Investment Briefing

Since the December ’22 publication, there are numerous updates in need of discussion in the Immunocore Holdings plc (NASDAQ:NASDAQ:IMCR) investment debate. Critically, its KIMMTRAK segment continues its pace of adoption, and the company has expanded the label’s footprint into several additional European markets this year. It has also its expanded its markets into Israel. Given the launch curve to date, along with the prevalence of underlying conditions the drug is indicated for, market fundamentals remain solid and provide a solid base for IMCR to work from.

Net-net, given the plethora of factors discussed here today, including KIMMTRAK updates, additional clinical assets in the pipeline, market-generated data and price objectives, I continue to rate IMCR a hold, eyeing targets to $62 then $75. Reiterate buy.

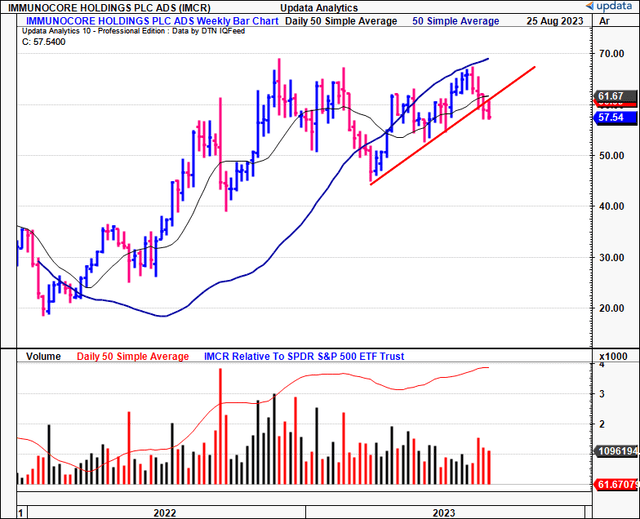

Figure 1.

Data: Updata

Critical updates to investment debate

1. Q2 FY’23 insights—KIMMTRAK adoption continues at rapid cadence

In H1 FY’23 IMCR booked revenue of $111mm from its KIMMTRAK label. Expanding into more than 35 countries, this YTD, KIMMTRAK, has been launched in 3 European markets (Italy, Austria, Finland) and Israel. These additions build its footprint onto already existing markets in the U.S., Germany, and France. As it stands, these 7 markets are anticipated to generate 75% of KIMMTRAK‘s global sales going forward. Meanwhile, Q2 sales were up 11% YoY to $57.8mm, also the 5th quarter of sequential growth.

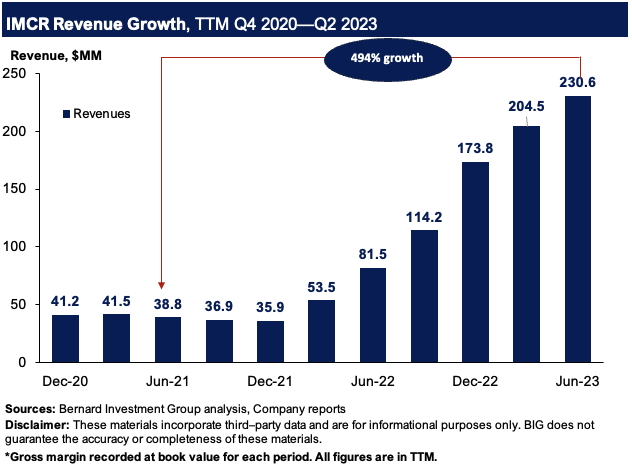

Take a step back and look at the broader picture—the launch curve of KIMMTRAK has been nothing short of a spectacle. Figure 2 outlines the company’s sales growth on a rolling TTM basis from 2020–2023. Revenues are up 494% from Q2 FY’21 to Q2 FY’23, hitting $230.6mm in the TTM.

Figure 2.

BIG Insights

Such a growth in 2 years is commendable, and illustrates the market’s adoption of KIMMTRAK. The fact it’s in 35 countries now solidifies this view, and management outlined several growth levers for the label going forward:

- U.S. growth was underpinned by 2 critical factors: 1) the expanded patient base, and 2) the drug’s extended therapy duration. Management estimates that IMCR’s market share has escalated to c.60% among first-line HLA-A02:01 positive patients with metastatic uveal melanoma (“MUM”). As a reminder, HLA-A02:01 is a specific human leukocyte antigen (“HLA”) allele and plays a crucial role in immunity.

- As such, there was a 14% growth in uptake in the U.S. market.

- KIMMTRAK’s traction in Europe—particularly in Germany and France—has been excellent. Management reported that basically, all first-line patients embraced the therapy on its latest findings.

The last point bodes well for the launch in other European markets outlined earlier, especially Italy, in my opinion. Estimates put the incidence of MUM at 2MM in “Southern Europe”, and 8–9MM in “Northern Europe”, and note that it is the most frequent ocular cancer in adult patients. Fallico and colleagues (2021) demonstrate that 2 cases per million is the range in Southern Italy. Data from longitudinal studies show that ~50% of these will evolve into metastatic lesions. If the rate of adoption is similar to its other European markets, this could be tremendously accretive.

Additional catalysts to move the needle

The company’s clinical programs are building additional pipeline assets around its KIMMTRAK label. These include expanding the indications of the drug, and additional clinical assets in the treatment of melanoma:

- IMCR is currently conducting a Phase 2/3 clinical trial named TEBE-AM, involving KIMMTRAK as a potential treatment for HLA-A02:01 positive patients in the second-line and/or later stages of cutaneous melanoma. This contrasts to the first-line population. The trial’s primary focus is on randomizing patients who have advanced melanoma, and have previously:

- Experienced progression on anti-PD1 treatment;

- Received prior ipilimumab; and

- Potentially been treated with a BRAF inhibitor.

- Within this trial, patients are assigned to one of three arms. These arms include 1) administering KIMMTRAK as monotherapy, or 2) combined with an anti-PD1 alongside a control arm. The trial’s design was presented at the American Society of Clinical Oncology (“ASCO”)’s 2023 meeting. The dual-primary endpoint includes overall survival (“OS”) and a reduction in ctDNA, a key genetic marker in tumour testing. IMCR aims for initial readouts in H2 FY’24, so keep a very close eye out for any progressions on this now until then.

- It’s also got a phase 3 trial underway for PRAME with its investigational compound IMC-F106C as a potential treatment for first-line cutaneous melanoma. Expect this to start in Q1 FY’24 so there will likely be first readouts a short while after that date. It will randomize 3 arms of the trial, then drop one of these after it obtains interim results on dosing and so forth.

- Finally, it is enrolling patients in a phase 1 trial with its IMC-M113V compound, investigating its potential as a breakthrough in HIV. The phase 1 arm will look at dosage and identify a potential therapeutic dose for the compound for patients with HIV, in order to see it will 1) reduce the viral load [in HIV], and 2) provide a ‘functional cure’—i.e., prevent HIV rebound.

Hence FY’24 is set to be a busy year on the clinical side for IMCR and this should be factored into the investment debate. It’s no saying on the conversion success of these clinical programs, but if positive, it could inflect positively on the company’s market value in my opinion.

Market-generated data

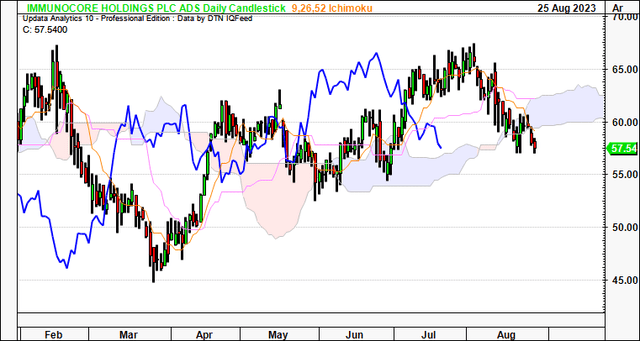

Technicals are supportive of IMCR’s current bullish trend. For one, on the daily cloud chart below, whilst the price line has broken the cloud base, the lagging line is still superior to the cloud. A break in price action higher would keep it on an upward trajectory in my view. Critically, a move to the $60.00 region would be positive and suggest a return to the longer-term bullish tend.

Figure 3.

Data: Updata

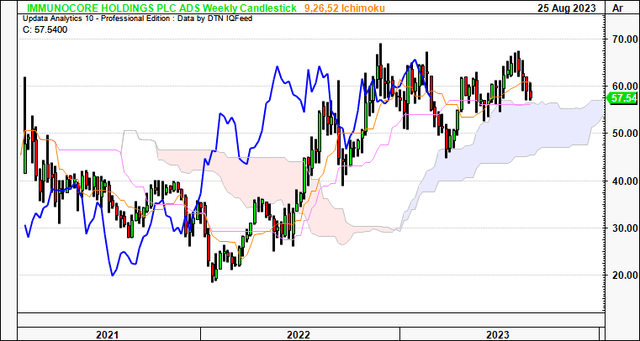

Speaking of the longer-term, the weekly cloud chart below looks out to the coming months. It is clearly positioned above the cloud (both price and lagging lines), highlighting the importance of maintaining a long-term view.

Critically, it is observed that:

- IMCR has tested the cloud top 4x over the last 8 months or so, bouncing off each point.

- It is currently testing the cloud top again, and because we still have the lagging line in a bullish position, there is reason to suspect the IMCR share price could bounce once more.

- Based on this setup, the current market range looks to be the support level, and, thus, could attract demand if the historical facts pattern upholds itself.

In my view, this chart is bullish and, again, reinforces the importance of maintaining a longer-term perspective.

Figure 4.

Data: Updata

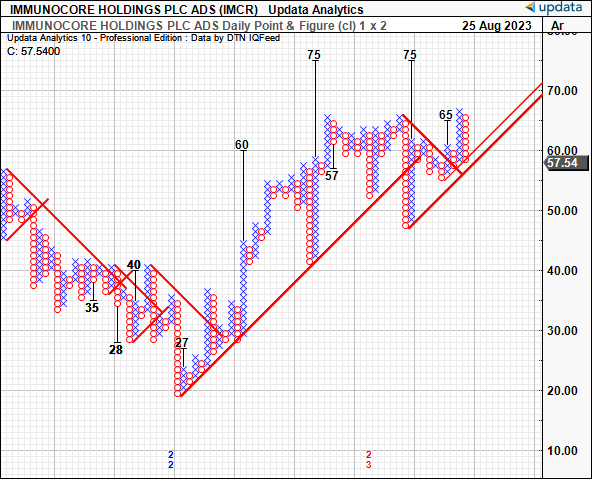

We also have upside targets to $75 on the point and figure studies below. These studies had eyed the move to $65 off the March 2023 lows, adding a layer of confidence to the estimates. These charts remove the noise of time and the intra-trend volatilities, critical data given where IMCR currently sits on a technical basis. The next directives are to $75/share, with 2 targets forming a cluster at this mark. I’d be looking to this as the next technical objective, therefore.

Figure 5.

Data: Updata

Valuation and conclusion

Even with the tremendous sales growth outlined earlier, the stock still sells at 11x forward sales as I write. One can’t ignore the fact of IMCR’s sales growth, hence, this premium (188% to the sector) tells me the market has very high expectations for the company. It suggests that investors are willing to pay high multiples to get a piece of IMCR. There’s also been 8 revisions higher to forward revenue estimates from Wall Street analysts in the past 3 months. Consensus now looks to $250mm in FY’23 revenues, but I’m looking ahead of this and have IMCR at $275mm in top-line sales this year. This implies another $164mm in global sales for H2 this year.

At 11x forward, this gets you to ~$62/share, near the critical juncture outlined in the technical analysis earlier. Therefore, I’d be looking to $62 as the initial objective, but eyeing $75 as a secondary range given the market-generated data and targets thrown off in the P&F studies. Options-generated data also illustrates investors are positioned bullishly with heavy demand in contracts priced at a $70 strike depth for September expiry, with plenty of open interest up to a $75 strike price. This is also consistent with upside targets derived in the December publication.

In short, IMCR continues pushing ahead with its KIMMTRAK segment, but it also has several new clinical programs underway in adjacent treatment markets. Some of these centre around melanomas as well, whereas others are investigating its core clinical assets in separate conditions. Given it has obtained a number of new jurisdictions to sell KIMMTRAK into this YTD, there is scope for adoption to continue at the recent pace in my view. I am eyeing price objectives to $62 then $75 based on the culmination of data presented here. Net-net, reiterate buy.

Read the full article here