Earlier this month, I wrote on Pan American Silver (NYSE:PAAS), noting that the stock’s Q2 results were solid with the inclusion of Yamana’s South American assets and that it was one of the more attractively valued name sector-wide. Since then, PAAS has significantly outperformed the Silver Miners Index (SIL) which is down 7.7% month-to-date, not helped by another miserable quarter from Guanajuato Silver (OTCQX:GSVRF), a fall of ground incident and fire at Hecla’s (HL) Lucky Friday Mine (shaft #2), and a prolonged strike at Penasquito which is Wheaton’s (WPM) largest silver stream from a contribution standpoint. Fortunately, the news has only been positive for PAAS, which reported solid growth in reserves, a balance sheet upgrade following the divestment of non-core assets, and investors can look forward to another update on its La Colorada Skarn Project by year-end. In this update, we’ll look at the recently released Reserve & Resource update below:

All figures are in United States Dollars unless otherwise noted.

Silver Reserves

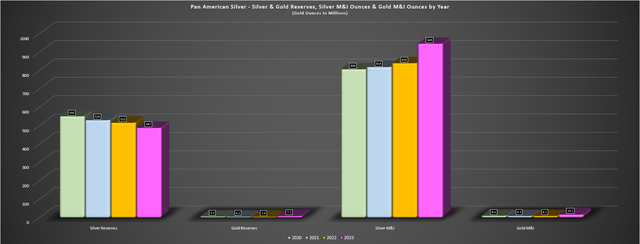

Pan American Silver released its FY2023 (reserves as of June 30th, 2023) last week, reporting total silver reserves of ~576 million ounces or ~487 million ounces when adjusting for the sale of MARA (56.25%), and Morococha (92.3%) at the end of July. This figure declined on a year-over-year basis (FY2022: ~515 million ounces) despite the Yamana acquisition, and is down from ~552 million ounces in 2019. However, silver reserves were roughly flat year-over-year if we adjust for the loss of ~33 million ounces of silver at Morococha (divestment), maintaining Pan American’s industry-leading silver reserve base which is larger than the silver reserve base of First Majestic (AG), Fortuna Silver (AG), Hecla Mining, Endeavour Silver (EXK) and MAG Silver (MAG) combined.

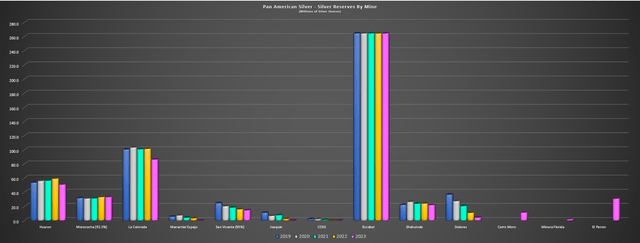

Pan American – Silver Reserves by Mine – Company Filings, Author’s Chart

Looking at the company’s silver reserves on a mine-by-mine standpoint, we can see that Escobal has remained flat at ~265 million ounces (care & maintenance), and Morococha (92.3%), COSE, and Joaquin have seen reserves drop to zero with these assets either being moved into care & maintenance or sold. As for currently producing assets in its silver segment, Huaron’s reserves declined to ~50.9 million ounces (~9.3 million tonnes) representing a 9-year mine life assuming similar throughput rates and based on solely reserves, while San Vicente’s reserves declined to ~14.6 million ounces (~1.4 million tonnes), translating to a sub 5-year mine life assuming similar throughput rates and solely reserves. Finally, La Colorada saw reserves decline to 86.3 million ounces (~9.2 million tonnes), translating to an 11-year mine life assuming throughput levels of ~800,000 tonnes per annum. These are relatively long mine lives as far as peer comparisons go for silver assets, with Fortuna down to just two years of mine life at San Jose on reserves.

Notably, Pan American Silver has ~940 million ounces of silver backing up its reserve base, with ~94.4 million ounces of silver and additional base metal upside at La Colorada Skarn. And while not all these ounces will make it into mine plans and a significant portion of these resources are at its Navidad development project (~632 million ounces), I am optimistic that Pan American can continue to replace its reserves at its assets and prolong its shorter mine lives, especially if we see upside in the silver price over the coming years. This is because unlike some producers that are using much higher metals price assumptions ($22.00/oz – $26.00/oz), Pan American Silver uses a more conservative price of $19.00/oz at most of its assets to calculate reserves.

Gold Reserves

Moving over to the company’s gold reserves, Pan American ended the year with ~12.9 million ounces of gold reserves or ~7.7 million ounces when adjusting for its now divested stake in MARA (56.25%) and Jeronimo (57%). This represented a ~120% increase from ~3.6 million ounces in the year-ago period. Plus, this reserve base is backed up by ~16.1 million ounces of measured & indicated gold resources or ~10.8 million ounces when excluding La Arena II (Sulphides) which may end up being a non-core asset that Pan American Silver could look at divesting given that it’s unlikely to pursue two major growth projects simultaneously (La Colorada Skarn appears to be the higher priority). This gold reserve base (~7.7 million ounces) dwarfs that of its silver peers, and even compares well to some predominantly gold producers like SSR Mining, which ended the year with just shy of 9.0 million ounces of gold reserves.

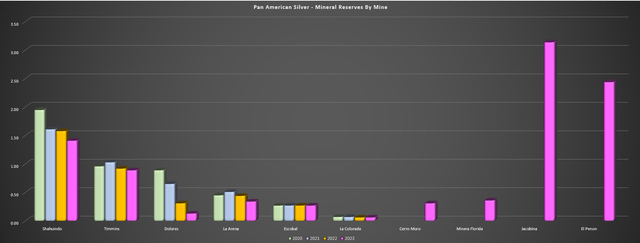

Pan American Silver – Mineral Reserves by Mine (Gold) – Company Filings, Author’s Chart

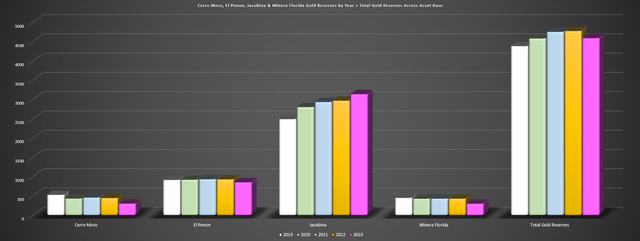

Looking at its gold assets above, we can see that reserves fell year-over-year at Shahuindo, Timmins, Dolores, and La Arena, with this trend in declining reserves being one key reason that the Yamana acquisition was so transformative for the company which was seeing rising costs and a more difficult time replacing reserves at legacy gold assets. Fortunately, these declines were more than offset by fresh additions to the portfolio, with a combined ~4.6 million ounces at its four new mines (Cerro Moro, El Penon, Jacobina, Minera Florida). And while Cerro Moro, El Penon and Minera Florida saw a decline in reserves year-over-year, Jacobina saw yet another increase in reserves to ~3.14 million ounces, up from ~2.5 million ounces at year-end 2019 despite 600,000+ ounces of mining depletion.

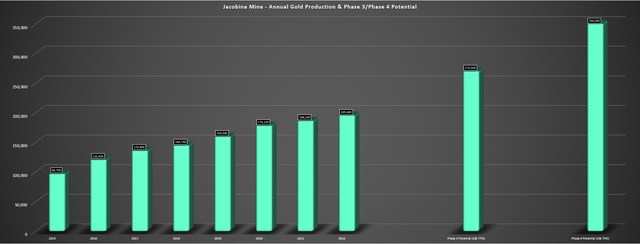

Jacobina Mine – Annual Gold & Phase 3/Phase 4 Potential – Company Filings, Author’s Chart

As for Pan American’s gold segment mine lives, Dolores is certainly running low on reserves with just ~130,000 ounces of gold in reserves, or just ~7.3 million tonnes, with limited resource inventory with it standing at just ~7.5 million tonnes. However, for core assets, Timmins has ~9.7 million tonnes in reserves or a 6-year mine life assuming an annual throughput rate of ~1.6 million tonnes and Shahuindo has over 92 million tonnes of reserves (~1.4 million ounces of gold), translating to over seven years of mine life assuming throughput of ~13 million tonnes per annum. Meanwhile, Jacobina’s reserve base sits at ~48.3 million tonnes, supporting a 13+ year mine life even at a higher Phase 3 throughput rate of ~3.65 million tonnes per annum. And Pan American’s new El Penon Mine has ~6.1 million tonnes in reserve inventory, translating to over 4 years of mine life, but with another ~7.5 million tonnes in the M&I category and upside from El Penon Deeps, and this is an asset that has consistently had a short mine life in its 23 years of operations, so I remain quite optimistic about its future.

Pan American – Silver & Gold Reserves, Silver & Gold M&I Ounces by Year – Company Filings, Author’s Chart

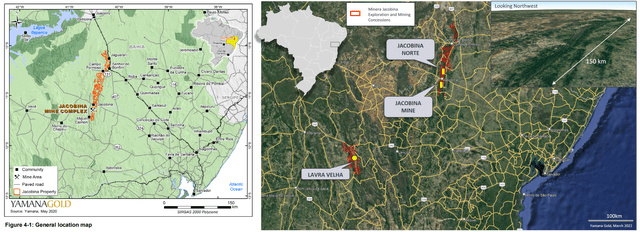

Meanwhile, like the company’s silver reserve base, we can see that Pan American has significant mineral resource inventory backing up reserves, with the Yamana acquisition translating to a significant increase in mineral resource inventory in the gold category (even ex-MARA, Jeronimo). And it’s important to note that the company’s reserve and resource base at Jacobina is concentrated in a ~14 kilometer area of a potential ~155 kilometer strike in what could be a very productive gold belt even if it yields just a fraction of what we’ve seen from other paleo placer deposits like Tarkwa in Ghana and the more famous Witswatersrand in South Africa. And while Yamana continued to grow resources along strike in its area of focus (Joao Belo Sul, Morro Do Vento depth extensions), the 15-kilometer strike Jacobina Norte (area directly north of the Jacobina Mine) was left untouched, with this potentially being a major extension.

According to Yamana, a surface sampling program at Jacobina Norte has defined an 11 kilometer long trend of quartz pebble conglomerate reefs with gold in rock and soil.

Jacobina Mine & Property, Jacobina Norte, Lavra Velha Heap Leach Opportunity – Company Presentation, 2019 TR

In fact, as the maps above show, the land package at Jacobina is among the largest and certainly one with a considerable exploration upside relative to other operating mines, with a larger land package than Chapada (former Yamana asset), and nearly double the size of Hounde (one of the most productive gold assets in West Africa) with Jacobina’s land package coming in at ~80,000 hectares. This is important for Pan American because Jacobina is arguably the company’s best asset, producing ~190,000 ounces at sub $900/oz all-in sustaining costs, making it one of the highest-margin gold assets in the sector even while it operates at just half of what could be its ultimate potential (~350,000 ounces per annum).

And with the asset permitted for a Phase 3 Expansion (permitted to 10,000 tonnes per day or ~270,000 ounces of gold per annum), this is the one asset where Pan American would want to have its exploration upside and long reserve life as investors have visibility into consistent ~$1,000/oz AISC margins over what will likely be a 20+ year mine life. So, while Pan American’s decline in reserves at legacy assets may have disappointed some investors, it’s important to note that the Yamana portfolio has had a far greater track record of replacing reserves (shown below) and this is despite consistently growing production at its workhorse (Jacobina), so with an aggressive exploration planned this year, I see the addition of these four assets from Yamana as a huge upgrade for the Pan American portfolio, with further growth coming from Pan American’s legacy portfolio at La Colorada Skarn where we’ll get a new update by year-end.

Cerro Moro, El Penon, Jacobina, Minera Florida & Total Gold Reserves by Year – Company Filings, Author’s Chart

Valuation

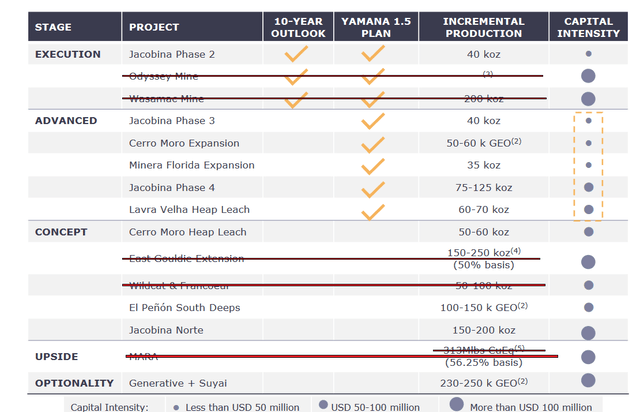

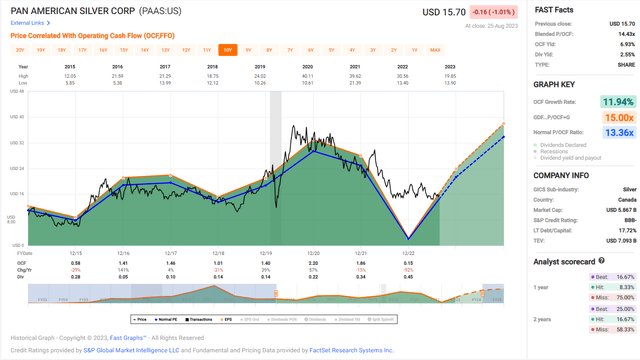

As highlighted in past updates, Pan American Silver continues to be one of the most attractive ways to get exposure to silver given that it trades at a discount to its historical multiple and a discounted multiple to mid-tier peers with meaningful silver exposure. This is evidenced by the stock trading at just ~6.3x FY2024 cash flow per share estimates ($2.50), a significant discount to names like First Majestic (AG) at ~8.8x FY2024 cash flow per share estimates, and Hecla at ~11.3x FY2024 cash flow per share estimates even after its recent correction. Plus, Pan American has the most impressive pipeline within this peer group, with the potential to add an incremental ~16 million ounces of silver production at industry-leading costs at Escobal, the potential to increase Jacobina’s production by 50% with the Phase 3 Expansion, and the potential for further growth from La Colorada Skarn, Lavra Velha, Cerro Moro (Plant Expansion and or Heap Leach) and El Penon South Deeps.

Pan American Growth Opportunities (Yamana 1.5 Plan) Adjusted For Assets Sold/Not Acquired In Deal – Yamana Investor Day

It’s important to note that these are mostly low-capex growth opportunities (except for La Colorada Skarn) and with the benefit of a stronger balance sheet following recent divestments, some of these opportunities are ones that Pan American could easily pursue even while it continues to advance La Colorada Skarn towards an eventual development decision and aggressively drill out its portfolio. So, with a portfolio that could produce ~1.9 million GEOs long-term (Escobal, La Colorada Skarn, Jacobina Phase 3/4, other smaller expansions), the stock should trade at a premium to peers in the silver space given its more attractive margins and longer average weighted mine life post-Yamana deal. And this is especially true when several silver names remain un-investable like Guanajuato Silver which is bleeding cash and diluting shareholders heavily, First Majestic Silver (AG) which has short mine lives and also struggles to generate any meaningful free cash flow, and Coeur Mining (CDE) which has one of the worst track records of creating shareholder value sector-wide.

Pan American Silver – Historical Cash Flow Multiple – FASTGraphs.com

Hence, using what I believe to be a conservative multiple of 11.0x cash flow for the premier way to get silver exposure sector-wide (diversified portfolio, several high-margin assets, strong pipeline), I see a fair value for Pan American Silver of US$27.50, pointing to a 75% upside from current levels (18-month target price), making it a solid buy-the-dip candidate.

Summary

Pan American Silver saw solid reserve growth on a year-over-year basis following its acquisition of Yamana’s South American assets, and even after its Morococha, Jeronimo, and MARA divestments, the company continues to have a significant reserve base of ~487 million ounces of silver and ~7.7 million ounces of gold. This translates to over 14.0 million silver-equivalent ounces, a very respectable reserve base with considerable exploration upside at key assets like La Colorada Skarn and Jacobina, and a planned 480,000 meters of drilling this year to drive further resource/reserve growth. So, while there may be more attractive ways to get exposure to gold with more upside to fair value, it’s hard to argue for a better risk-adjusted way to get exposure to silver, making Pan American unique among its peer group. And with PAAS’ technical picture beginning to improve with a higher low in place at US$15.00, I would view any pullbacks to this support area as buying opportunities.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here