Moreover, the free cash flow rose from $0.2 billion to $0.4 billion. General Electric Chairman and CEO H. Lawrence Culp, Jr. emphasized the strong performance by highlighting the double-digit growth in orders and revenues. This performance was chiefly driven by an increased demand in General Electric Aerospace and a record-setting orders influx in Renewable Energy. Given these results, the company revised its full-year guidance upwards.

While General Electric may not be garnering the same media glare it once did during the era of Jack Welch, it has certainly been catching the eyes of its investors. Over the past twelve months, under the stewardship of H. Lawrence Culp, General Electric’s stock has soared by over 100%, a testament to the company’s remarkable management and successful turnaround. Given this surge, people wonder if General Electric’s meteoric rise has reached its pinnacle or if greater heights await. One must assess the company’s trajectory over the past year to delve deeper into this question. A significant factor that contributed to this resurgence was the market recognizing General Electric’s potential for growth, an insight later validated by the impeccable execution of the management. This realization and renewed optimism across all of General Electric’s business sectors paved the way for the stock’s impressive performance.

About a year ago, while the aerospace division of General Electric was exhibiting strong growth, it faced challenges in its supply chain, particularly concerning the production of commercial airplane engines and its overall defense business. On the other hand, while the power segment was stable, the renewable energy sector was not meeting investors’ expectations. Various factors contributed to this slump, including escalating raw material prices, supply chain complications, and prior commitments to uncompetitive rates. However, the latest second-quarter earnings report narrated a different story altogether. General Electric elevated its overall expectations and, more significantly, for each business unit. A pivotal update was the merger of General Electric Renewable Energy and Power, set to be rebranded as General Electric Vernova and spun off in early 2024.

Focusing on General Electric Aerospace, there is a noticeable rebound in the commercial aerospace sector, evident from the resurgence in flight departures. This upturn bodes well for General Electric’s aftermarket engine sales. The company is also making strides in addressing its supply chain issues, with plans to roll out 1,700 LEAP engines in collaboration with Boeing and Airbus. Furthermore, General Electric Renewable Energy, comprising of onshore wind, offshore wind, and grid, is on an upward trajectory, especially in the onshore and grid sectors.

A Deep Dive Into Recent Market Rally

The technical perspective for General Electric paints a highly optimistic picture, with the stock currently navigating a pronounced upward trend. Historically, one can trace back General Electric’s most significant surge from its 1988 low of $9.79 to its zenith at $200.05. Between 1988 and 2000, buoyed by the innovative leadership of CEO Jack Welch, General Electric’s stock underwent substantial growth. Jack Welch’s vision guided General Electric through pivotal shifts, from streamlining lagging segments to aggressively nurturing the high-performers and broadening its international footprint and service offerings. This was underpinned by Jack Welch’s tenet of positioning each General Electric segment at either the market’s pinnacle or as a close runner-up, fostering a culture defined by ambition and excellence. This era, characterized by dynamic economic expansion, technological breakthroughs, and buoyant financial markets, bolstered the impact of Jack Welch’s strategies, propelling General Electric’s stock to new heights.

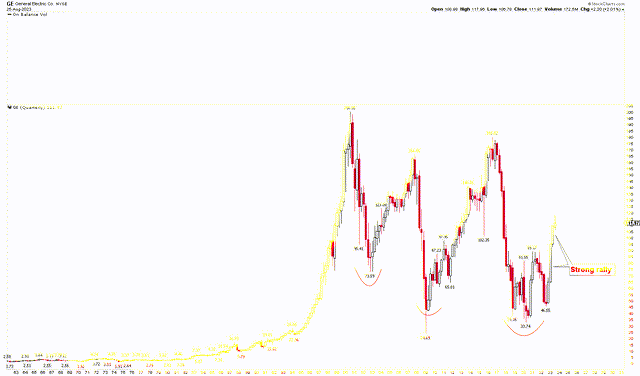

The following chart identifies three significant bottoms demarcated by red arcs: the 2002 low at $73.59, the 2009 dip to $24.69, and the 2020 drop to $33.74. Historically, each of these lows was met with a robust upward reaction in stock price. Particularly noteworthy is the formidable base established in 2020 at $33.74, which evolved over four years from 2018 to 2022. This four-year consolidation around this support indicates a firm bottom, and recent quarterly candlesticks further signal an uptrend, indicative of a bullish momentum.

General Electric Quarterly Chart (stockcharts.com)

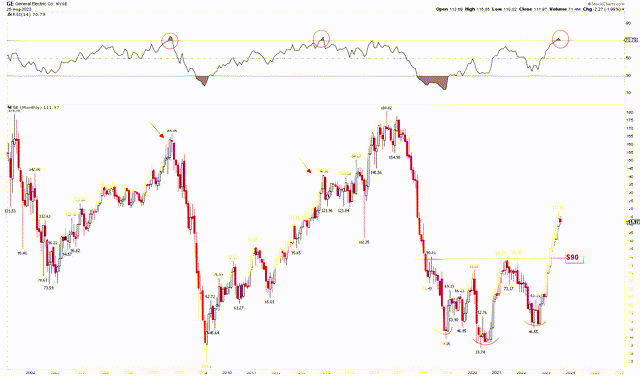

For a granular insight into General Electric’s bullish trajectory, the ensuing monthly chart elucidates the bottom formation process from 2018 to 2022, which is distinctly bullish, underlined by the appearance of an inverted head and shoulders pattern. This pattern’s shoulders rest at $39.16 (left) and $46.55 (right), with the head at $33.74. The pattern’s neckline breached at $90, suggesting a potential climb in stock price. Though the bullish monthly candles underscore market vigor, the current RSI indicates the stock is veering into overbought territory, prompting a slight retreat from the highs. Historically, such overbought phases, as highlighted by the red arrows in the following chart, have precipitated considerable corrections. However, this instance may differ, given the unequivocally bullish price action and the successful breach of the inverted head and shoulders neckline. Any short-term market pullbacks stemming from overbought conditions could pave the way for enticing buying prospects around the $90 mark.

General Electric Monthly Chart (stockcharts.com)

Key Action for Investors

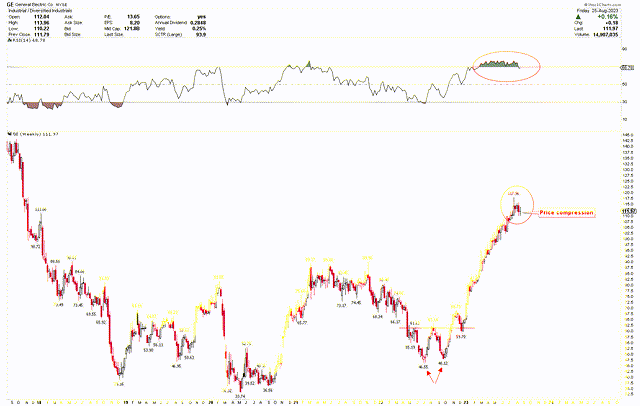

Based on the above discussion, the prevailing long-term trend remains bullish while the stock exhibits an overbought status, as the RSI indicates. Delving deeper into this bullish trajectory, the weekly chart below identifies a double bottom at $46.55 and $48.12, with a neckline at $60. Once this double bottom was surpassed, the stock registered significant gains. Even as the RSI suggests an overbought scenario leaning towards a correction, the recent appearance of an inside candle denotes price compression, often a precursor to substantial price shifts. Should the stock cross the $117.96 threshold, it could witness an upward surge.

Conversely, if overbought conditions lead to a price dip, it might pave the way for a corrective phase. Nevertheless, any downward trajectory can be a lucrative entry point for long-term investors. The previously mentioned neckline of the inverted head and shoulders on the monthly chart, positioned at $90, is a robust support level. Hence, for prospective investors, the current price offers an appealing entry, with the potential to accumulate more positions if the price retracts towards the $90 mark.

General Electric Weekly Chart (stockcharts.com)

Market Risk

In the past, General Electric grappled with issues in its aerospace supply chain, especially concerning commercial airplane engine production and defense operations. While there have been recent advancements, any future supply chain setbacks might hinder growth. Similarly, General Electric’s renewable energy division encountered hurdles, including rising raw material costs, logistical challenges, and binding uncompetitive rate agreements. A recurrence of such problems could impair its progress. The growing rivalry in aerospace and renewable energy fields could challenge General Electric’s market dominance.

From a technical viewpoint, the monthly and weekly charts highlight the market’s overbought status, suggesting a potential correction. The critical support is pegged at $90, but a monthly close beneath this benchmark might negate the long-term bullish projection.

Bottom Line

General Electric has journeyed through ebbs and flows, facing challenges yet illustrating remarkable resilience. General Electric’s revival story is taking center stage, highlighted by impressive stock performance and strategic overhauls across its business divisions. The financial figures for 2023 bear testimony to this resurgence, with notable gains in orders, revenues, and profitability. Historical stock trends showcase General Electric’s potential, with recent bullish patterns suggesting significant growth potential. The emergence of an inverted head and shoulder pattern over the past 4 hours underscores a critical bottom formation process, pointing towards a potential surge upwards. Although the stock price may face a correction because of its overbought status, this pullback is seen as an attractive entry point for buyers. A solid support level is established around the $90 mark, allowing investors to initiate long positions for substantial returns. If, however, the market persists in its upward trajectory without any correction, investors may be left without optimal entry points. As a strategy, investors might consider buying at current levels and further augmenting their holdings near the $90 threshold.

Read the full article here