Just about every company has a price where the stock is attractive to investors and one where investors should dump the stock. This case is very clear for a development voice AI software company like SoundHound AI (NASDAQ:SOUN) where the stock is very volatile due to AI hype. My investment thesis is more Bullish on the stock following the dip back towards $2, down from a recent high above $4 again.

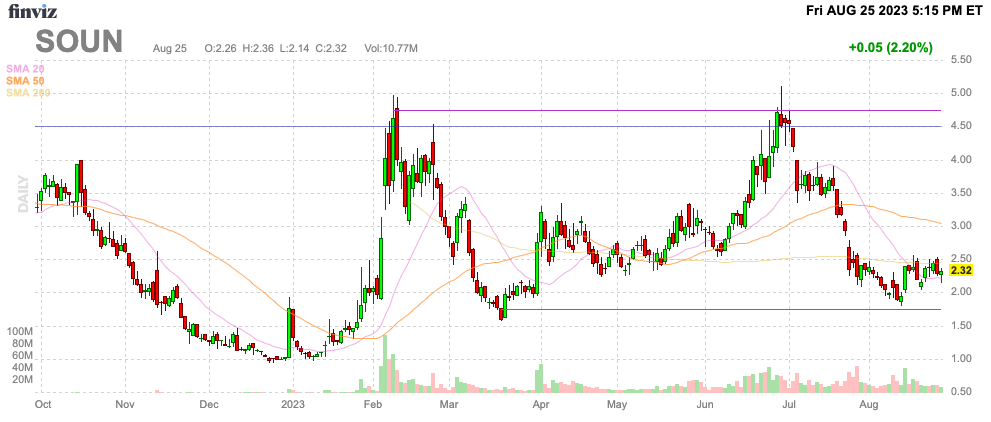

Source: Finviz

Not Enough Momentum

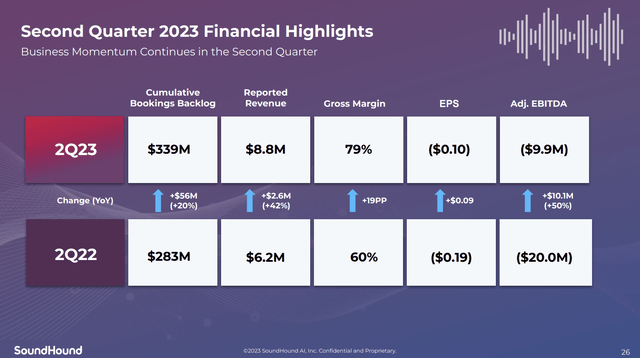

SoundHound AI reported Q2’23 revenue of only $8.8 million and the company maintained guidance for 2023 of just $43 to $50 million in revenues. The company has a promising AI ordering product, but the customer base still appears far too limited.

A prime example is the list of customers adopting the Smart Ordering product called out in the earnings release and earnings call. Outside of a deal with White Castle, the company doesn’t list any nationally known brands and even the White Castle deal only includes a goal of 100 drive-thru lanes not until the end of 2024.

The Chat AI for Automotive product is another promising opportunity. The product includes generative AI and conversation capabilities, yet the product doesn’t ever lead to material revenue growth due to the length of automotive deals.

The consensus analyst estimates are for 2023 revenues of $46 million leading to $78 million in 2024. When dealing with revenues below $100 million, SoundHound AI should be able to drive much faster revenue growth.

As an example, a major restaurant brand like Wendy’s (WEN) announced an AI chat drive-thru ordering test with Google (GOOG, GOOGL). While SoundHound AI lists a $339 million cumulative bookings backlog, the amount only grew 20% YoY from $283 million last Q2.

Source: SoundHound AI Q2’23 presentation

The backlog sounds impressive, but the contract lengths are up to 8 years due to the length of automotive deals. The average contract is 6.5 years amounting to just $52 million worth of annual backlog tilted more towards the end of the contract term.

The voice AI products are all promising with the enormous market opportunity. The issue continues that SoundHound AI just hasn’t been able to deliver the actual sales on the income statement, even with the AI surge the last year that has led to Nvidia (NVDA) selling billions worth of GPUs. SoundHound AI is effectively adding just around $14 to $15 million in incremental sales this year.

Buy Dips, Sell Rips

Anyone looking at the chart of SoundHound AI will quickly see how the stock rallies from $2 to $4 and dips back to $2 on a regular basis. The stock valuation at $2 is still somewhat elevated so investors have to be careful.

SoundHound AI isn’t profitable and continues burning a lot of cash. The market shouldn’t be surprised by this scenario considering the company doesn’t forecast topping $50 million in revenues this year.

Any company in an exciting space like voice AI with products like Smart Ordering and Dynamic Interaction needs to invest in building these products. For Q2, SoundHound AI only spent $11.7 million on R&D in a market against companies spending billions on AI chips. If anything, the spending levels are very minimal.

In the last quarter, the company raised a large amount of cash to just push the cash on the balance sheet to $130 million. SoundHound AI reported an adjusted EBITDA loss of $9.9 million in the last quarter and burned $19.2 million in operating cash flows during Q2.

The company borrowed the money from Atlas Capital when the potential exists to sell some shares on the spikes in the stock price when the market cap surged to the $1 billion range. A small tech firm loaded with debt loses a lot of the long-term appeal.

Considering the backlog in voice AI applications, the stock turns more appealing when the stock dips towards $2 and the market cap reaches down to $500 million. The stock trades at ~7x analyst estimates for 2024 revenue of $77.6 million.

As with the prior recommendations, SoundHound is more of an AI trading vehicle. At $4+, the stock gets expensive with the market cap reaching up to $1 billion and the forward P/S target soaring towards 15x.

In both February and June, SoundHound AI surged to those elevated levels with quick 100% gains. In both cases, the stock returned right back to $2 due to rather weak quarterly results.

Takeaway

The key investor takeaway is that SoundHound AI has some promising voice AI technologies for the automotive market and customer service applications. Regardless, the stock trades volatile providing the opportunity to buy the dips to $2 and sell the rips to $4+.

Read the full article here